This article is machine translated

Show original

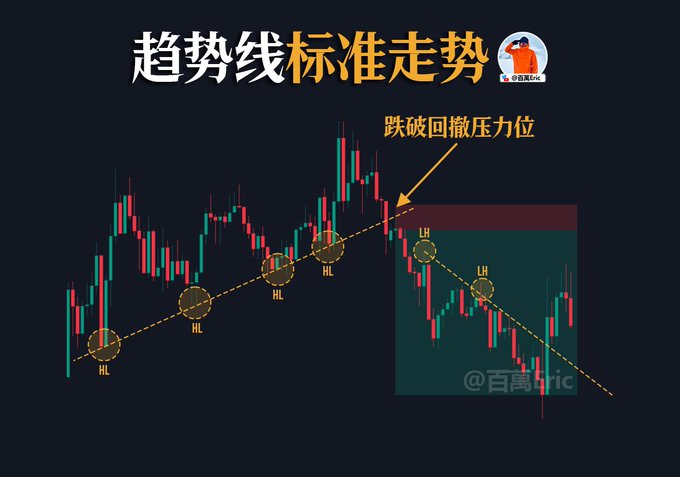

In an uptrend, prices repeatedly make higher lows (HL), confirming and extending the trendline. As long as the trendline is valid, bulls remain in control.

The true turning point occurs when prices first break below the trendline. When the price rebounds and retests but fails to re-establish itself, the trendline shifts from support to resistance, signaling a shift in bullish and bearish power.

If the market subsequently begins to make lower highs (LH), this further confirms bearish dominance. Staking short positions at this point will significantly improve both the win rate and profit-loss ratio.

To put it simply, the value of a trendline lies not in its "drawing" (drawing it or not is irrelevant, as long as you know it), but in its response to breakouts and retests.

It is the key point where bullish and bearish power shifts and the true signal of a trend reversal.

Thanks for sharing

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content