This article is machine translated

Show original

🗞 Bergchain Weekly Report - Escape the Top Series (Part 41)

This week, BTC saw a wave of growth after stepping on STH-RP.

But after the release of unemployment rate and NFP data, there was another wave of decline.

The STH-RP defense battle mentioned last week is still undecided.

The FOMC meeting is approaching, and September is destined to be a turbulent month.

Let's take a look at this week's #escapethetopweeklyreport👇:

//

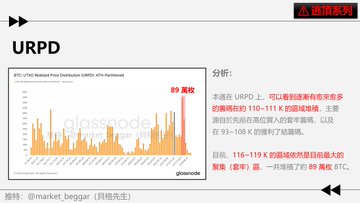

1) URPD

For the analysis logic and detailed tutorial on BTC chip structure, please refer to the following links:

x.com/market_beggar/status/196...…

As the BTC price has stagnated at the current price for a while,

It is obvious that more and more chips have begun to accumulate in the current range on URPD.

The chips transferred here mainly come from the profit-taking chips between 93K and 108K.

As well as a small number of chips that were previously bought at high prices and then sold at a loss.

The chips bought in the high area of about 116~119K were sold off slightly.

But it is still the largest locked-in area at present, with a total of about 890,000 chips accumulated.

//

2) STH-RP

Regarding the STH-RP (short-term holder average cost) analysis method,

For details, please see this post: x.com/market_beggar/status/188...…

📊 The current STH-RP is approximately 109,749, which is close to the current price. When the weekly report was released last Sunday, BTC was just above STH-RP.

Then there was a wave of growth this week, and it seemed that STH-RP provided some support.

But with STH-RP moving up again this week, coupled with Friday's pullback,

Currently, the price of BTC is still very close to STH-RP, with a distance of less than 1%.

Although the bulls seem to have gained the first-mover advantage, the STH-RP defense battle has not yet ceased... ‼ ️

//

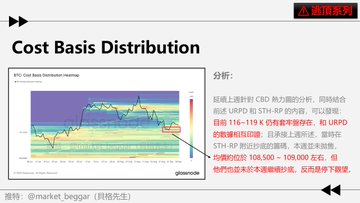

3) CBD Heatmap

The CBD heat map has three dimensions: time, price, and number of chips;

Unlike the URPD chart, the CBD Heatmap uses "address basis" as the statistical basis.

Combining the above URPD and STH-RP, we can draw the following two conclusions:

1️⃣ There is still a locked-in position between 116 and 119 K, which is consistent with the URPD.

2️⃣ The chips that buy the dips in the STH-RP area last week were neither increased nor sold this week. It must be said that the price can be supported in the STH-RP area this week.

The contribution of these large buy the dips chips is absolutely indispensable;

Therefore, whether STH-RP can continue to provide support,

It is definitely related to these big buy the dips.

//

4) Conclusion 📝 Key points:

1️⃣ URPD: There are about 890,000 locked-in chips in the 116~119 K area

2️⃣ STH-RP: Currently around 109.7K, close to the current price, the game is not over yet

3️⃣ CBD Heatmap: Last week's big buy the dips did not increase their positions this week, but they also did not sell.

-

The above is the 41st issue of the Chain Weekly Report. I hope it is helpful to you.

Below, I will attach the following in the comment area:

All analysis articles related to "The Second Escape from the Top" are provided for your study and reference.

As usual, I will answer all your questions. I wish you all a happy weekend 🥘

-

📚This Week's Article Review🔥A Comprehensive Collection of Learning Resources for "On-Chain Analysis and Trading Concepts"

x.com/market_beggar/status/196...…

A critical week: Huge Realized Profits reappear, and the STH-RP defense battle begins

x.com/market_beggar/status/196...…

BTC Technical Update: Still no plan for swing trading

x.com/market_beggar/status/196...…

US capital sentiment curve update: US capital slightly returns

x.com/market_beggar/status/196...…

Bonus: Asian Capital Sentiment Curve

x.com/market_beggar/status/196...…

The Bitfinex whale that quietly increased its BTC holdings

x.com/market_beggar/status/196...…

貝格先生

@market_beggar

08-31

🗞 貝格鏈上週報 - 逃頂系列(四十)

八月一晃而過,眨眼間的功夫九月已悄然到來。

自我在 8/14 分享 BTC 新高 Stop Hunt 的訊號後,

直至今日 BTC 依然以下跌為主基調,本週也不例外。

並且,目前 BTC 已下跌到極其關鍵的 STH-RP 位置 ... 👀

以下就讓我們一起本週「#逃頂 週報」的內容吧👇:

// x.com/market_beggar/…

⚠️ Top Escape 2.0 Series

Note: Except for the first post, the rest are listed in chronological order, with the earliest at the bottom.

-

Comprehensive Risk Checklist

x.com/market_beggar/status/192...…

Key Week: Massive Realized Profit Returns, STH-RP Defense Battle Begins

x.com/market_beggar/status/196...…

Risk Alert: STH-RP Officially Breaks Down

x.com/market_beggar/status/196...…

Massive Realized Profit Spikes for the Third Time

x.com/market_beggar/status/195...…

BTC New ATH Fakeout: Liquidity Grab Complete, Bearish Technicals

x.com/market_beggar/status/195...…

Potential Three-Stage RUP Divergence & Realized Profit Still Cooling Off

x.com/market_beggar/status/195...…

US Funds Sentiment Curve Update: Is American Money Quietly Pulling Out Again...?

x.com/market_beggar/status/195...…

RUP Signal Update: Minor Divergence Appears

x.com/market_beggar/status/194...…

Unusual Imbalance Signal: Price and PSIP Correlation Shift

x.com/market_beggar/status/194...…

Beggar On-Chain Weekly - Top Escape Series #34: Special Chip Structure Analysis

x.com/market_beggar/status/194...…

Bullish News Everywhere & RUP and Realized Profit Getting Restless

x.com/market_beggar/status/194...…

Top Hunter Plan V

x.com/market_beggar/status/194...…

Top Hunter Plan IV

x.com/market_beggar/status/194...…

Emergency Update: US Funds Sentiment Curve Seems to Have Turned

x.com/market_beggar/status/194...…

Top Hunter Plan III

x.com/market_beggar/status/194...…

Top Hunter Plan II

x.com/market_beggar/status/194...…

Top Hunter Plan I

x.com/market_beggar/status/194...…

BTC Hits New High as Expected, Is This the Top?

x.com/market_beggar/status/194...…

AVIV Heatmap Data Update: Alternative Top Evaluation Method

x.com/market_beggar/status/194...…

Data Update: Cointime Price Deviation Top Price Estimate

x.com/market_beggar/status/193...…

Bitfinex Whale Likely Closed Out Positions

x.com/market_beggar/status/193...…

Special Cycle & Weak Market

x.com/market_beggar/status/193...…

Bitfinex Whale Position Closed?

x.com/market_beggar/status/193...…

Realized Profit Divergence Emerging

x.com/market_beggar/status/193...…

US Funds Sentiment Curve Divergence: Officially Confirmed

x.com/market_beggar/status/193...…

Glassnode Weekly Report Breakdown

x.com/market_beggar/status/193...…

Alts Topping Out Early

x.com/market_beggar/status/192...…

US Funds Sentiment Divergence Risk

x.com/market_beggar/status/192...…

x.com/market_beggar/status/193...…

Old Guard Whales vs New Money: Bitfinex & Coinbase Premium/Discount

x.com/market_beggar/status/192...…

Bitfinex E/B Legendary Whale Position Closure

x.com/market_beggar/status/192...…

Bitfinex BTC Longs Whale Position Closure

x.com/market_beggar/status/192...…

Technical: BTC’s High-Gas Trend

x.com/market_beggar/status/192...…

History as a Mirror: All Potential Top Signals Compiled

x.com/market_beggar/status/192...…

A Fleeting Dream: The Monologue & Bias of a 103K Top Escaper

x.com/market_beggar/status/192...…

貝格先生

@market_beggar

08-30

風險提示:短期持有者平均成本正式跌破⚠️

雖然今天是週六,按理而言我不該打擾各位週末休息的雅興,

但隨著今晨 08:00 日線收盤價寫死,的確出現了一項不好的訊號:

「短期持有者平均成本(STH-RP)已被跌破」。

上一次破位的狀況可參考此帖:

https://x.com/market_beggar/status/1894209808557105335…

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content