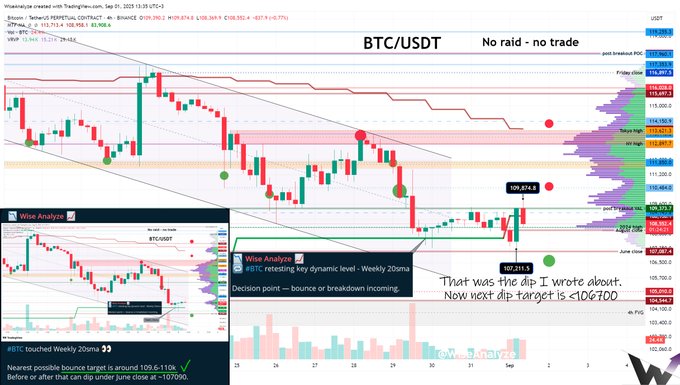

Bounce target <110k achieved ✅ 🎯 Key Levels to Watch: • Above: 109400 / 110484 / 111490 • Below: 108208 / 107087 / 105010 🔥 $BTC Liquidation Heatmap: • Above: 110540 / 113197 / 114230 • Below: 107200 / 106510 / 104985 The dip toward June close nearly touched that level but bounced slightly higher. From here, either price holds above August close at 108208 today, or it dips lower for liquidity. The nearest pool spans ~106200–107100, with my alert set at 106800. Monthly candle closed bearish, but the broader uptrend is intact (for now). Weekly chart printed its 3rd red candle in a row, yet still holds within the uptrend. So while bearish momentum dominates the Daily TF, Bitcoin remains inside the HTF uptrend. That suggests further downside liquidity grabs below 107k are possible, with dips extending toward 104–105k. After that, I’d expect a swing toward 114–115k. If the sequence flips and we first swing up, that’s the weaker scenario, as liquidity under 107k would remain uncollected. ⏰ TG alarms set for: 113621, 109875, 106700, Daily 20-sma

Zen

@WiseAnalyze

08-30

$BTC touched Weekly 20sma ✅

Nearest possible bounce target is around 109.6-110k

Before or after that can dip under June close at ~107090.

That zone is critical. Either this will be the bottom of correction (with wicks down to 104-105k next week), or next month there will be

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content