In his latest article for Wall Street, Bessant for the first time listed "moderate long-term interest rates" alongside maximum employment and stable prices as the three statutory responsibilities that the Federal Reserve must focus on to rebuild its credibility. Combined with Bessant's previous remarks about responding to the "national housing emergency," this means that yield curve control has been officially put on the table, making distortion operations and even balance sheet expansion possible.

This article is machine translated

Show original

qinbafrank

@qinbafrank

08-13

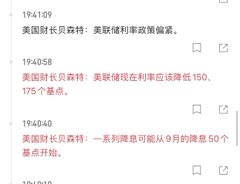

晚上贝森特的讲话要点:呼吁美联储降息,甚至9月份50个基点;未来发债还是会议短债为主,当然随着利率的变化发债结构也要变;估计未来会继续做收益率曲线控制以防止收益率飙升https://x.com/qinbafrank/status/1925871211923296629?s=46&t=k6rimWsEbo2D2tXolYcM-A…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content