The US Federal Reserve (Fed) will host a Payments Innovation Conference on October 21, bringing stablecoins, tokenization, DeFi , and AI into high-level discussion for the first time.

Fed finalizes schedule for conference on stablecoins and Tokenize. Photo: CNBC

Fed finalizes schedule for conference on stablecoins and Tokenize. Photo: CNBC

The US Federal Reserve (Fed) has just announced that it will hold a Payment Innovation Conference (Payments Innovation Conference) on October 21, 2025. The event brings together multiple stakeholders to discuss how to improve the payment system, with a focus on stablecoins , tokenization of financial products and services, DeFi , and artificial intelligence ( AI ).

@federalreserve announces it will host a conference on payments innovation on Tuesday, October 21: https://t.co/XnhqinMlwO

— Federal Reserve (@federalreserve) September 3, 2025

Notably, the conference will be broadcast publicly on the Fed's official website, demonstrating the level of transparency and broad interest that this event aims to achieve.

Why is this news important?

- Fed officially brings crypto into high-level discussion: Stablecoins, tokenization, DeFi and AI are no longer peripheral but become the focus of payment innovation strategy.

- A clear shift in stance: From restrictive to open, the Fed is removing barriers, reducing regulatory burdens, paving the way for US banks to enter the crypto sector.

- Stablecoins are linked to national interests: Not only do they help improve payments, stablecoins also increase demand for US bonds and strengthen the USD's position.

- Tokenize Doesn't Weaken the Fed: New Report Claims the Fed Still Maintains Monetary Policy Power in a Tokenize System.

Main theme of the conference

- According to the announcement, the program will include discussion sessions on:

Stablecoin business model and potential use in payment systems.

Tokenize - bringing traditional financial assets to the blockchain.

The intersection of traditional finance (TradFi) and decentralized finance (DeFi).

Applying AI in payments opens up new directions for transaction speed and efficiency.

- Fed Governor Christopher Walleremphasized : “Innovation has always been a core part of payments to meet the changing needs of consumers and businesses. I look forward to hearing new ideas and XEM the opportunities and challenges that technology presents to improve the safety and efficiency of the system.”

Softening stance on crypto

- This conference takes place in the context of the Fed's more open stance towards crypto under the Trump administration. Over the past half year, the Fed has:

Retracts guidance that previously advised banks against getting involved in crypto and stablecoins.

End special monitoring program for banks with crypto-related activities.

Eliminate the concept of “reputational risk” in bank audits, which has been a tool to restrict crypto businesses.

Even XEM letting its employees own crypto .

- These changes have brought an important victory for the crypto industry, contributing to ending the “crypto debanking” situation in the US.

- At the Wyoming Blockchain Symposium (August 19), Michelle Bowman, Vice Chair of Fed Supervision, also called for the Fed to take a less cautious and more proactive approach to new technologies such as blockchain and AI, instead of placing too many barriers. She also advocated reducing the regulatory burden on small banks, encouraging financial innovation.

From payment innovation to national interest

- The Fed has not only eased policy but also begun to view stablecoins in a more positive light. In the minutes of the July meeting of the Federal Open Market Committee (FOMC), Fed officials asserted that fiat-backed stablecoins could improve the efficiency of the payment system, and the issuance and use of stablecoins would increase demand for collateralized assets, especially US Treasury bonds.

- Fed Governor Waller also argued that stablecoins could increase competition in the payment sector, help reduce transaction costs for users, and at the same time promote global demand for the US dollar. The key point lies in the statement that "stablecoins are not only technological, but also a tool to strengthen the financial strength and monetary status of the US".

- A joint study by the New York Fed and the Bank for International Settlements (BIS) cited by Reuters shows that even in a decentralized and Tokenize financial system, the central bank can still implement monetary policy effectively, even faster thanks to smart contracts. This eliminates concerns that Tokenize will weaken the Fed's control, but on the contrary, it can become a lever to increase the effectiveness of macro management.

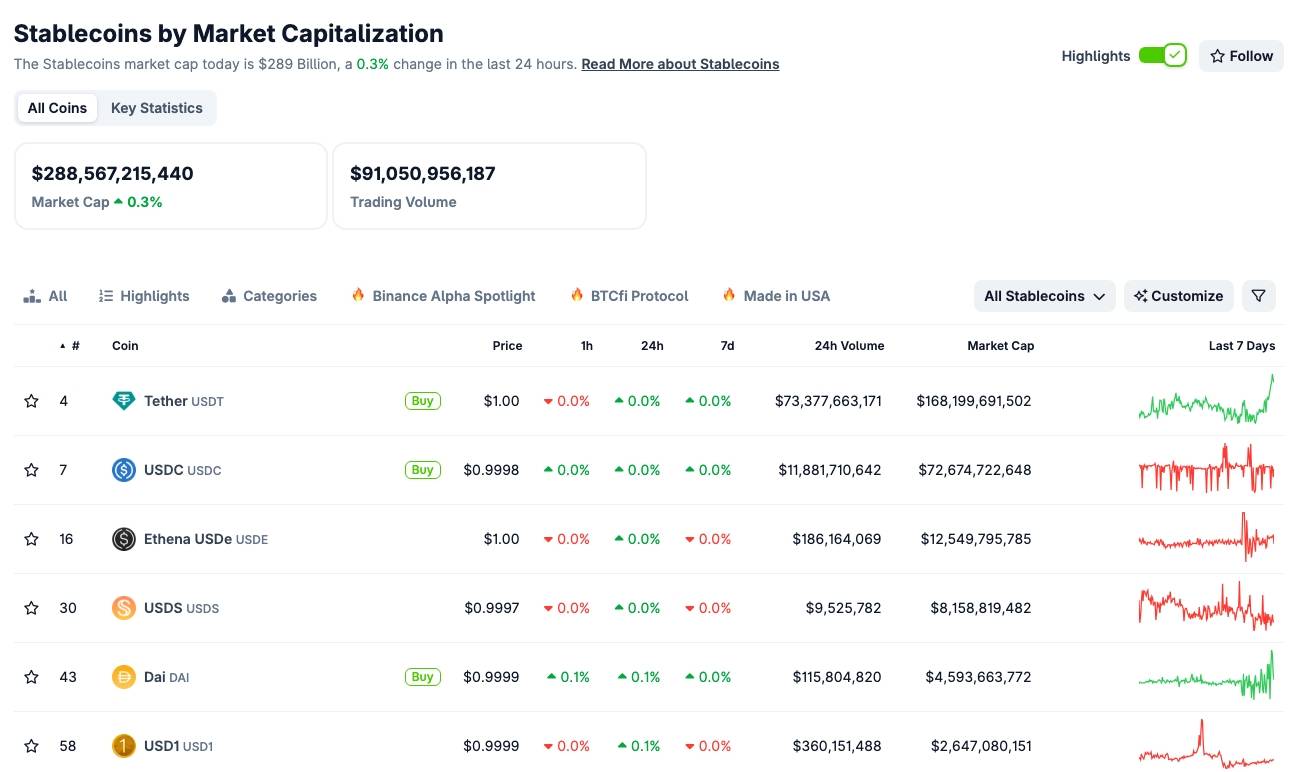

- The stablecoin market is currently witnessing an unprecedented boom. As of early September 2025, the total Capital of this segment has reached about 287-288 billion USD, an increase of more than 22% compared to the beginning of the year and continuously setting new peaks. In August alone, the on-chain stablecoin volume exceeded the 3 trillion USD mark, nearly doubling compared to the previous month. According to a forecast from Barron's, the total stablecoin Capital could even reach 500 billion USD by the end of 2026, making this asset class one of the main pillars of the global financial infrastructure.

Stablecoin market Capital as of the morning of September 4, 2025, CoinGecko screenshot

Stablecoin market Capital as of the morning of September 4, 2025, CoinGecko screenshot

Coin68 synthesis