Treasury BV - backed by the Winklevoss twins and Nakamoto Holdings - raised $147 million, bought more than 1,000 BTC and is preparing to list on Euronext.

Treasury BV, a company backed by the Winklevoss brothers, collects over 1,000 BTC

Treasury BV, a company backed by the Winklevoss brothers, collects over 1,000 BTC

According to Bloomberg , a new Bitcoin treasury company called Treasury BV ( Treasury for short) - backed by the Winklevoss twins and Nakamoto Holdings (a subsidiary of KindlyMD ) - has just successfully raised 126 million Euros (~147 million USD) in a private Capital round.

The funds were immediately used to purchase over 1,000 BTC , marking the beginning of a strategy to become Europe's largest publicly listed Bitcoin treasury company, and laying the groundwork for a planned public listing on the Euronext Amsterdam stock exchange under the ticker TRSR , through a merger with investment firm MKB Nedsense (MKBN).

Bitcoin Treasury company Treasury BV said it had raised initial funding of €126 million through a private round led by the venture capital firm of billionaires Cameron and Tyler Winklevoss https://t.co/4MqSRPpTxP

— Bloomberg (@business) September 3, 2025

Why this news is important

Treasury BV aims to become the first Bitcoin treasury company to be listed on a major European stock exchange.

The successful raising of $147 million immediately puts Treasury in the group of European businesses holding large-scale BTC .

- The participation of Winklevoss Capital and Nakamoto Holdings shows the growing confidence of US investment funds in Bitcoinizing the financial system.

Background and related events

Data from Bitcoin Treasuries : The largest European company holding BTC today is Bitcoin Group (Germany) with 3,605 BTC (~$400 million), followed by Sequans Communications (France) 3,205 BTC and The Smarter Web Company (UK) 2,440 BTC.

Treasury also signed an agreement to acquire Bitcoin Amsterdam - Europe's largest Bitcoin conference - to boost its media coverage and expand its reach.

Recently, Amdax (Netherlands) also announced plans to launch a Bitcoin treasury company and list on Euronext Amsterdam.

The Bitcoin treasury model, while attracting attention, also faces the risk of over-leverage, which analysts have compared to the 2008 financial crisis.

- The Winklevoss brothers' Gemini exchange also revealed its IPO plan , hoping to raise $317 million through a stock offering to investors on a major US stock exchange.

Expert opinion

Mr. Khing Oei , Founder and CEO of Treasury BV: “Bitcoin is reshaping the global financial market. We call the upcoming trend the Capital of Bitcoin, expanding BTC ownership similar to stocks. Treasury was established to put Bitcoin at the center of the European financial ecosystem.”

He also highlighted the risks of excessive leverage that many rivals face. The Treasury will maintain lower leverage levels to avoid the “death spiral” scenario that occurred during the 2008 financial crisis.

Conclude

Treasury initially launches with 1,000 BTC, aiming to expand holdings through issuance of shares and convertible debt.

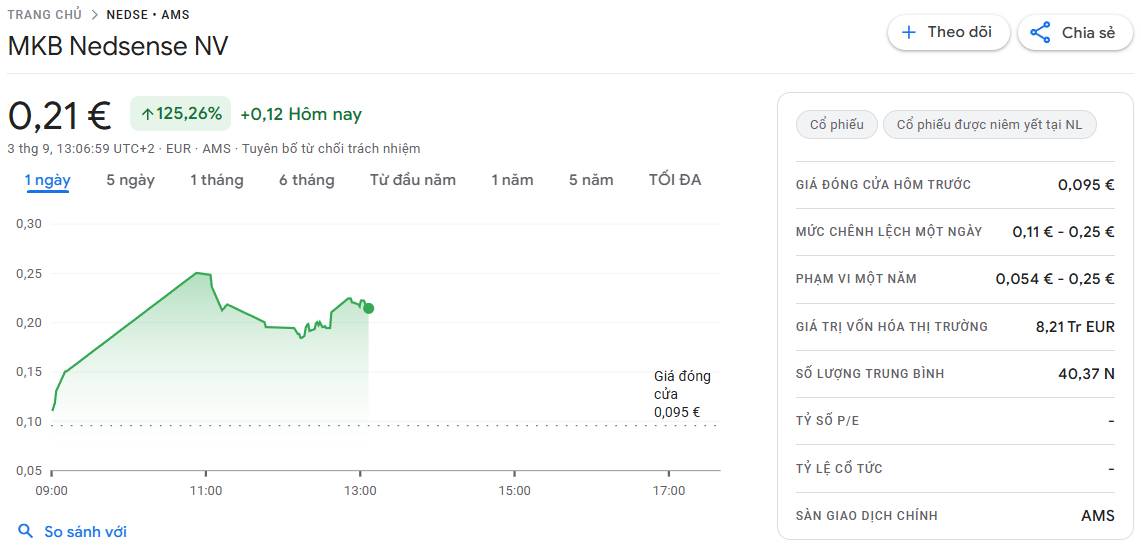

The public listing on Euronext Amsterdam (TRSR) through MKB Nedsense makes Treasury the first Bitcoin treasury company in Europe. The news sent MKBN shares soaring more than 125% in pre-market trading.

If successful, Treasury has the potential to become the “Strategy of Europe,” paving the way for a host of other companies to integrate Bitcoin as a strategic reserve asset .

Evidence

100 Public Companies Holding Bitcoin Worldwide as of September 3, 2025. Source: Bitcoin Treasuries

100 Public Companies Holding Bitcoin Worldwide as of September 3, 2025. Source: Bitcoin Treasuries

MKB Nedsense NV stock price movement captured at 06:30 PM on 09/03/2025 on Google Finance

MKB Nedsense NV stock price movement captured at 06:30 PM on 09/03/2025 on Google Finance

Coin68 synthesis