REX–Osprey’s XRP ETF, which is being launched under a unique mechanism compared to other XRP ETF proposals, is expected to officially launch this week.

REX–Osprey Prepares to Launch First XRP ETF in the US

On September 16, REX Shares and Osprey Funds filed a prospectus with the US Securities and Exchange Commission ( SEC ) for the REX-Osprey XRP ETF (Ticker: XRPR). According to the company's announcement, the product could be listed as early as next week, becoming the first ETF to give investors direct exposure to XRP price fluctuations on the US stock market.

The REX-Osprey™ XRP ETF, $XRPR , is coming this week! $XRPR will be the first US ETF to deliver investors spot exposure to the third largest cryptocurrency by market cap, $ XRP .

— REX Shares (@REXShares) September 15, 2025

From REX-Osprey™, the team behind $SSK . @OspreyFunds

View Fund Prospectus:… pic.twitter.com/qMdKhfBZ0e

Why is this news important?

- This is proof that besides Ethereum and Bitcoin, other Token are also being noticed by organizations and are increasing their access.

- XRPR could generate large Capital flows from Wall Street as it is the first ETF to track XRP price movements, increasing liquidation and potentially boosting the value of the Token ,

What is XRPR and how does it work?

- REX–Osprey's XRP ETF (XRPR) is structured in a legal structure that complies with the Investment Company Act of 1940, designed to protect investors from fraud and conflicts of interest.

- REX–Osprey’s choice of the 1940 framework over the more common approach gives the fund more legitimacy and approval, according to Bloomberg Intelligence ETF analyst James Seyffart. It allows the ETF to operate like a traditional mutual fund, rather than relying entirely on the years-long spot Capital approval process.

- ETFs under the Investment Company Act do not hold XRP directly in the main fund, but will use an intermediary subsidiary to own the assets. This approach helps meet legal requirements, but can lead to price deviations, incur additional operating costs, and require more stringent risk management.

- According to the filing, the XRPR ETF will hold XRP directly but will also allocate at least 40% of its assets to shares of other XRP related ETFs. Additionally, the fund will access XRP through its Cayman-based subsidiary, REX-Osprey XRP (Cayman) Portfolio SP, and may use Derivative to supplement its exposure.

- This approach was also applied to REX-Osprey's previous Dogecoin ETF, with a similar structure to manage legal and operational risks.

- This is not the first time Rex–Osprey has used the 1940 Act legal framework. Previously, in July 2025, the fund successfully launched the Solana Staking ETF , becoming the first product on the market to operate under this model.

- In addition to XRP and Doge, Rex–Osprey also has ETF filings for memecoins TRUMP and BONK. However, the listing dates for these products have not been announced yet.

Crypto ETF Approval Status in the US

- The crypto ETF wave is booming this year. As of now, there are more than 90 ETF filings related to digital assets pending approval at the SEC, including Solana, Litecoin and many other altcoins.

- In July, the SEC officially approved the in-kind creations and redemptions mechanism for crypto ETFs, and allowed the filing of listing and Spot Trading of Bitcoin and Ethereum ETFs as well as options for some Bitcoin spot ETPs.

- However, since August 2025, the strong rise of crypto Treasury has somewhat overshadowed the ETF fever. In addition, the SEC continues to delay making decisions on a series of new crypto ETF applications, causing the product launch process to almost stagnate, while the number of applications submitted to the regulatory agency is piling up.

Evidence

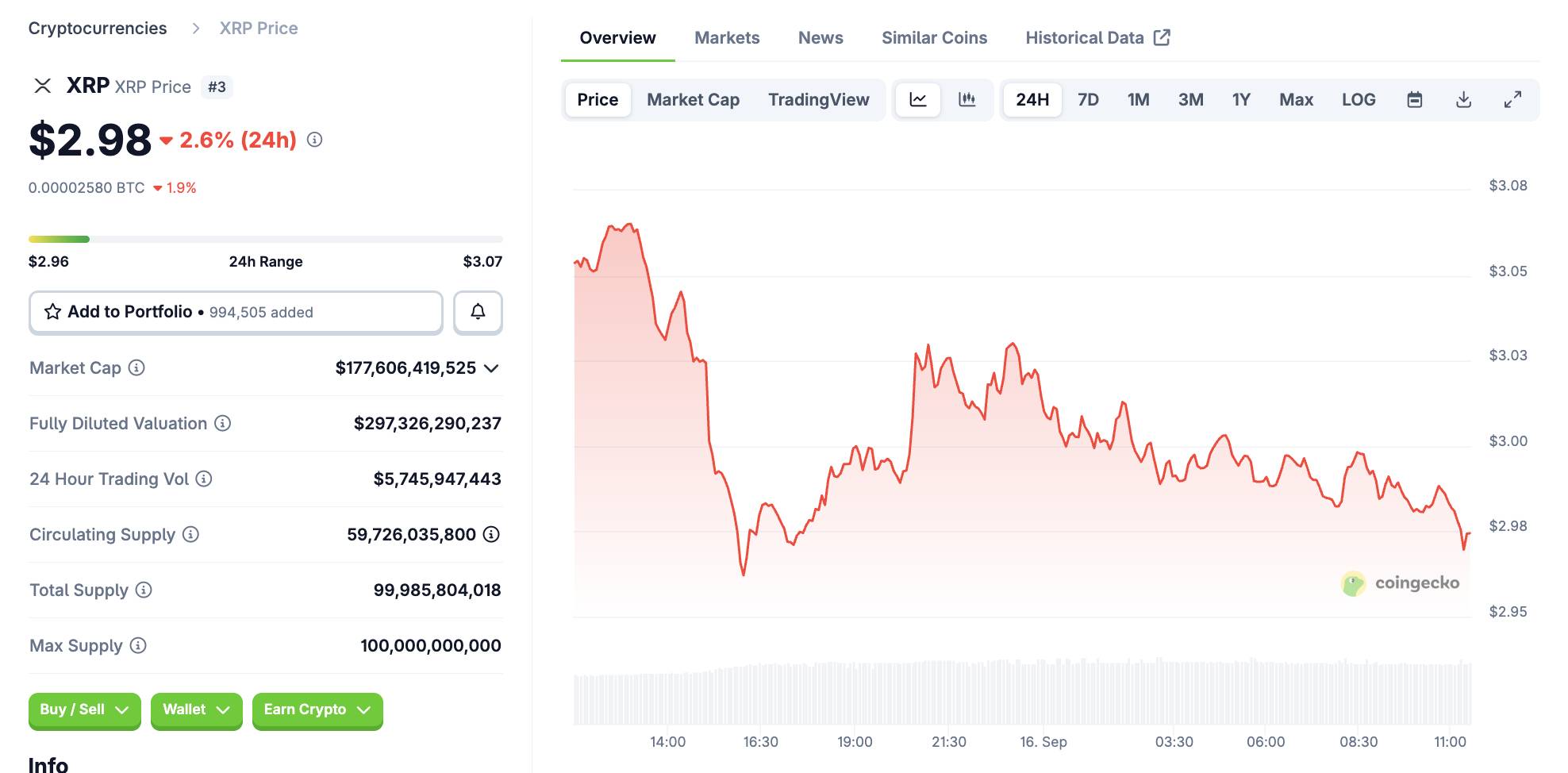

- XRP price in the past 24 hours has not had too many significant fluctuations, down slightly by 2.6% and is currently fluctuating around $2.98.

XRP price movement in the last 24 hours, screenshot on CoinGecko at 11:30 AM on 09/16/2025

XRP price movement in the last 24 hours, screenshot on CoinGecko at 11:30 AM on 09/16/2025

Coin68 synthesis