IP, the native Token of Story Protocol—a Layer 1 blockchain focused on intellectual property—has emerged as one of the best performing assets today, up nearly 25% over the past 24 hours.

The rally comes on the heels of a major announcement from Heritage Distilling, which revealed that it is taking “the first of many steps” to implement a treasury reserve strategy around the Token . With technical and on- chain indicators showing increased participation from retail investors, the IP looks poised for continued growth.

Heritage Distilling's treasury strategy puts IP in the spotlight

The price of IP has increased by double digits over the past 24 hours, making it one of the best performing assets today. The price increase comes after an announcement from Heritage Distilling Holding Company, which confirmed that it is implementing its newly launched “IP Strategy.”

The strategy positions Heritage as the first Nasdaq-listed company to adopt an IP-focused treasury reserve plan. It also marks a step toward the acceptance of programmable intellectual property as a digital asset by organizations.

Heritage said it raised $220 million in August through a private investment in public equity (PIPE) round to fund its IP acquisition.

The Capital attracted support from major institutional investors, including a16z crypto, Arrington Capital, dao5, Hashed, Polychain Capital , and Selini Capital. Cantor Fitzgerald and Roth Capital Partners Vai as placement agents.

Volume explodes, showing confidence behind the rally

Excitement surrounding the announcement pushed IP to a new All-Time-High of $11.84 on Tuesday before falling back to $10.28 at the time of writing.

Despite the correction, buying pressure remains strong in spot markets, highlighted by rising daily volume . At press time, volumes totaled $650 million, up more than 650% over the past day.

To stay updated on TA and the Token market: Want more Token insights like this? Sign up for Editor Harsh Notariya's daily Crypto Newsletter here .

PI price and volume . Source: Santiment

PI price and volume . Source: SantimentWhen a sharp increase in volume accompanies an asset’s price increase, it shows strong confidence behind the move. It shows that buyers are pushing the price higher and are doing so with increasing participation. This trend reinforces the IP’s ability to grow sustainably, as increased liquidation provides deeper support for further price increases.

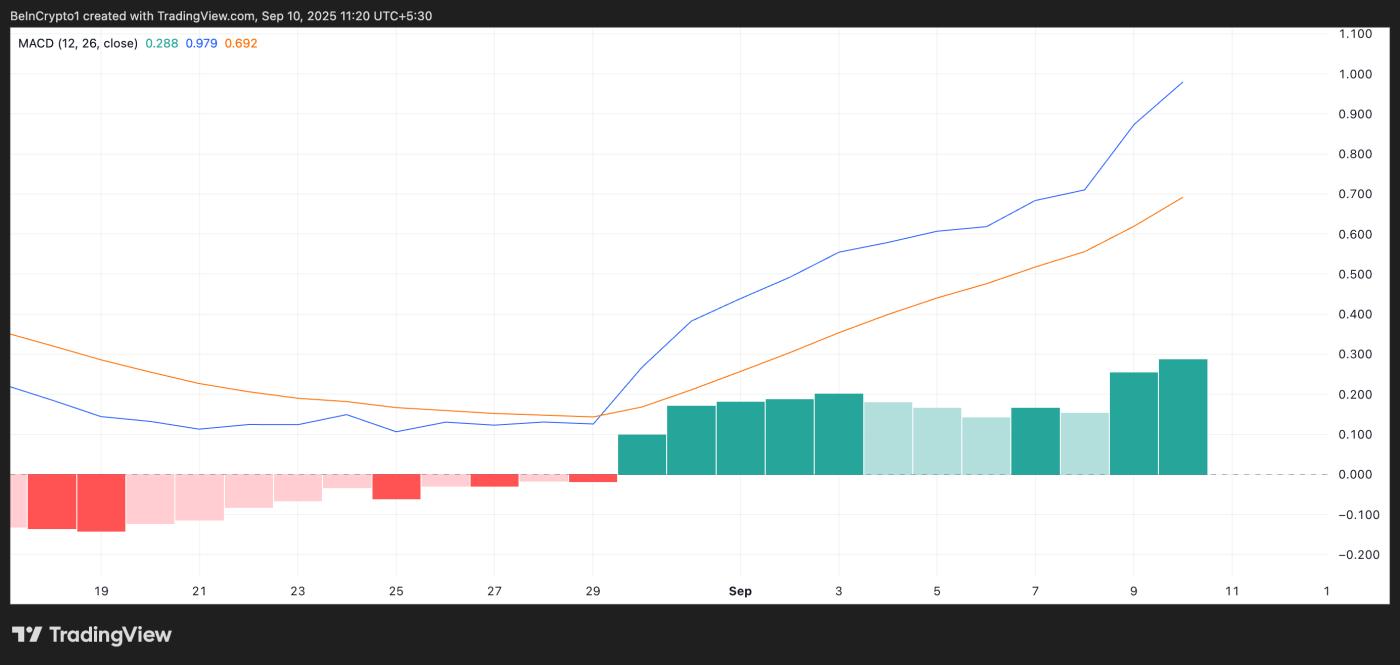

Furthermore, the Token ’s Moving Average Convergence Divergence (MACD) indicator setup on the daily chart supports this bullish outlook. At the moment, IP’s MACD line (blue) is above its signal line (orange), reflecting the dominance of the uptrend.

IP MACD. Source: TradingView

IP MACD. Source: TradingViewMACD is a momentum indicator that helps traders identify potential changes in trend strength and direction.

When the MACD line is above its signal line, bullish momentum is in control, suggesting that IP could maintain its bullish momentum in the short term.

Can the bulls break above $11.84 or will profit taking prevail?

Sustained buying pressure could push IP back to All-Time-High of $11.84. If buyers maintain control, the Token could continue its rally past this level and attempt to record a new high.

IP Price Analysis. Source: TradingView

IP Price Analysis. Source: TradingViewHowever, if profit-taking continues, this bullish outlook could be invalidated. In that case, IP could drop below $9.91 and fall to $8.40.