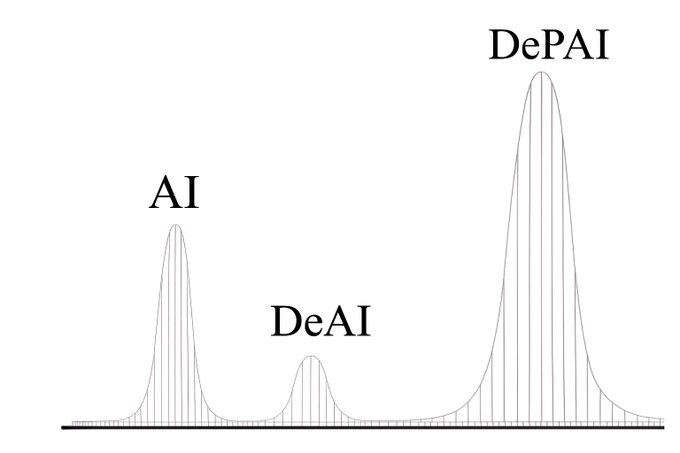

To be clear I still think we are early to the Robotics trade. If you’ve seen how badly some of them move, it’s borderline laughable. However, as AI improves so will their co-ordination and functionality. Once we have robots doing chores in homes at competitive price points there will be a surge in retail interest. We aren’t far off; you can pick up a “half decent” humanoid robot for $10k. Still too expensive for your everyday household, but not eye watering. What does this mean for Decentralized Physical AI (“DePAI”)? Well, since when has price tracked fundamentals? There will be an abundance of speculative vapourware that degens will have a gamble on, driving an even bigger AI cycle to what we saw in Q1. Amongst this you’ll want to keep an eye on the projects with real revenues and product market fit outside of crypto. We’ve already seen how well Hype, ENA, PUMP have done with sustainable business models (god forbid). Others that are less talked about include Aethir ($160m ARR), Peaq, USDai and possibly some of the TAO subnets/affiliated companies if they find their stride. If you think DePAI won’t have the same PMF as traditional robotics, there are crypto vehicles that get access to these private rounds (Apptronik, figure etc) through their token. Let’s just hope we don’t run the “NAV is a meme” playbook back. Timelines are always hard to judge, but I suspect we will see an AI/DeAI/DePAI Supercycle at some point in the next 12 months, possibly sooner if macro turns giga bullish.

s4mmy

@S4mmyEth

09-14

Robotics & Physical AI will inevitably go parabolic at some point.

The total Market Cap is trading at 1% of DeAI, with several protocols hitting 80% ROI this week alone.

Would an in depth ecosystem analysis be useful?

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content