This report, written by Tiger Research, analyzes how the Malaysian builder community has emerged as a hidden force behind global Web3 leaders. We would like to thank Lydian Labs , the organizer of MYBW 2025, for their support of this research.

Opinion of Figures

1. Introduction

Tiger Research positioned itself as the official research partner for Malaysia Blockchain Week, the country's premier blockchain event, organized by Lydian Labs . A notable feature of the event was the active participation of regulatory authorities, who had previously been conservative towards the crypto industry but are now engaging in constructive discussions for its development.

2. Malaysian Crypto Market: Three Keywords You Need to Know

3. Timeline of Crypto Regulation in Malaysia

Phase 1: Building a Digital Asset Regulatory Framework (2019–2020)

Phase 2: Strengthening Enforcement and Blocking Foreign Exchanges for Investor Protection (2021–2024)

The SC created an " Investor Alert List " to warn users. The list includes global exchanges like Binance and Bybit, along with a warning that trading through these platforms is not protected by Malaysian law.

Phase 3: Rapid Transformation Post-Trump Election (2025–Present)

The government's political commitment quickly translated into concrete policy changes. In June 2025, Prime Minister Anwar launched the " Digital Asset Innovation Hub ," led by Bank Negara Malaysia (BNM), as a regulatory sandbox. This sandbox serves as a safe space for digital asset trials and innovation. Digital Minister Gobind Singh Deo announced the formation of a " Digital Asset and Blockchain Working Committee " at a blockchain industry roundtable hosted by MDEC, underscoring the government's systematic approach.

Technical infrastructure development is also being accelerated. Minister of Science, Technology, and Innovation, Chang Lih Kang, announced the official launch of the Malaysia Blockchain Infrastructure (MBI) at the opening of Malaysia Blockchain Week 2025. This infrastructure is being developed jointly by MIMOS and local mainnet project Zetrix , with the aim of leveraging blockchain in government transparency, halal certification, and trade and supply chain efficiency.

The most striking change was the loosening of regulations by the SC. In June 2025, the SC released a Consultation Paper , marking a shift from a strictly approval-based review system to significant deregulation. By July 2025, only 23 cryptocurrencies that passed SC review would be able to be traded on local exchanges. However, under the new framework, exchanges can make their own listing decisions, provided they meet specified criteria, without requiring prior approval from the SC . However, this deregulation does not mean total freedom. The regulator also increased exchange capital requirements, encouraged a self -regulatory model , and maintained restrictions on high-risk assets such as privacy coins, meme coins, and certain stablecoins.

This approach seeks to balance market freedom and financial system stability. Ultimately, this policy shift demonstrates Malaysia's strategy to compete with Singapore and Hong Kong as a major Web 3 hub in the Asia-Pacific. In conjunction with the Trump administration's pro-crypto policies, Malaysia is positioning itself as a crucial bridge between Western capital and Asian markets.

4. Sector Exploration: Malaysia's Crypto & Blockchain Ecosystem

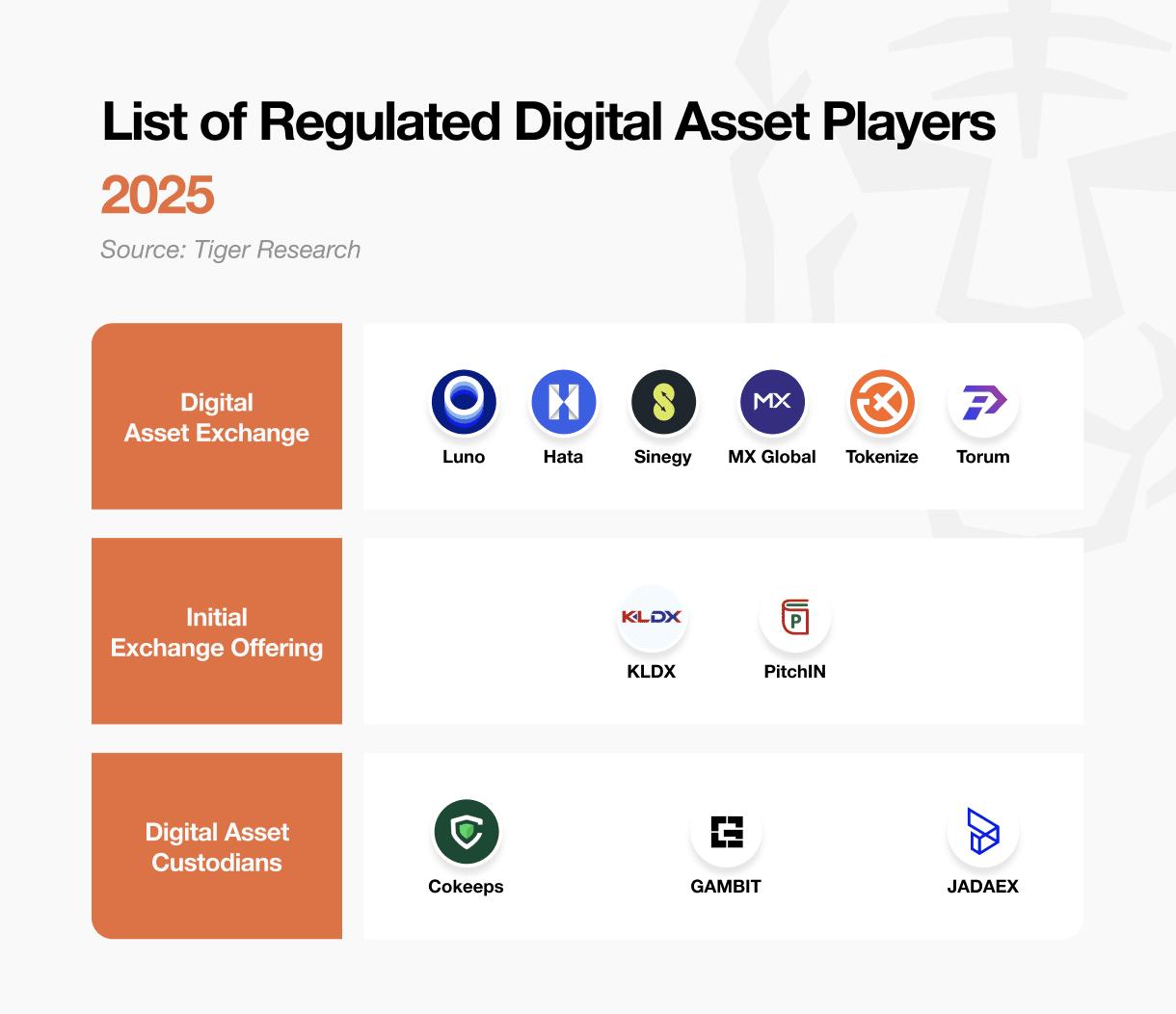

4.1. Centralized Exchanges (CEX)

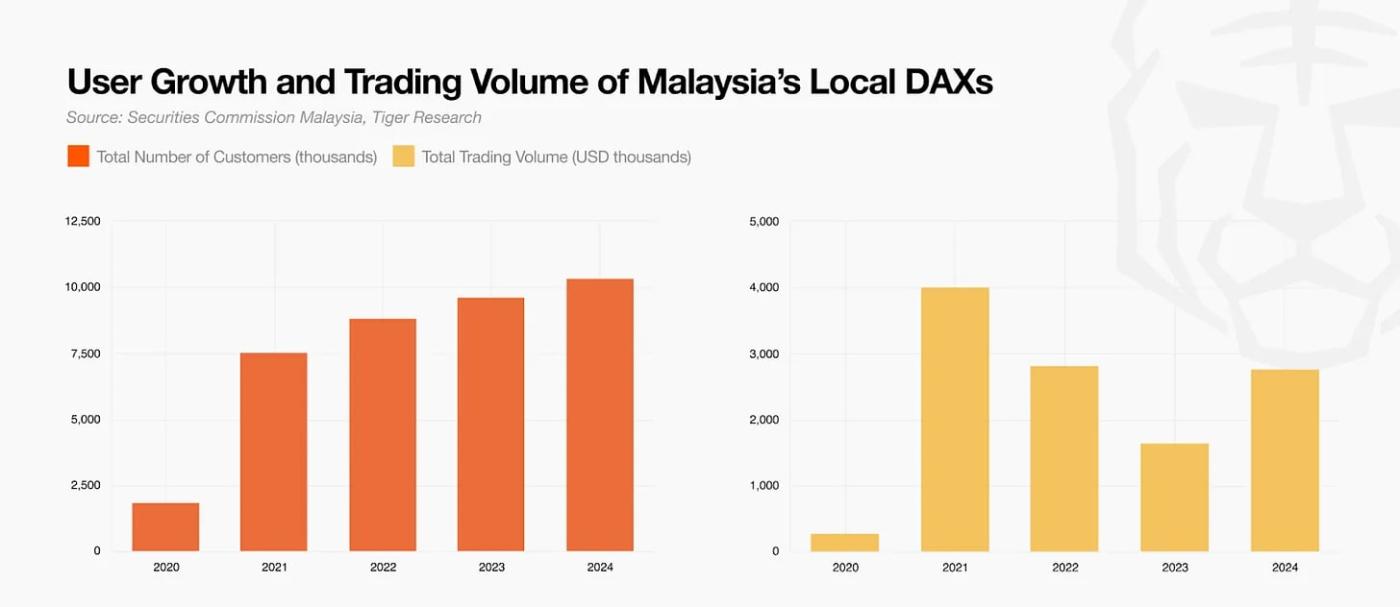

Malaysia has six recognized local crypto exchanges. Luno dominates with over 90% of local trading volume, creating a win-win situation similar to other Asian countries like Korea and Thailand. However, newcomers like Hata , which launched last year, are showing rapid growth and are starting to inject new energy into the market. Sinegy is also a major player, providing crypto trading services to corporations and institutional investors.

Local exchanges have limited real-world influence. Despite regulatory efforts to block unregistered foreign exchanges like Binance, many investors remain active using global platforms through indirect methods. Approximately 40–60% of Malaysia's total spot crypto trading volume is estimated to occur on global exchanges like Binance and Bybit.

The small size of the local crypto market also poses a challenge. Although Luno controls over 90% of the local market, its trading volume remains limited. Luno's daily trading volume shows a 200-fold gap compared to Upbit in Korea. According to BNM's 2024 annual report , the total net outflow of deposits to DAX-listed exchanges was less than 1% of total national banking deposits by the end of 2024, and only about 0.4% of the market capitalization of securities listed on Bursa Malaysia.

Investors appear to be choosing global exchanges due to the structural limitations of local exchanges. Direct SC involvement in crypto listings requires a rigorous approval process, limiting the choice to just 23 tradable cryptocurrencies . Low liquidity makes large-scale trading difficult. The lack of margin trading or derivatives also reduces investor appeal.

In this environment, local exchanges are pursuing a survival strategy by operating parallel brokerage businesses. They provide OTC services and stablecoin on/off-ramps outside of their exchange offerings. This strategy targets family offices and digital nomads as an additional source of income. This business model arises from restrictions on major stablecoins like USDT and USDC on local exchanges, as well as low liquidity for large transactions.

Malaysia's crypto tax policy also influences user choices. Crypto profits are subject to income tax, not capital gains tax. The government only taxes the amount withdrawn. For example, if someone holds 10 BTC but only withdraws 1 BTC locally, tax is only levied on the withdrawal amount. Airdrops , staking , and DeFi earnings are also subject to income tax . The government monitors crypto activity through trading data from local exchanges. Smuggling and underreporting of activity can result in investigations and sanctions. This tracking system is a major factor deterring investors from using local exchanges.

4.2. Stablecoin

Malaysian regulators have a conservative stance on stablecoins . Dollar-backed stablecoins like USDC and USDT remain unlisted on local exchanges. While BNM has not issued an explicit statement, this cautious approach is likely influenced by policy priorities established after the 1998 Asian financial crisis, when rapid capital outflows caused serious economic disruption. This incident heightened concerns about exchange rate stability and foreign exchange management.

The SC's recent consultation paper shows that this cautious approach persists. Regulators view stablecoins as vulnerable to market price volatility and potentially endangering the stability of the local financial system. Rather than being considered a regular means of payment, they are viewed as a potential macroeconomic risk.

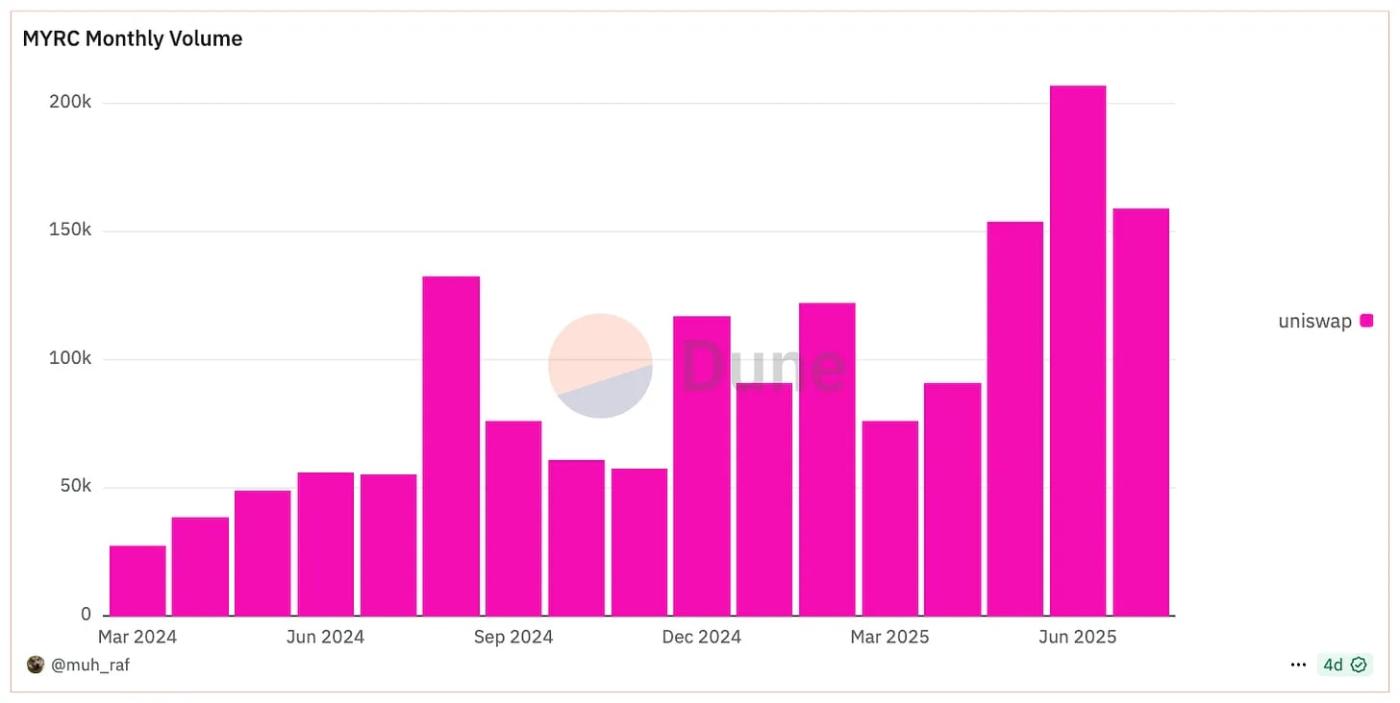

Nevertheless, private sector stablecoin experiments continue. Blox is developing 'MYRC,' a stablecoin pegged to the ringgit. MYRC is a fiat-backed stablecoin (ringgit) that runs on the Arbitrum and Ethereum networks. Users can mint MYRC via local bank account deposits through the Blox platform and exchange it in the same way. MYRC is currently in beta with a market capitalization of around USD 700,000, still limited but quite actively traded.

However, overlapping regulations have caused project delays. Dual oversight by the SC and BNM has created unclear responsibilities and standards. Blox has been working on the project for three years, communicating with regulators, but has yet to receive final approval due to unclear regulatory positions. The lack of a consistent stablecoin regulatory framework is a major factor in the approval delay.

Signs of change are emerging. Prime Minister Anwar Ibrahim recently announced consideration of a regulatory sandbox through the " Digital Asset Innovation Hub ," including a ringgit-based stablecoin experiment . This central bank-led sandbox will provide a controlled environment for fintech and digital asset companies to test new technologies and services.

However, given government concerns about capital controls, the initial focus is likely to be on applications within the local financial ecosystem, rather than cross-border payments . Examples include 24-hour payment infrastructure (outside of bank operating hours), escrow services that can utilize conditional payment functions, such as for prepaid refunds for closed fitness centers or uncertain home renovation contracts. Implementing " programmable money " could be a solution to everyday financial problems.

4.3. NFT Community

The Malaysian NFT market remains in a downturn. Many users who jumped in during the NFT hype and high prices have suffered losses and exited the market. This pattern is similar to other countries. While there are local collectors for global projects like BAYC, Azuki, and Milady, their activity is generally limited to small hobbyist gatherings. Malaysia has yet to see a major NFT project grow locally.

4.4. Islamic Finance

Malaysia has positioned itself as Asia's largest Islamic finance hub. The country ranks first globally in the sukuk (Islamic bond) market. This is supported by its predominantly Muslim population (over 60%). By 2024, Islamic finance will comprise approximately 47% of the national financial system.

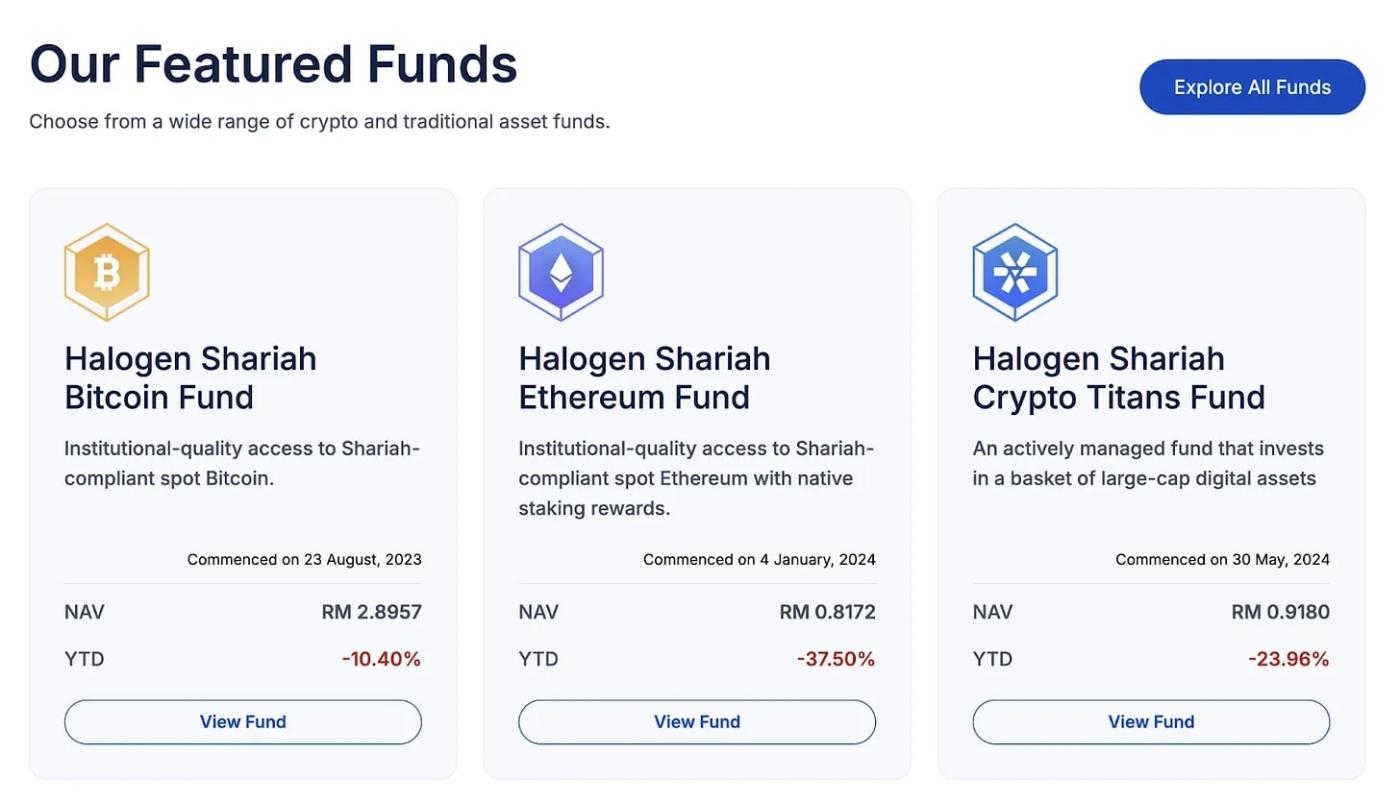

Various Islamic finance-based crypto products have emerged, such as Halogen Capital, the world's first Sharia-compliant crypto mutual fund manager, managing approximately USD 75 million in various products such as Sharia-compliant Bitcoin funds, Ethereum funds, and others.

Nawa Finance is a Sharia-compliant DeFi protocol. They partner with Solv Protocol to offer a Sharia-compliant Bitcoin DeFi product, certified by Amanie Advisors (a registered Sharia advisor in SC). This product offers a secure and transparent halal income structure. Nawa Finance has surpassed USD 50 million TVL, demonstrating significant progress in Sharia-compliant DeFi.

Sharlife shows innovation in the Islamic charity system. This platform allows zakat payments using crypto, collaborating with MAIWP (Federal Region Islamic Religious Council) to build a digital charity system.

There are also practical obstacles. Crypto is still not recognized as an official payment method, limiting its real-world applications. The federal system presents challenges to institutionalization nationwide.

However, the potential for global expansion remains high. Expertise in Islamic finance and local experience are competitive assets in overseas markets. Malaysia has previously expanded its sukuk market model and institutions to the Middle East and Southeast Asia. This suggests a similar expansion path for crypto; major Muslim countries like Saudi Arabia and Indonesia may adopt Malaysia's Sharia-compliant digital asset model. Malaysia has considerable potential to lead the global digital transformation in this sector.

4.5. Mainnet Environment

The blockchain mainnet scene in Malaysia remains limited. Among global mainnets, the Solana Superteam is the only one actively present in Malaysia. The Superteam collaborates with various local Solana-based projects, such as Jupiter and Meteora, focusing on supporting local builders and founders to expand the ecosystem. The organization also actively organizes community activities such as hackathons. Ethereum communities like Ethereum KL also exist, but with limited activity.

IOTA is an exception. The project became an official sponsor of MYBW 2025 and conducted active marketing activities locally. IOTA obtained Sharia compliance certification from Cambridge IFA and strengthened its branding targeting the Islamic finance market. The company is accelerating its market strategy in Malaysia.

4.6. Bitcoin Mining

However, illegal mining has become a serious problem. According to Malaysian blockchain association ACCESS , state utility TNB reported losses of approximately RM441 million (USD100 million) due to illegal mining. Electricity theft is common, with some causing fires. Recent incidents include identity theft for fraudulent electricity contracts. Authorities are tightening their crackdown, confiscating 985 illegal mining devices.

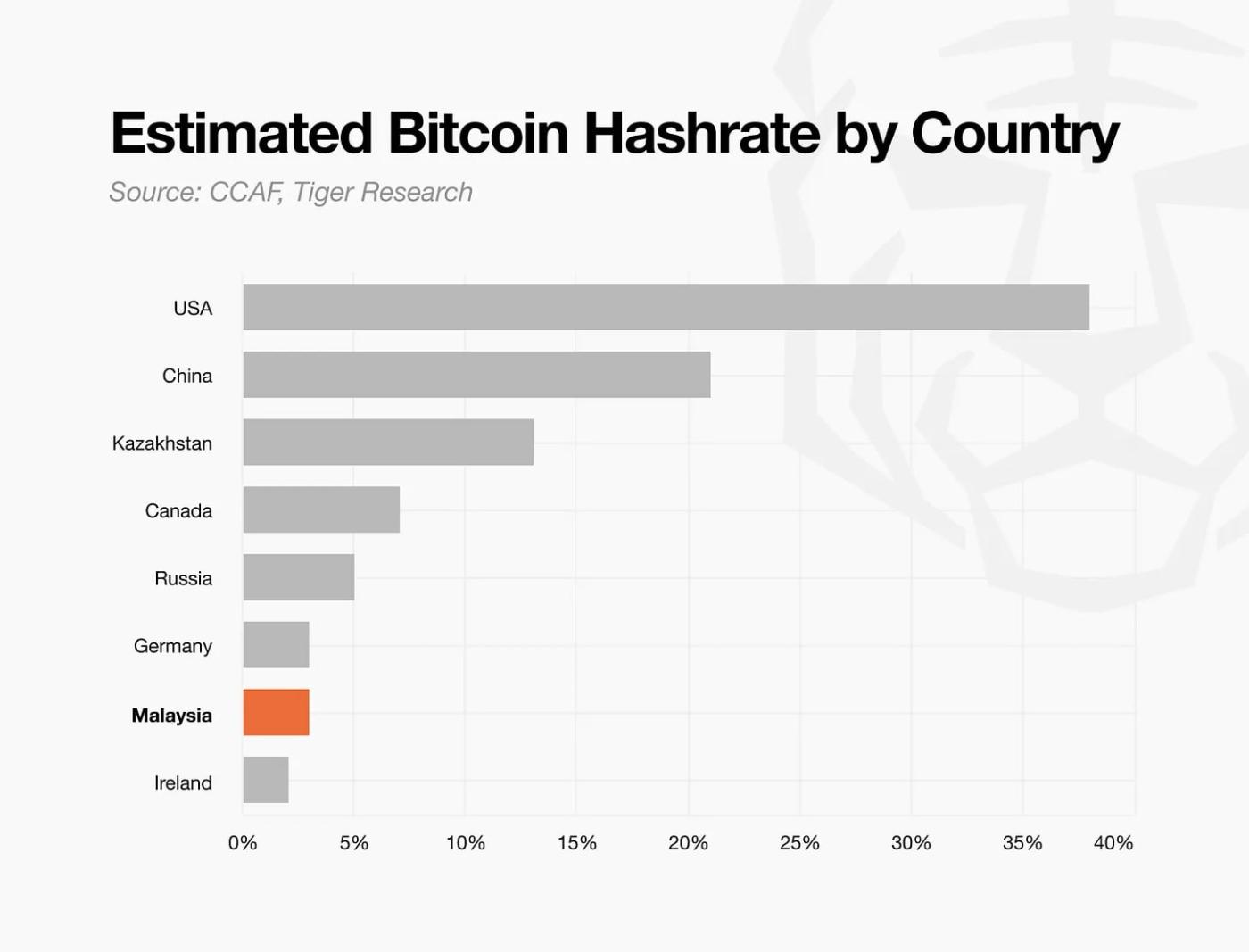

Malaysia's mining industry shows strong growth potential, supported by renewable energy and institutional acceptance. However, the industry also faces social costs and regulatory issues due to illegal mining—a factor that has contributed to Malaysia's emergence as a global hub for bitcoin mining, while also presenting challenges that need to be addressed.

5. Malaysian Crypto Market: Opportunities and Challenges

5.1. Challenge Factors

Malaysia has a multilingual population, speaking multiple languages. This can provide advantages in communication. However, for crypto projects looking to enter the market, this creates complexities. They must tailor their strategies based on different target groups. This creates barriers to entry for new players.

For example, there are stark differences between the ethnic Chinese and non-Chinese communities in Malaysia. They speak different languages, engage in different community channels, and have different investment preferences. Sharia law influences the majority of ethnic Malays, who tend to have a passive attitude towards financial investments. In contrast, the Chinese community actively invests in local and international stock markets. They also use derivative products on global crypto exchanges and on-chain platforms like Hyperliquid. The market is segmented into distinct segments. A single approach will be ineffective in addressing this structure.

Malaysia's Web3 industry also faces a shortage of developer talent. While Malaysia boasts a wealth of talented entrepreneurs, the number of Web3 developers remains relatively small, especially compared to neighboring countries like Vietnam and Indonesia. Many top talent choose to relocate to Singapore or other countries to build companies or further their careers. This creates a structural problem: Malaysia struggles to retain and develop talent within its domestic ecosystem. While Malaysia produces global-standard talent, its local Web3 ecosystem is structurally limited, hampering its activation and growth. This is a major challenge to the development of the local crypto market.

5.2. Opportunity Factors

Despite the challenges, the Malaysian crypto market still holds significant potential. One of its key strengths lies in its global talent network. Prominent projects like Coingecko and Etherscan originated in Malaysia and now have global influence. Malaysian talent also plays a crucial role in various global projects, including Meteora, Drift, and Pendle. They form a close network across the global crypto industry. This network creates a collaborative ecosystem where opportunities can be shared and leveraged.

This talent network has the potential to become the foundation for developing a local ecosystem. Recently, a growing number of talented individuals who built careers abroad have begun returning to Malaysia. Factors such as the low cost of living and stable living conditions are driving this trend. Their return brings new energy to the local ecosystem through connections and contributions to the community. Opportunities to share knowledge and collaborate with the next generation are also increasing.

Several renowned universities, such as Asia Pacific University (APU) , Sunway University , and Taylor's University, are also actively engaged in blockchain-related academic activities. This ensures a continuous flow of next-generation Web3 talent. If this trend is accompanied by government policy support, Malaysia's Web3 ecosystem could grow even faster.

🐯 More from Tiger Research

Telusuri lebih lanjut laporan yang relevan dengan topik ini:[Special Report] Vietnam Crypto Market 2025: Complete Analysis of 21 Million Investors

[Special Report] Tiger Research Asia Insights: 2024 Review & 2025 Outlook

Disclaimer

This report is based on materials believed to be reliable. However, we make no warranty, express or implied, as to the accuracy, completeness, or suitability of the information presented. We are not responsible for any loss or damage arising from the use of this report or its contents. The conclusions and recommendations contained in this report are based on information available at the time of writing and are subject to change without notice. All projects, estimates, projections, objectives, opinions, and views expressed are tentative and subject to change without notice, and may differ or conflict with the views of other parties or organizations.

This document is prepared solely for informational purposes and does not constitute legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and should not be construed as an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or prospective investors.

Terms of Use

Tiger Research permits fair use of reports it has compiled and published. 'Fair use' is a principle that permits the use of portions of content for the public interest, as long as it does not harm the commercial value of the material. If the use complies with this principle, reports may be used without prior permission. However, when citing Tiger Research reports, you are required to:

Clearly cite 'Tiger Research' as the source.

Includes Tiger Research logo (black/white).

If the material is to be re-compiled and republished, separate approval is required. Unauthorized use of the report may result in legal action.