TRM Labs published a piece recently that summarized the situation with Iranian crypto-asset exchanges as “Declining Volumes, Rising Tensions, and Shifting Trust” and cited declining transaction volumes at Iranian crypto-asset exchanges as signs of progress. While it is true that volumes at the largest Iranian crypto-asset exchange is declining (the largest exchange was hacked and temporarily shut down in what looks like a politically-motivated action ) the Iranian crypto-asset market, actually looks to be getting more resilient.

“Just because all the swans you’ve ever seen are white, doesn’t mean there’s no such thing as a black swan.”

A friend of ChainArgos asked us to perform a little analysis into what’s really happening at Iranian crypto-asset service providers. We are happy to oblige.

This is a brief note to demonstrate that “the plural of an anecdote is not data” while exploring what is really going on at Iran’s exchanges.

“The great enemy of the truth is very often not the lie — deliberate, contrived and dishonest — but the myth — persistent, persuasive, and unrealistic. Too often we hold fast to the clichés of our forebears.”

“We subject all facts to a prefabricated set of interpretations. We enjoy the comfort of opinion without the discomfort of thought.”

— John F. Kennedy

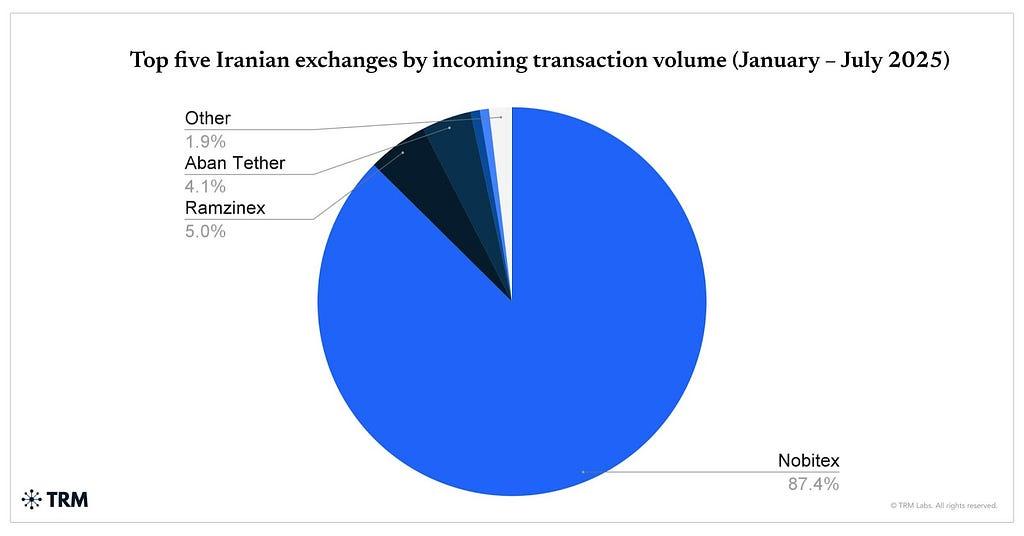

TRM Labs’ data give Nobitex, the largest crypto-asset exchange in Iran and the one that was recently hacked, 87.4% market share in Iran for a recent period.

As has been well-documented for many years, Iran is involved in a number of regional conflicts and its economy has come under significant strain from a range of sanctions-related issues.

For Iran’s embattled economy and financial system, Nobitex’s 87.4% market share for a financial services business is clearly a “fragile situation.”

So it is unsurprising that the Iranian crypto-asset industry would somehow become more resilient over time if for no other reason than that the largest entities are also the largest targets, and press home the need to decentralize risk.

TRM Labs’ data includes the followng pie chart:

Only 3 Iranian crypto-asset exchanges are named by TRM Labs. So we are going to present data that suggests:

- A few pieces in TRM Labs’ pie chart are missing, some of which are of a meaningful size, begging the question why they were omitted.

- Some of these smaller “pie pieces” which have been excluded from TRM Labs’ pie chart are growing fast.

- Confirmation bias is defined as focusing on only the data that is convenient to your narrative.

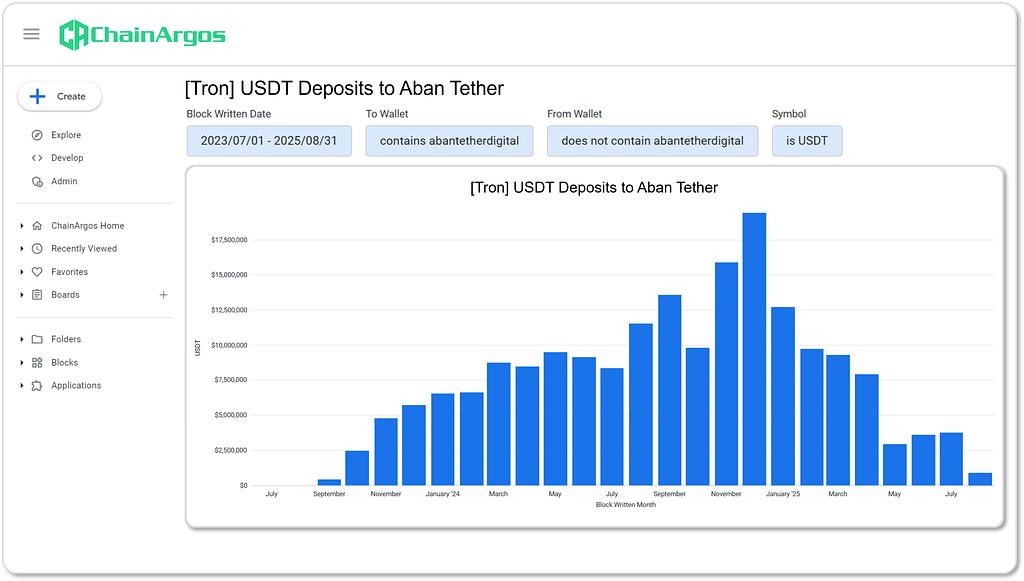

Aban Tether Digital

Here are USDT deposits to Aban Tether, by month, on TRON:

Do the USDT deposits for Aban Tether appear to be decreasing for 2025.

Yes.

Is the overall quantum of flow consistent with Aban Tether having 4.1% of a $3 billion market?

Sure.

This initial exercise is not about finding an exact match with TRM Labs’ dat, but rather, it is about establishing a baseline that we are all looking at the same things.

It also sets a baseline for deposit inflows which is how we are going to look across Iran’s various crypto-asset exchanges.

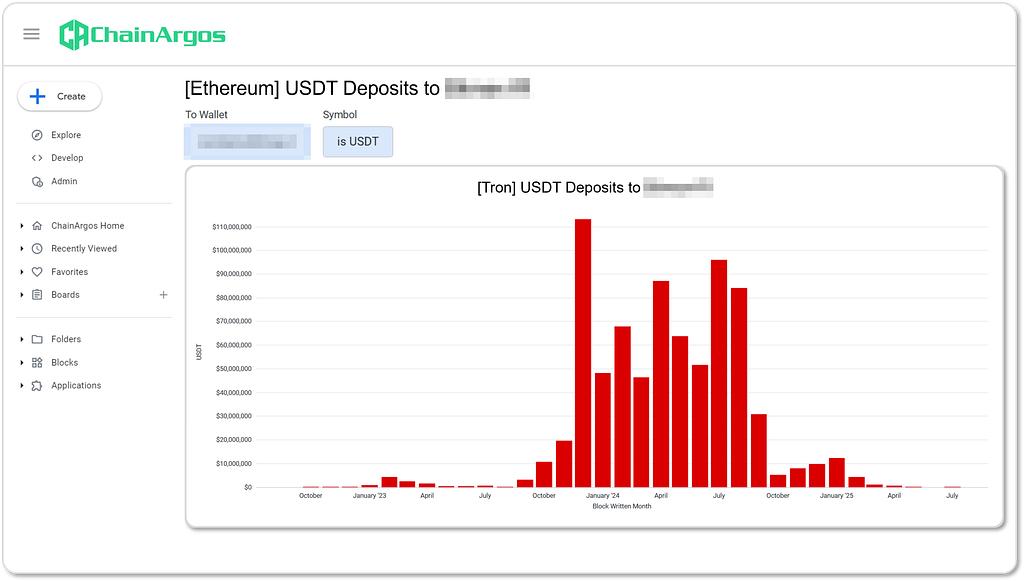

An Iranian Service Provider TRM Labs Does Not Seem To Have Identified

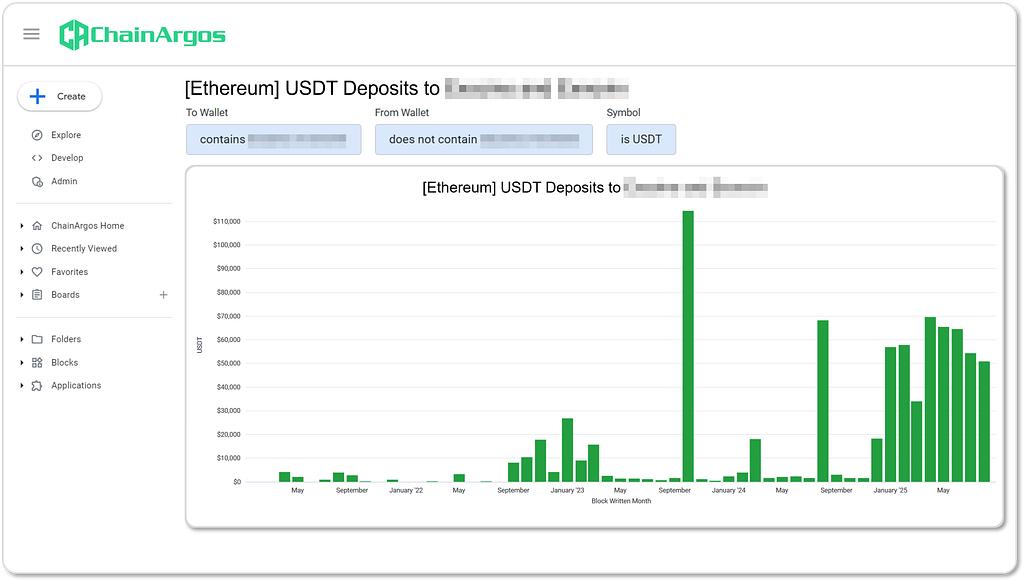

Here is an Iranian crypto-asset service provider that does not seem to be included in TRM Labs’ analysis.

These are monthly inflows of USDT on Ethereum to the unidentified Iranian service provider:

While most of that activity appears to be from 2024 rather than 2025, the issue of course is that by focusing purely on the 2025 activity to the exclusion of all others, it’s easy to miss large service providers that do exist in Iran.

Since August 2022, this Iranian service provider has received over $777 million in USDT deposits.

There Is Growth And It Is Diversified

All of TRM Labs’ analysis can be summarized as “Nobitex activites on TRON have decreased.”

While this may be a fair statement, (Nobitex is by far the most high profile Iranian crypto-asset exchange and operates mainly on the TRON blockchain.), it’s important to note that Nobitex was also hacked during the period of time under observation by TRM Labs in its report (January to July 2025).

It is also hard to tell time using the sun at night.

“I am most often irritated by those who attack the bishop but somehow fall for the securities analyst — those who exercise their skepticism against religion but not against economists, social scientists, and phony statisticians.”

— Nassim Nicholas Taleb

So let’s look somewhere a bit more interesting.

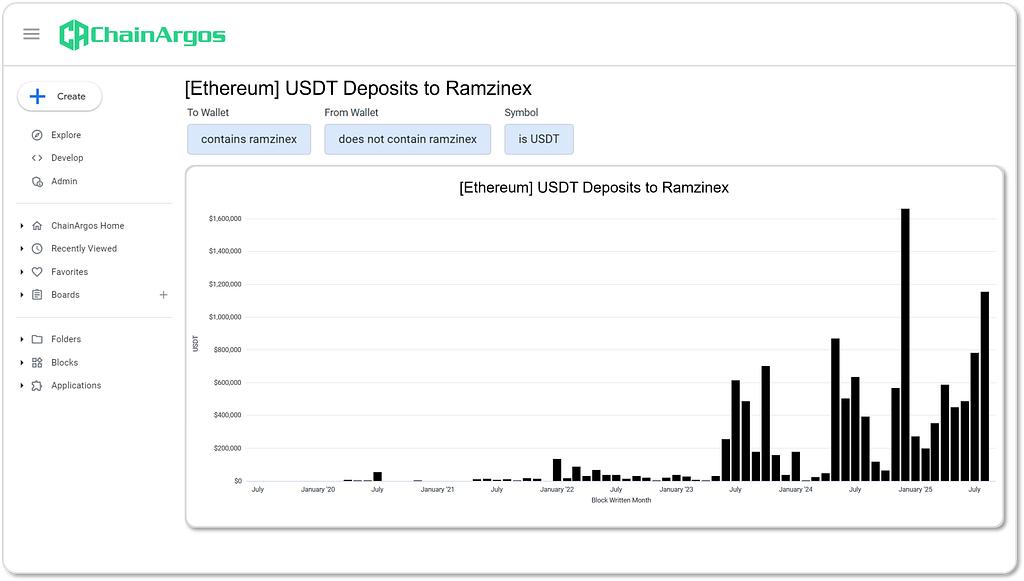

Here are USDT deposits on Ethereum for another Iranian crypto-asset exchange, Ramzinex:

Are those numbers massive?

No.

But are they clearly growing?

Yes.

Are we sure we are missing new Iranian service providers because we are always missing new providers (such is the nature of this business)?

Yes.

Here are two tiny Iranian crypto-asset service providers nobody seems to be tracking:

Massive growth?

Assuredly.

And a spike in use in October 2023?

Check.

Note that this is not even on the TRON blockchain, this is on Ethereum, but is still USDT.

While the absolute amounts may not be massive, this demonstrates that there is a proliferation of growing Iranian crypto-asset service providers that are perhaps not getting as much attention as they deserve.

Furthermore, it’s impossible to know how big a crypto-asset service provider is until it is observed to be large.

Flagging only the largest crypto-asset exchanges and watching them to the exclusion of all other data, is a bit like saying that the only predators in a jungle are tigers because those are the only ones you can see.

As any good soldier will tell you, it’s the malaria from mosquitoes that ultimately kills you, not the tigers.

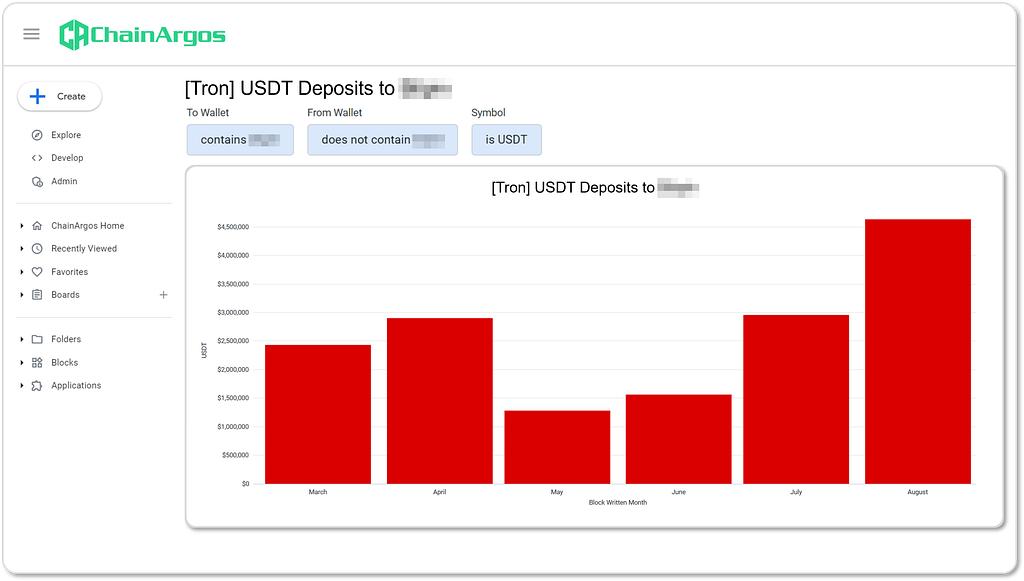

Here is an Iranian crypto-asset service provider on the TRON blockchain where USDT deposits only started in March 2025:

In just 6 months, over $15.7 million USDT has been deposited to this brand new Iranian crypto-asset service provider, and certainly a singificant amount for any new business.

In fact, those flows are even larger than for Aban Tether in some recent months.

For instance, Aban Tether saw over $960,000 in USDT deposits on the Tron blockchain in August 2025, while this brand new service provider enjoyed an inflow of $4.6 million worth of USDT.

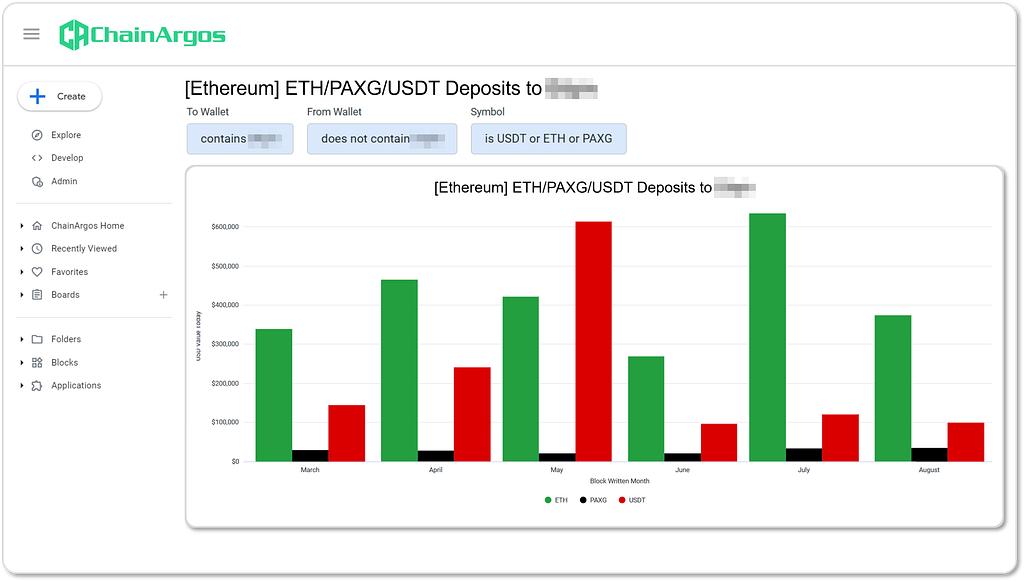

Now let’s look at that same unidentified Iranian crypto-asset service provider on the Ethereum blockchain, but expand our investigation beyond just USDT.

Let’s include USDT, ETH, and PAXG all in USD terms for ease of analysis:

Given the hack of Nobitex and freezes by Tether, it makes absolute sense for Iranian users to diversify their token usage, instead of just limiting themselves to USDT (as USDT could get frozen by Tether).

PAXG, the gold-backed token issued by Paxos Trust LLC, a US-regulated trust company is an unsual choice for Iranian users living under sanctions, but for now it appears to not be causing them any consternation.

Summary

In TRM Labs’ defense, volumes in USDT, the stablecoin that keeps getting seized or frozen, on the largest and most high profile crypto-asset exchange in Iran that was recently hacked are indeed decreasing.

But that’s like watching the first half of The Sixth Sense, walking out of the movie theater, and deciding you knew how it ended. (Spolier Alert: Bruce Willis’ character was dead all along.)

But blockchain intelligence or analytics isn’t about stating the obvious (especially where it is convenient to do so), it’s about understanding the data and being honest enough to recognize the gaps and deficiencies.

It’s important to recognize that the use of crypto-assets to evade sanctions in places such as Iran, are endeavors often undertaken by people who are both competent and determined.

If nothing else, the Iranian crypto-asset exchange sector seems to be getting more resilient with high growth observed across smaller entities.

Because it’s harder to hit many small targets, Iran appears to be taking a leaf out of the blockchain’s own playbook — decentralization.

Objectively this looks like the natural outcome for an ecosystem that is more or less under siege.

More famously this has been described thus:

https://medium.com/media/53f2f9a9a9e3271c5b448173e1475a4f/hrefSo no, this does not look like a system that is contained and shrinking. Life indeed finds a way.

But depending on who you ask, you won’t find what you’re not looking for.

https://medium.com/media/10fb1cf46fd08188f092566b96e0752b/href

An Alternative Perspective On Iranian Exchange Activity was originally published in ChainArgos on Medium, where people are continuing the conversation by highlighting and responding to this story.