Polkadot suddenly "adjusts" tokenomics, bringing the supply to 2.1 billion Token. Photo: Easy Crypto

Polkadot suddenly "adjusts" tokenomics, bringing the supply to 2.1 billion Token. Photo: Easy Crypto

Polkadot DAO via Referendum 1710

- Polkadot DAO , the community governance system behind the Polkadot ecosystem, officially passed Referendum 1710 with 81% consensus , marking an important milestone in changing the DOT issuance mechanism.

🚨 DOT supply → capped at 2.1 Billion 🚨

— Polkadot (@ Polkadot) September 14, 2025

The Polkadot DAO has signaled support for a Hard Cap, by passing Referendum 1710 on the “Wish For Change” track, with 81% in favor.

Today ⤵️

→ 1.6 Billion DOT exist

→ 120M DOT/year minted each year

→ No supply cap

What Ref. 1710… pic.twitter.com/OJMtDumAZC

- This proposal replaces the previous unlimited issuance model, which created approximately 120 million DOT per year, with a mechanism to cap the Max Supply supply at 2.1 billion DOT . This is considered a strategic move to tighten tokenomics, reduce inflation, and increase scarcity for DOT.

- Under the new model, DOT will apply a two-year inflation schedule, then move towards equilibrium with a fixed supply.

If 120 million DOT/year continue to be issued, by 2040, the total supply will reach about 3.4 billion DOT.

On the same reference frame, if applying the new model, the supply is only about 1.91 billion DOT, nearly half lower than the old scenario.

- Notably, with this supply limit, DOT is called by some analysts to have “joined the scarcity club” along with Bitcoin, with a supply ceiling of 21 million BTC , increasing predictability and appeal in the eyes of long-term investors.

- This important decision is made through the OpenGov mechanism - a governance framework launched from 2023, allowing every DOT holder the right to make their own proposals, participate in voting, or delegate their voting rights.

Impact of the proposal

- One point that the community is paying attention to is that reducing DOT issuance will curb selling pressure from Staking rewards , as the amount of new Token released to the market each year is less.

- However, some are concerned that reducing inflation too quickly could affect the financial strength to ensure sufficient incentives for validators to participate in maintaining network security. If Staking rewards are reduced too soon, validator incentives may decline.

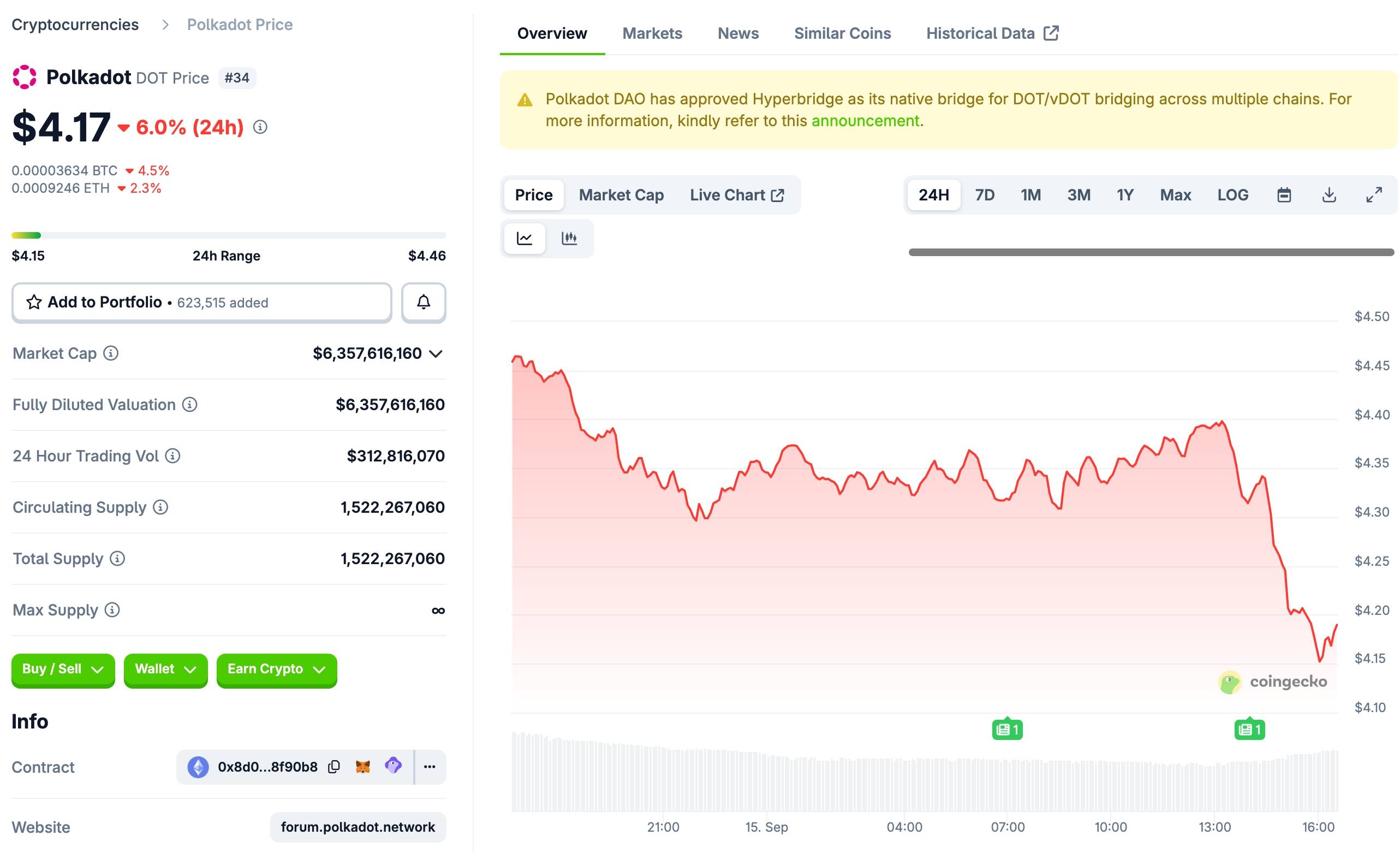

- Despite the positive long-term news, DOT price is still moving quite negatively:

Over the past 24 hours, DOT has dropped 6% and is trading around the $4.2 mark.

In the last 7 days, DOT recorded an increase of nearly 4%.

Market Capital is currently approximately $6.4 billion.

DOT price movement in the last 24 hours, screenshot from CoinGecko at 04:20 PM on 09/15/2025

DOT price movement in the last 24 hours, screenshot from CoinGecko at 04:20 PM on 09/15/2025

- In the long term, the 2.1 billion DOT supply limit is expected to combine with the Polkadot 2.0 roadmap and technical upgrades such as elastic scaling, Parachain ... to improve competitive position.

- In addition, analysts are also closely monitoring legal moves, such as the US SEC delaying the approval of the Grayscale Polkadot Trust ETF until November 2025. If approved, the ETF could become a strong channel for attracting institutional Capital for DOT.

- Although the move to limit the supply of DOT is expected to create long-term value, Polkadot still faces many doubts from the community. In the first half of 2024 report, the project spent up to 37 million USD on marketing activities (total cost 86.5 million USD), but social media coverage has barely improved . If this spending rate continues, the Polkadot treasury (currently ~200 million USD) may only last about 2 more years.

Coin68 synthesis