- Technical indicators show that ETH is facing a short-term range of 4436-4809. Breaking through the upper track may start a new upward trend.

- The Cancun upgrade and ERC-3643 standard adoption provide fundamental support for long-term value

- Accelerating institutional adoption and the tokenization of real-world assets are driving ETH’s long-term growth potential.

ETH Price Prediction

Technical Analysis: ETH faces key resistance level in the short term

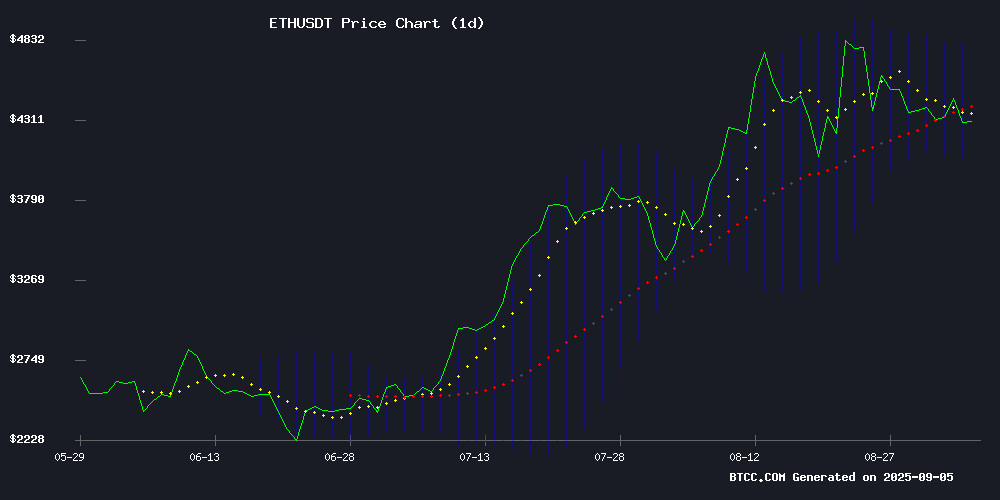

According to BTCC financial analyst Robert, ETH's current price of 4414.54 USDT is slightly below its 20-day moving average of 4436.8490, indicating slightly weak short-term momentum. The MACD indicator is positive at 29.8828, but compared to its signal line of -58.1532, it suggests weakening momentum. The upper Bollinger Band at 4809.0728 is acting as a significant resistance level, while the lower Bollinger Band at 4064.6252 provides support.

Robert pointed out: "From a technical perspective, ETH needs to hold above the 4436 level to regain upward momentum. If it breaks through the 4809 resistance level, it may start a new round of upward movement."

Market sentiment: strong fundamentals but short-term uncertainties

BTCC financial analyst Robert said: "Despite the $120,000 in losses caused by the DeFi vulnerability incident, Ethereum 's overall fundamentals remain strong. The Cancun upgrade reduced Layer 2 fees by 95%, significantly improving network efficiency, and ERC-3643 has become the preferred standard for tokenizing real-world assets, indicating that institutional adoption is accelerating."

Robert added: "Singapore's recognition of MagnaChain and the MC public chain, as well as the success story of early investors who saw their holdings rise from $310,000 to $4.3 billion, all provide strong support for the long-term value of ETH . However, the 14-day delay in the validator queue and the large-scale withdrawal of ETH from OKX may lead to short-term volatility."

Factors affecting ETH prices

DeFi users lose $120,000 due to unlimited wallet authorization vulnerability

A DeFi user suffered a $120,000 liquidation after failing to revoke unlimited token authorization, exposing the systemic risks hidden behind blockchain convenience. The incident revealed a critical vulnerability in the ERC-20 protocol, where 83% of new users unknowingly granted blank-check access to smart contracts .

60% of DeFi projects require unlimited authorization, which is like handing over a credit card with no spending limit. Malicious contracts exploit this vulnerability to empty wallets without warning. Such vulnerabilities resulted in $97 million in losses in the fourth quarter of 2023, effectively leaving the vault open for the sake of transaction speed.

Projects often defend this feature as efficiency, but secretly use it to adjust collateralization ratios or deduct fees. This regulatory gap leaves users unprotected in this "Wild West" of programmable finance—saving five seconds could expose their entire assets.

Ethereum validator queue faces 14-day delay as demand surges

The Ethereum Proof-of- Stake network is experiencing unprecedented congestion, with validator queues reaching record highs. Over 1.6 million ETH is stuck in a processing bottleneck—825,453 ETH awaiting withdrawal and 833,609 ETH awaiting activation. This bottleneck has resulted in a 14-day waiting period for both incoming and outgoing transactions, demonstrating the significant strain on the network infrastructure.

This backlog highlights Ethereum's maturation as a strong staking platform since its transition from proof-of-work in 2022. Validators are facing operational constraints just as institutional interest in liquid staking derivatives reaches new highs. Market participants interpret queue accumulation as a bullish indicator—demonstrating growing conviction in Ethereum's long-term value proposition, despite short-term efficiency issues.

Network architects now face a critical scaling challenge. These delays could dampen validator participation at a time when Ethereum needs strong decentralization. Liquid staking protocol could gain further traction as stakeholders seek solutions to locking up capital, potentially reshaping the ecosystem's power dynamics.

A new address withdrew $65.84 million worth of ETH from OKX, generating a profit of $1.3 million.

A newly identified Ethereum address withdrew 15,256.6 ETH from the OKX exchange, valued at approximately $65.84 million, at an average price of $4,315 per ETH. The transaction was completed within 11 hours, resulting in a current floating profit of $1.296 million.

This rapid accumulation and subsequent withdrawal behavior indicates that institutional or high-net-worth investors remain interested in Ethereum despite continued market volatility. Such large-scale capital movements often indicate strategic positioning in anticipation of price fluctuations.

ERC-3643 becomes the preferred standard for tokenizing real-world assets

The ERC-3643 token standard is gaining recognition as the most suitable framework for tokenizing real-world assets (RWAs), addressing critical compliance and traceability requirements. Unlike traditional standards like ERC-20 or ERC-1400, ERC-3643 embeds compliance logic directly into the token, bridging the gap between traditional financial regulatory requirements and the permissionless nature of blockchain.

Financial giants like SBI have already leveraged ChainLink ’s Cross-Chain Interoperability Protocol (CCIP) to advance RWA tokenization in Japan. Meanwhile, projects like Plume Network aim to bring “everything to the blockchain,” highlighting the growing institutional interest in compliant blockchain solutions.

SEC Chairman Paul Atkins emphasized the importance of ERC-3643 in a July 2025 speech, explicitly endorsing it as the benchmark for the digital financial revolution. The standard's ability to automate compliance checks reduces costs and accelerates adoption, making it the backbone of the future RWA market.

Singapore recognizes blockchain innovation: MagnaChain and MC public chain receive institutional recognition

Singapore continues to position itself as a blockchain-friendly hub, with projects such as MagnaChain and MC Public Chain (MIXMAX CHAIN) receiving institutional recognition, demonstrating the city-state's strategic focus on fintech, gaming, and asset trading infrastructure.

MagnaChain has developed into a gaming-focused blockchain, partnering with industry giants such as Epici Games to integrate Unreal Engine. Its architecture prioritizes the high throughput and security required of interactive entertainment platforms, and its partnership with the Shanghai Yangfan Association further demonstrates its cross-border ambition to build a decentralized gaming ecosystem.

MC Chain provides financial infrastructure through an Ethereum-based Layer-2 solution, featuring enhanced privacy protocols and performance upgrades. Developed by the Singapore MC Chain Foundation, the technology stack addresses key limitations of mainstream DeFi platforms while maintaining regulatory compatibility.

Early Ethereum Investors Turn $310,000 into $4.3 Billion in Market Recovery

An early Ethereum ICO investor has resurfaced after an eight-year hiatus, pledging 150,000 ETH worth $656 million. The investor originally purchased 1 million ETH during the 2015 ICO for $310,000, now valued at $4.3 billion. Ethereum recently surpassed its all-time high of $ 4,946.05, fueled by ETF inflows, marking a strong reversal after years of stagnation.

Standard Chartered Bank predicts that ETH could reach $8,000 by 2026, and analyst Geoff Kendrick even suggests a long-term trajectory to $35,000. Market strategists note that "the awakening of whale wallets symbolizes institutional confidence," noting similarities with Bitcoin's early adoption cycle. Retail investor interest in ETH staking has surged 47% year-to-date.

Ethereum's Cancun upgrade slashes Layer 2 fees by 95%

Ethereum's Cancun upgrade officially launched on March 13, 2023, bringing revolutionary transaction cost reductions to the Layer 2 network through the implementation of EIP-4844 (Proto-Danksharding). This upgrade introduces dedicated "blob blocks" for Layer 2 data storage, completely eliminating competition for block space on the mainnet and significantly reducing gas fees for major Layer 2 solutions by 75%-95%.

Starknet can now process transactions as low as $0.01, while Optimism and Arbitrum have seen their fees drop from $0.16 to $0.04 and from $0.30 to $0.05-$0.10, respectively. These differences in savings stem from technical characteristics—zero-knowledge proof chains like zkSync achieve more efficient data compression, while high-activity networks like Arbitrum benefit from reduced data contention.

ETH Price Prediction: 2025, 2030, 2035, 2040

According to the comprehensive analysis of BTCC financial analyst Robert, the price prediction of ETH is as follows:

| years | Price Prediction (USDT) | Key drivers |

|---|---|---|

| 2025 | 5,800-6,500 | Increased Layer2 adoption and institutional tokenization demand |

| 2030 | 12,000-15,000 | The global RWA tokenization market is mature and DeFi is scaling |

| 2035 | 25,000-35,000 | Ethereum becomes the global settlement layer and the metaverse economy develops |

| 2040 | 50,000-75,000 | Fully implement Web3 infrastructure and establish global value storage status |

Robert emphasized: "These forecasts are based on the current trajectory of technology development and market adoption rates. Actual performance may be adjusted due to regulatory changes, technological breakthroughs, and macroeconomic factors. Investors should focus on Ethereum network activity and institutional adoption progress as long-term value indicators."