Get the best data-driven crypto insights and analysis every week:

The Flavors of ETH: From Wrapped to Liquid Staked Tokens

By: Tanay Ved

Key Takeaways

Tokenized versions of ETH such as WETH, LSTs, and LRTs enable ERC-20 compatibility, greater interoperability, and improved capital efficiency on-chain.

With roughly 24% of ETH staked via Lido, stETH and its wrapper wstETH have become widely used forms of DeFi collateral and are often employed in looping strategies to enhance returns.

The pricing and reward mechanisms for these tokens vary, with some following a rebasing design while wrapped versions accrue value with a rising exchange rate to ETH.

As these assets scale, monitoring validator queues, secondary-market liquidity and the LST premium/discount to ETH will be important to gauge redemption and liquidity risk.

Introduction

As a Layer-1 blockchain, Ethereum’s value proposition extends beyond being a digital currency. Its programmability allows assets to be used in productive ways, such as securing the network, serving as a yield bearing and collateral asset within its on-chain ecosystem. To make ETH more usable and composable across these contexts, a variety of “flavors” or tokenized versions of ETH have emerged.

From wrapped ETH, which provides ERC-20 compatibility, to liquid staking tokens (LSTs) that provide staking yield while being transferable, and other variants that layer on additional yield and utility. These tokenized forms of ETH have become integral to Ethereum’s infrastructure, unlocking interoperability and capital efficiency. But as they become more layered, and intertwined in the ecosystem, they bring important implications for liquidity, peg stability and redemption dynamics.

In this issue of Coin Metrics’ State of the Network, we map the landscape of tokenized versions of ETH and explain their emergence. We then focus on liquid staking tokens, analyzing their pricing mechanics, reward structures, and utility, while assessing liquidity conditions and the risks that shape their stability.

Tokenized ETH Landscape

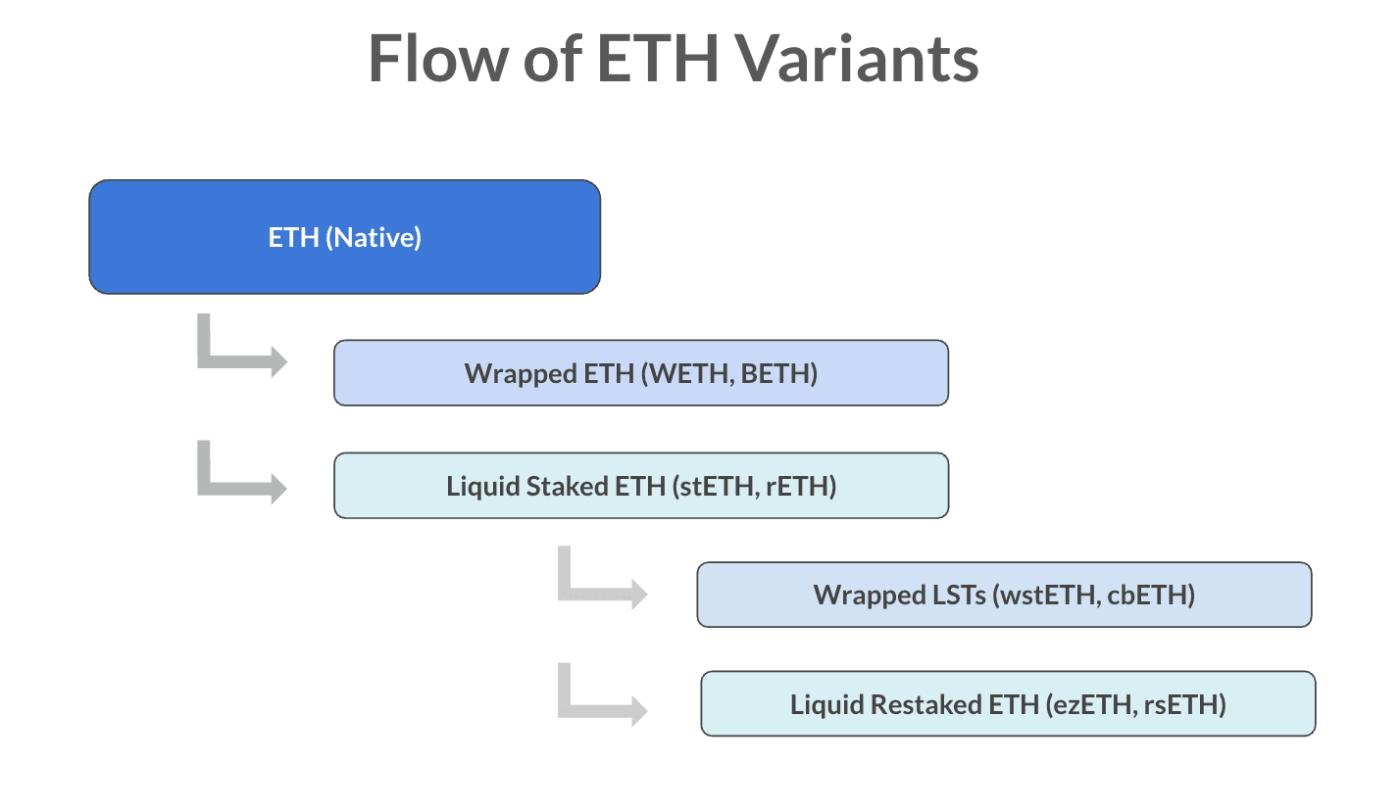

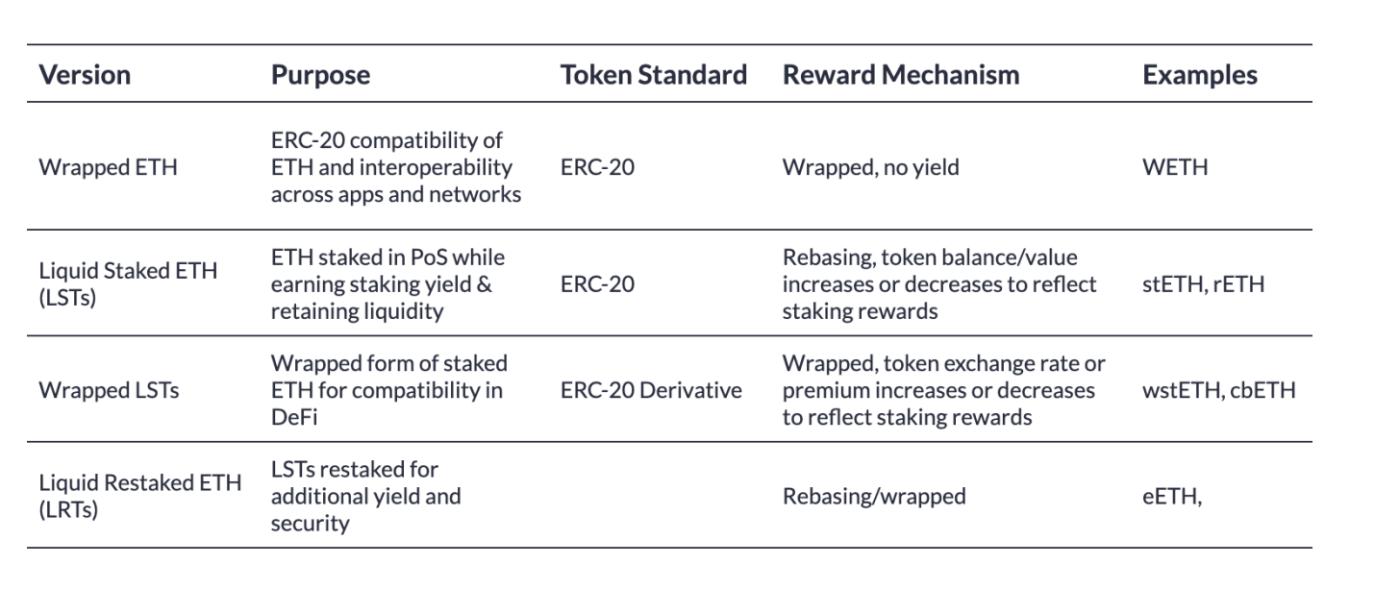

Today, ETH exists in these major forms: native ETH, wrapped ETH, liquid staked ETH (LSTs) and liquid restaked ETH (LRTs). While they can layer complexity, these variants have emerged to address prior constraints, growing liquidity, composability, and access to new yield opportunities on-chain.

Source: Coin Metrics

Wrapped ETH (WETH)

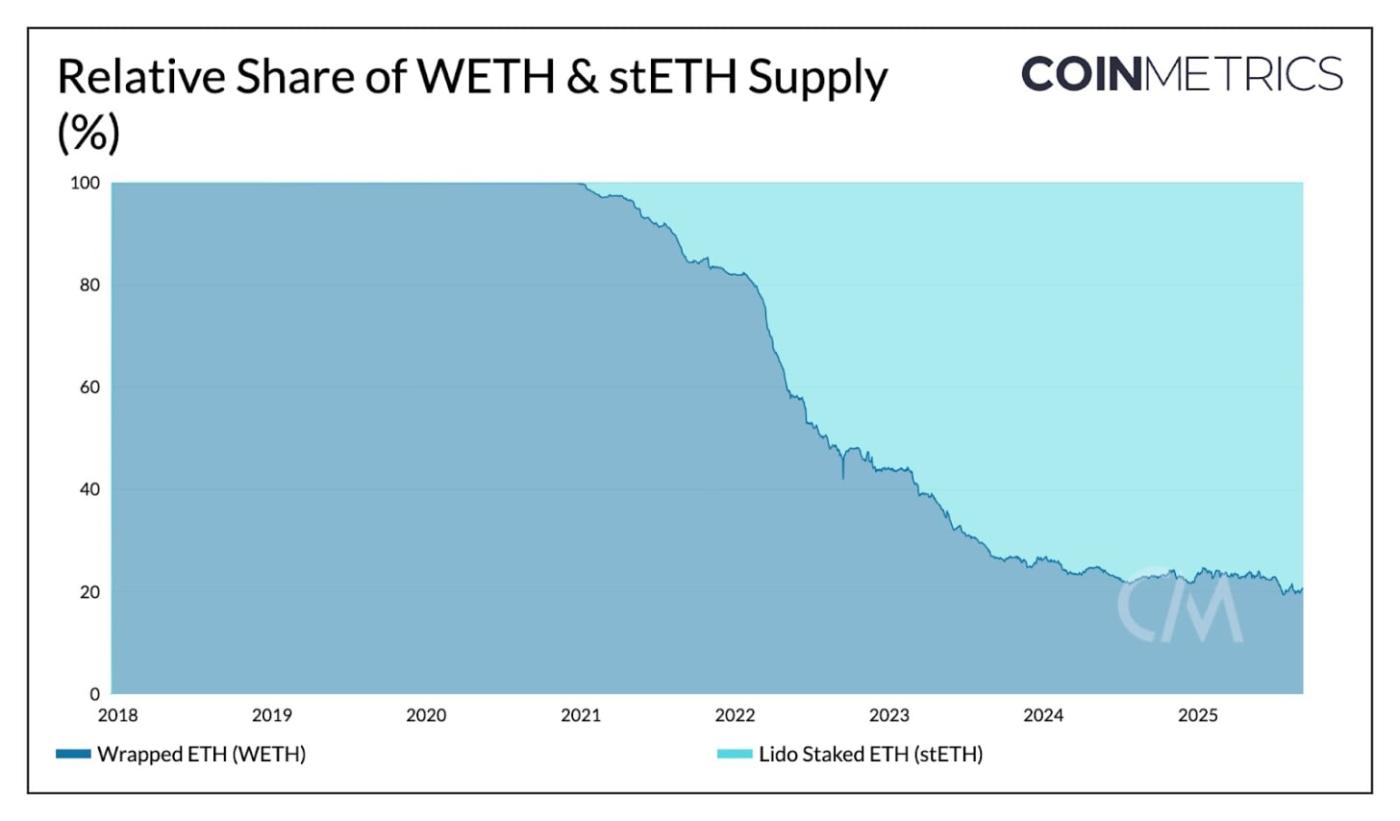

As Ethereum’s native token, ETH is essential for paying transaction fees, compensating validators to secure the network and acting as a medium of exchange. But because it is not ERC-20 compatible, its use in early DeFi was limited. This led to the creation of Wrapped Ether (WETH), an ERC-20 representation of ETH. WETH quickly became integral to decentralized exchanges, liquidity pools, and lending protocols such as Uniswap and Aave, where it serves as a core trading pair and collateral asset. By 2021, WETH supply exceeded 8M, making it the dominant tokenized form of ETH.

Source: Coin Metrics Network Data Pro

Liquid Staking Tokens (LSTs) & Wrapped LSTs

Ethereum’s transition to proof-of-stake (PoS) brought new opportunities. Prior to the Shapella Upgrade, staked ETH was locked on the Beacon chain and effectively illiquid. Liquid staking tokens (LSTs) such as Lido’s stETH addressed this by staking to validators on behalf of users and issuing transferable claims on staked ETH.

Their ability to accrue rewards while remaining liquid drove rapid adoption across lending protocols and liquidity pools. Wrapped versions like wstETH convert rebasing tokens into fixed ERC-20s better suited for integrations. Together, LSTs and their wrappers have since overtaken WETH as the dominant tokenized form of ETH.

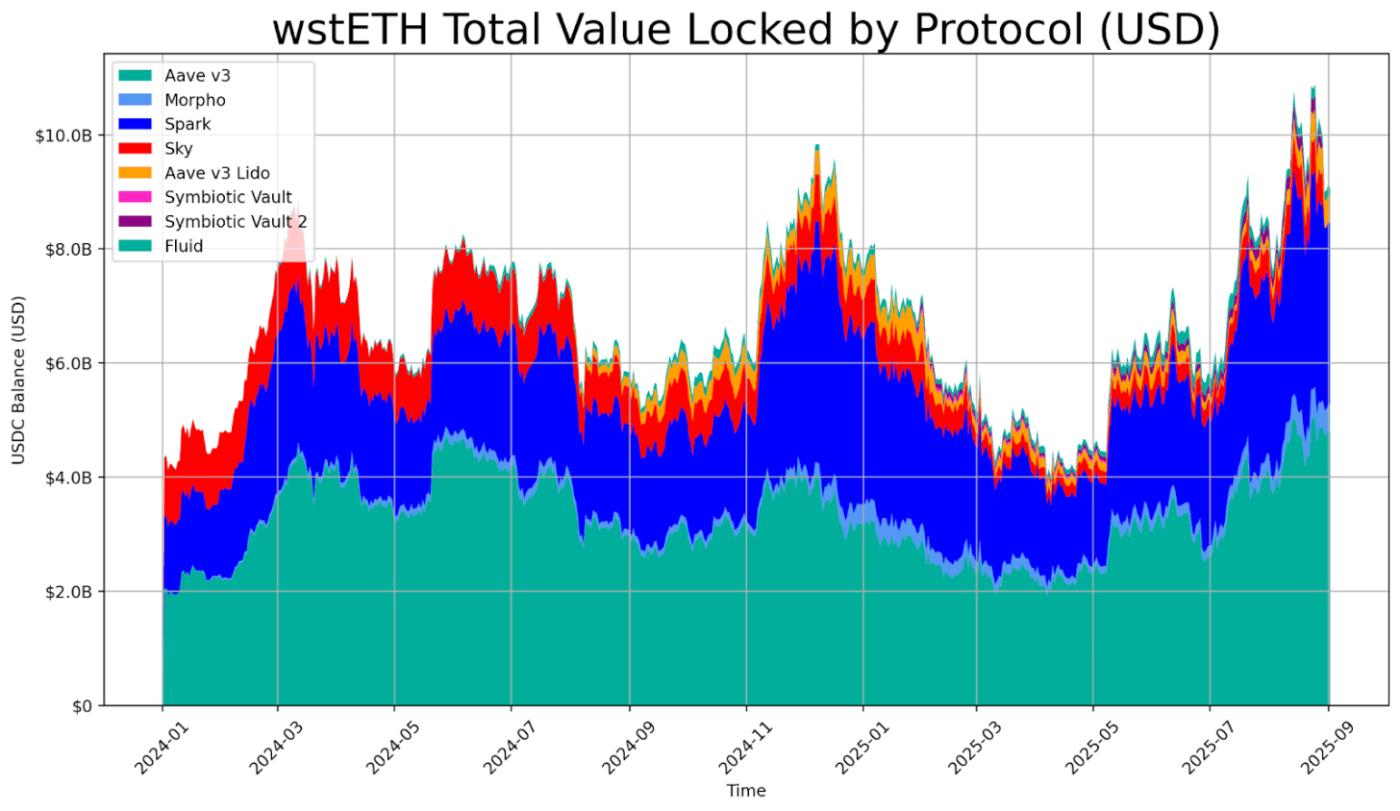

Roughly $10B of Lido’s wrapped staked ETH (wstETH) is locked in DeFi lending protocols on Ethereum mainnet, highlighting its role as a core collateral asset. In practice, users often deposit LSTs to borrow ETH or stablecoins, recycling the proceeds to buy more stETH in “looping” strategies that amplify staking yields. It also underpins lending and restaking vaults, combining staking rewards with collateral utility for capital efficiency. As demand for tokenized and yield-bearing assets grows, they are likely to play a central role in DeFi markets as shown by LSTs.

The table below provides an overview of the different versions of tokenized ETH:

Liquid Staking Tokens (LSTs)

Pricing & Reward Mechanisms

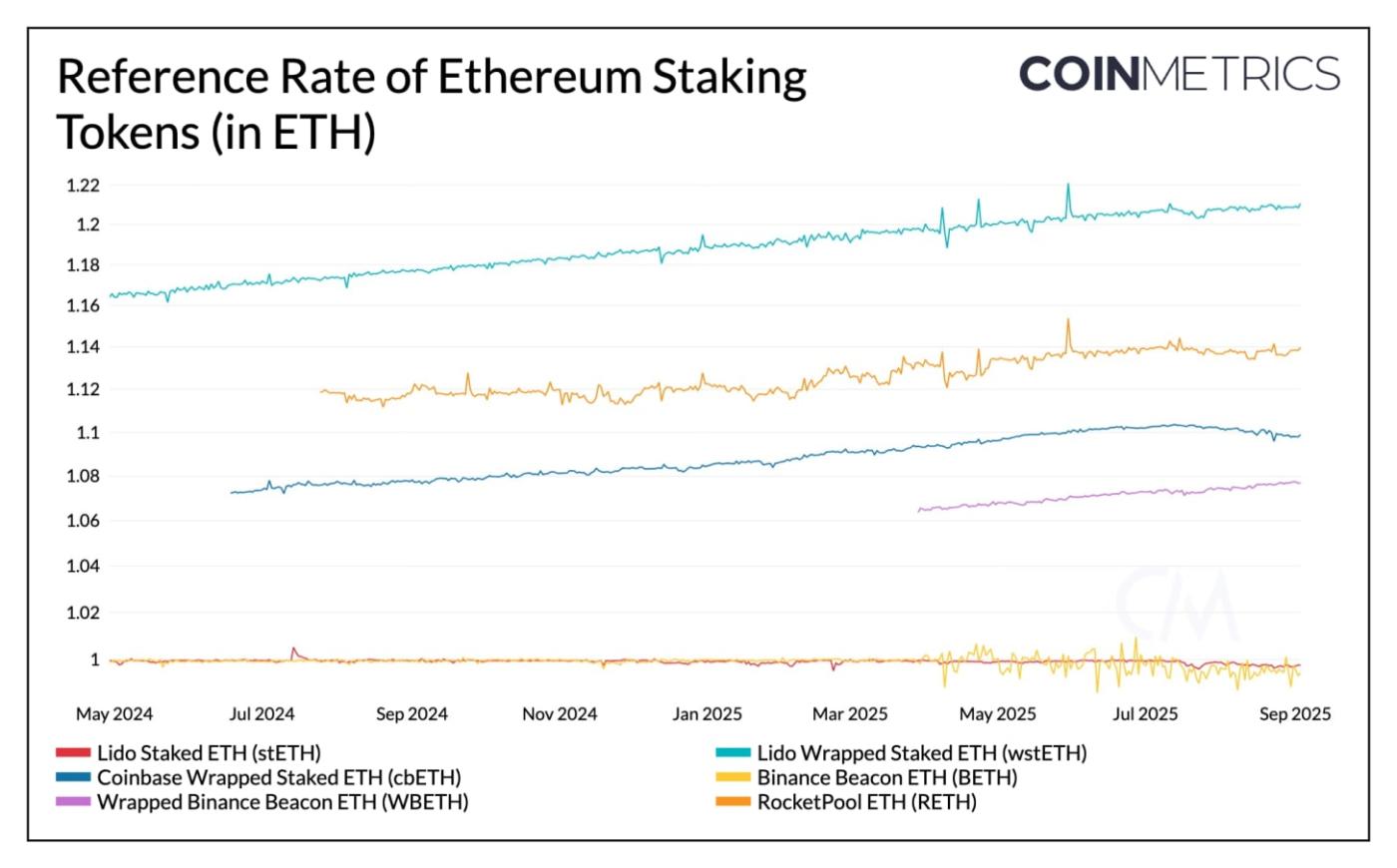

Although all liquid staking tokens (LSTs) represent claims on ETH, they trade at different prices depending on their design and how they account for staking rewards. Rebasing tokens such as Lido’s stETH are structured to stay close to par with ETH by increasing user balances over time. Wrapped LSTs such as wstETH or Coinbase’s cbETH, designed for ERC-20 compatibility, keep balances fixed and instead accrue value through an increasing exchange rate to ETH.

Source: Coin Metrics Network Data Pro

As seen above, Lido’s stETH trades closely to the underlying ETH, while wstETH and Coinbase’s cbETH trade at a premium. Wrapped LSTs are also subject to pricing dislocations during periods of stress, low liquidity or operational changes that can impact market perception and can result in declining in premiums as demand shifts.

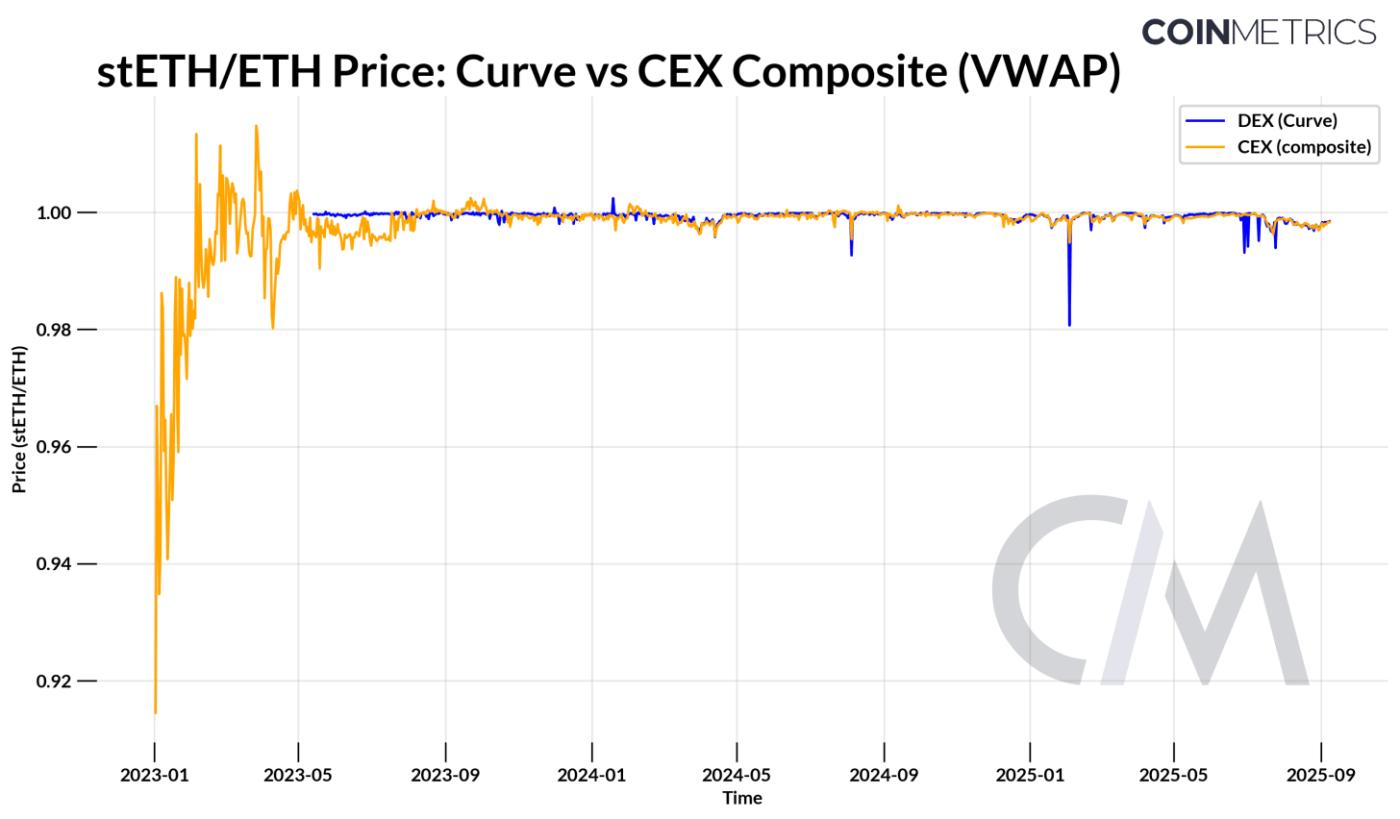

DEX vs. CEX Pricing

stETH trades across both DEXs such as Curve and centralized exchanges like OKX, Bybit, and Deribit. Prices typically remain aligned, with arbitrage narrowing gaps, but stress events can cause temporary dislocations. During the Terra/Luna collapse in May 2022, stETH on Curve fell to ~0.935 ETH (a 6.5% deviation), triggering cascading liquidations and capital losses for entities like Three Arrows Capital that had used stETH in leveraged looping strategies. Since then, reliance on a single venue has reduced, with price discovery now more evenly distributed across DEXs and CEXs.

Source: Coin Metrics Market Data Feed (CEX markets included from the following centralized exchanges: OKX, Bybit, Deribit, Huobi & Gate.io)

Redemptions & Liquidity

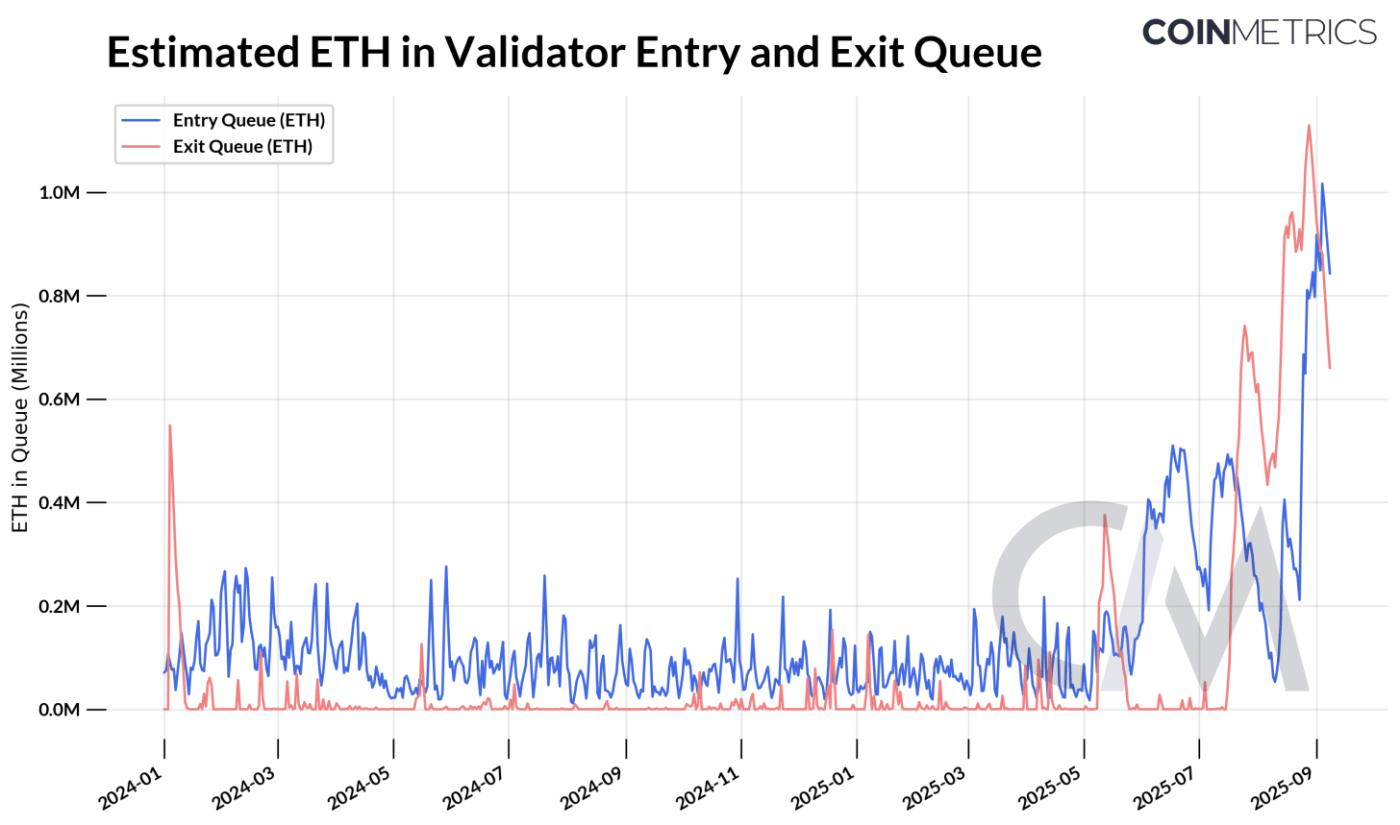

Stakers have two main paths to redeem for ETH: through Ethereum’s validator system or through secondary centralized and decentralized exchanges (DEX) markets. Primary redemption occurs via Ethereum’s entry and exit queues, which regulate the flow of validators joining and leaving the network. These are governed by the churn limit, meaning only a fixed number of validators can enter or exit per epoch (~6.4 minutes). Queue lengths expressed in validator counts, ETH or time reflect both staking demand and redemption pressure.

ETH in the exit queue recently exceeded 900K ETH (~33K validators) as stakers realized profits after ETH’s run-up and some looping strategies unwound. As of September 8, that figure has declined to ~660K ETH (~20K validators). Over the same period, ETH in the entry queue also rose above 900K, indicating strong staking demand and larger average effective balances post-Pectra upgrade.

Source: Coin Metrics Network Data Pro

How Liquid are Liquid Staking Tokens (LSTs)?

Liquidity is an important factor for liquid staking tokens (and LRTs) as users have to rely on secondary markets for redemptions, especially when the exit queue lengthens. These redemptions typically occur through on-chain or off-chain trading venues where LSTs can be swapped for ETH or WETH. These CEX and DEX markets enable efficient arbitrage, but when validator exit queues lengthen and liquidity is thin, de-pegs can be a more frequent occurrence.

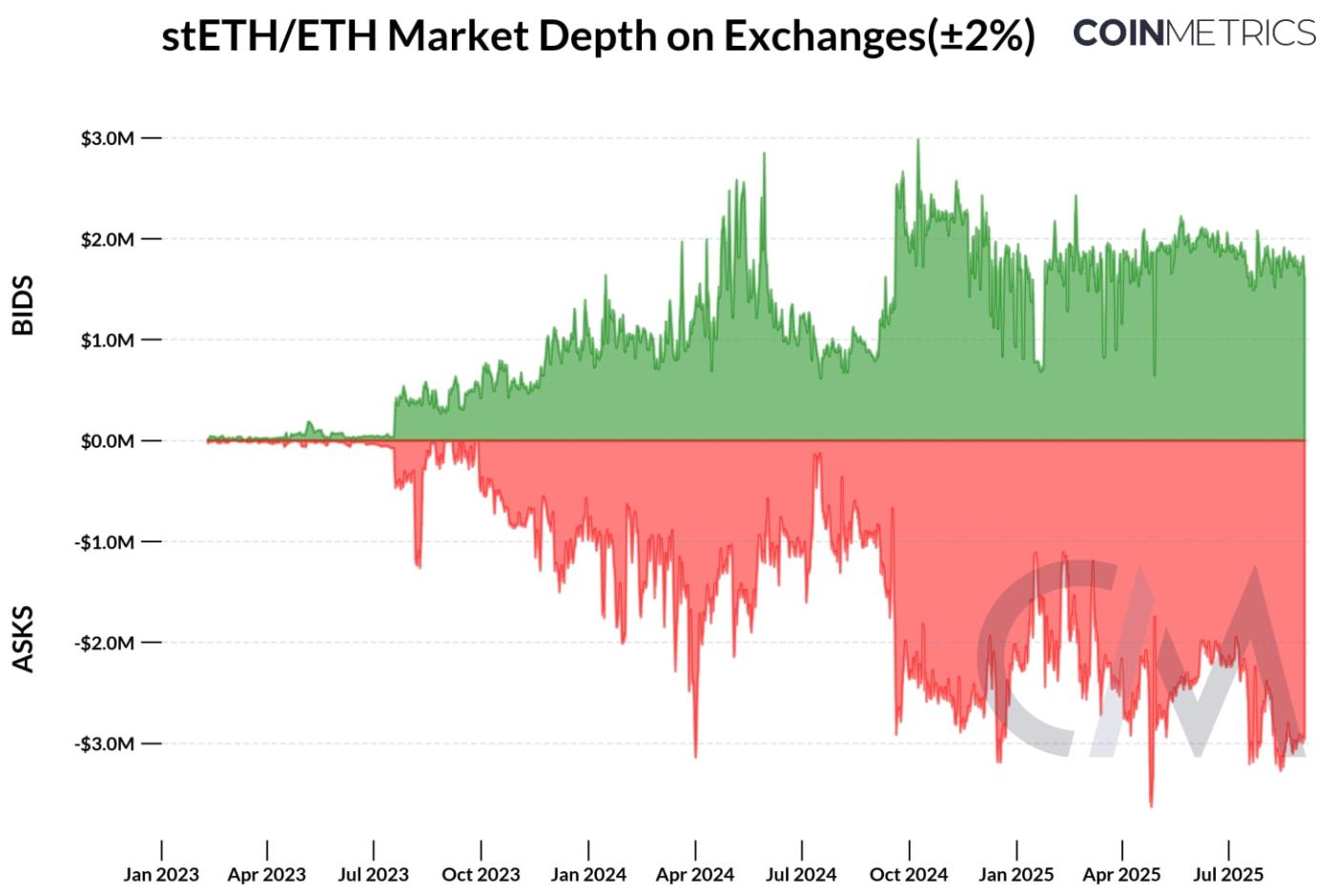

As noted in the section above, liquidity for LSTs like Lido’s stETH has become more distributed across venues. While the lion's share of stETH liquidity was initially in the Curve stETH/ETH pool, it has since spread towards other DEXs like Balancer and centralized exchanges. stETH–ETH spot markets across exchanges like Deribit, Bybit, and OKX have about $4.6M of liquidity within ±2% of mid-price ($1.6M bids / $3.0M asks).

Source: Coin Metrics Market Data Pro (Included centralized exchanges: OKX, Bybit, Deribit, Huobi & Gate.io)

Conclusion

Tokenized versions of ETH, from wrapped to liquid staking tokens, are now central to Ethereum’s infrastructure and have also gained traction in PoS ecosystems like Solana. Wrapped ETH addressed early composability challenges, while liquid staking tokens (LSTs) and liquid restaking tokens (LRTs) are extending ETH’s capital efficiency and composability. At the same time, their renewed growth and past episodes of dislocations have resurfaced considerations around liquidity, redemptions, and pricing risks that can spill over.

As new pools of capital deploy on-chain, from digital asset treasuries to potential staked ETH ETFs following recent SEC clarification on liquid staking tokens, new opportunities for yield and interoperability are being created. At the same time, liquidity and redemption dynamics will be critical to watch as tokenized and yield-bearing assets continue to scale and become more embedded across the ecosystem.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

Follow Coin Metrics’ State of the Market newsletter which contextualizes the week’s crypto market movements with concise commentary, rich visuals, and timely data.

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.