Last week's market ended with PPI and CPI data in line with investors' expectations of a positive rate cut. The S&P 500 index closed at a new high in the US stock market, while the cryptocurrency market saw BTC return to $116,000 and ETH break through $4,700 to restart its upward trend. Everyone expects the US Federal Reserve to cut interest rates by at least one basis point next Wednesday, restarting the rate cut cycle. This will actively infuse funds into the market and push up the prices of risky assets. Cryptocurrencies have also benefited from this sentiment, with both BTC and ETH spot ETFs recording positive inflows.

VX:TZ7971

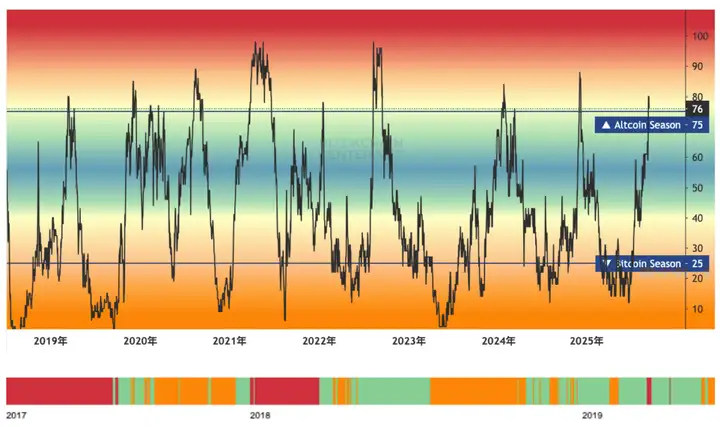

The Altcoin Season Index, which measures the trend of Altcoin, also reached 84 at the weekend, indicating that the prices of most Altcoin have seen a significant increase. According to past records, when this index breaks through 75, the altcoin season generally begins an upward trend that lasts for 2-3 months. If this trend continues, the altcoin season will most likely continue until the end of the year, which coincides with the time when the market expects interest rate cuts to trigger a market rally.

The core feature of the current market is that liquidity shows a trend of "selective concentration".

The biggest difference between this cycle and previous ones is that the 2021 market cycle was driven by liquidity - at that time, credit costs were low, liquidity was abundant, and risky assets benefited from the loose environment.

The market in 2025 is completely different: interest rates are currently high and liquidity is tight, but risky assets (Bitcoin, stocks, and even gold) are still gradually rising.

Why does this contradiction arise? The core driving force is the devaluation of fiat currencies - investors are hedging the risk of cash devaluation by allocating assets.

This trend has completely changed the market's rhythm: the previous risk-on market, characterized by widespread gains, is being replaced by a structural market characterized by a concentration of funds in high-quality, resilient assets. Market logic has shifted from a blind pursuit of all assets to one characterized by precise timing, patience, and discipline.

This shift in market logic has significantly increased the difficulty of investing—you can no longer rely on an environment of "flooding capital and opportunities everywhere." However, for investors who can adapt to the new logic, it also means clearer structural opportunities.

The Federal Reserve will hold its interest rate meeting on September 16 and 17 and is expected to cut interest rates for the first time since December last year;

At 2:00 am on September 18th, Beijing time, the Federal Reserve FOMC announced its interest rate decision and a summary of economic expectations; at 2:30 am, Federal Reserve Chairman Powell held a monetary policy press conference; for us retail investors,

"Sustained stability" is better than "short-term speculation";

Patience trumps FOMO (fear of missing out).

"Precise timing" is better than "pursuing Alpha (excess returns)".