Traditional markets were unnerved by weak private sector payrolls data released by ADP, which showed just 54,000 jobs added in August, well below market forecasts of 75,000.

VX:TZ7971

Friday will also see the release of the more important US jobs report, which will reveal whether the labor market is strong or losing momentum. Wednesday's labor force data showed that the number of unemployed Americans (7.24 million) now exceeds the number of employed Americans (7.18 million). While economists expect an increase of 80,000 jobs in August, some worry the actual number may be far lower than expected.

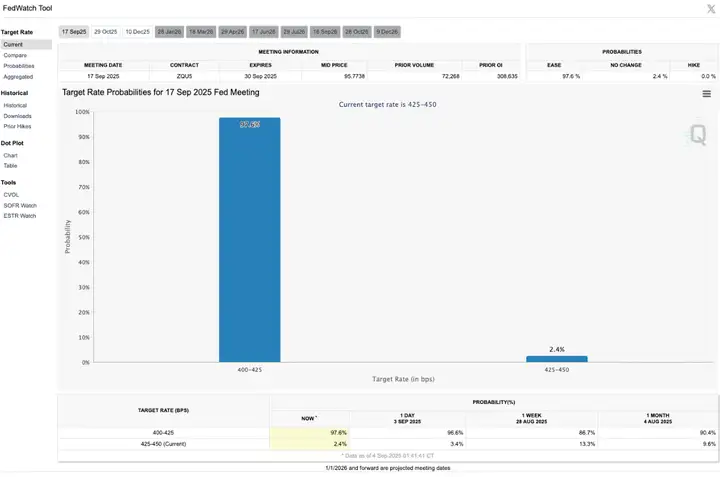

For Bitcoin investors, signs of a slowing labor market could be a sign that the Federal Reserve is considering cutting interest rates. CME Group's FedWatch tool currently shows a 97.6% probability that the Fed will cut its benchmark interest rate by 25 basis points at its September meeting, a move many traders expect would trigger a rebound in Bitcoin prices.

While the market is anxiously awaiting this week’s U.S. jobs data, retail and institutional investors are actively buying in the spot market.

The BTC/USDT liquidation heat map shows that the Bitcoin price is hovering tightly between $109,000 and $111,200, with short-term traders taking profits near the high of this range.

If Bitcoin breaks through $114,000, the cumulative short position liquidation intensity of mainstream CEX will reach 847 million.

On the contrary, if Bitcoin falls below $111,000, the cumulative long order liquidation intensity of mainstream CEX will reach 1.416 billion.

Meanwhile, with the growing wave of corporate cryptocurrency purchases, Nasdaq, the second-largest US stock exchange and home to numerous cryptocurrency reserve companies, has decided to tighten scrutiny and implement stricter regulations for companies that purchase cryptocurrencies through capital increases. Nasdaq will strengthen its scrutiny of cryptocurrency investments by listed companies. This increased scrutiny stems from the lack of transparency surrounding the cryptocurrency investments of many companies like MicroStrategy, and the apparent lack of transparency surrounding the purchases of cryptocurrencies by many companies that raise funds from the public to boost their stock prices. Nasdaq is concerned that this practice could increase investor risk.

Upon the news, the stock prices of most companies similar to MicroStrategy plummeted, causing cryptocurrency investors to worry about the impact on cryptocurrencies and fears that the new policy would force some companies to sell their holdings, leading to a decline in the cryptocurrency market. While this new regulation is actually beneficial to the cryptocurrency market in the long term, as it prevents these companies from "playing big" and potentially increasing risks in the future, it will undoubtedly cause some short-term pain in the cryptocurrency market.

Today's panic index is 48, remaining neutral.

The US will release its heavyweight non-farm payroll data tonight. The last release in August caused a sharp drop in both stocks and currencies, leading the market to be wary of another shocking release tonight. Therefore, be aware of the potential for significant market volatility tonight. Furthermore, since it's Friday, there may be a risk-off period before the US stock market opens, potentially leading to a market correction. Therefore, be cautious with your positions or wait for clearer market trends before entering the market. Currently, the total number of Bitcoins held by listed companies worldwide has exceeded 1 million, equivalent to $112.4 billion. However, most Bitcoin reserve companies have only just begun long-term investment strategies, and much of the funds raised have yet to be invested. There's still room for growth, so don't panic.