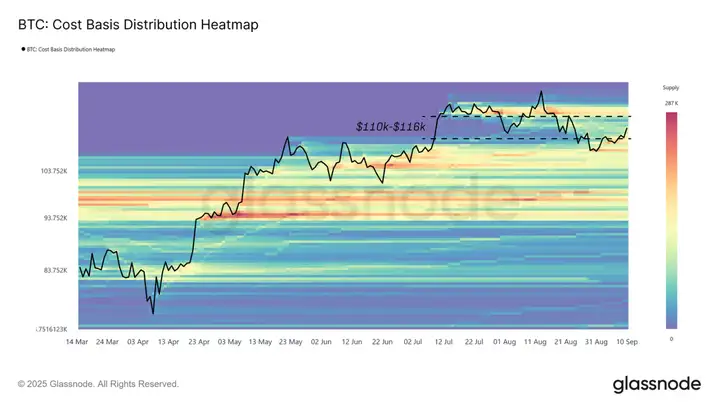

After hitting an all-time high in mid-August, market momentum has continued to weaken, pulling Bitcoin below the cost basis of recent high buyers and back into the "gap" range of $110,000 to $116,000. Prices have been fluctuating within this range since then, gradually filling the gap as supply is redistributed.

VX:TZ7971

As shown in the cost basis distribution, the rebound from $108,000 was supported by significant buying pressure on the chain, a "buy the dip" structure that helped stabilize the market.

Provisioning Cluster

According to the heatmap, there are currently three different investor groups influencing price movements:

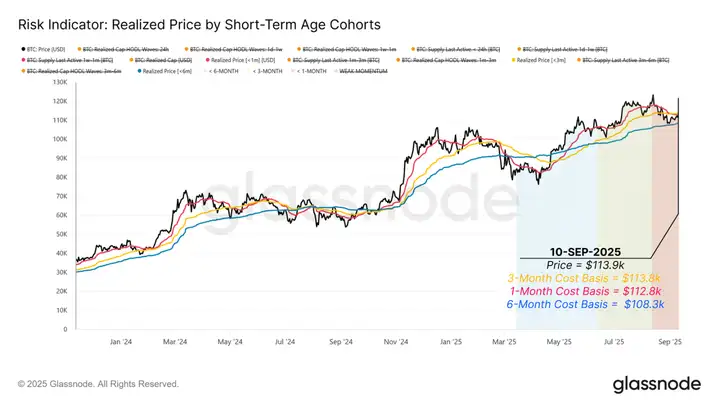

Those who bought at the high end of the market over the past three months have a cost basis of nearly $113,800.

Dip-buying in the past month has gathered around $112,800.

For short-term holders over the past six months, the cost basis is anchored around $108,300.

These price levels define the current trading range. Reclaiming $113,800 would restore profits to buyers at the highs and propel the bullish trend to continuation. However, a break below $108,300 could plunge short-term holders back into losses, potentially triggering renewed selling pressure and opening the way for a drop to the lower boundary of the next major supply cluster at $93,000.

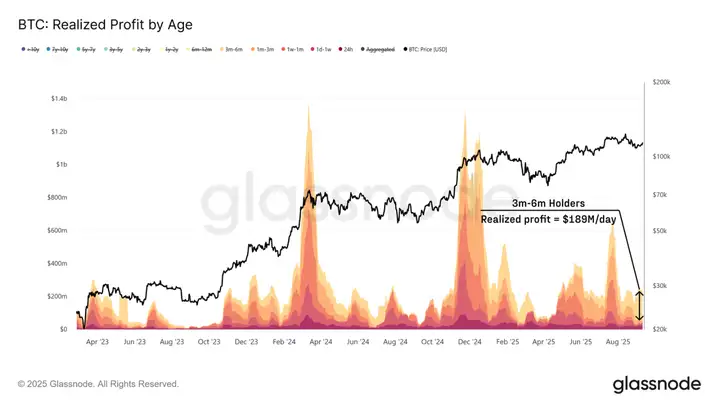

Experienced short-term holders took profits

Having identified the immediate supply clusters shaping the range around the current price, let’s now look at the behavior of different groups of holders during the rally from $108,000 to $114,000.

While bargain hunters provided support, selling pressure primarily came from experienced short-term holders. Holders with a 3-6 month trading period realized approximately $189 million in profits daily, representing approximately 79% of all short-term holder profits. This suggests that investors who bought early during the February-May decline are taking profits on the recent rebound, creating significant resistance.

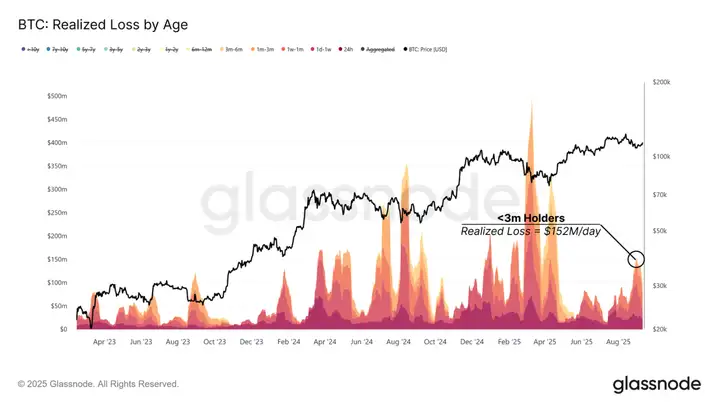

Buyers at high prices realize losses

Besides profit-taking by seasoned short-term investors, recent buyers at the top also weighed on the market by realizing losses during the same rally.

The group of holders as of 3 months ago is realizing losses of up to $152 million per day. This behavior mimics earlier periods of stress in April 2024 and January 2025, when buyers at the top capitulated in a similar fashion.

For a mid-term rally to resume, demand must be strong enough to absorb these losses. This would be confirmed if prices stabilize above $114,000, restoring confidence and encouraging new inflows.

Liquidity absorbs seller pressure

With both profit-taking and loss realization weighing on the market, the next step is to assess whether the new liquidity is strong enough to absorb these sellers.

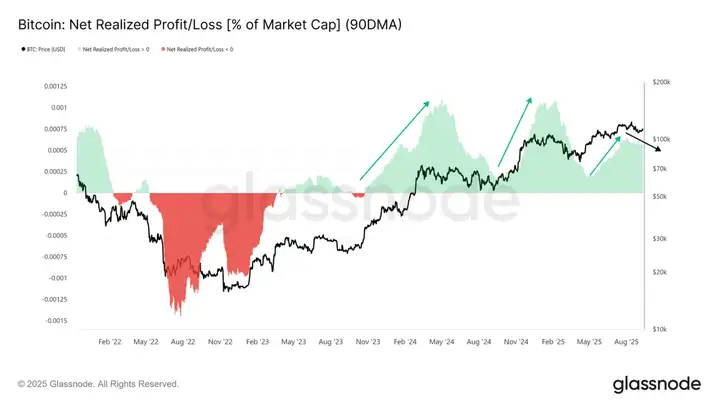

Net realized profits, expressed as a percentage of market capitalization, provide this measure. The 90-day simple moving average peaked at 0.065% during the August rally and has been trending downward since then. While weaker than at the peak, current levels remain elevated, suggesting continued support from inflows.

As long as prices remain above $108,000, the liquidity backdrop remains constructive. However, a deeper decline could exhaust these inflows and hinder further rallies.

On-chain liquidity remains constructive but trending downward, while ETF flows, once the cornerstone of this bull cycle, have lost strength. Consequently, derivatives markets have become more important, with futures and options activity helping to absorb selling and influence price direction. Both futures basis and options positions reflect a more balanced structure than in past overheated phases, suggesting the market is advancing on a firmer foundation.

Looking ahead, the ability to recapture and hold $114,000 will be crucial to restoring confidence and attracting new inflows.

Today's panic index is 52, turning neutral.

Technical demand from cryptocurrency reserves will continue to provide strong support for the crypto market. The market is expected to remain supported by strong liquidity, a favorable macroeconomic environment, and encouraging regulatory developments. The Federal Reserve is expected to implement two interest rate cuts on September 17 and October 29, as the US labor market has shown sufficient signs of weakness. This will not lead to a localized peak, but will instead mobilize idle funds in the OTC market. Lower interest rates could prompt a significant portion of the $7.4 trillion in funds in money market funds to enter the market after a wait-and-see approach. A significant shift in the current inflation trajectory would pose a risk to this outlook. Hold on to your current spot positions and don't get out of the market hastily.