The crypto has been buzzing with news lately. Let's start with Dogecoin : Elex, Musk's personal lawyer, is taking on the role of chairman of the Dogecoin Treasury. Did you get that? A lawyer originally worked for their clients, but now they're taking on the chairmanship. Does that make sense? Absolutely.

Since Musk himself is not available to speak publicly, he's letting his lawyers do the talking. You know the intrigue behind this. If Musk casually retweets this post one day, the DOGE market could explode, potentially boosting the company's IPO momentum.

Even more outrageous is that both Grayscale and Bitwise have applied for Dogecoin spot ETFs ! Remember, Grayscale is a veteran of Bitcoin and Ethereum ETFs, so its chances of success are very high this time.

The results are expected to be released in mid-October, when spot ETFs for SOL, XRP, ADA, and LTC will also be announced. In other words, October may be a "big test month" for Altcoin.

Looking at the overall market, Bitcoin has fallen badly in the past two weeks, but don’t rush to call it a bear market.

A key indicator— USDT issuance —has not plummeted as it did during the previous bear market, but is actually still rising. This suggests that funds haven't fled, but are simply waiting and watching. Global money supply (M2) hasn't contracted either; at most, it's sideways, so talk of a "bear market" is premature. It's likely a lack of momentum; once incremental funds arrive, the market will likely rebound.

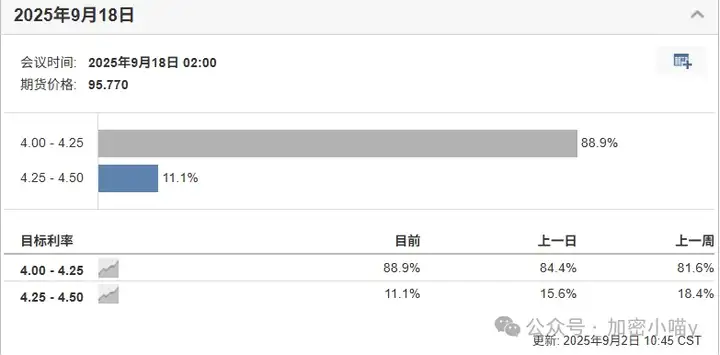

Then why is the crypto still falling even though the Federal Reserve is about to cut interest rates?

Because institutions are hesitating . Morgan Stanley says the probability of a recession in the US is 40%, and Goldman Sachs also says it's 35%.

This isn't a low-probability event; if it breaks out, it will lead to a major crash, so institutions are reducing their risk exposure. In the short term, interest rate cuts are positive, but transmission takes time. Historically, major bull markets have typically begun in the middle or late stages of interest rate cut cycles. Therefore, we may need to be more patient in the coming months; the real bull market may not come until late next year. In the short term, BTC's four-hour MACD has golden cross, suggesting a potential rebound, but the daily and weekly charts haven't yet recovered, so don't rush All In.

ETH, however, is quite impressive, with the largest on-chain buying in nearly two years, as whale are trading Bitcoin for Ethereum. They're eyeing the potential approval of a spot ETF in October and the epic November upgrade that will see a 20-fold performance surge.

The attitude of the whale is simple: buy when the price drops, and wait for a big market trend in October or November.

Summarize:

October may indeed be a pivotal month for the crypto. Whether it's ETFs, upgrades, or hints from Elon Musk, positive news is being released. However, there's no such thing as free money in the market; risk and opportunity are always tied together. All we retail investors can do is stay calm, avoid chasing opportunities, and conserve our reserves. When the opportunity arises, even pigs can fly.

That's all for now! If you're still unsure about your direction in the crypto, why not join me? Join the VX + Q group for free and get first-hand market analysis, altcoin opportunities, and individual coin trading opportunities. Join us now! Otherwise, you might be on the other side of the market again in the next wave.

Welcome to join us by private chat +V: Mixm5688