In just one week, the market value of a token called CARDS soared nearly ninefold. Behind it was not a new public chain or some complex financial derivatives, but a group of Pokémon cards .

On August 29th, Collector Crypt launched the CARDS token on the Solana chain, with an initial fully diluted valuation (FDV) of only approximately $67 million. According to Coingecko data, the CARDS token has soared from less than $0.02 since its launch, rapidly climbing to around $0.30 between September 3rd and 6th, a cumulative increase of nearly 10 times. Although it has since retreated, the price has remained stable above $0.20, several times higher than its initial level.

Putting Physical Cards on the Chain : The Business Logic of Collector Crypt

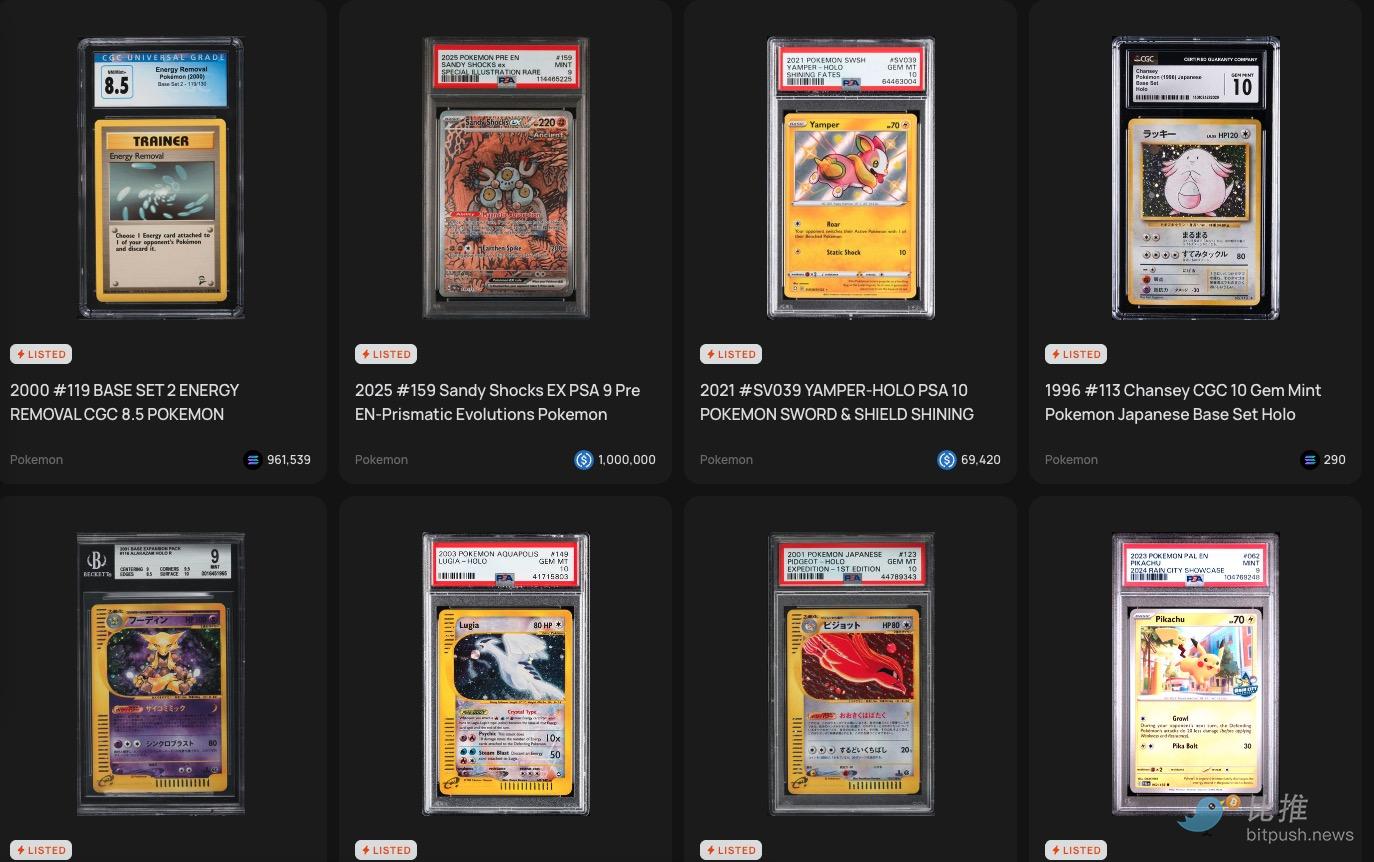

Collector Crypt is a collectibles trading platform built on the Solana public blockchain, featuring a "physical card on-chain + random draw mechanism." It tokenizes authentic, graded, and encapsulated Pokémon cards and stores them in secure physical vaults.

Collector Crypt Core Team:

Tuom Holmberg, CEO: Holmberg is a serial entrepreneur with a background in applied physics and an MBA. He has been a Magic: The Gathering collector for over 25 years and has been mining Bitcoin since 2013.

Dax Herrera, Chief Technology Officer (CTO): Herrera has a background in computer science and is a serial entrepreneur in the digital marketing space.

Richard Shafer, Sr. Software Engineer: Shafer has 15 years of experience in software and technology.

The project successfully completed its seed round of financing in February 2023, and received support from well-known investment institutions such as GSR , Big Brain Holdings and Genesis Block Ventures.

According to the official introduction, users can randomly obtain digital certificates (NFT ) of these cards through the platform's "Gacha Machine" (a card drawing mechanism), and can choose the repurchase mechanism to exchange NFT for fiat currency or crypto assets.

The platform's core token CARDS is used for payment, incentives and governance within the platform.

The platform's core token CARDS is used for payment, incentives and governance within the platform.

Collector Crypt attempts to solve the three major pain points of traditional collectibles trading: insufficient liquidity, difficulty in distinguishing authenticity, and a long path to monetization.

The platform stores graded Pokémon cards in a partner vault, which is then converted into redeemable NFTs. Users can choose to hold the NFTs and redeem them for physical cards in the future, or they can purchase random packs through the platform's "Gacha" mechanic. Similar to real-life blind boxes, users don't know whether they'll receive a common or rare card.

However, Collector Crypt offers instant buy-back prices on-chain, roughly 85%–90% of the price indexed by external markets like eBay and ALT. This means that even if players don’t get the ideal card, they can still quickly cash out their NFTs, lowering the barrier to entry and reducing the risk.

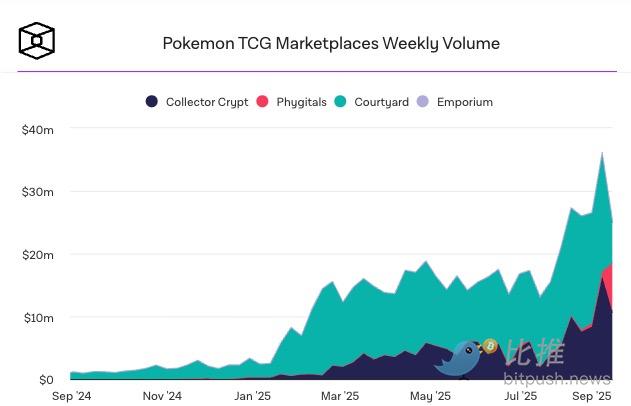

Trading volume and cash flow

Data shows this isn't just a "fantasy game." So far this year, the platform's Pokémon TCG trading volume has exceeded $150 million. In the past week alone, trading volume exceeded $10 million, and the week before that, it reached $16 million. Since the beginning of the year, weekly trading volume has averaged a 27% growth rate.

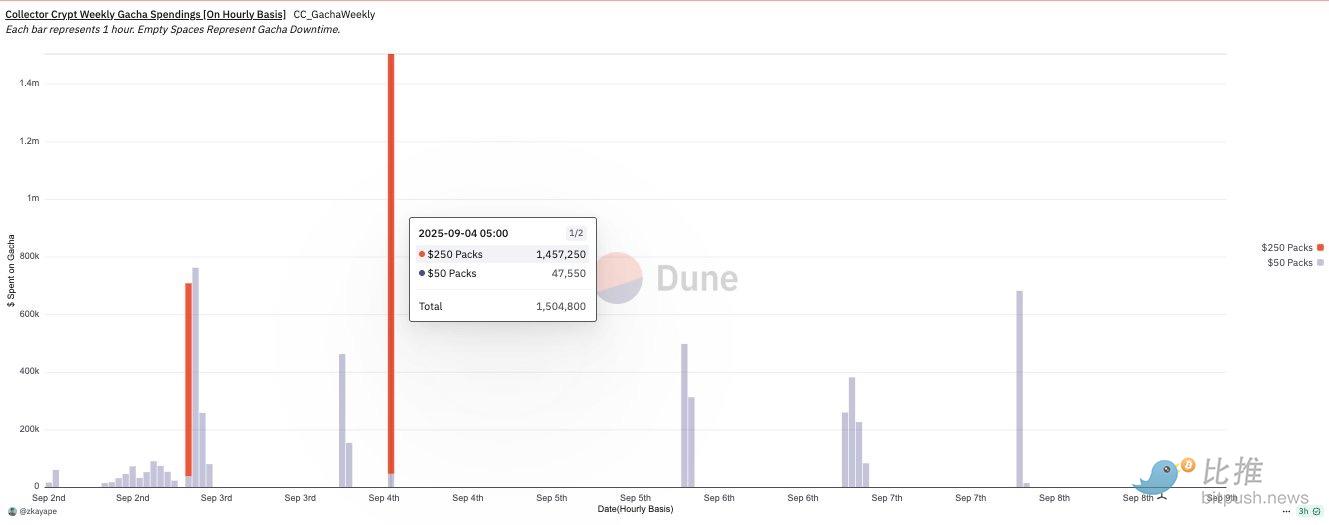

On the consumer side, data from The Block shows that over the past five weeks, user spending on Gacha has remained above $5.7 million per week. The platform's average weekly revenue is approximately $666,000, most of which is used to support buybacks.

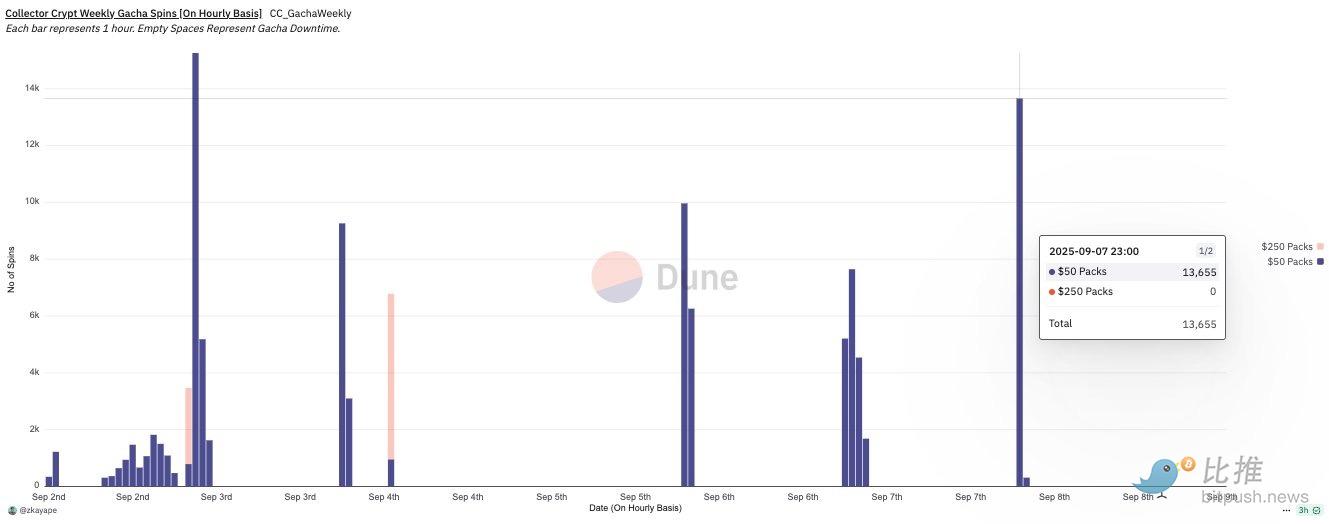

Dune data shows that despite being online only one day in the past week, Collector Crypt still generated $7.9 million in card pack spending (the previous weekly high was $8.5 million).

Demand for the Collector Crypt card machine is incredibly strong. During a recent platform launch, the platform sold approximately 14,000 $50 card packs within an hour, generating $700,000 in sales. This equates to:

233 card packs sold per minute;

An average of 4 transactions per second;

The sales before the system was suspended were also very strong: usually around 15,000 to 17,000 $50 card packs were sold. On September 4th, $1.5 million worth of $250 legendary card packs were sold in less than an hour.

This cycle of "revenue-buyback-reinvestment" forms a cash flow-driven endogenous growth logic. On the one hand, sustained real trading volume provides a value anchor for the token; on the other hand, the buyback mechanism provides participants with a liquidity outlet, further stimulating user participation.

The driving force behind the increase: narrative, mechanism and capital

The surge in CARDS is not driven by a single factor, but rather the resonance of narrative, mechanism and capital.

First, Pokémon itself is one of the most influential IPs in the world. In 2023, the secondary market transaction volume of Pokémon cards reached billions of dollars. However, the pain points of traditional collectibles are:

Poor trading liquidity: Collectibles are difficult to quickly convert into cash, especially high-value cards.

Authenticity is difficult to guarantee: It is difficult to distinguish between true and false, resulting in extremely high trust costs.

High barrier to entry: It is difficult for ordinary players to get their hands on rare cards.

Collector Crypt lowers the threshold for participation through the "tokenization + randomization" model and transparently records transactions on the blockchain, attracting a user group that understands Web3 and is keen on collecting.

What is more important is the role of funds.

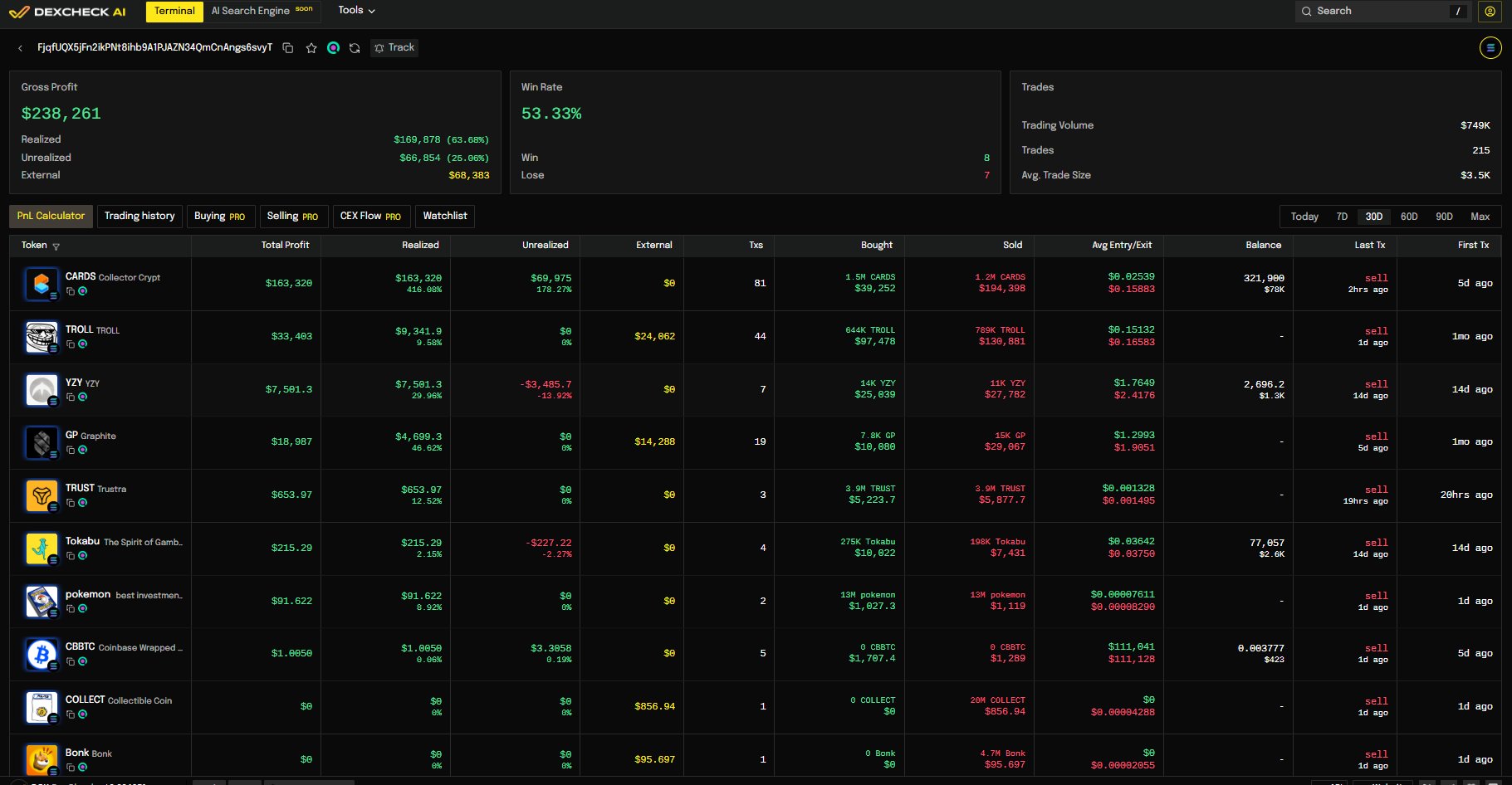

On-chain data shows that some large investors bought the token in batches within a few days after it went online, and sold it in batches after the price rose, making profits of hundreds of thousands of dollars in just one week.

One trader invested a total of $39,000 in CARDS between August 30 and September 2, purchasing 1.5 million units at an average price of $0.025. At the token's all-time high, the total value of his holdings exceeded $360,000. He subsequently sold 80% of his holdings, netting a profit of $163,000. He currently holds $275,000 worth of CARDS, meaning his total profit over the past 30 days, excluding other external sales, has exceeded $180,000. Of his most recent 15 trades, 8 have been profitable, for a 53% win rate.

This "whale" operation not only directly pushed up prices, but also created a herd effect, attracting retail investors to flock in.

The test of sustainability

However, market frenzy cannot mask potential risks. With only approximately 10% of CARDS tokens currently in circulation, future unlocking pressure is inevitable. Furthermore, the short-term arbitrage activities of large investors mean that drastic price fluctuations are likely to recur in the near future.

Furthermore, Gacha's randomness and cashback design bear strong gambling-like characteristics, potentially facing regulatory scrutiny in various jurisdictions. Collector Crypt's overreliance on the single Pokémon IP is also a potential concern. If it fails to expand into other collectibles categories, its growth story may hit a bottleneck.

But like all surges driven by capital and sentiment, the challenge ahead lies in whether Collector Crypt can continue to maintain growth in trading volume and revenue after the hype fades, and transform itself from a "blind box on the chain" into a truly sustainable collectible financial infrastructure.

Author: Bootly.eth

Twitter: https://twitter.com/BitpushNewsCN

BitPush TG discussion group: https://t.me/BitPushCommunity

Bitpush TG subscription: https://t.me/bitpush