Top 5 things Vietnamese crypto investors need to note about Resolution No. 05

Top 5 things Vietnamese crypto investors need to note about Resolution No. 05

"Citizens are allowed to do everything that is not prohibited by law." - 2013 Constitution

In recent days, Resolution No. 05/2025/NQ-CP on piloting the crypto asset market in Vietnam (hereinafter referred to as Resolution 05 ) of the Government has been the hottest topic of discussion in the Vietnamese crypto community. In the article about the evolution of crypto in Vietnam, we have seen a clear transformation just by naming “crypto” from an alternative currency (virtual currency) to an asset (digital asset/crypto asset).

This article will summarize the most notable points about Resolution No. 05, from the perspective of individual investors in the field of crypto assets.

*Please note that all information is the author's subjective opinion and should not be XEM legal advice.

1. Rights, not Obligations

The first key point is that investors have the Right , not the Obligation , to open an account to trade digital assets on a licensed exchange.

Stipulated in Article 7, Clause 1 of Resolution 05, “Domestic investors holding crypto assets and foreign investors are allowed to open accounts at crypto asset service providers licensed by the Ministry of Finance to deposit, buy and sell crypto assets in Vietnam.”

Article 7, Clause 1 of Resolution 05

2. "In Vietnam"

Articles 1 and 2 of Resolution 05 clearly stipulate the scope and subjects of the Resolution.

Article 1 and Article 2 of Resolution 05

In short, there is only one subject that will be outside the scope of Resolution 05, which is individuals abroad because the scope of regulation of the Resolution is " in Vietnam ".

For example: Ms. An is a Vietnamese living in Korea. So Ms. An is not subject to Resolution 05, but is required to comply with the laws of the host country when wanting to buy Bitcoin with fiat money.

However, Resolution 05 has not clearly explained what the phrase " in Vietnam " includes. This unintentionally creates an ambiguous situation for individuals who are in need of using services from foreign Providers, whether "in Vietnam" implies (a) physical presence in Vietnam or (b) using IP from Vietnam, or both.

3. CEX exchange in frame

The most obvious thing in Resolution 05 is the inclusion of centralized exchanges (CEX) under a strict management framework. In particular, the conditions and licensing regulations for CEXs are officially announced by the Government. We will discuss this in depth in the following article for businesses.

For individual investors, crypto asset trading in Vietnam must now go through a licensed exchange. This is different from point 1 above, which can be roughly understood as Vietnamese citizens are not required to open an account, but if trading digital assets, it is required to go through a licensed exchange.

According to Article 7, Clause 2, investors need to grasp 2 important milestones :

The time the first floor in Vietnam was licensed; and

6 months after the above date.

Article 7, Clause 2 of Resolution 05

The most important is the second milestone, which is the time when investors are required to trade crypto assets in Vietnam through a licensed exchange, otherwise it will be illegal.

4. Holding assets

The custody of crypto assets in Resolution 05 only stops at being defined in Article 3, Clause 6, and Chapter 3 on the Organization of digital asset exchanges. Thus, the self-custody of crypto assets by individual investors is not within the scope of this document.

Article 3, Clause 6 of Resolution 05

Referring to the 2013 Constitution and the 2015 Civil Code , the people's property rights are protected by the State, including: the right to possession, the right to use and the right to dispose. In other words, individual investors have the right to store assets where they want. This will partly explain point 1. when Resolution 05 does not require people to open accounts and store crypto assets on licensed Vietnamese exchanges.

Provisions on property ownership in Chapter XIII of the 2015 Civil Code

However, we will still need to wait for guidance and additional documents from relevant agencies. It is not impossible that Vietnam can continue to let DeFi operate in the gray area like developed markets, while still strictly managing CEX to remove our country from FATF's Gray List.

5. Income tax

a/ Tax calculation

Resolution 05 stipulates that the tax applied to crypto assets will be the same as securities, which is 0.1% of the transfer price (when sold) according to Article 16, Circular 92/2015/TT- BTC .

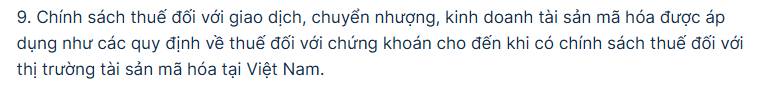

Article 4, Clause 9 of Resolution 05

Article 16, Circular 92/2015/TT- BTC on securities transfer tax

For example: Mr. Thinh buys 100 million VND of Bitcoin, he will not incur tax liability. When Mr. Thinh sells that BTC for 100 million VND on a licensed exchange, he will have to pay tax of 0.1% of the selling value, which is 100,000 VND.

b/ Implementation

Article 17, Clause 1d of Resolution 05 also states that the Ministry of Finance is responsible for guiding the implementation of tax policies. Therefore, the tax regulations on crypto assets will only apply from the time the Ministry of Finance provides the guidance document, instead of from September 9, the time the Resolution was issued. In particular, the scope of tax collection will only be calculated from the time the guidance document is issued onwards, and there will be no retrospective collection.

This also applies to the provisions on sanctioning investors if there is a violation according to the provisions of the Resolution.

Article 17 of Resolution 05

Peripheral

In addition, the Resolution does not currently mention other sources of income other than those from crypto-asset transactions, such as from Airdrop activities, DeFi, farming, Staking, etc. Therefore, investors need to patiently wait for further guidance from the authorities to know the specific legal framework.

Above are the 5 most interesting points about Resolution No. 05 for investors and individual transactions related to digital assets. Readers can XEM the full text of the Resolution here . If you have any comments or questions that need to be answered, please comment below for discussion.

Andy