Written by David, TechFlow

Original title: iPhone 17 released, I found that the biggest "Apple thinking"in the crypto is hoarding coins

Today the entire technology circle is discussing one thing: the iPhone 17 was released.

WeChat Moments, Weibo, and Xiaohongshu were flooded with Apple news. Some stayed up late to watch the press conference, while others wondered if the price was worth it.

However, this year's discussion is a bit different. In addition to the new product itself, a new meme has become popular on the Chinese Internet:

"Android thinking" and "Apple thinking".

Some people summarize that Android users have a "price-performance mindset" and they compare parameters and calculate prices for everything; Apple users have an "experience mindset" and are willing to pay a premium for the ecosystem and brand.

Then this meme spread more and more widely, from the mobile phone circle to various fields, and people began to use these two ways of thinking to describe ways of doing things.

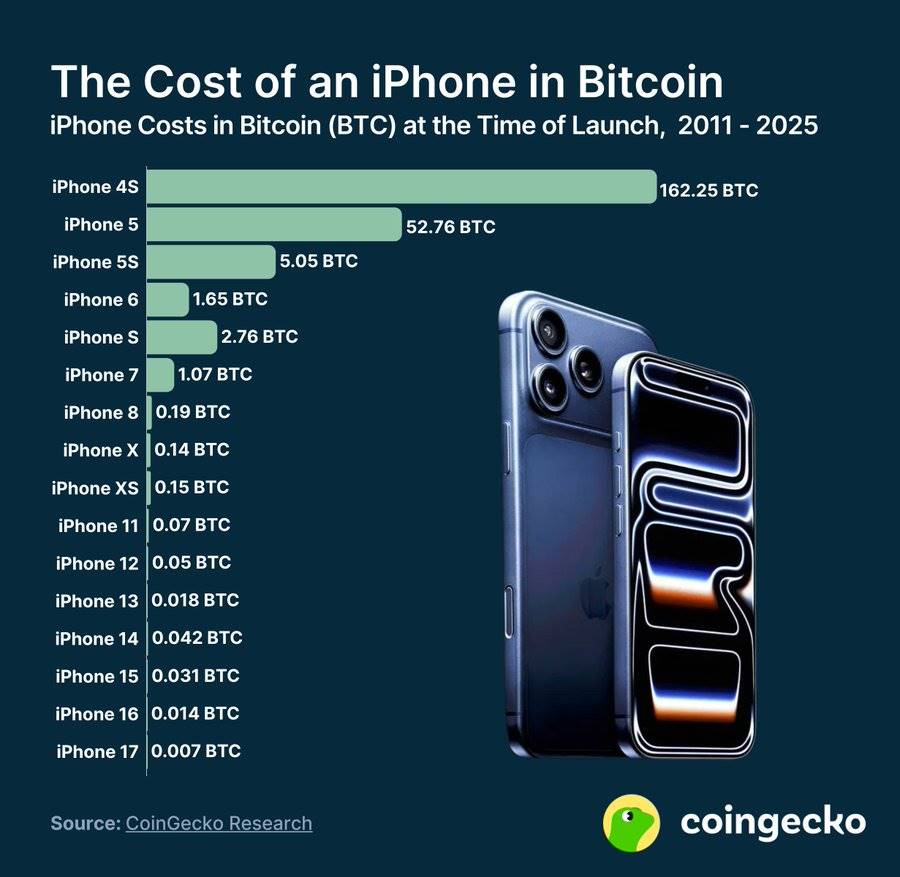

Just as the editor was browsing these discussions, a picture posted by Coingekco on Crypto Twitter jumped into the timeline.

In 2011, it cost 162 BTC to buy an iPhone 4S; in 2024, it only cost 0.014 BTC to buy an iPhone 16. Based on today's iPhone 17 price, it's about 0.07 BTC.

I stared at this picture for a long time. Whenever the value of goods is calculated using a currency standard, people always feel sorry for the currency they have lost.

While everyone is discussing "Android thinking vs. Apple thinking", I am thinking about another question: In the crypto, what is the real "Apple thinking"?

If Apple thinking is to believe in a certain brand or concept and then hold it for a long time without wavering, then are those who have held BTC from 2011 to now the most thorough practitioners of "Apple thinking"?

This idea made me start to re-examine many phenomena in the crypto.

Those thinking labels in the crypto

The crypto may be the place in the world that likes to label people the most.

"Diamond hands" or "paper hands", "Builder" or "Trader", "value investment" or "speculation"...we always classify ourselves and others.

Now, the joke of "Android thinking" and "Apple thinking" has spread to the crypto, which is surprisingly appropriate.

What is the "Android thinking" in the crypto?

The core is one word: fight.

They believe that small investors must take high risks to achieve success. It took BTC from $90,000 to $180,000 to double, but a on-chain meme can increase tenfold in a single day. They aren't pursuing steady growth, but rather social class transition.

The logical chain of this thinking is very clear: ordinary people do not have resource advantages → must find asymmetric opportunities → new projects and new concepts are most likely to generate Alpha → so keep trying and keep rotating.

So what is the "Apple thinking" in the crypto?

The core is also one word: hoarding.

I believe timing is more important than choice. It's not that I don't want to make quick money, but I believe the expected return of chasing hot stocks is negative. Rather than losing 90 out of 100 projects and making 10, it's better to choose the one with the highest certainty and hold it for the long term.

The logic of this thinking is also clear: the market is unpredictable in the short term → most people cannot outperform the market → BTC is the only target that has been verified by time → holding on is victory.

The most typical ones are those "laser eye" avatars, whose personal profiles may only have one word: Bitcoin.

What’s interesting is that the two sides may not understand each other and even doubt each other.

Looking at Apple thinking from an Android perspective, people think these people are too conservative. Crypto is a place with high risks and high returns. If you want to be conservative, why don’t you buy Moutai?

Looking at Android thinking from the perspective of Apple thinking, these people are dancing on the edge of a knife. They make 10 times the profit today and lose everything tomorrow. In the end, they will most likely lose money when they calculate the total bill.

Both sides have their own beliefs. One side believes in WAGMI, while the other side believes in HODL.

But these two may not be a question of right or wrong at all, but a question of situation.

Can the optimal strategies of a young person who enters the market with 5,000 yuan and an old man who enters the market with 5 million yuan be the same?

Even if the former loses everything, it's only two months' salary; but if the bet is right, it could change your life. With the latter, if the bet is wrong once, it could be ruined forever.

So the "Android mindset" is right: if you don't gamble, how can you turn things around? The "Apple mindset" also has its own position: preserving the principal is the key to long-term survival.

It's like someone asking you, should I buy an iPhone or an Android?

The answer always depends on what you want.

The wonderful mapping of "Apple thinking"

On the surface, the crypto and "Apple thinking" should be isolated from each other.

After all, the birth of crypto was to break monopolies, embrace openness, and promote innovation. Apple, on the other hand, represents a closed ecosystem, centralized control, and incremental updates. Logically, the crypto should naturally reject the "Apple mindset."

But the reality is full of irony: the most successful coin is the most "Apple-like".

Bitcoin has been around for over a decade, and its codebase updates are incredibly cautious. Doesn't this resemble the iPhone's slow-paced innovation? Every year, people say the iPhone is falling behind, yet it still sells the best every year.

The community that believes in BTC the most is also the most "Apple-like".

The arrogance of Bitcoin bulls is no less than that of any Apple fan. They have a famous saying:

"Shitcoin is shitcoin." No matter what innovative ecosystem you have, it's all garbage in their eyes. And there's also Satoshi Nakamoto's famous quote:

"If you don't believe me, I'm sorry I don't have time to convince you."

Doesn’t this self-centered attitude resemble the sense of superiority of some Apple users who feel that “Android just isn’t good enough”?

Even more interesting is the market's current choices. Institutions, listed companies, and national reserves have all begun hoarding Bitcoin. You could call it a case of belated hindsight, but it's hard to say they're all fools, pouring real money into an unprofitable investment.

There is a deep logic here: in a market full of uncertainty, "boring" may be the biggest advantage.

BTC doesn’t need a roadmap, a whitepaper update, a CEO to promote its products, or even marketing. It’s just there, the same as it has been for over a decade, boring but reliable.

But for most players in the crypto, this kind of thinking is still difficult to put into practice, and the biggest paradox is this: while shouting about decentralization and innovation, the market has invested the most money in the most "conservative" project, BTC.

"Android thinking" makes tinkering become an instinct

This paradox is worth pondering. Why is it that in the crypto, which prides itself on openness and innovation, the vast majority of money ends up flowing into the most closed and conservative strategies?

Let’s first look at the “innovation anxiety” in the crypto.

Every bull market has a new story. 2017 saw ICOs, 2020 saw DeFi, 2021 saw NFTs and GameFi, and 2024 saw tokens and AI. At the outset, each story claimed to “change the world.”

Where does anxiety come from? From missing out.

Seeing others achieve financial freedom with SHIB, change their fate with BAYC, and make a killing with early DeFi mining, who wouldn’t be anxious? So everyone desperately chases the next trend, fearing they’ll miss out again.

Social media amplifies this anxiety. Open Twitter and you'll be flooded with messages like "Congratulations to [someone] for achieving a 1,000-fold return" and "Ten more Alphas in the [someone] track." Not following the hype feels like a crime, a failure to properly participate in the industry.

But the reality is cruel.

How many ICO projects from 2017 are still alive?

The more innovation, the more it returns to zero. This has become almost an iron rule in the crypto. What matters is how much fruit you have left before the wave recedes.

It is easy to dive into the wave, but it is difficult to get out of it safely.

Let's be honest, if there is a so-called extreme "Android thinking" player in the crypto, then his real state must be very tired.

Open the Twitter feeds of these players and you might see that they are all paying attention to: new L2 launches, which chains have airdrops, new DeFi pools, the floor price of inscriptions, the trends of AI concept coins...

When the meme was at its peak, they might be scanning links and looking for angles at three in the morning while others were sleeping; they were researching new narratives while others were resting on weekends.

The so-called "scientists", when the filter is removed, are just ordinary people who are racking their brains to find a sure-win information gap, and they are tired but happy.

Ask the "Android thinking" players around you, how many of them really make money?

The real situation for most people may be that they made 10 times the money in Project A, but lost it all in Project B; they made 1 million in the early bull market, but lost it all in the bear market; they caught an Alpha today, but fell into three pits tomorrow.

After a year of accounting, it is better to just hold on to the BTC.

Why is this so? Because the "Android mindset" has a fatal problem: information overload. When you try to seize every opportunity, you actually seize nothing.

When your attention is spread across 100 projects, your understanding of each is superficial. You think you're researching, but you're really just browsing. You think you understand the information gap, but in fact, you're only seeing what others want you to see.

The deeper problem is that in this circle, for ordinary people, diligence is the only antidote to anxiety.

Most crypto players know deep down that they have no real advantage. Without insider information, technical advantages, or deep pockets, the only thing they can do is "work harder." But in a PVP market, hard work may be the least valuable.

Of course, Android thinking has also been successful.

Android players who really make money often focus on a specific niche, have their own information sources, and know when to stop... More importantly, they treat this as their full-time job.

In contrast, the state of "Apple thinking" players is completely different.

They might not even check the price for a month, and their lives aren't crypto. They have their own jobs, careers, and lives. Crypto is just part of their asset allocation.

There's no right or wrong, only choices. If you have the time, energy, and talent, "Android Thinking" might really be for you.

The wisdom of choice

Let’s go back to the picture at the beginning of the article.

The iPhone is priced in BTC, and its price has fallen from 162 to 0.01 in 13 years, a drop of 99.99%.

This numerical comparison is indeed very impactful, but in fact, let's think about another more practical question:

If you were the person who was struggling to decide between buying an iPhone 4S or 162 BTC in 2011, what would you think now?

In 2011, the iPhone was a truly revolutionary product, while Bitcoin was just an experiment among geeks. Choosing an iPhone was rational, while choosing Bitcoin was crazy.

But looking back 14 years later, the rational choice made you own a piece of electronic junk that had long been obsolete, and the crazy choice made you own an asset worth $1.5 million (if you could hold on to it and not sell it).

What does this mean?

Maybe nothing can be explained. Success is just a survivor bias. What everyone did at that time was the most suitable choice for their own personality and the most reasonable choice in retrospect.

There is no right or wrong, really, there is no right or wrong.

The market will reward truly excellent "Android thinking" players, those who find Alpha; the market will also reward firm "Apple thinking" players, those who hold Beta.

The market punishes those who waver. So the real question is never which way of thinking to choose, but do you understand yourself?

Whether you choose to buy an iPhone or BTC, whether you think in an Android or Apple way, the most important thing is:

This is your own choice, not the answer given to you by others.

After all, in the crypto, the highest level of "Think Different" may be "Think for Yourself".