Ethereum (ETH) is experiencing a period of strong growth in liquidity, network revenue, and transaction activity as the cryptocurrency market continues its recovery momentum.

VX:TZ7971

Stablecoin liquidity and network revenue peak

The supply of stablecoins on Ethereum increased from $152 billion in August 2025 to $163.5 billion in September of this year. This set a new all-time high and is considered one of the largest liquidity inflows to the Ethereum network this year, playing a key role in driving activity on DeFi platforms and decentralized exchanges.

Meanwhile, Ethereum generated $99.1 million in network revenue over the past 180 days, reflecting stable demand for block space as users continue to pay transaction fees. Higher liquidity means stronger trading activity, a deeper DeFi market, and more sustainable price support for ETH.

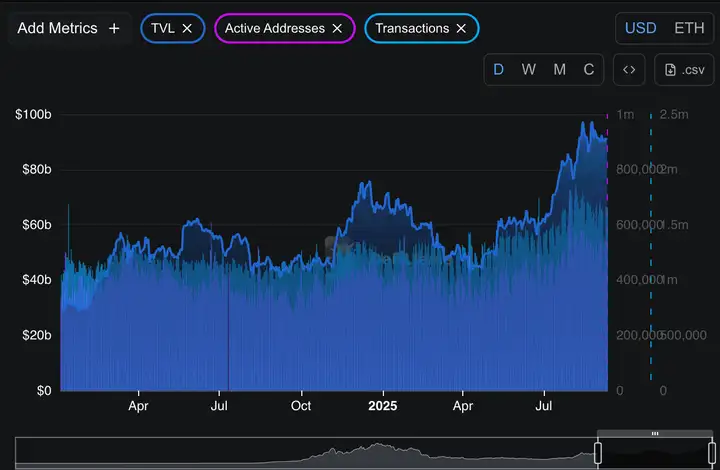

According to DefiLlama, Ethereum remains the largest DeFi platform with $90.9 billion in total value locked (TVL), declining only slightly over the past 24 hours but still hovering near yearly highs overall.

Vibrant network

On-chain data shows that Ethereum remains in high demand, underscoring the network's central role in the cryptocurrency ecosystem. Ethereum's daily active addresses reached 540,717, demonstrating strong engagement among the existing user community.

Furthermore, the Ethereum network’s expansion is evident: 64,794 new addresses were added in 24 hours, reflecting Ethereum’s growing appeal to investors and institutions, who are increasingly choosing the network for transactions, asset storage, and decentralized finance applications.

Trading activity was also very busy, with 1.66 million transactions processed daily, demonstrating diverse usage demand across many different areas, from lending and staking to derivatives and DeFi products.

Notably, Ethereum recently generated $1.4 million in transaction fees in a single day, the highest in the entire blockchain ecosystem. Such high transaction fees not only reflect strong demand but also demonstrate that Ethereum remains a sustainable platform despite facing stiff competition from other networks.

Market outlook and key points

Ethereum is currently trading around $4,411 after nearly two weeks of trading in a tight range. This tug-of-war suggests the market is waiting for clear signals to determine its next move.

The $4,500 mark is considered the most important resistance level in the short term. If ETH manages to break through this level, the bullish momentum is expected to consolidate, with the next target at $4,883, thus opening up new prospects for a growth cycle.

Conversely, if ETH fails to withstand the pressure from sellers, it may be forced to retest important support levels. In the short term, the $4,100 to $4,200 price range is seen as a first layer of cushion. In a more pessimistic scenario, the $4,060 and $3,880 areas will act as deep support levels to maintain the long-term growth structure.

Ethereum will either reclaim $4,500 or face a deeper sell-off. Until the market establishes a clear direction, there should be no rush.

This means that ETH is currently at a sensitive point: just one decisive breakout or drop could lead to a strong shift in investor sentiment.

Long-term perspective: cumulative signal returns

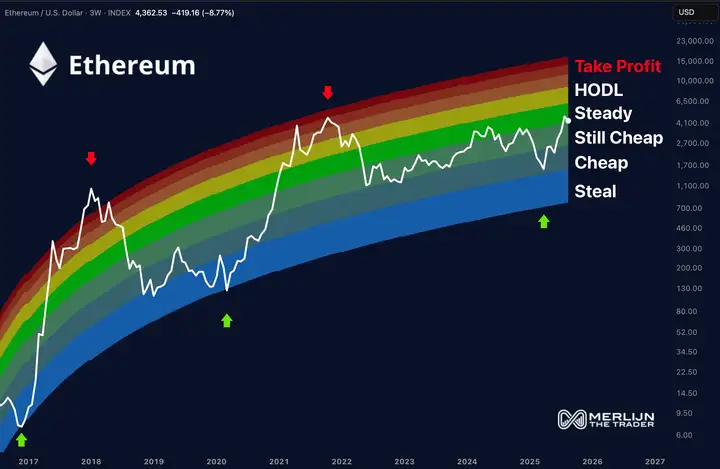

Looking at the monthly time frame, the MACD indicator has just crossed bullish, a sign of a long-term growth cycle following a prolonged accumulation period.

The accumulation chart shows ETH in the “stable” zone around $4,362, just above the “still cheap” zone, which is typically associated with the accumulation phase for long-term and institutional investors.

The higher areas labeled "HODL" and "Take Profits" have previously coincided with periods of popular growth and allocation by retail investors.

Ethereum is at a critical threshold: record liquidity, high transaction fees, robust total value locked (TVL), and positive technical signals all point to a healthy network. However, ETH's next move will depend on whether it can break through $4,500.

If this resistance is broken, Ethereum may enter a new growth phase with a target target of $4,883.