With the release of the U.S. non-farm payroll data last night, the market once again welcomed expectations of a rate cut, but after a short-term rally, the broader market fell sharply again and is currently stabilizing above $110,000.

VX:TZ7971

BTC buying is weak, and ETH reserve strategy remains to be verified.

On September 4, the U.S. BTC spot ETF had a net outflow of $227 million in a single day. Following the net inflow of over $300 million in a single day on September 2 and 3, it turned to net outflow again, indicating that the market has turned bearish on the price trend of BTC again. At present, the total net inflow of BTC spot ETF is $54.55 billion; the recent performance of the U.S. ETH spot ETF data is even bleaker, with continuous net outflow from August 29 to September 4. The net outflow on September 4 alone reached $167 million. At present, the total net inflow is $13.04 billion.

Overall, the market has entered the "proof-of-concept" stage, with BTC buying somewhat scattered and weak. Whether listed companies' "ETH reserve strategies" can achieve the effect of "both cryptocurrency and stock prices rising together" is also entering a verification period. Coupled with the tightening of US regulatory policies on "listed companies establishing crypto reserves," the market is entering another dormant period.

BTC institutional buying has peaked: listed companies' holdings exceed 1 million BTC

On September 4, BitcoinTreasuries published a statement saying that the total amount of Bitcoin held by listed companies worldwide has exceeded 1 million, reaching 1,000,442. Among them, Strategy ranked first, holding 636,505 Bitcoins.

Even a strong company like Strategy still lacks buying power compared to the massive "BTC listed company reserve" and the even larger sell orders from the gradually awakening BTC OGs and ancient whale. Notably, the latest news indicates that despite meeting the relevant requirements, Strategy failed to enter the S&P 500 index.

Many listed companies, however, view their BTC reserve strategy merely as a means to boost stock prices, lacking both the ability and the motivation to purchase more BTC. The resulting increase in buying is a drop in the bucket compared to selling. This suggests that institutional buying of BTC by listed companies has peaked and requires further positive stimulus to accelerate further.

ETH reserves enter the verification period, and related concept stocks are weak

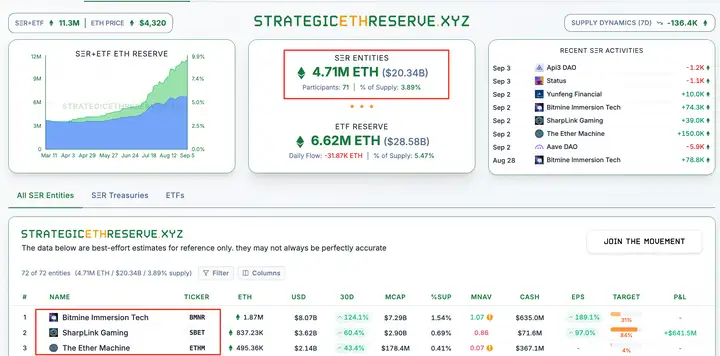

Currently, the ETH reserve listed companies hold 4.71 million ETH, worth US$20.34 billion, accounting for 3.89% of the total ETH supply. The number of participating companies has increased to 71, but in terms of the stock price performance of major listed companies, whether the ETH reserve strategy can continue to be effective remains to be verified.

Looking at the stock price performance of the top three listed companies with the largest ETH reserves (as of September 6):

Bitmine (BMNR) stock price is currently at $42.04, down nearly 75% from its historical high of $161 in July;

Sharplink (SBET) stock price is currently at $14.94, down nearly 90% from its all-time high of $124.12 in May;

The share price of ETH Machine (ETHM) is currently at $10.75, down nearly 30% from its historical high of $15.24 in July.

Tightening regulations: Nasdaq will increase scrutiny of cryptocurrency investments by listed companies

Nasdaq is increasing its scrutiny of cryptocurrency investment activities by its listed companies. Previously, some companies raised funds to purchase cryptocurrency assets to boost their stock performance. However, Nasdaq has expressed concerns about this behavior, believing it could potentially mislead investors and has decided to strengthen regulatory measures.

Nasdaq has not yet publicly disclosed specific regulatory actions, but it is expected to require companies to disclose detailed information about their cryptocurrency investments, including investment size, strategy, and potential risks. Furthermore, Nasdaq may conduct special scrutiny of companies that frequently trade cryptocurrency assets to ensure their activities comply with market regulations. This move reflects the growing regulatory focus on the cryptocurrency market.

Based on the above information, the volatile trend in the crypto market may continue. Combined with the current economic policies of the United States, perhaps an interest rate cut will bring about a new round of positive stimulus.

The non-farm payroll data was in line with expectations, but the market reaction was flat.

According to Jinshi Data, the US unemployment rate was 4.3% in August, compared to 4.2% in the previous month and 4.30% expected. The seasonally adjusted non-farm payrolls in August were 75,000, compared to 79,000 in the previous month and 7.5 expected. Overall, this was in line with expectations.

Overall, the combined employment figures for June and July were revised downward by 21,000 compared to the previous data. This suggests a certain optimism about the previous employment data. Just three days earlier, on September 3rd, following the release of US employment data, the probability of a September Fed rate cut rose to 98%. This suggests a rate cut is imminent.

The non-farm payroll data that is in line with expectations has increased the possibility of an interest rate cut to a certain extent, but the positive impact is mediocre, so the market has reacted indifferently to it, which is reflected in the price, which is the current slight fluctuation in the overall market performance.

BTC's monthly key support is $107,600, and the market is in a repair phase.

BTC is currently priced at $110,700 on the monthly chart, slightly above the short-term holder realized price of $107,600, a level considered a key monthly bull market support level.

Furthermore, the NUPL indicator, at 0.53, suggests broad profit-taking in the market, though not yet reaching the extreme levels of previous cycles. High-time frame bullishness remains, but the market remains in a correction phase and is sensitive to profit-taking. A key reference point is the STH realized price of $107,000; holding this area would support the continuation of the uptrend. Currently, the NUPL has shown no signs of a final frenzy, suggesting further upside potential after consolidation.