Despite significant increases in institutional investors' holdings in the spot market in recent months, Bitcoin prices have remained confined to a narrow range and have even shown a downward trend. A closer look at market dynamics reveals that the futures market, a primary driver of Bitcoin's price, has recently shown signs of weakness.

VX:TZ7971

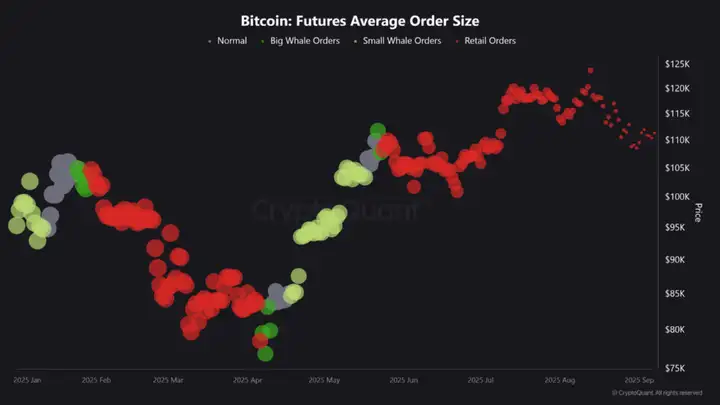

CryptoQuant data indicates a decline in whale(or large) participation in the futures market. This is reflected in the average order size (total trading volume divided by the number of trades), which suggests the market is more influenced by smaller retail traders than by large orders from whale. The "Futures Volume Bubble Chart" further confirms this observation, suggesting the market has entered a cooling phase with reduced trading activity.

In addition, the "Bitcoin Futures Cumulative Taker Volume Difference (90-day CVD)" indicator highlights that sellers (Taker Sell) have been exerting greater pressure on the market. The dominance of this seller activity shows the bearish sentiment in the market, which means that futures market participants currently expect Bitcoin prices to fall.

The current Bitcoin futures market is cooling, with declining whale activity and the growing influence of retail investors exacerbating bearish sentiment. Retail investors are generally slow to react to market fluctuations, often entering the market at the tail end of the trading cycle. Unless whale return and actively trade, prices are likely to remain range-bound or face further downward pressure.

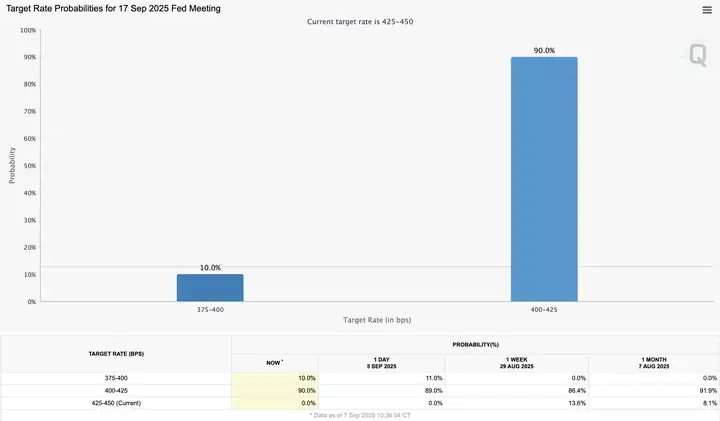

As the U.S. Federal Reserve (Fed) interest rate decision approaches on September 17, the market has almost reached a consensus on the expectation of a rate cut. However, this has not ignited optimism in the cryptocurrency market.

According to CME's FedWatch tool, traders currently estimate that the probability of the Fed cutting interest rates in September is as high as 100%, with most expecting a 1 basis point cut (25 basis points), but there is still a 10% chance that the Fed will directly cut interest rates by 2 basis points (50 basis points).

The US added only 22,000 non-farm jobs in August, far below the 75,000 expected by economists. This relatively weak employment data does add to the reasons for the Fed to turn dovish.

Generally speaking, loose monetary policy is beneficial to risky assets like Bitcoin. However, the market has already priced in some interest rate cuts, coupled with institutional investors taking profits and relatively flat ETF flows. These two forces are offsetting each other and are the key reasons why Bitcoin's current upward momentum is limited, causing the currency's price to consolidate in a narrow range.

If a rate cut reflects economic weakness, it could exacerbate risk aversion in the market. Meanwhile, persistently high inflation is also limiting market risk appetite. Without strong ETF inflows or a significant expansion in overall market liquidity, Bitcoin will face an uphill battle to break through the $120,000 mark.

Data shows that inflows into Bitcoin and Ethereum spot ETFs in the first week of September were significantly lower than the record highs reached in July and August. As the upward momentum of this market cycle has been primarily driven by institutional funds, the slowdown in ETF inflows may reflect a cooling of overall market momentum.

Currently, the key support level for Bitcoin is $110,000.

As long as Bitcoin holds this level, the market structure remains positive. Above that, resistance lies at $113,400, with stronger resistance areas at $115,400 and $117,100. A break above these barriers would indicate the market has absorbed the selling pressure and is poised to challenge new highs.

Looking ahead, in addition to focusing on next week’s Federal Open Market Committee (FOMC) meeting, we should also pay attention to potential catalysts on and off the chain.

In terms of on-chain data, the supply of stablecoins is approaching historical highs, which means that the market has sufficient potential "dry powder" (idle funds that can be invested at any time) to ignite the next wave of growth at any time; at the same time, the balance of Bitcoin and Ethereum on cryptocurrency exchanges continues to decline, which has also alleviated the recent selling pressure.

Off-chain, we need to pay attention to the latest developments on the regulatory side, especially the integration of regulatory frameworks promoted by the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), as well as the flow of ETF funds, which will continue to affect market sentiment.

As of now, total assets in US money market funds have increased by $52.37 billion, reaching a record high of $7.26 trillion. This massive influx of funds could fuel the next leg of Bitcoin and other Altcoin' upward movement. With further interest rate cuts from the Federal Reserve, retail investors are likely to shift funds from money market funds to assets like stocks and cryptocurrencies. If the yield on money market funds falls from 4.5% to 4.25% or 4%, investors will reallocate funds to stocks and cryptocurrencies.