Source: On-Chain Mind, compiled by Shaw Jinse Finance

Bitcoin has fallen 12% from its all-time high, prompting online chatter to suggest the bull run may be over. But is this really the beginning of a crash, or just another typical shakeout in Bitcoin's volatile history?

In this article, I will compare the current market structure to previous cycles and identify key levels that will determine whether this correction is benign or something more concerning.

Let's get started.

Key Points at a Glance

Historical context reveals normalcy : Bitcoin’s current 12% pullback pales in comparison to the 20% to 40% declines that frequently occurred in past bull cycles, suggesting this is just a regular fluctuation rather than a trend reversal.

Key support levels to watch : indicators such as short-term holders’ realized price ($109,000) and moving averages (200-day moving average $101,000, annual moving average $93,000) will determine whether the bull trend continues.

Investor mindset shift : Viewing pullbacks as accumulation opportunities can transform fear into strategy, especially for long-term holders.

There are no signs of capitulation yet : indicators such as the realized output profit ratio (SOPR) are showing profits rather than losses, pointing to a persistent bullish structure.

Background analysis of Bitcoin's pullback

It’s been about two weeks since Bitcoin retreated from its all-time high of $124,000, raising the question: Is this just a brief pause, or the beginning of a deeper contraction?

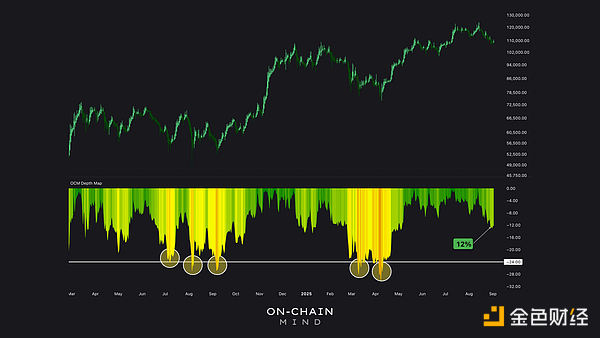

To put this into context, we can look at the depth chart, which measures the current price retracement relative to the previous all-time high.

In the past year and a half, we have seen five other corrections of double the magnitude of 12%.

Compared to at least five other drops of more than 24% in the past year and a half , today’s 12% drop is relatively mild. Despite the widespread bearish sentiment online, data shows that Bitcoin has experienced much more severe declines before, and in relatively recent times.

Lessons from past cycles

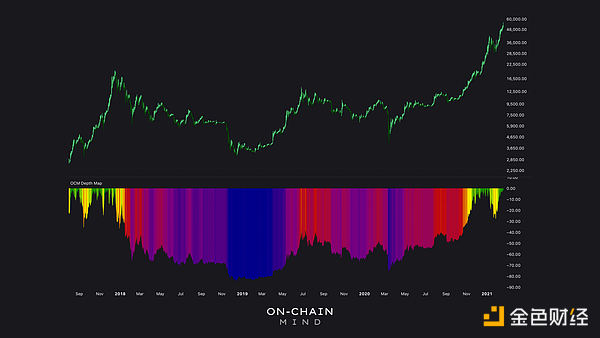

It's crucial to compare the current market structure to past cycles. A useful comparison is the 2017 bull market, which also experienced a step-by-step rise before peaking. Here's what happened then:

A 20% correction is normal and occurs almost every month during an uptrend.

There have been 30% and even 40% pullbacks before the market continued higher.

While Bitcoin has grown into a larger, more institutionally recognized asset since 2017, volatility remains its inherent characteristic. In fact, we’ve witnessed multiple 20% to 30% pullbacks during this bull run.

Would I be surprised, then, to see another 30% drop? Not at all. That would take the price down to around $87,000, a level that, while seemingly subdued, is within historically normal territory.

From a personal perspective, such declines can be beneficial for net accumulators like me. Lower prices create opportunities to accumulate more Bitcoin at attractive levels, while rising prices expand overall wealth—both good things in my opinion. For investors with a 5-10 year time horizon, these short-term fluctuations are largely irrelevant.

When would I turn bearish?

A 30% to 40% correction isn't inherently bearish. History shows that only when the market declines beyond this level does it enter a prolonged bear market phase, as was the case after the 2018 crash. In those cases, the recovery can take two to three years to reach new all-time highs. See below for more details.

It can take many years for prices to recover to their previous highs. If you miss the top, you may find yourself holding onto your position for the long term.

Currently, the market remains healthy as long as the structural bullish trend remains intact.

Key price levels I'm watching

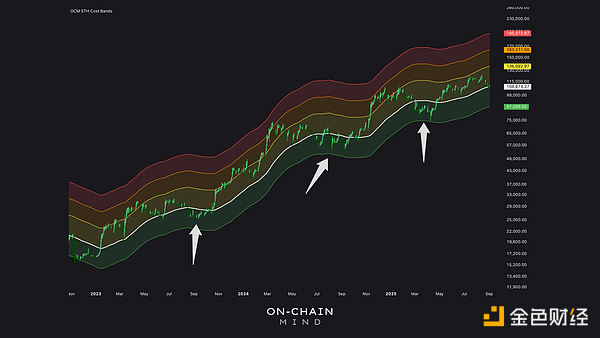

Short-term holder realized price

The Short-Term Holder (STH) Actual Buy Price measures the average purchase cost of Bitcoin by recent investors (more specifically, those who purchased Bitcoin within the past five months). It often acts as a psychological support level:

Current STH realized price: $109,000 .

A price drop below this level could cause new investors to lose patience or panic sell.

The Deviation Multiple, or my Cost Band, visually demonstrates how far price has deviated from this key level.

When price trades within the green cost band during this bull market, it provides us with the best risk-reward opportunity of this cycle.

The green cost band currently bottoms out at around $87,000 (interestingly, this corresponds to the 30% retracement of the all-time high), marking the highest risk/reward accumulation area. While the market may hover around this level for several months, further upward momentum usually emerges after the last wave of selling has ended.

200-day moving average

The 200-day moving average (MA) is a widely followed technical indicator that often represents long-term trend support.

Current 200-day moving average: $101,000 .

A price test at this level suggests a pause in the trend, but does not necessarily mean a weakening market.

In both bull and bear markets, prices like to revisit this level as a test of trend continuation.

From a statistical perspective, prices tend to revert to the mean in a trending market. From a psychological perspective, this is a magnetic round number (with the attractive $100,000 figure nearby). A break below this level could exacerbate bearish sentiment, but holding this level maintains the bullish structure even if the market moves sideways.

365-day moving average

To me, the annual moving average defines the line between a bull market and a bear market.

Current 365-day moving average: $93,000 .

A breach here would trigger a reassessment of the broader market health, particularly investor spending behavior and herd selling dynamics.

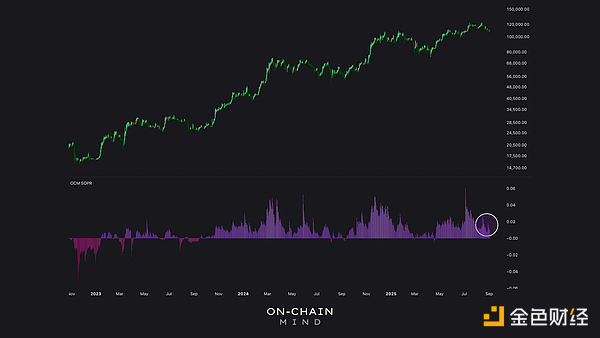

Using SOPR to assess investor behavior

The realized output profit ratio (SOPR) measures the ratio between the token sale price and the purchase price:

SOPR > 1 (purple): Token is sold at a profit.

SOPR < 1 (pink): Tokens are being sold at a loss, indicating capitulation.

Even though SOPR is trending down, it is well in line with our expectations for the current phase of the market.

Currently, the SOPR's 7-day moving average remains positive, indicating that active investors are making profits rather than losses. A dark pink signal coupled with a test of the 365-day moving average could be a warning of potential structural weakness in the market.

Current Strategy and Mindset

Holding Bitcoin means taking the risk of price fluctuations .

Bitcoin's history shows that patience is more important than reactivity. Pullbacks of 20% to 40% are commonplace in every cycle. While they feel severe, they're merely blips in the grand scheme of things. A 12% drop amidst the online frenzy? That's understandable.

While a deep pullback is always a possibility, instead of worrying about it, it’s better to focus on key price levels:

STH realized price: Psychological support at $109,000

200-day moving average: Trend confirmation at $101,000

365-day moving average: Bull/bear dividing line at $93,000

Holding these positions will keep your bullish outlook intact, even as you experience fluctuations in market sentiment. Structurally, the bullish trend remains intact, and the overall market structure remains unchanged. Pullbacks are a normal part of the upward trend, and until there's evidence to the contrary, the trend is your friend.