Compiled by Tim, PANews

Many people must be wondering whether the current trend of the crypto market is a fluctuation before breaking through new highs, or a signal that the market has reached its peak?

In reality, it’s not that simple. The short, medium, and long term scenarios can look very different.

I will provide a comprehensive analysis of BTC, ETH, and Altcoin before they enter each stage:

Now let’s get straight to the point: the next few months will determine how this cycle plays out, and I think this tweet is worth revisiting.

Let’s start with what’s happening now.

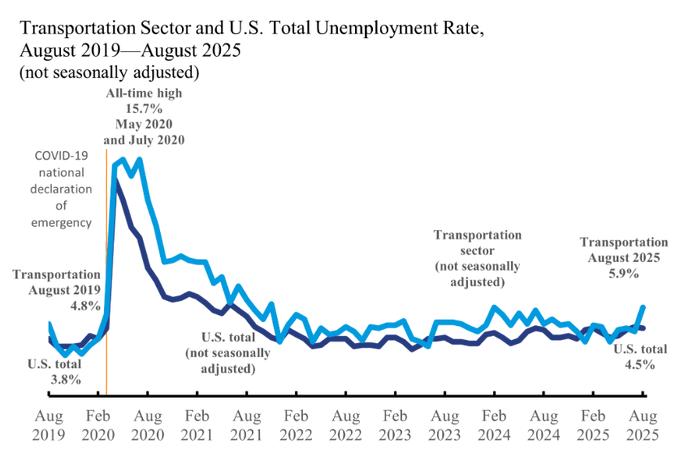

Data last Friday showed the unemployment rate climbed to 4.3%, the highest level since 2021.

Nonfarm payrolls showed just 22,000 jobs added, compared to expectations for more than three times that.

The U.S. job market has been surprisingly strong for years.

Even as growth slows, hiring remains strong.

This report changes that trend.

This is the first time since the outbreak that both unemployment and hiring rates have turned red at the same time.

The market reacted immediately to the news.

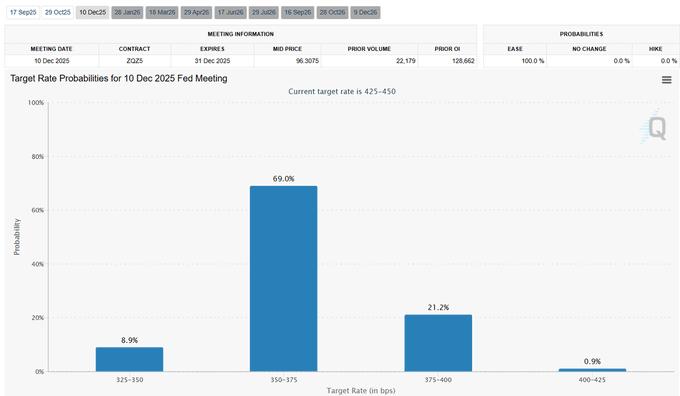

Futures market pricing shows that the market believes the probability of a rate cut in September has reached 100%.

Most expect a 25 basis point rate cut, but the Fed could still choose to cut by 50 basis points.

Beyond that, traders see a greater than 75% chance of three or more rate cuts in 2025.

The turning point finally came.

But there is one thing you need to understand, a rate cut does not mean that everything will immediately go up and not down.

The reason is that interest rate cuts will not affect everything overnight.

For cryptocurrencies, the short-term, medium-term, and long-term outlooks will be very different.

Short-term impact

The short-term impact is likely to be bearish.

When unemployment rises, it first triggers fears of a recession in the market.

This is why gold is hitting new all-time highs while risk assets are underperforming.

Here's what might happen:

- Bitcoin may retest its recent lows.

- Ethereum and Altcoin could drop 10–20% or more.

But that doesn't mean the cycle is over.

This reflects how traders behave when negative economic data first hits: they sell risky assets and move into safe assets.

Medium-term impact

With the Fed's rate cuts imminent, the bond market will adjust and yields will fall.

Lower yields mean more borrowing and lending, leading to higher spending.

It will also help companies increase borrowing to expand their businesses or conduct buybacks.

Increased spending means higher profits for companies, and their stock prices will soar.

When stocks rise, Bitcoin and Altcoin tend to rise even more.

A new change has emerged in this cycle: institutional entry.

Spot Bitcoin and Ethereum ETFs have opened up direct channels for pension funds and asset management companies; approval of Altcoin ETFs is also imminent.

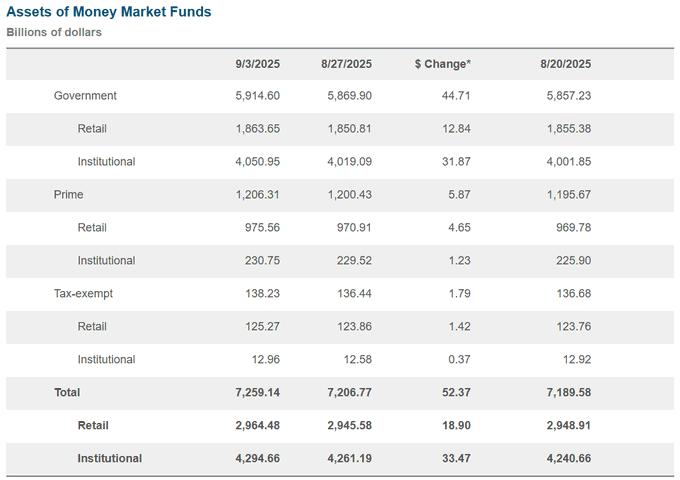

In addition, there is $7.2 trillion in funds parked in money market funds, which will see outflows if Treasury yields start to fall.

Imagine if even just 1% of the funds flowed into cryptocurrencies, it would be enough to push Bitcoin and Altcoin to new highs.

That's why the fourth quarter of 2025 looks so important.

Liquidity will start to return.

The stock saw more buying.

And cryptocurrencies may be the biggest winners among all risk assets.

Bitcoin typically leads trends while Altcoin lag, but in past cycles their biggest gains have come near the end.

If history repeats itself, early 2026 could be a frenzy phase for Altcoin as Bitcoin stabilizes at higher levels.

Long-term effects

After the mid-term rebound, risks reappear.

The tariffs introduced earlier this year will take another 6-8 months to fully show up in inflation data.

This suggests that early 2026 could be the time when inflation starts to rise again.

If inflation climbs while unemployment remains high, the Fed may be forced to pause its rate cuts or even raise them again due to concerns about stagflation.

The combination of a weak job market and rising prices has historically typically marked the end of an economic cycle.

It is environmental factors that may trigger a stock market crash and a crypto bear market.

So the script is this:

- Short term (next 3-4 weeks): market volatility, pullbacks, and panic trading.

- Medium term (Q4 2025 to January 2026): Liquidity returns, Bitcoin hits new highs, and Altcoin enter a frenzy phase.

- Long term (from Q1 2026): Inflation risks rise and the Fed’s response could mark a cycle top.

Final Thoughts

Last Friday's weak jobs data suggested one thing: the Fed is about to pivot.

Typically, a shift in Fed policy signals poor economic conditions, so a short-term adjustment seems likely.

But as things unfold, I think the crypto market will be the biggest winner by Q4 2025.