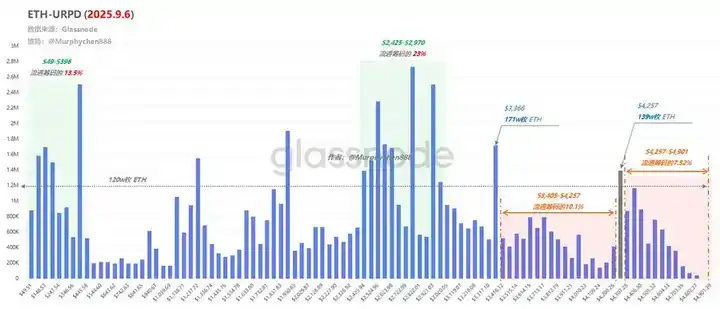

As shown in the chart, ETH's chip structure exhibits an inverted F-shape, with significant accumulation at low and intermediate levels, but little at high levels. The bottom range, $49 to $396, still holds 13.5% of the circulating chips today, despite eight years of volatile market conditions. The highest accumulation range, $2425 to $2970, accounts for 23% of the circulating chips and represents ETH's strongest support.

VX:TZ7971

At the current price of $4,257, 7.52% of the holdings remain above the upper limit, while only 10.1% remain within the -20% price range (i.e., $3,405 to $4,257). This suggests that ETH hasn't experienced sufficient turnover during its rapid rise and pullback. Therefore, if ETH prices continue to rise, while trapped holdings above the upper limit are dwindling, the unrealized profits of profit-taking holders below the lower limit will be greater than those of SOL, leading to greater theoretical selling pressure. This will test the consensus among ETH's main investors and veteran OGs. Currently, 1.39 million ETH have accumulated around $4,257, which also serves as a valid support level.

Even during ETH's upward trend, holdings at low levels remained stable, demonstrating strong confidence in holding the coin. However, this also resulted in a significant amount of unrealized profits, which, when profits are substantial, also creates a potential risk of selling.

SOL Chip Structure Analysis

As shown in the figure, the distribution of SOL chips is roughly olive-shaped, that is, there is a large amount of accumulation in the middle and slightly less at both ends. With the current price of US$203 as the center, the SOL accumulated in the upper 20% price range (i.e. US$203 to 242) accounts for 7% of the total circulation; the SOL accumulated in the lower -20% price range (i.e. US$162 to 203) accounts for 39.2% of the circulating chips.

If SOL prices continue to rise, the primary selling pressure will come from profit-taking by those holding lower positions, as the top-side holdings are running low. Recent volatility has seen strong turnover within the -20% price range, raising the average cost for all participants. Therefore, theoretically, selling pressure will be minimal when a certain level of unrealized profit is realized. The last significant volume bar on the URPD chart was at $144, suggesting that the primary entry point during the correction was likely above $144. If the expected profit margins are not achieved, there should be no rush to sell SOL holdings.

Today's panic index is 44, which has dropped to panic status.

Despite market expectations of further Federal Reserve rate cuts, the US dollar has surprisingly remained strong, even resisting a significant decline after disappointing non-farm payroll data. For now, the impact of tariffs on commodity prices appears to be modest. A potentially greater headache for the Fed is the recent resurgence in services inflation. The headline CPI is expected to edge up 0.1 percentage point to 2.8% in August, while the core CPI is likely to remain unchanged at 3.1%. Ethereum's key support level is $4,260; if it falls below, watch for $4,000. BTC key support level is $107,000; if it falls below, watch for the 100,000 mark, which short positions can consider as an entry point.