Polymarket has just received the green light from the CFTC to return to the US, following the $112 million acquisition of QCEX.

Polymarket officially returns to the US after CFTC ruling, supported by MrBeast. Photo: Forbes

Polymarket officially returns to the US after CFTC ruling, supported by MrBeast. Photo: Forbes

Polymarket , a crypto-based prediction market platform, has officially been cleared by the Commodity Futures Trading Commission (CFTC) to operate legally in the US , marking a major turning point for a project that has faced serious legal hurdles in the US.

Polymarket has been given the green light to go live in the USA by the @CFTC .

— Shayne Coplan 🦅 (@shayne_coplan) September 3, 2025

Credit to the Commission and Staff for their impressive work. This process has been accomplished in record timing.

Stay tuned https://t.co/NVziTixpqO

Why is this news important?

- Legalizing a precedent: After years of debate, Polymarket has proven that the path to legalizing prediction markets in the US is feasible.

- Multi-level impact: From politics (Trump Jr.), tech (Elon Musk), to pop culture (MrBeast), Polymarket is building a wide-ranging influence ecosystem.

- Booming market: The sharp increase in the number of new markets shows that the prediction market is not only a crypto trend but is gradually becoming an attractive information and financial channel.

- Risk and monitoring: The warning from the NFL reflects that the prediction market will still face challenges from industries directly related to betting.

- Mainstreaming Web3: With the resonance from legal, political, media and community, Polymarket has the potential to become a typical case of bringing Web3 prediction market into the mainstream.

“Green light” within a narrow framework

- On September 3, the CFTC issued a “no-action letter” to QCX (a recognized Derivative exchange) and QC Clearing (a Derivative clearing organization). The letter states that the parties will not be subject to penalties for failure to comply with certain recordkeeping and data reporting requirements for binary options and variable payout contracts.

- In other words, the CFTC temporarily allows these entities to operate within a certain scope without being penalized in terms of reporting procedures and data storage for the above types of contracts.

- While the exemption is narrow and similar to previous cases, it provides an important legal foundation for Polymarket after the company spent $112 million to acquire QCEX. - a CFTC-licensed Derivative exchange. This officially paved the way for Polymarket to legally return to the US market, after federal investigations ended in the summer of 2025 without new charges.

- Polymarket is banned from operating with US users from 2022 following a settlement with the CFTC regarding unregistered Derivative trading.

- CEO Shayne Coplan confirmed on X: “Polymarket has received the green light from the CFTC to operate in the US. This process was completed in record time. Stay tuned for more.”

Political-media support

- Polymarket not only has legal advantages but is also fueled by Capital flows and powerful factors:

1789 Capital, a fund backed by Donald Trump Jr. , has just poured tens of millions of dollars into Polymarket. President Trump’s eldest son has also joined the advisory board, further strengthening the platform’s political and media clout. Polymarket is also Capital $200 million at a pre-money valuation of about $1 billion.

In June, Elon Musk's X announced a partnership with Polymarket , opening up the prospect of integrating prediction markets right into a global social media platform.

Recently, CEO Shayne Coplan also revealed in a tweet that MrBeast - the world's biggest YouTuber who was once"exposed" for pumping up crypto - directly mentioned Polymarket in his livestream. Coplan commented: "A whole new generation will understand the prediction market like second nature." This could be a strong media push, helping Polymarket reach tens of millions of young audiences worldwide.

. @MrBeast kept checking the polymarket about himself on his own stream.

— Shayne Coplan 🦅 (@shayne_coplan) September 2, 2025

A whole new generation will understand prediction markets like second nature. pic.twitter.com/1hCixmdP4J

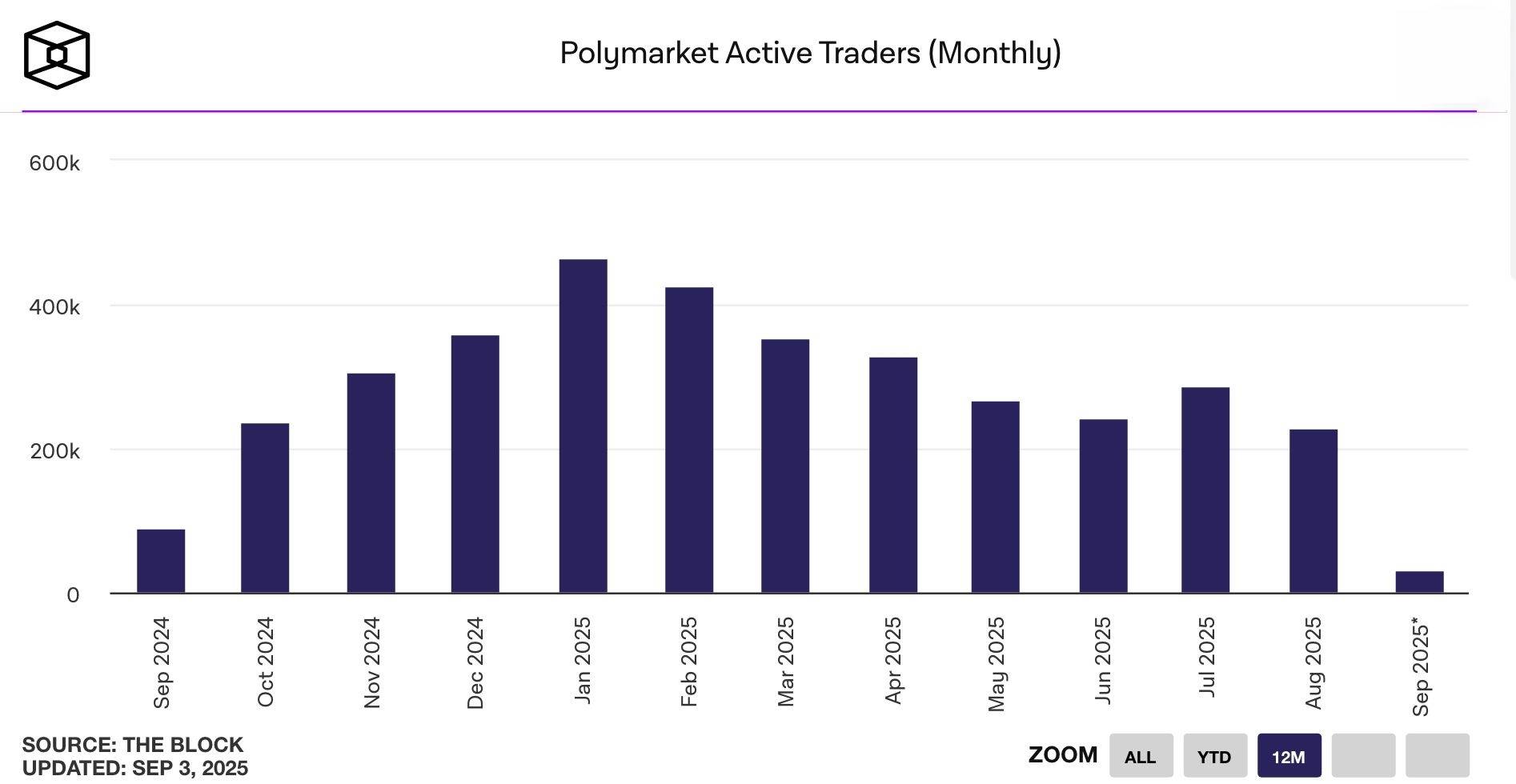

- In terms of data, July saw more than 11,500 new markets on Polymarket, up 44% from the previous month. However, this figure has not yet reached the peak in January, showing that demand for prediction markets is still strong, but there is still a lot of room for recovery.

Statistics on the number of active traders on Polymarket. Source: The Block (04/09/2025)

Statistics on the number of active traders on Polymarket. Source: The Block (04/09/2025)

- Polymarket's biggest rival, Kalshi , is also on the rise. The platform has just completed a $185 million Series C round, raising its valuation to $2 billion. The company also recruited John Wang, a famous crypto influencer, as its Chief Crypto Officer, and partnered with Robinhood to soon launch a football betting product, aiming to popularize prediction markets to millions of retail users.

- However, not everyone is supportive of the prediction market boom. Recently, the NFL expressed concerns that platforms like Polymarket may lack oversight standards, leading to the risk of manipulating results or negatively affecting transparency in sports. This is a major challenge if Polymarket expands into areas related to sports betting.

Coin68 synthesis