Approximately $199.3 million worth of leveraged positions were liquidated in the cryptocurrency market over the past 24 hours.

According to currently available data, the cryptocurrency market has seen increased volatility, with both long and short positions taking a hit.

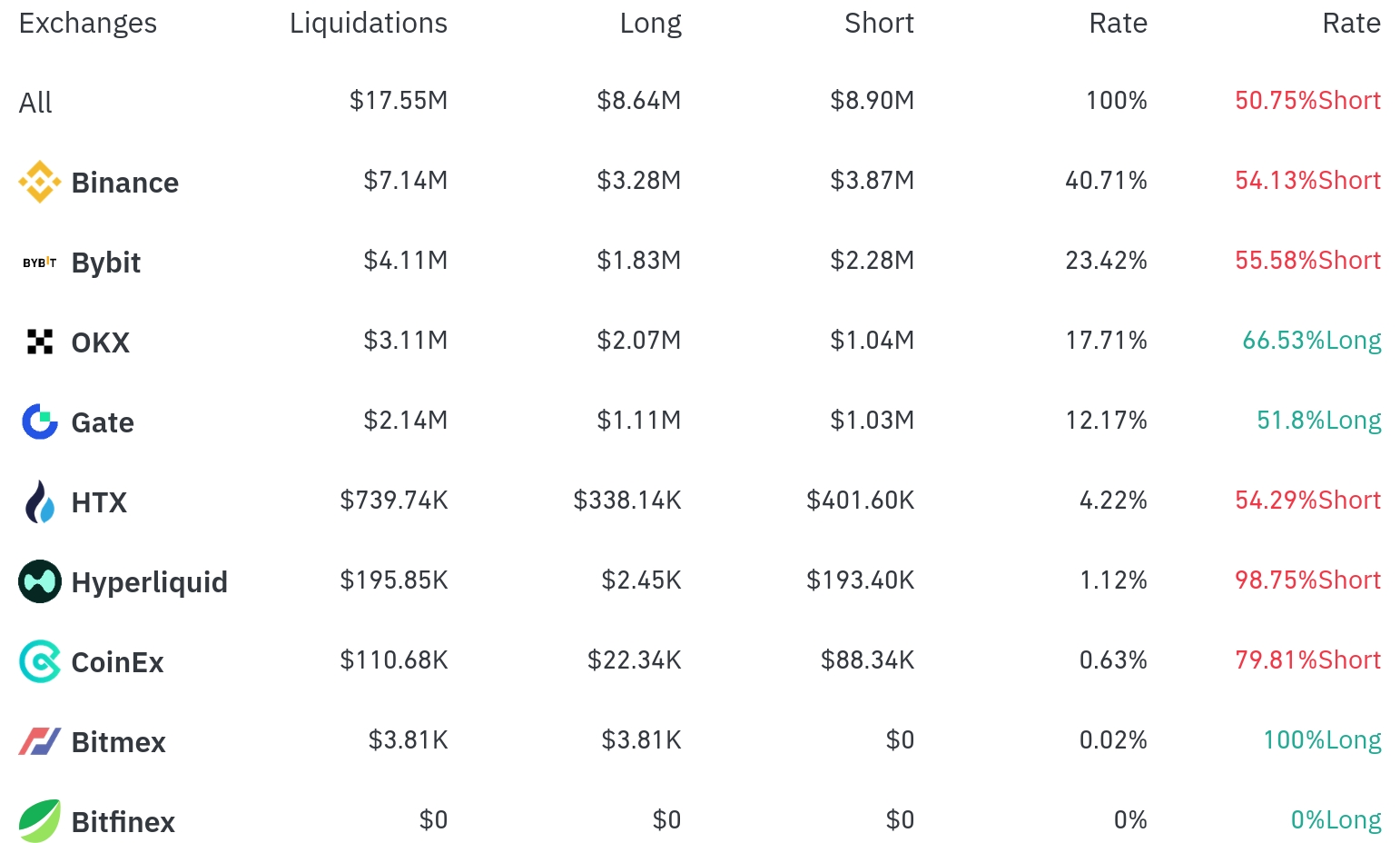

Binance saw the most liquidations over the past four hours, with a total of $7.14 million (40.71% of the total). Short positions accounted for $3.87 million, or 54.13% of the liquidations, exceeding long positions.

The second exchange with the most liquidations was Bybit, with $4.11 million (23.42%) of positions liquidated. Similarly, short positions accounted for a higher proportion at 55.58%.

OKX saw liquidations of approximately $3.11 million (17.71%), but the long position ratio was higher here at 66.53%.

Notably, Hyperliquid had an overwhelmingly high short position liquidation rate of 98.75%, while Bitmex observed a 100% long liquidation phenomenon, with only long positions being liquidated.

By coin, Ethereum (ETH) recorded the highest liquidation volume. Approximately $67.3 million worth of Ethereum-related positions were liquidated over the past 24 hours, with the current price at $4,339.20, down 1.06% over the past 24 hours. Over the past four hours, $2.57 million in long positions and $3.44 million in short positions were liquidated.

Bitcoin (BTC) saw approximately $48.4 million in positions liquidated over the past 24 hours, with the current price at $110,987, up 0.65% over the past 24 hours. In Bitcoin, short positions liquidated ($20.78 million) significantly outnumbered long positions liquidated ($326.38 thousand) over the past four hours.

Solana (SOL) liquidated approximately $17.66 million over the past 24 hours, with the current price rising 3.67% to $210.37. Notably, Solana's long position liquidation value ($11.58 million) exceeded short position liquidation value ($6.08 million) over the past 24 hours.

Dogecoin (DOGE) saw liquidations of approximately $5.24 million, a 0.54% increase over the past 24 hours. Within four hours, long positions worth $137.33 thousand and short positions worth $3.70 million were liquidated.

Of particular note was the "WLFI" token, which saw a massive liquidation totaling $14.24 million. The "TA" token also recorded a high liquidation amount of $28.34 million.

What's notable about this data is that most exchanges show a high short position liquidation rate. This suggests that the recent price rebound of some cryptocurrencies has taken a toll on short position investors. The particularly high short position liquidation rate for Bitcoin is noteworthy.

In the cryptocurrency market, "liquidation" refers to the forced closure of leveraged positions by traders who fail to meet margin requirements. This large-scale liquidation demonstrates the high volatility of the cryptocurrency market and the active participation of investors in leveraged trading.

Get real-time news... Go to TokenPost Telegram

Copyright © TokenPost. Unauthorized reproduction and redistribution prohibited.