Nasdaq will list SOL Strategies, the third-largest holder of Solana . While some rivals have listed, they have moved into crypto from their previous businesses.

In other words, this listing shows that Nasdaq is interested in Cryptoasset management companies. Yesterday, the campaign to examine these companies caused stocks across the industry to drop, so this is a welcome olive branch.

Solana on Nasdaq

Digital asset management (DAT) companies have become a global phenomenon recently, and Nasdaq is listing a number of them. Nasdaq has traded shares of ETH investors , large Bitcoin Miners /DATs , and now, Nasdaq is adding a Solana asset management company to the list:

SOL Strategies, the third-largest Solana asset manager, is the fourth company to receive a Nasdaq listing, but has some unique advantages.

The other three companies, Upexi, DeFi Development, and Exodus Movement, all started as unrelated companies. They only recently moved to Solana .

Potential benefits and advantages?

In other words, these companies received Nasdaq listings for unrelated businesses, not for their Solana assets. SOL Strategies, on the other hand, has been holding Token for much longer than its competitors .

A recent study found that they have been Staking Token more efficiently than their competitors, earning passive income from their assets.

So, SOL Strategies may have a chance to stand out in this space, and this listing could provide the perfect opportunity. While this Solana asset management company won’t start trading on Nasdaq until September 9, it is already listed on Canadian exchanges.

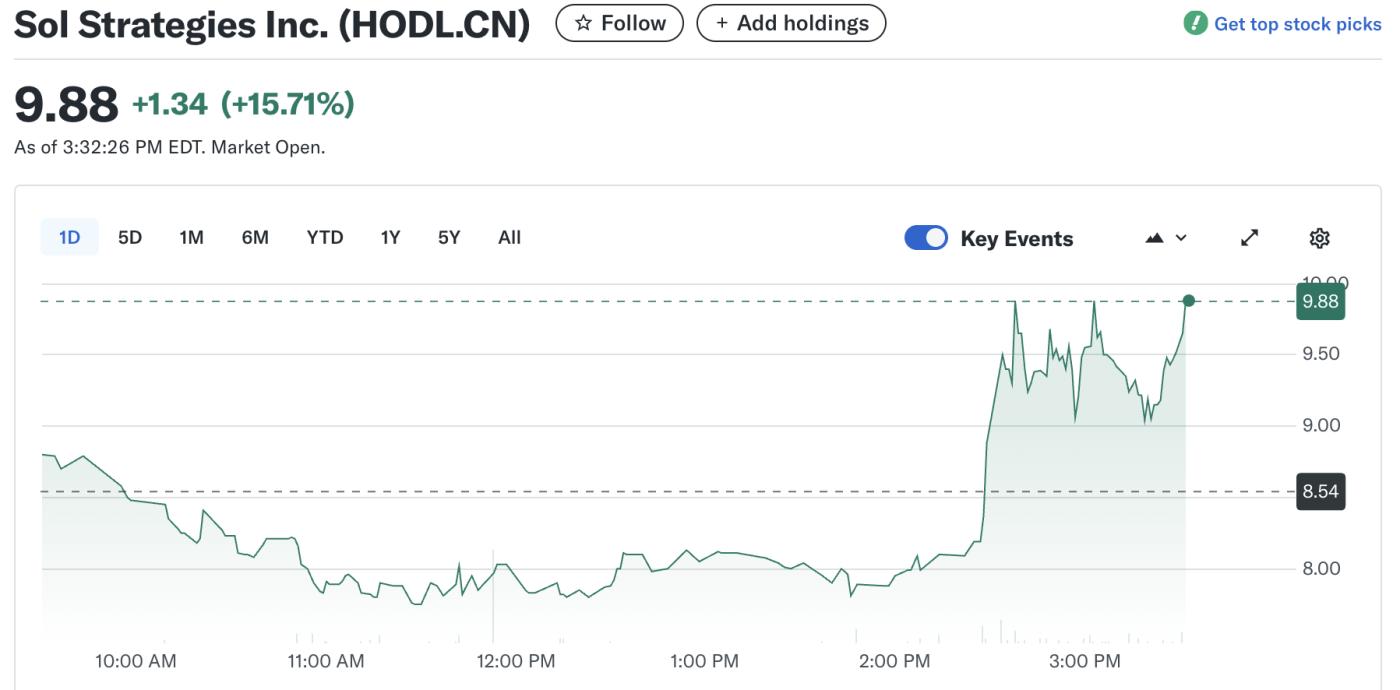

According to those indicators, today's development is very positive:

SOL Strategies price performance. Source: Yahoo Finance

SOL Strategies price performance. Source: Yahoo FinanceHowever, this Nasdaq listing does not necessarily guarantee the company a top spot in the asset management space Solana. Despite its early start, strong commitment to crypto and Staking , they are still only the third largest holding company.

Competition is intensifying, especially as a three-party plan to build a $1 billion Solana fund made significant progress today.

For now, it’s clear that Nasdaq is interested in digital asset management companies, Solana or not. While Nasdaq has recentlybegun a campaign to probe these companies for financial misconduct, it’s not a full-scale attack.

The Nasdaq investigation has sent stocks down slightly across the industry, so this olive branch is good news too.