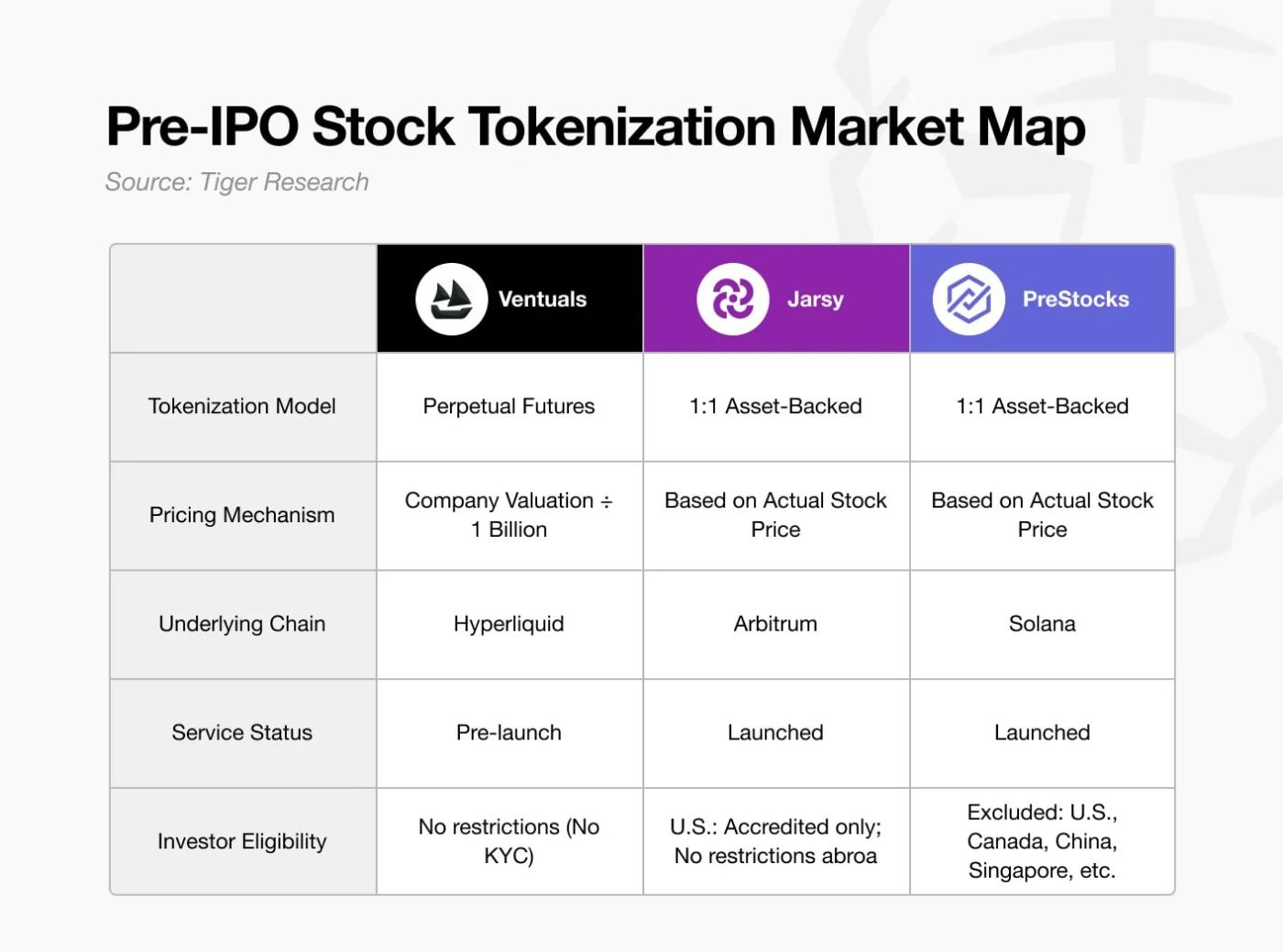

This report, compiled by Tiger Research, discusses how tokenization lowers investment barriers in the pre-IPO equity market through case studies of Ventuals, Jarsy, and PreStocks.

TL;DR

Despite offering high returns, the private equity market remains largely inaccessible to retail investors, with a bias favoring institutions and high-net-worth individuals.

Tokenization has the potential to overcome the limitations of the traditional financial system, particularly in terms of liquidity, access, and convenience, but significant legal and technical barriers remain.

Projects like Ventures, Zoshi, and FreeStock are exploring different approaches to tokenizing private equity assets. While still in their early stages, these efforts show potential to reduce structural barriers in the market.

1. The Allure of Private Equity — But It's Not for You

How can someone invest in SpaceX or OpenAI? As private companies, both are closed to most investors. Retail access is virtually non-existent, and investment opportunities typically only emerge after the IPO.

The main problem is the exclusion of the potential for substantial profits generated in private markets. Over the past 25 years, private markets have created about three times more value than public markets.

Two structural factors explain this. First, capital fundraising is a highly sensitive process for private companies. Regardless of investor qualifications, deals are typically awarded to well-known institutional investors. Second, the growth of private capital markets has expanded financing options. Many companies can now raise billions of dollars without going public.

OpenAI is a prime example of both dynamics. In October 2024, the company raised $6.6 billion from major investors including Thrive Capital, Microsoft, Nvidia, and SoftBank. In March 2025, OpenAI secured an additional $40 billion in the largest private funding round in history, led by SoftBank with participation from Microsoft, Coatue, and Altimeter.

This describes a system where only a select group of institutional investors gain access, while a mature private capital infrastructure provides companies with an alternative to a public listing.

Thus, the current investment landscape is increasingly exclusive, deepening inequalities in access to high-growth opportunities.

Dive deeper into Asia's Web3 ecosystem with Tiger Research. Join over 16,000 pioneers for exclusive, up-to-date insights into market conditions.

2. Equal Access: Can Tokenization Address Structural Challenges?

Could tokenization be a real solution to the structural imbalances in the private equity market ?

At first glance, this model may seem appealing: real-world assets are converted into digital tokens, enabling fractional ownership and facilitating 24/7 trading on global markets. But at its core, tokenization simply repackages existing assets, such as pre-IPO shares, into a new format. Solutions to increase access already exist within the traditional financial system.

So, what makes it different from tokenization?

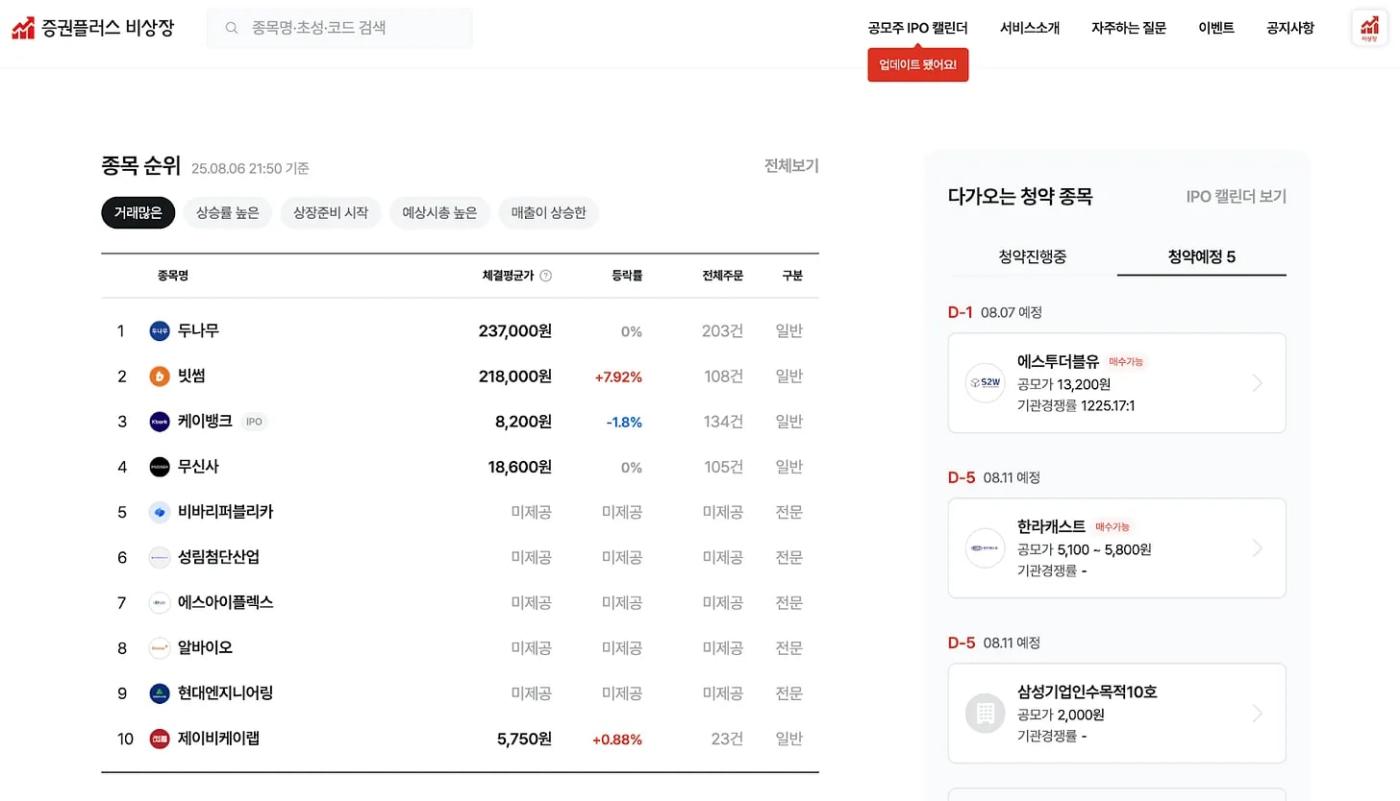

3. Projects Attempting to Tokenize Pre-IPO Stocks

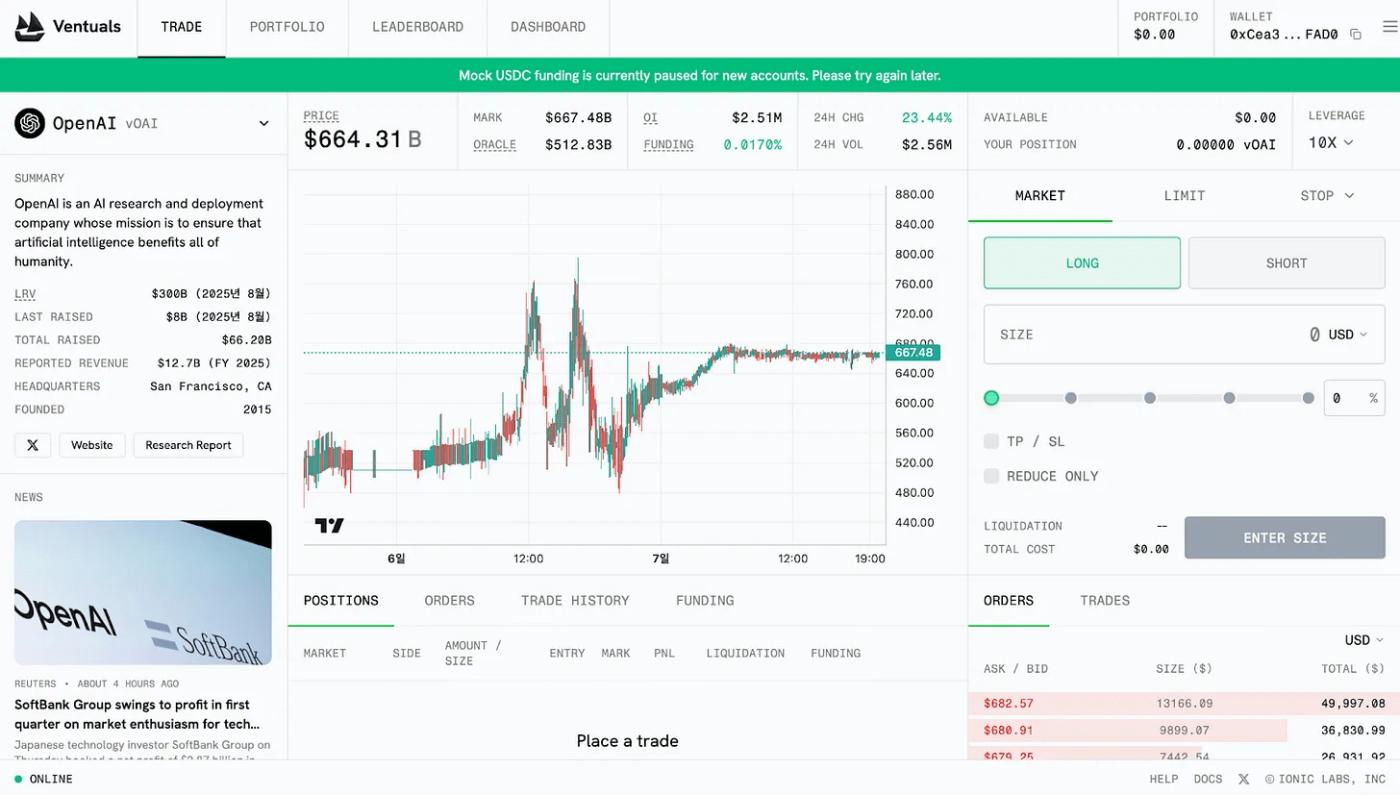

3.1. Ventuals

Ventuals is built on a perpetual futures structure . Its primary advantage is that it allows derivatives trading without requiring direct ownership of the underlying asset. This allows the platform to quickly list a wide range of pre-IPO shares while bypassing common regulatory requirements such as identity verification or accredited investor status.

This perpetual futures product is implemented using Hyperliquid's HIP-3 standard. However, this standard is currently only operational on the testnet , and Ventuals itself is still in the pre-launch stage.

The pricing model is also unusual. Instead of using stock prices or actual market transactions, the token price is calculated by dividing the company's total valuation by one billion. For example, if OpenAI is valued at $35 billion, then one vOAI token would cost $350.

However, this ease of access brings structural challenges, particularly the reliance on oracles . Valuation data for private companies is inherently closed and updated irregularly. Derivatives based on such incomplete information can exacerbate information asymmetries in the market.

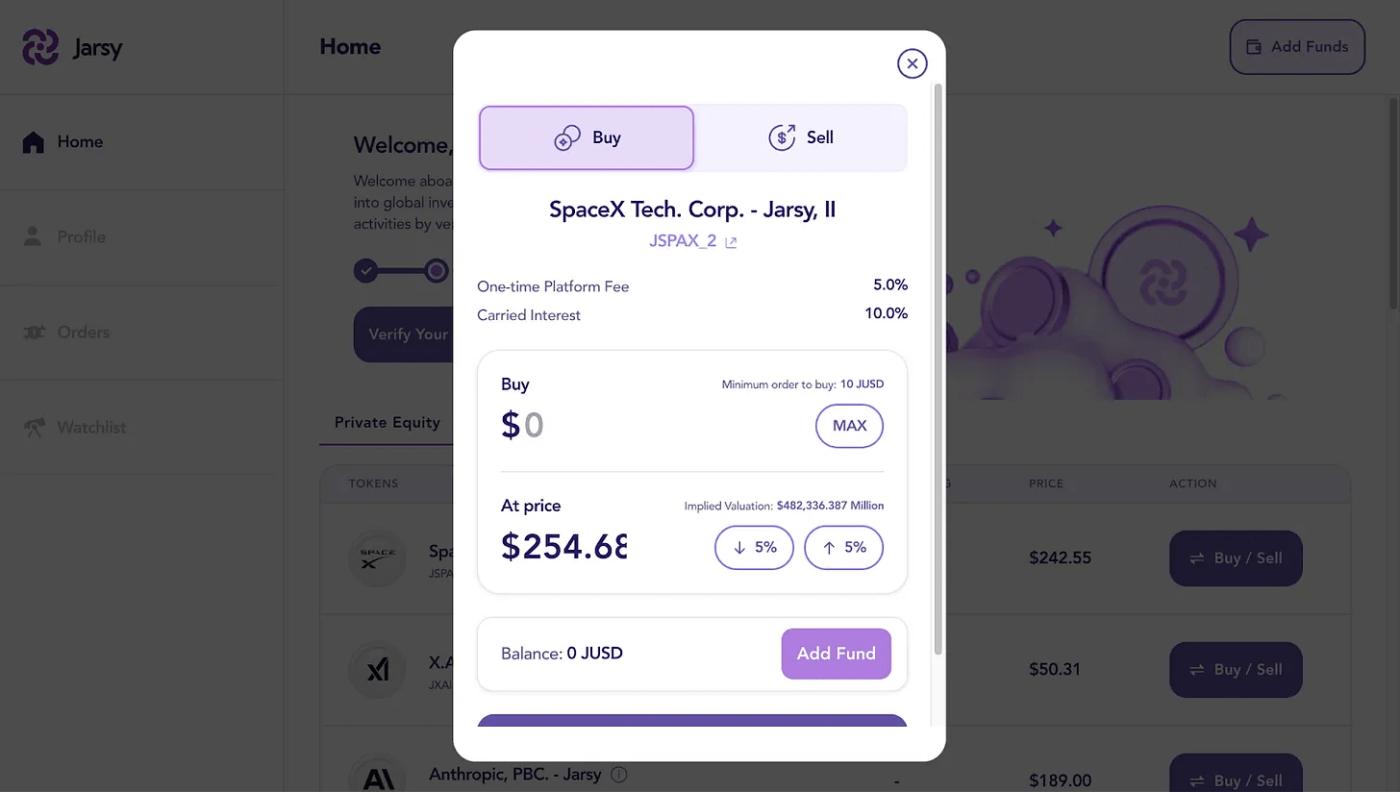

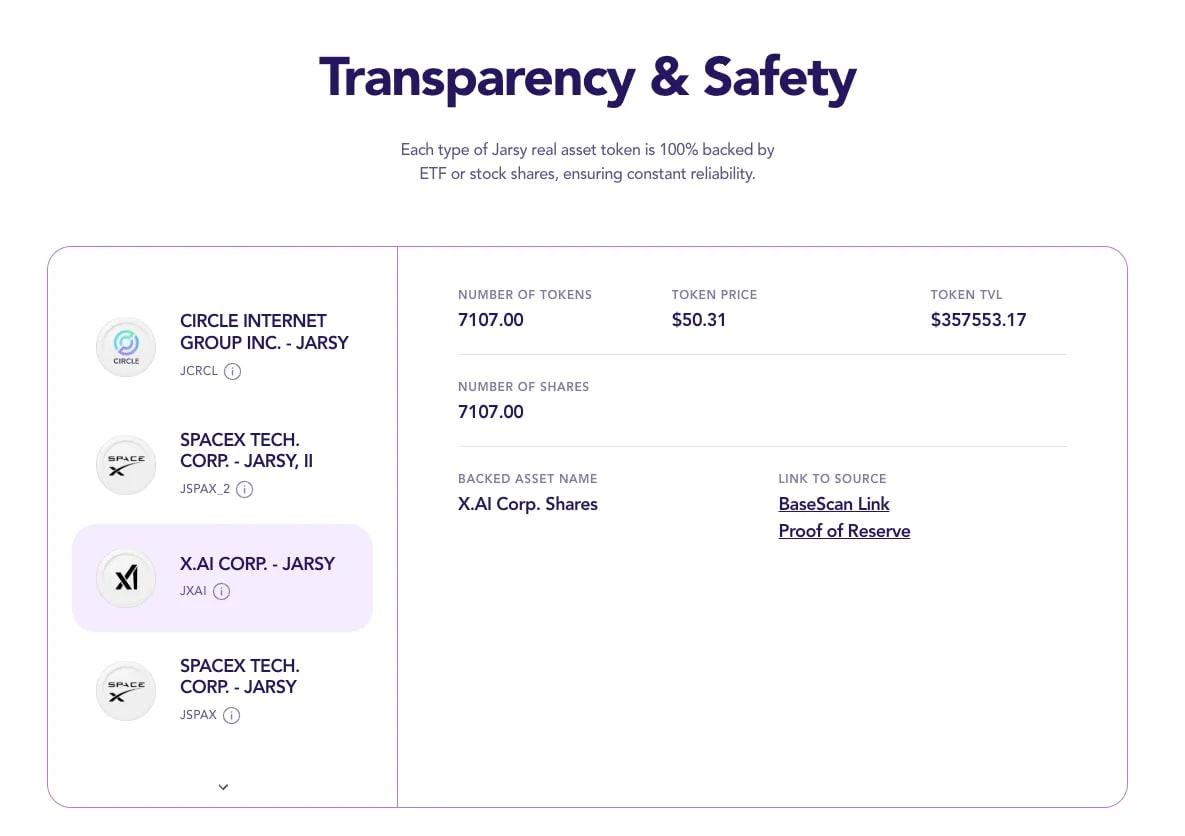

3.2. Jarsy

Jarsy uses an asset-based tokenization model with a 1:1 ratio. The primary mechanism involves the direct acquisition of pre-IPO shares and the issuance of one token for each share held. For example, if Jarsy owns 1,000 SpaceX shares, it will mint 1,000 JSPAX tokens. Although investors don't directly hold the underlying shares, they retain all associated economic rights, including dividends and price appreciation.

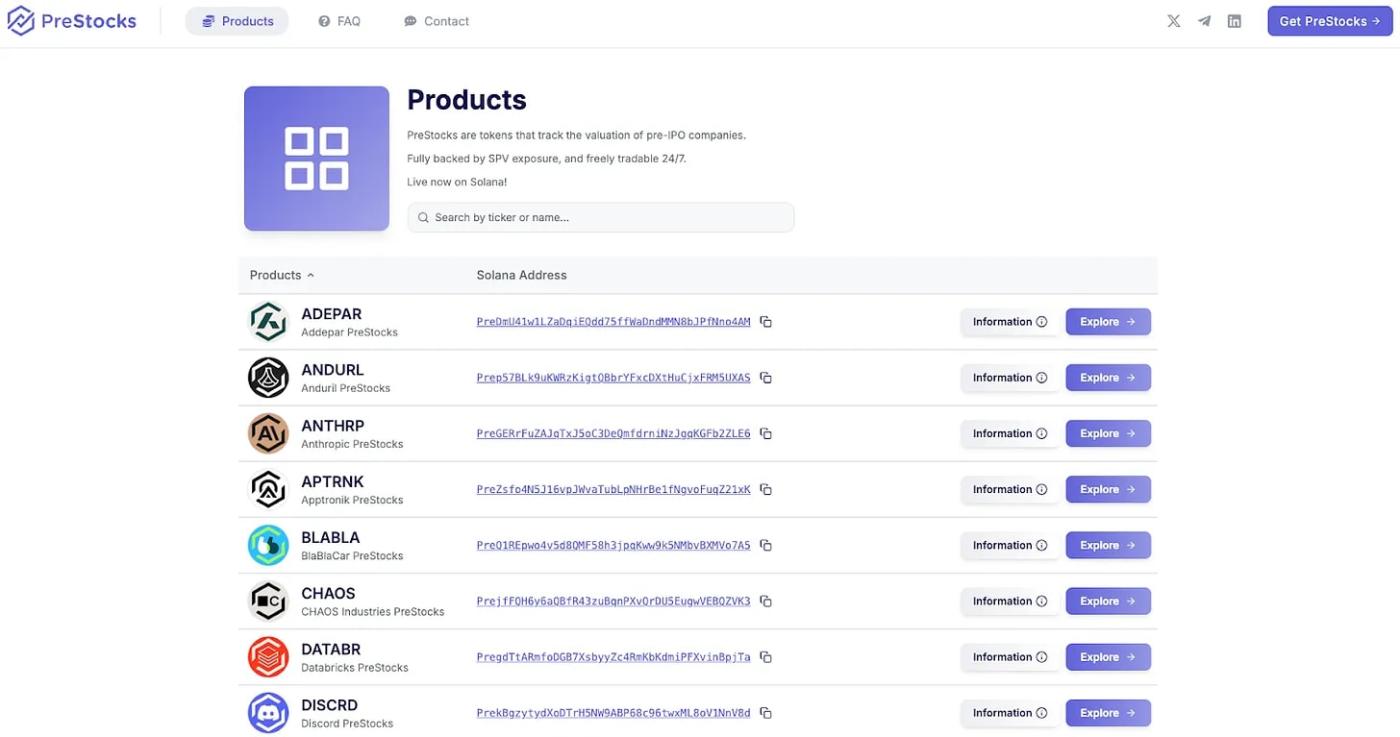

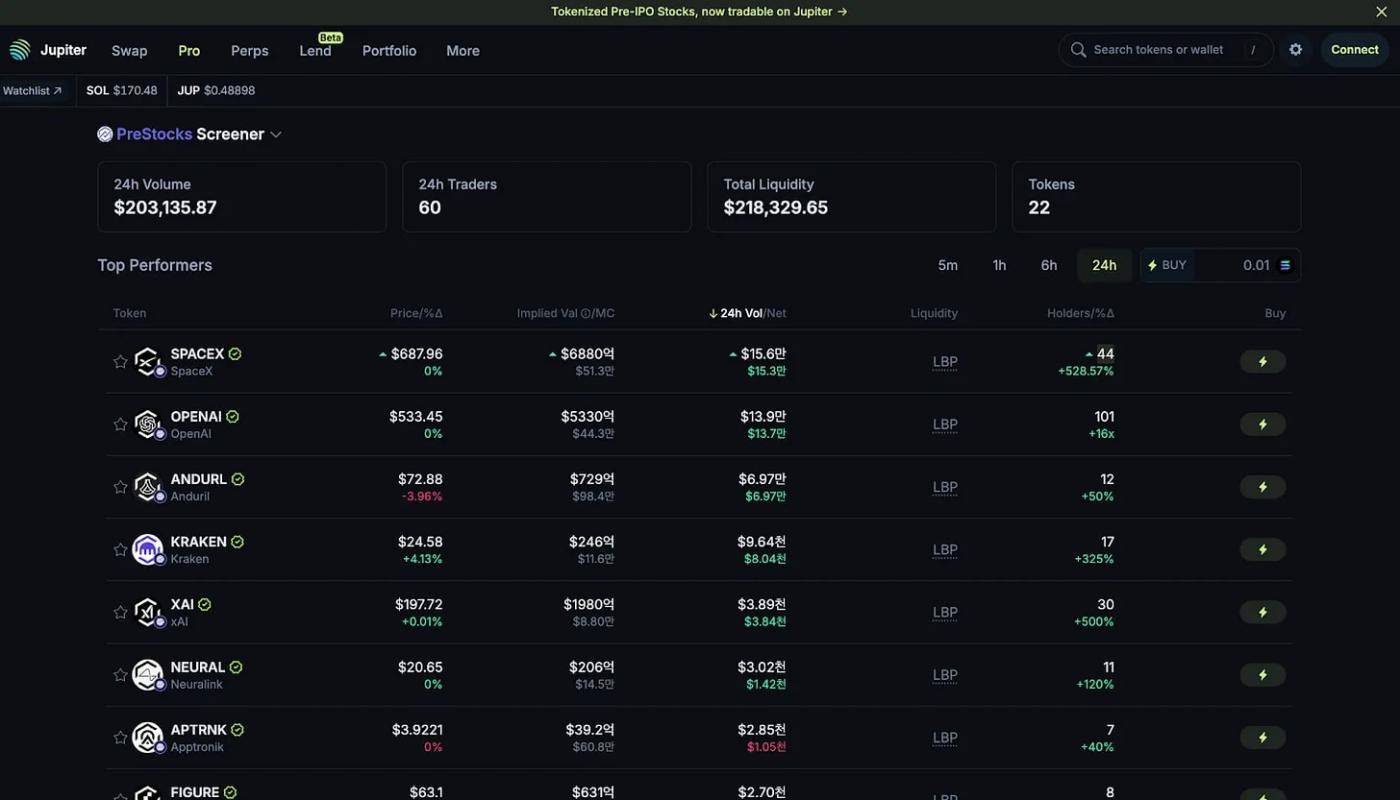

3.3. PreStocks

PreStocks adopts a similar model to Jarsy, purchasing shares in private companies and issuing tokens backed by 1:1 assets. The platform currently supports trading in 22 pre-IPO stocks and recently launched its product to the public.

4. Unresolved Challenges in Pre-IPO Stock Tokenization

First, regulatory uncertainty is the most fundamental obstacle.

Second, resistance from private companies remains a critical obstacle.

Third, technical and operational complexity cannot be ignored.

🐯 More from Tiger Research

Telusuri lebih lanjut laporan yang relevan dengan topik ini: Disclaimer

This report is based on materials believed to be reliable. However, we do not expressly or impliedly guarantee the accuracy, completeness, or suitability of the information presented. We disclaim any liability for any loss or damage arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, projections, objectives, opinions, and views expressed in this report are subject to change without notice and may differ or conflict with the views of other parties or organizations.

This document is provided solely for informational purposes and should not be construed as legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or prospective investors.

Terms of Use

Tiger Research permits fair use of reports it has compiled and published. 'Fair use' is a principle that permits the use of portions of content for the public interest, as long as it does not harm the commercial value of the material. If the use complies with this principle, reports may be used without prior permission. However, when citing Tiger Research reports, you are required to:

Clearly cite 'Tiger Research' as the source.

Includes Tiger Research logo (black/white).

If the material is to be re-compiled and republished, separate approval is required. Unauthorized use of the report may result in legal action.