This article is machine translated

Show original

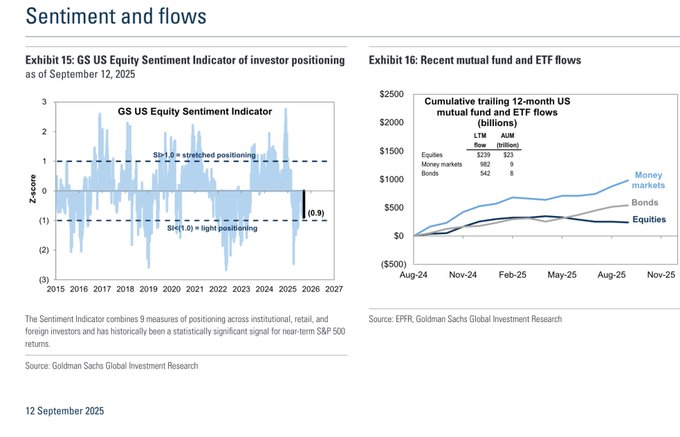

Hedge funds are frantically increasing their holdings in tech stocks, reaching a seven-month high, while simultaneously selling cyclical stocks for six consecutive weeks. While the broader market is trending upward, most of the money isn't pouring into the stock market. Instead, it's flowing into very conservative fixed income investments. It seems like this is a classic "bull market for the few"—

So, while the market has been rising in recent weeks, participation has been limited, and there's likely a sense of miss the pump. Perhaps many are waiting for a clearer signal, such as the Federal Reserve confirming a rate cut next week and outlining a clear path forward, or economic data showing stronger signs of recovery. Until then, they're choosing to remain cautious and wait and see.

Once the market's optimism becomes more widely accepted, will there be a short squeeze on the trillions of dollars of "ammunition" that remain on the sidelines?

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content