It’s a muddled macro moment: inflation is reheating, labor market data is sending mixed signals, and the debate over Fed independence is getting louder. With potential rate cuts on the table, I sat down with Cleveland Fed President Beth Hammack to talk about why independence matters, what she’s seeing in the data that keeps her leaning modestly restrictive, and how AI is reshaping the entry-level workforce for recent grads. We also get into what the Fed actually does beyond monetary policy, what she’s hearing from businesses, and why markets may be underpricing the biggest risk ahead.

This transcript has been lightly edited for clarity and flow. Below is the audio version, which is also available wherever you listen to podcasts.

This is a reader-supported publication. To receive new posts and support my work, consider becoming a paid subscriber.

Recorded on Friday, August 29, 2025.

Why Fed Independence Matters

Kyla: So President Hammack, could you talk about the importance of Federal Reserve independence? It's one of the main things that gives the Fed so much credibility here and abroad. So could you talk about what that means for markets, for the economy largely.

President Hammack: To me, a threat to Fed independence is a threat to low inflation. Achieving low inflation can mean making tough choices. It means that sometimes we have to maintain higher interest rates to ensure that we have lower rates over the longer and medium term.

And what is interest? It's the cost of borrowing money. If interest rates are higher, that's going to discourage households and businesses from borrowing, and that'll help bring down inflation. But those tough trade-offs can be really uncomfortable.

If we don't have independence, it likely means that we'll have higher inflation and higher costs. Over time, business leaders and politicians on both sides of the aisle agree that Fed independence is important to make sure that we can fulfill our dual mandate that we've been given from Congress. That mandate is to support maximum employment and price stability over the medium to longer term.

The Fed is accountable to Congress. The Chair, Jerome Powell, meets with Congress twice a year on what's known as his Humphrey-Hawkins testimony. That allows him to explain to our elected leaders about how we’re seeing the economy and where some of the challenges might be.

Having independence allows us to be free from short-term political pressures as we look to steer the economy to those dual mandate objectives of maximum employment and price stability.

Kyla: There still is some political influence in terms of nominating Fed governors and things like that - but a lot of people will call the Fed “unelected bureaucrats”. Could you talk about that?

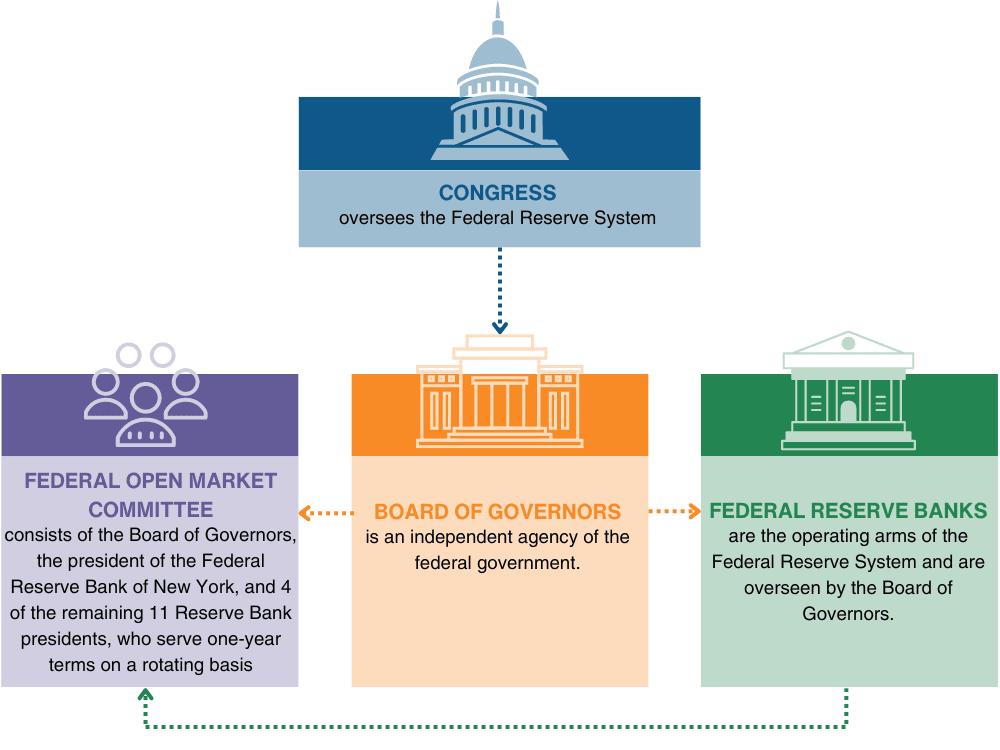

President Hammack: I would say we're independent, but accountable. So the Federal Reserve system is set up of two main parts.

One is the Board of Governors in Washington DC. Those people are appointed by the President and confirmed by the Senate.

Then you've got 12 Regional Reserve banks across the country, one of which is in Cleveland. Those regional reserve bank presidents are appointed by a local Board of Directors. Those Boards of Directors are pulled from members of the community and business leaders to help represent that area.

So you've got a federated system. Together we form the FOMC, all 19 of us. The seven governors vote at every meeting. The President of the New York Fed votes at every meeting. He's the Vice Chair of the FOMC and then four of the bank presidents vote at any given meeting on a rotating basis.

Kyla: Your job as a president is to be in the community. You're really involved, you're hearing from constituents on what their needs are and then delivering that news. Is that the correct way to interpret your role?

President Hammack: I'd say it's twofold.

One is for us to gather information about how the economy is doing and to understand what the experience is so that when I go to Washington, I can accurately represent how people across Ohio, Eastern Kentucky, Western Pennsylvania, and parts of West Virginia are faring and I can make sure that I'm doing everything I can to help set up an economy that's working for all of them.

The other is for us to be out in the community and understand what maybe some of the barriers are for individuals getting into the workforce. We spend a lot of time through our community development work, understanding what's happening both in the workforce development space with small businesses and with affordable housing.

Those are kind of three pillars that we spend a lot of time digging into to understand what's working and what's not working. We don't implement programs, but we do study what programs are working and we try to elevate and make connections, so we convene stakeholders across different groups to bring them together to help work on solutions to some of these core problems.

Staying Modestly Restrictive

Kyla: It seems like you've been looking at some of the economic data and have said that it's more important right now to stay modestly restrictive. And of course, Chair Powell gave his Jackson Hole speech and said it might be time to cut - or at least hinted at that. Could you talk about what you're seeing in the data that supports the fact that you think it might be best to stay modestly restrictive right now?

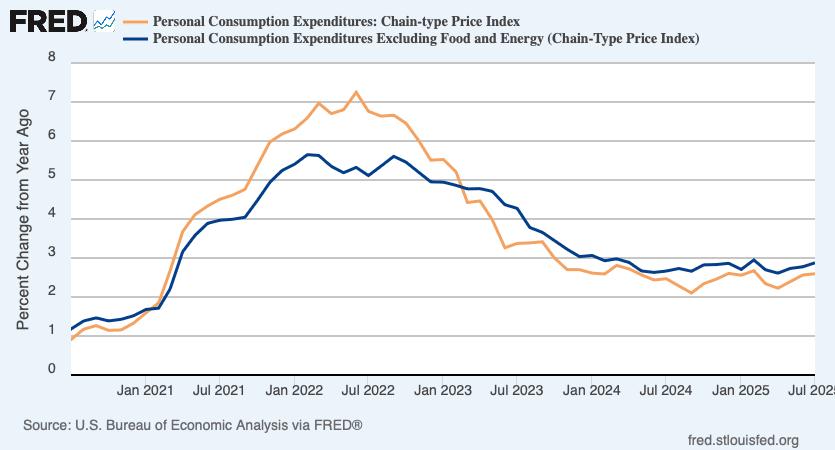

President Hammack: This is a challenging time for monetary policy. We're seeing pressure on both sides of our mandate. But to me, what I'm mostly seeing right now is that inflation is too high and it's been trending in the wrong direction.

Inflation

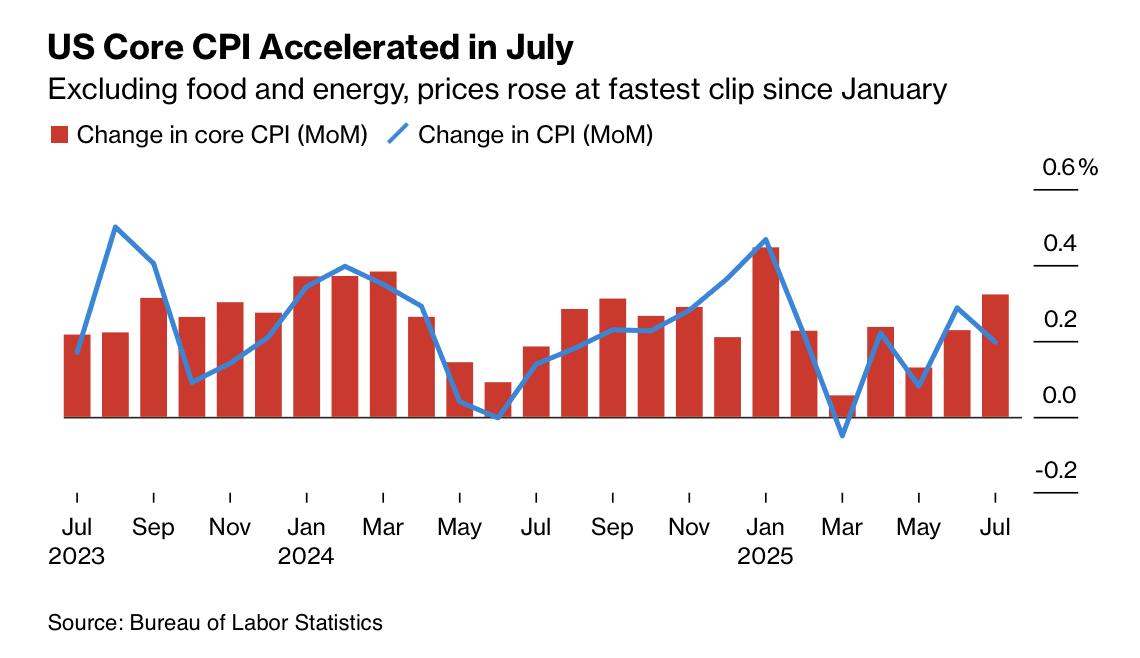

Recent reports have showed that core goods prices are moving higher and that may be driven by tariffs1.

There's some debate as to whether or not that's going be a one-time move or more persistently, but more concerning is that services inflation has also been moving up. That is less likely to have been driven by tariffs. That's something that we need to watch closely.

When I talk with businesses in the region, what I hear from them is that they've done their best to try to buffer individuals from raising prices that they've been eating into their margins, but that's not really going to last forever.

We saw that kind of play out in last month's data of the CPI, which moved up modestly. But the PPI moved up even more. I do anticipate that that is probably going to converge at some point and the pricing pressures we're seeing may make their way into the consumer's hands.

The Labor Market

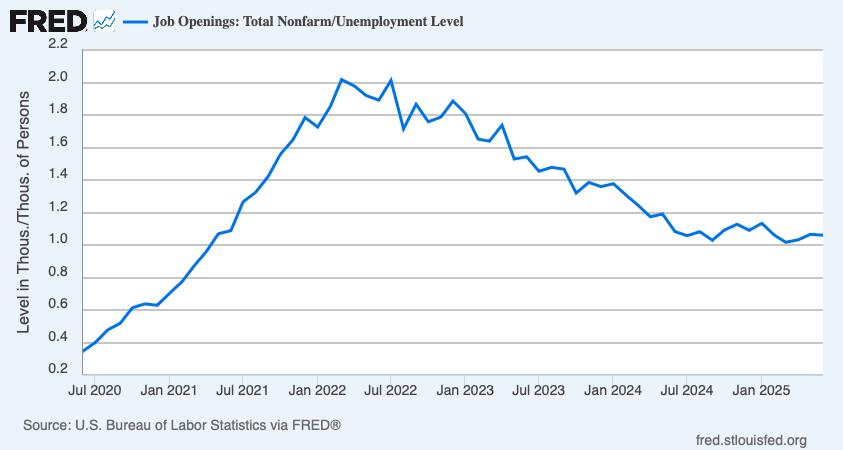

Right now, when I look at the labor market, to me it looks pretty balanced.

We have seen some shifts in terms of the headline growth in payrolls that are being created. But a lot of that could be driven by what's happening in labor supply. So with the changes in immigration, you would expect that you need fewer jobs being created to maintain the same level of unemployment.

We had one report in early August, which signaled that there could be some signs of slowing in the labor market because of the headline job numbers.

But on the other hand, we still had an unemployment rate that was low and stable and right around my estimates of maximum unemployment.

To me, when I look at the balance between those two sides of the mandate, I think it's more important that we continue to put pressure on bringing inflation back down to target. I think we need to stay modestly restrictive to do that.

Could the Fed Be Too Late?

Kyla: The recent labor market report was relatively weak. The only jobs that are really being added are in healthcare. There is a risk that all of this expedites - that the labor market deteriorates very quickly. Then the Fed finds itself in a situation where they're too late to respond effectively. How do you think about managing that sort of risk?

President Hammack: It's really about the balance of risks when we're looking at the overall picture and how we're setting monetary policy. As you rightly point out, monetary policy works with what we call long and variable lags, which means sometimes it takes a long time between when we make a rate change and what actually flows into the real economy.

We don't know exactly how long that's gonna take. We try to set policy not based on where we are today or where we were a month or a quarter ago, but where we think we're headed over the medium and longer term. So for us that requires really looking at forecasts of where we might be headed.

Right now, on the labor side, it's a little bit challenging to figure out what those forecasts should look like because we are seeing so many structural changes in the economy right now. But when I step back and look at where we are, it looks to me like we are still generally at a pretty healthy labor market. We may see the number of jobs being created coming down, but the supply of labor has also structurally come down.

A couple of other things that I look at are the (1) vacancies-to-unemployment ratio. That number has been generally pretty stable around one, meaning that there's just about as many unemployed people as there are jobs available. Sometimes it takes time for people to find their way into the right opportunity. That to me is a sign of things being in balance.

The other place that we look in Cleveland is (2) we've done analysis of worker notices, which is the Worker Adjustment and Retraining Notification (WARN) notices that come out that need to get filed ahead of larger layoffs. Those have not been trending upwards. They've moved up very slightly, but they're still within historical ranges.

So to monitor the labor market, we try to look at a broad confluence of those numbers pulled together. Then I add that with the conversations I'm having with businesses in the district. What I'm hearing is it took them a really long time to find the talent that they needed. They're loath to let people go unless they see a more significant downturn. So right now, to me, it looks like the labor market is pretty healthy and pretty stable. But as you know, there are definitely some things we need to continue watching closely for potential signs of slowing.

The Slow-to-Fire, Slow-to-Hire Labor Market

Kyla: It's a slow to fire, slow to hire labor market. In my conversations with people, I've also heard this note that it's very difficult to find people that are trained properly for the job. When you put your Fed hat on, like how do you think about that? These restrictions to the labor market that might just be things like training.

President Hammack: It could be training. I think that's where some of the workforce development that we've talked about comes in. I think there's also bigger shifts in the picture like AI and other new technologies that are coming out which are going to shift how we think about things. The place where I've heard the most concern in hiring has really been around recent college graduates.

We've heard that they're having a much tougher time getting into the labor market. It is a low hiring, low firing environment - someone coined the term job hugging, right? Instead of job shopping, the people who have jobs are kind of holding them as tight as they can because they want to make sure they can maintain it.

But people who don't have jobs are struggling. We had an event that we call our Policy Summit in June, where we bring together a whole bunch of community development specialists and leaders across the country to talk about some of these challenges. They talked about how applying for jobs in this environment with the online technology that we have can be really challenging because you send out hundreds of resumes and oftentimes you get two or three responses. There's lots of things that just don't even send you a response when you're sending out your resume to try to reach out. That's a really challenging environment for individuals.

The Impact of AI on the Labor Market

Kyla: It seems like AI is taking over job recruitment strategies and that AI is replacing the entry level workforce. How do you think about this massive technological change that we're all going to have to navigate? How does that impact how you think about the economy?

President Hammack: It's definitely going to be a big change and what exactly it's going to mean is still uncertain at this point. Technological progress is really crucial for raising living standards and we've seen lots of different moments of technological progress over the past several hundred years, whether you look at the shift from horses to cars, steam engines, calculators, the Internet, and every time you have these types of new transformational technologies come on, you see some amount of shifting in the jobs. There are jobs that are being destroyed, but new jobs that are being created. What's really important is to watch is how fast is that pace is moving.

Are you seeing as many new jobs be created as jobs being destroyed, which would keep the labor market in balance? Of course, there'll need to be some solutions because the people who are losing their jobs may not have the skills for the new jobs that are created. There'll be some amount of worker retraining that's needed, and we at the Fed don't operate that, but we can help study that and help see what is working and what's having the most most impact and which are the most effective programs, and help amplify those so that hopefully more individuals can find their way back into the labor market, if that is how this progresses.

Kyla: Have you seen any effective programs of retraining?

President Hammack: We've seen a couple of things. There's an organization in Cleveland that we've spent some time with called Magnet, which is the Nonprofit Manufacturing Advocacy and Growth Network. They really work to help explain why manufacturing is a great set of opportunities and why those can be great high paying jobs. They work with local businesses to help provide them ideas on robotics and ways to implement AI and other types of machine learning to help support and improve their businesses.

There are places like community colleges too. I went and visited Lorain County Community College which is just slightly west of Cleveland. They've developed clean rooms where they're training individuals who come straight from high school, go through a 10 week program and come out on the back end of that with a reasonably high paying job and a pathway to continuing their education, continuing to grow and continuing to improve in the wages they earn in the roles they take on.

It’s About Trends, Not Just Point-in-Time Data

Kyla: Last year when the Fed cut, the data looked a bit worse. How do you think about comparing now to then?

President Hammack: To me, it's not just about the point-in-time data, it's really about the trend and where are we headed. Last year when we reduced rates by 100 basis points starting in September we had unemployment that was right around these levels. It's been pretty consistent between 4% and 4.3% over the past 12 to 18 months. We had inflation that had come from above 7% to below 3% and was trending in that downward direction.

So we had confidence that we would continue to make progress towards that 2% objective. Over the last 12 months, we've really made little further progress, and if anything, we're seeing inflation now tick back higher. That's a place that we need to watch.

The Two Speed Economy

The other thing I'll point to when I'm out in the district talking to individuals and businesses is I hear about a two speed economy.

I hear about people at the top of the wealth spectrum who are feeling really confident. They're maybe feeling buoyed by prices in the stock market that are supporting their IRAs or their 401ks.

But then I hear from lower income individuals at the bottom end of the spectrum and inflation continues to really bite for them. It means that their paycheck is largely going to housing and food and there's really not much left over for new clothing for going out to the movies for ordering in for a night.

We really have this disconnect in terms of what's going on in the economy.

Wealth Inequality

Kyla: When wealth inequality comes up like that it’s probably very difficult to make a decision. The economy is becoming more and more uneven. How does the Federal Reserve think about managing something like that?

President Hammack: Well, we really have one tool and that one tool is monetary policy, which is largely setting interest rates. We also have our balance sheet and we use our communications to help explain where we are and where we think we're headed. But monetary policy is not really well equipped to deal with the income inequality issues. That's really something that we leave to the fiscal policy makers.

Maybe it's a good time to talk about kind of the other four functions away from just monetary policy that we do. Monetary policy is what most people know us for - moving interest rates - but we have four other functions that really help contribute to how I see how monetary policy needs to be set.

Financial stability: This was the reason for our founding - to make sure that we can watch across the broad economy, see where there are risks and instabilities, make sure that we have the tools we need to help keep the financial system working, and really having a strong and healthy financial system allows us to implement monetary policy. If the markets aren't working, it makes it much more complicated for us to get our rate transmission into the markets.

Supervision and regulation: We oversee the banks and the financial institutions within our districts. Within Cleveland's district, there are about 250 institutions that we work with, making sure that these are stable strong banks allows them to provide credit to individuals and businesses, which is really the the growth engine of the economy.

Payment system: We process and issue cash to banks. I like to think of the Fed as being the bank for banks. We're where a commercial bank goes when they want to deposit their funds. We have to ensure that that system runs smoothly behind the scenes and that money can transfer amongst individuals, businesses, and financial institutions.

Consumer protection and community development: This is where we really try to serve the regional areas that we're representing, understand how the economy is performing for them, help highlight different ideas and solutions of where things are going. Talking with individuals out in the district what I hear day to day is that inflation continues to bite, that wages haven't kept up, and that they're feeling more and more stretched.

I was with a business in Wooster, which is a small college town in northeast Ohio, talking with some individuals who were working in a factory and they were talking about how they've always had a [$400] emergency fund, but that $400 fund isn't paying for what it used to pay for. It used to cover getting your air conditioning replaced and getting some small auto changes needed. Now it's just not stretching quite as far. Once you wipe out that fund rebuilding, it takes an awful long time and puts them in a more precarious position.

What the Stock Market Might Not Be Seeing

Kyla: So you're talking about these concerns that the everyday person is facing, but when you, look at the markets, it's just nonstop. The S&P 500 is skyrocketing. Do you think that there's anything that the stock market is missing?

President Hammack: Financial markets price risk, that's their job. It's the collective judgment of lots of different individuals that come together, but they still get surprised from time to time. I'd say there are two places in particular that I'm focused on where I think markets may be surprised in the near future.

The first one is really around Fed independence.

The second one is around sort of the overall outlook for the economy.

Over the last 40 years, what we've seen is long-term interest rates have continued to trend down and inflation has generally been low and reasonably stable. Part of this is because there's been widespread belief that the Fed acting as an independent body would be able to reduce inflation and be able to keep that contained. If we had a loss of monetary policy independence, that could threaten our ability to control inflation. That might mean that longer term interest rates rise and stay higher on a more sustained basis. Certainly, it could impact things like mortgage rates and 10-year [Treasury yields] and the longer end part of the curve. That could be pretty difficult for the economy to adjust to as you settle into that new normal.

On the more fundamental side of the economy, I do think there's a real challenge for monetary policy because we are seeing these competing crosscurrents on our inflation side of our mandate and on the employment side of our mandate.

Both of those could be under pressure in the near term, and so we need to watch closely how we balance that. As you pointed out, it does seem like there's a real disconnect between what I'm seeing in the financial markets, with the S&P 500 making new highs, and when I'm out talking to local businesses and hearing about how they're thinking about their customer bases.

The equity markets seem very optimistic about margins and the ability for businesses to continue to have robust demand, whereas when I talk to businesses on Main Street, what I'm hearing is a lot more caution and a lot more concern that maybe they can't push pricing any further. Their costs are going up. They feel like they need to raise prices to maintain their margins, but they're worried about demand dropping off if they do that. There's much more nuance and tension in what I hear from Main Street than I think what we're seeing from the Wall Street pricing.

Kyla: Do you think that they know what is potentially at risk?

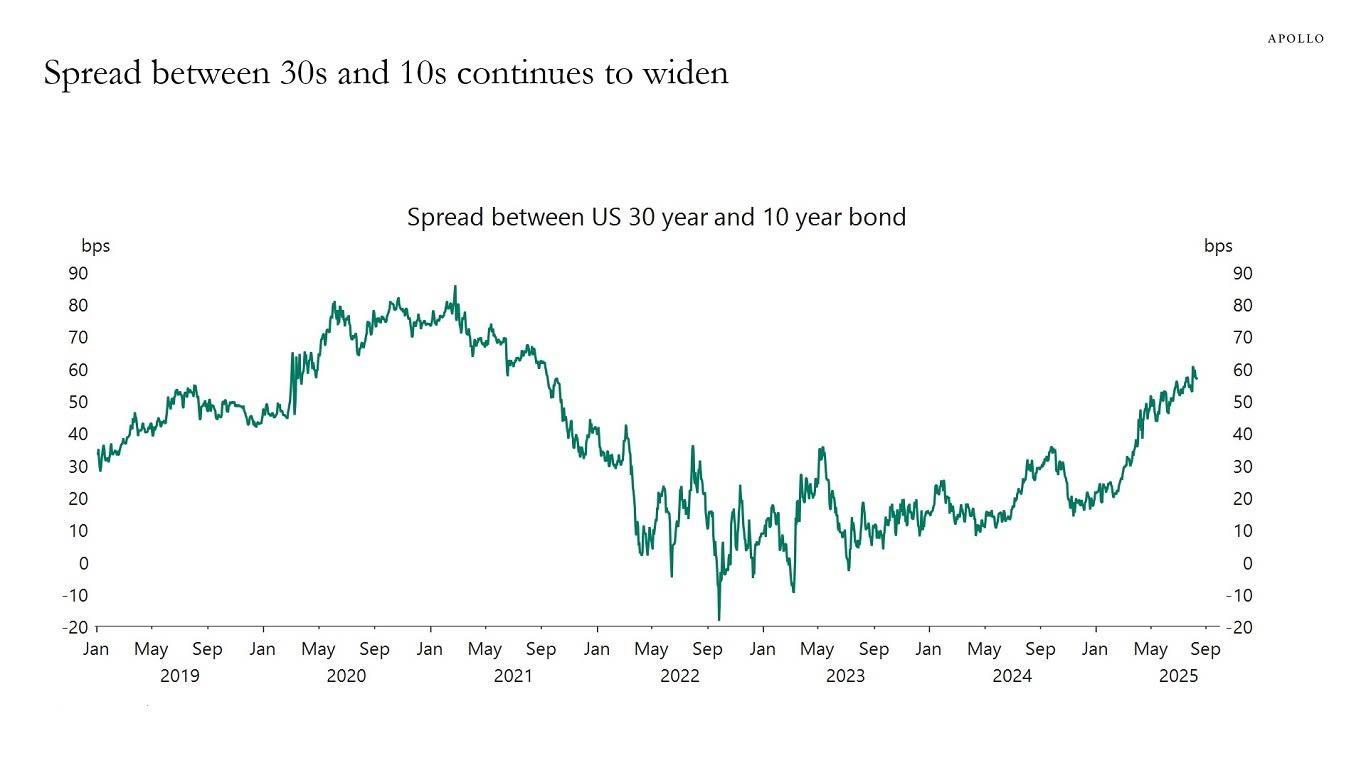

President Hammack: The markets have had a pretty muted reaction. I think participants in the markets understand what it means. That’s the best I can judge from the modest yield curve steepening we've seen, which is the front end staying low and the back end going higher, which is what you would expect if monetary policy independence was being threatened because you might have more pressure to lower near term rates.

[The Fed doesn’t] control the back end of the curve, but if the market starts anticipating a higher inflation - and more risk of inflation becoming out of control - that could put more pressure on higher yields at the back end of the curve. I think that's something you would likely see if there was more concern about Fed independence.

As we talked about, we're independent but accountable. I think there's a lot of misconceptions about how the Fed operates. We try to get out there and explain who we are and what we do. But I recognize individuals have lots of things going on in their lives and we may not be first and foremost of their concerns.

Kyla: Institutions are pretty confusing to understand. It sounds like that there's higher concerns about inflation. You're watching the labor market very closely and Fed independence is top of mind. That's what you're going into the next few months really paying attention to, those three things.

President Hammack: I think that sums it up really well.

Kyla: Is there anything else that you want to add or anything else that you wanna talk about?

President Hammack: I would just say thank you very much. I really appreciate the opportunity, um, to talk with you and thank you for all the work that you're doing to help young people understand what's going on in their financial health and what's going on broadly in the economy. I think it's critically important. I spend time trying to talk to my 19 and 22-year-old kids about it as well. But I have a feeling that putting it in your format probably resonates better.

Kyla: Thank you so much for all that you do.

Four Takeaways

Four things stood out from this conversation with President Hammack:

Independence really matters. If politics push the Fed around, long-term rates can jump and stay high - pricier mortgages and car loans - and it can dent how the world views the dollar. If we don’t have central bank independence, it could lead to higher inflation and higher costs, as President Hammack said.

The Fed isn't unified on what comes next. While Chair Powell hinted at rate cuts in Jackson Hole, Hammack wants to stay restrictive to fight inflation that's creeping back up (Odd Lots interviewed some other Fed Presidents at Jackson Hole that said the same thing). There is genuine uncertainty about the economic path ahead.

There's a real disconnect between financial markets hitting new highs and what businesses are actually experiencing. The S&P 500 assumes companies can keep raising prices and maintaining margins, but Main Street businesses are telling Hammack they're worried about pushing customers away if they raise prices further. The markets could be underpricing two risks - an erosion of independence and a messy inflation/employment cross-current.

Recent graduates are struggling find work, for many reasons. There does seem to be a cooling labor market - but to President Hammack, inflation is the thing to pay attention to right now. Services are still getting more expensive, and what businesses pay (producer prices) are rising faster. That pressure often rolls downhill.

The bigger picture is that economic data is getting fuzzier just as the stakes are getting higher. Fed independence questions, inflation concerns, and labor market shifts are all happening at once. The path ahead requires balancing risks that pull in opposite directions.

Thanks for reading.