Following the successful launch of the Bitcoin spot ETF , global asset management giant BlackRock has once again turned its attention to blockchain.

According to Bloomberg, BlackRock is exploring the possibility of moving funds linked to real-world assets (RWAs), including traditional ETFs, onto blockchain. This news quickly sparked heated market discussion and brought "asset tokenization" back into the spotlight.

This isn't an isolated incident. Fidelity 's tokenized money market fund (FDIT, also known as FYOXX) launched on Ethereum this week. Previously launched in stealth mode, it is held by institutions like Ondo and has already reached hundreds of millions of dollars in on-chain assets. Nasdaq has also applied to the SEC for permission to trade tokenized securities alongside traditional stocks on its exchange. Clearly, Wall Street is experimenting with blockchain.

BlackRock's Crypto Landscape: From ETFs to On-Chain Funds

As the world's largest asset management company, BlackRock has established a complete layout in the crypto field:

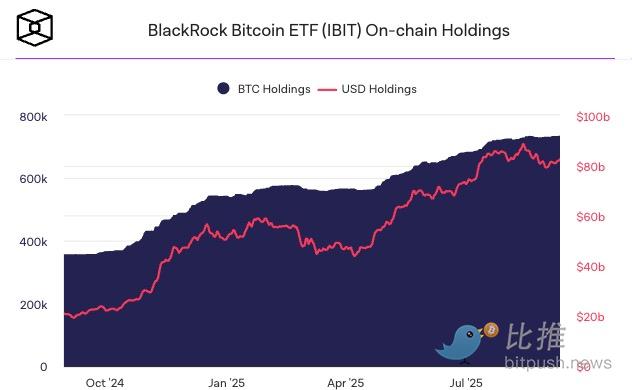

Two flagship products, iShares Bitcoin Trust and iShares Ethereum Trust, have seen cumulative inflows of $55 billion and $12.7 billion, respectively, each exceeding $10 billion in assets under management within a year. This pace of growth is exceptionally rare in the history of global ETF development.

Thematic Fund: iShares Blockchain and Tech ETF tracks a basket of blockchain and crypto-related technology company stocks, providing indirect industry exposure.

On-chain attempts: The BUIDL fund (BlackRock USD Institutional Digital Liquidity Fund), launched in 2023, became the first tokenized fund to exceed US$1 billion in size, and its assets exceeded US$2 billion in 2025. It is currently running on the Ethereum chain.

Its CEO Larry Fink has repeatedly stated: "All financial assets will eventually be tokenized." In his vision, blockchain will become the underlying operating system of the future financial market.

However, BlackRock's tokenization efforts are still in the exploratory phase. Whether scaling BUIDL or moving traditional ETFs onto the blockchain, both require regulatory approval. Currently, the U.S. Securities and Exchange Commission (SEC) has yet to provide a clear framework, and market participants remain divided on the significance and prospects of tokenization.

Skeptics: Traditional ETFs are enough

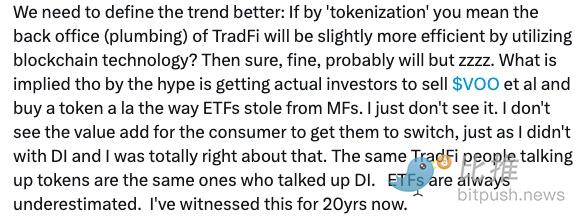

Some argue that tokenization doesn't bring additional value to end investors. Bloomberg ETF analyst Eric Balchunas points out that ETFs are already low-cost, highly liquid, and low-barrier-to-entry products, leaving little reason for them to be replaced.

Furthermore, the tokenized stock market is currently quite niche. According to RWA.xyz data, the total market value of on-chain tokenized US stocks (such as TSLA and AAPL) is less than $500 million, far less than the trillion-dollar ETF market. Even with Robinhood and Kraken launching tokenized stock trading, such products remain limited to crypto natives.

This view holds that tokenization may improve back-end efficiency, but it will have little impact on the investor experience, and is unlikely to disrupt the market again like ETFs replaced mutual funds.

Institutionalists: "Transitional Plan"

ETF research expert Dave Nadig emphasized that current ETFs and tokenized stocks are more like "wrapping layers" and a "transitional solution" based on the existing system.

In simple terms:

It's not truly revolutionary: Current practices (such as converting stocks into tokens) don't actually change the traditional financial system. They simply add a layer to the existing system, wrapping stocks in a new package—the token, which is the core of this package—while the stocks themselves still operate under the rules of traditional finance.

True tokenization requires legal reform: According to Dave Nadig , this means that assets are fundamentally created, traded, and settled on the blockchain, rather than relying on traditional brokerages and clearing houses. However, this true transformation will never be achieved without the rewriting of laws and the full coordination of regulators.

In short, the current buzz about "tokenized stocks" is merely a superficial improvement on the old system. A true financial revolution requires a thorough overhaul of the legal and regulatory landscape. Current securities laws and clearing regulations do not allow for a complete on-chain replacement; the SEC has yet to define a compliance framework for tokenized securities; and traditional finance, with its reliance on clearinghouses and custodians, is difficult to rapidly replace.

This means that unless there is a massive legal rewrite, tokenization will remain superficial and unable to achieve financial reconstruction.

Practical: Expanding the boundaries of ETFs

Practical voices focus on "incremental users" and "new ways of playing." Ondo Finance CEO Iandebode emphasized that the value of tokenization lies not in replacing ETFs, but in expanding its use cases and user base.

Accessibility: Hundreds of millions of people worldwide are still unable to directly invest in index funds like VOO due to geographical location, capital account controls, or investment barriers. Tokenization allows them to access these assets on-chain.

Usability: Tokenized ETFs are not just “buy and hold”, but can also be directly used as on-chain assets to participate in DeFi: mortgage lending, joining liquidity pools, configuring automated strategies, etc.

This type of design is similar to the on-chain money market fund launched by Fidelity or the tokenized stocks provided by Kraken: they do not subvert the original products, but give assets more liquidity and composability. Therefore, tokenization will become the "second growth curve" of ETFs, not a replacement, but an extension.

Amidst these divergences, BlackRock's strategy is particularly crucial. It represents the world's largest asset management company's foray into the field, and could also serve as a model for the integration of Wall Street and the crypto world.

In the short term, tokenization struggles to compete with the trillion-dollar ETF market. However, in the long term, as more institutions enter the market and the regulatory framework becomes clearer, this experiment may truly move from the periphery to the core, even changing the underlying logic of financial markets. Is BlackRock's move simply "old wine in new bottles" or the beginning of a "great financial migration"? The answer will likely become clearer.

Twitter: https://twitter.com/BitpushNewsCN

BitPush TG discussion group: https://t.me/BitPushCommunity

Bitpush TG subscription: https://t.me/bitpush