Circle issued over $677 million worth of new USDC Token today, leading to a lot of speculation in the community. The company has issued a large amount of its stablecoin, which could be a positive sign.

These Token will ensure greater liquidation in the event of a spike in user activity. However, there is currently no definitive answer as to Circle’s motives.

Circle Issues New USDC

Tether ’s latest stablecoin announcement has attracted a lot of attention in the crypto world, but it’s not the only giant in the space. Circle , the world’s second-largest stablecoin issuer, made headlines when it issued over $677 million worth of USDC Token in a three-hour period:

Naturally, this large USDC issuance has sparked a lot of speculation . Typically, large Token Issuance are a sign of future growth. They often indicate that the issuer istrying to build large liquidation , as when World Liberty Financial issued $200 million1 before the stablecoin was listed on Coinbase.

Is this a bullish signal?

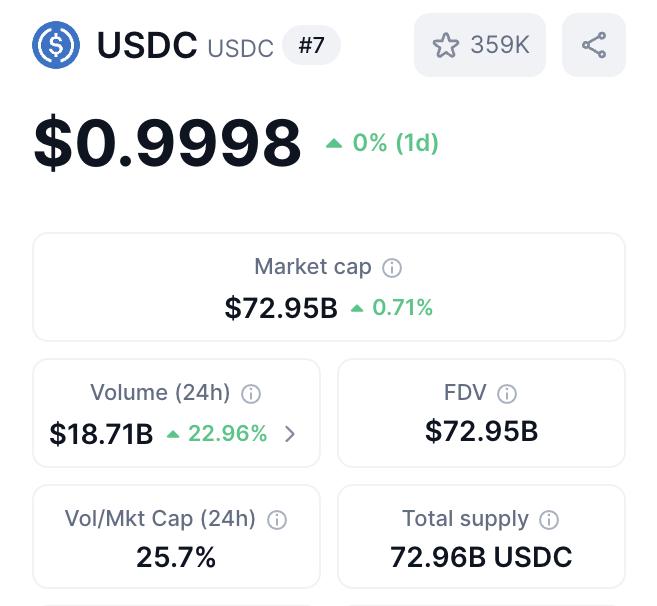

If Circle needs to boost liquidation, that could explain the massive USDC issuance. The stablecoin's 24-hour volume has increased by 20% since yesterday, and the $677 million in new Token could help keep it circulating in its ecosystem.

USDC Volume . Source: CoinMarketCap

USDC Volume . Source: CoinMarketCapThat may not be the whole story, however. Circle ’s stock has been trending down for about a month, after all, and the company reported poor results for the second quarter.

The stablecoin issuer may have plans that involve massive liquidation boosts, but this massive issuance does not appear to be a natural consequence of high volume .

In fact, it could even cause problems, as the company will soon need to comply with new US regulations by buying more Treasury bonds.

Massive release model

Trading bots have noted that Circle has been Token Issuance daily, totaling more than $1 billion in new USDC over the past week. The company also regularly burns Token, but much less than the new issuance.

These Token Issuance are irregular in size, with numbers like 100 or 250 million appearing alongside seemingly random numbers.

These patterns belie the idea that this is just business as usual. Many community observers seem to believe that Circle is preparing some plan to use this additional liquidation .

Ultimately, however, there is no clear answer. Regardless, it is worth keeping an eye on Circle in case these USDC issuances signal a strong new opportunity.