This report, authored by Tiger Research, explores how Plasma aims to revolutionize blockchain infrastructure by becoming the "Chrome of stablecoins," much as Chrome revolutionized web browsing by overcoming the limitations of Internet Explorer.

1. The Role and Purpose of Stablecoins

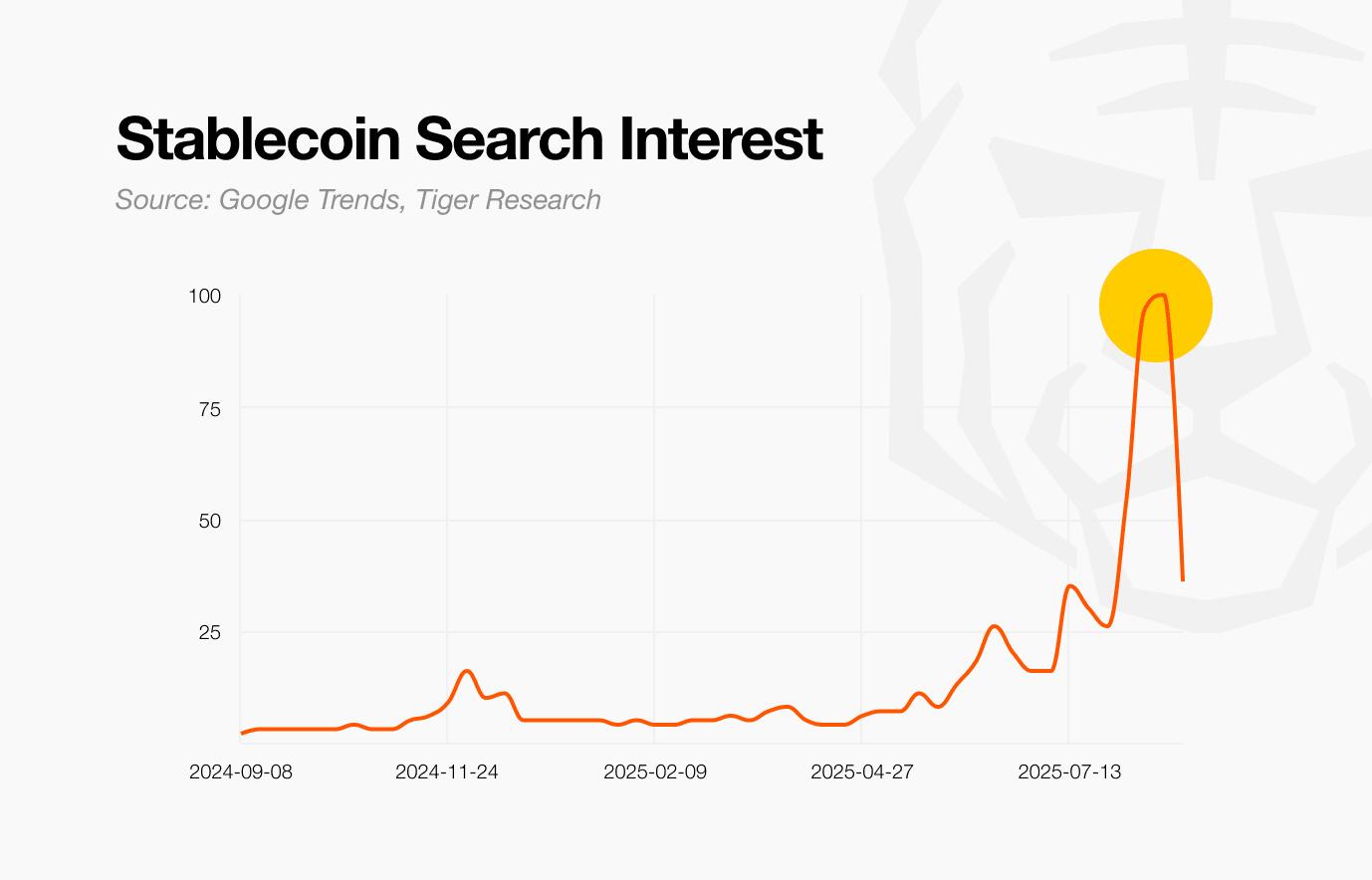

Interest in stablecoins has surged in the cryptocurrency market. However, few can clearly explain how stablecoins differ from existing digital payment methods. This is because digital payments have been possible in the past with credit cards and mobile payments.

Stablecoins are virtual assets that secure stability by linking their price to a fiat currency, such as the US dollar. Their key difference lies in their use of a new consensus system called blockchain, rather than traditional financial systems. Blockchain technology enables direct transactions between individuals, without intermediaries like banks or credit card companies.

The existing fiat currency system involves a multitude of intermediaries, including banks, credit card companies, and remittance companies. Each transaction step adds time and costs. International remittances, for example, require multiple banks and intermediaries, taking from days to weeks and incurring high fees. Transactions are only available during banking hours, and services are unavailable on weekends and public holidays.

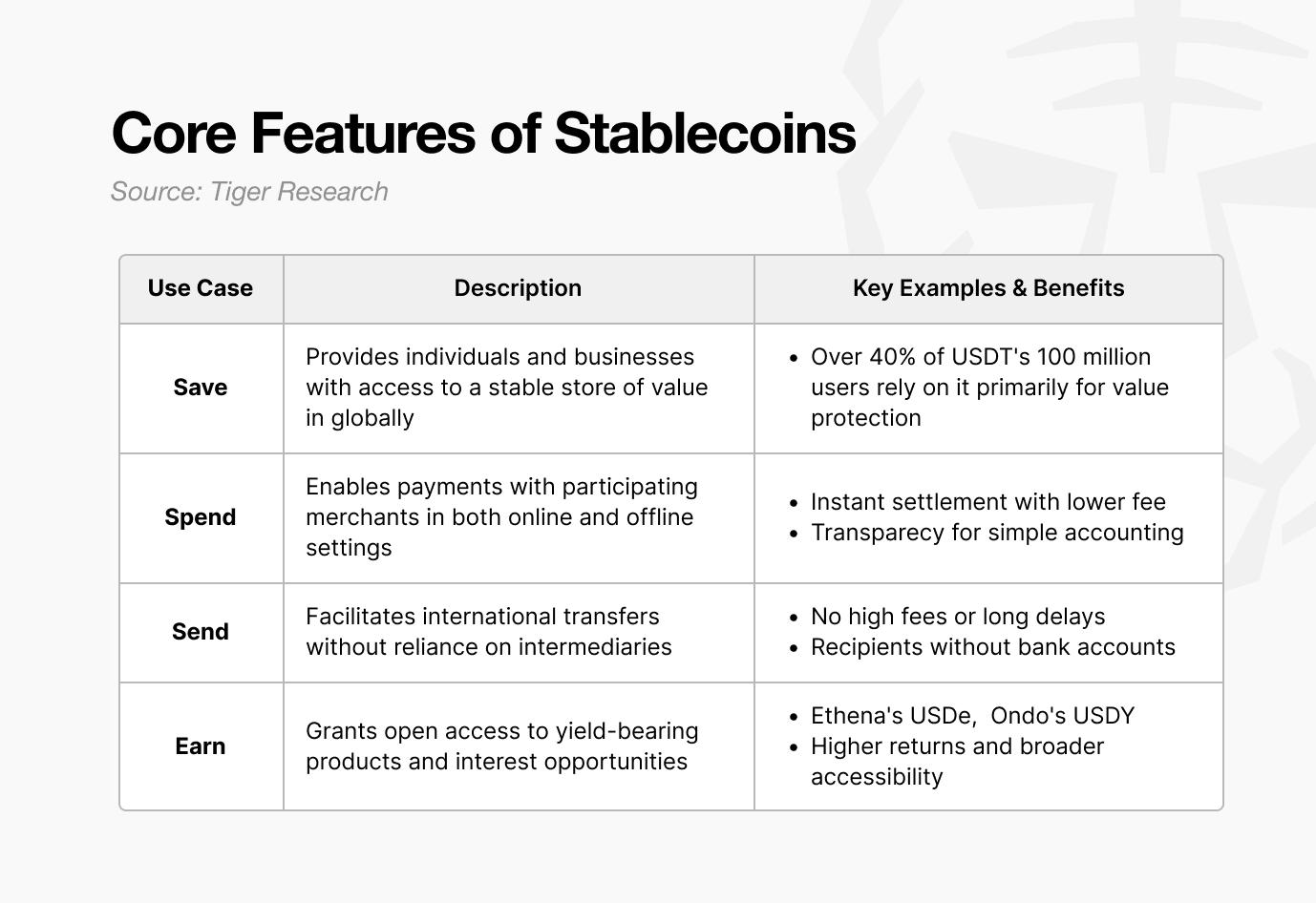

Stablecoins connect people directly through blockchain networks. There's no need to obtain permission or wait for approval from an intermediary. Transactions can be made instantly, anytime and anywhere, as long as there's an internet connection. In essence, stablecoins are transforming the fundamental financial infrastructure, creating an experience similar to handing over cash directly to the recipient, regardless of their location. Based on these differences, stablecoins offer four core values: permissionlessness enables global financial inclusion; programmability enables automated, smart finance; low costs maximize economic efficiency; and high-speed processing completes a real-time global payment infrastructure.

Let's look at a real-world example. A freelancer in Argentina creates a digital wallet without bank approval and saves dollars. Programmability allows automatic monthly deposits, and the low-cost exchange reduces the existing $10 fee to $0.10. High-speed processing allows the funds to be converted into safe-haven dollar assets within three seconds of receiving their paycheck, protecting them from inflation.

These use cases can be broadly categorized into four categories: savings, spending, remittances, and earnings, each offering a new experience that transcends the limitations of the existing financial system.

However, despite the innovative potential of stablecoins, significant barriers remain to their practical adoption by general users. Unlike traditional financial services, they require complex technical understanding, including multiple chain selection, wallet address management, private key storage, and bridging.

In other words, to truly realize the potential of stablecoins, we need infrastructure that anyone can use immediately. Just as Chrome simplified complex web technologies, this is precisely why stablecoins need a service that can act as a "chrome" for them.

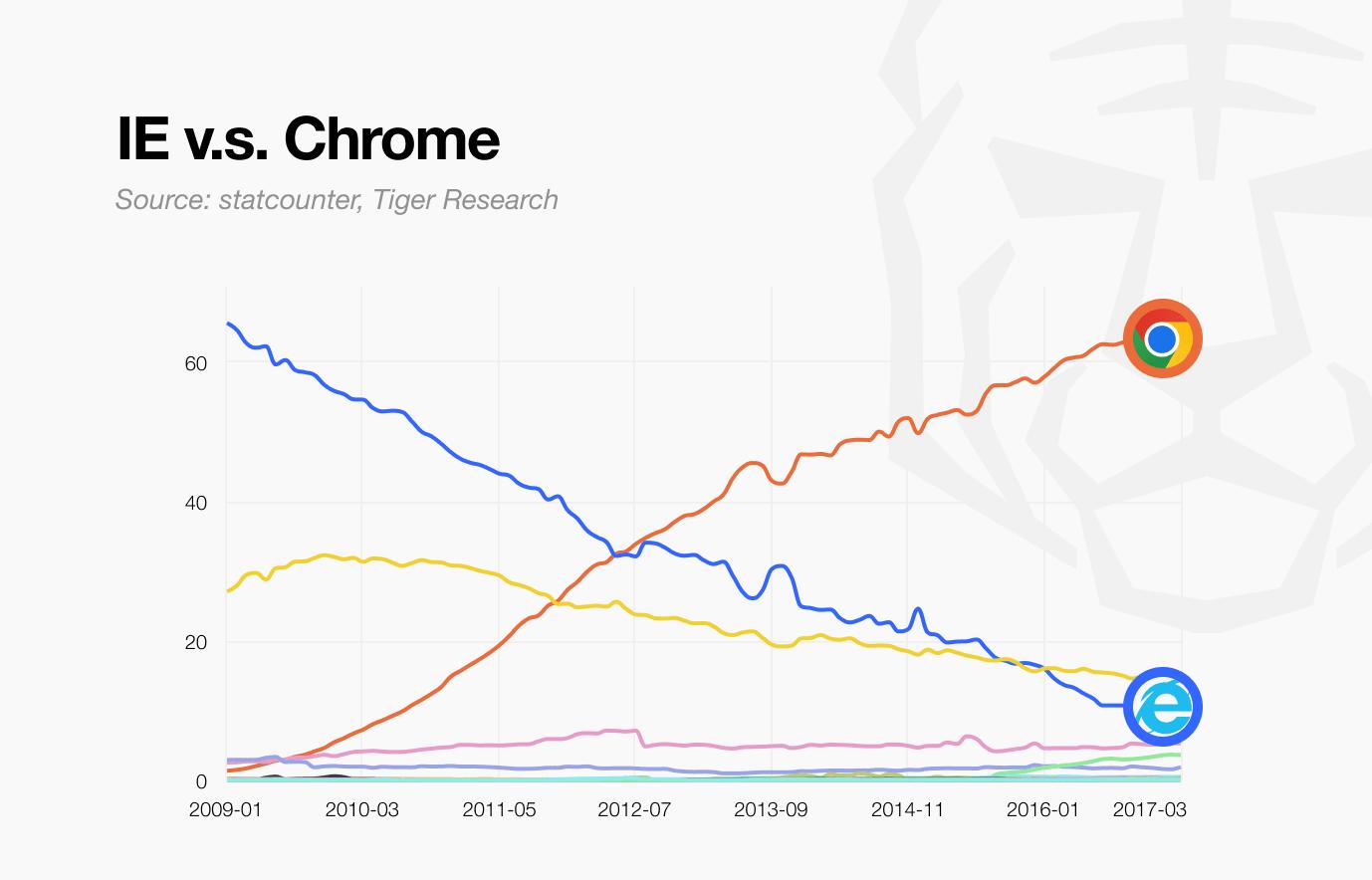

Internet Explorer (IE) popularized complex web technologies, but despite its 95% market share, it suffered from slow speeds, security vulnerabilities, and a lack of support for web standards. With no alternatives, users accepted complex plug-in installations, slow performance, and frequent crashes.

In 2008, Google Chrome changed everything. It boasted 10x faster performance, a multi-process architecture for enhanced stability, and automatic updates fortified security. Complex technology was completely hidden behind the browser, leaving users with only a fast and stable web experience. Within five years, Chrome overtook Internet Explorer to become the world's most popular browser.

The stablecoin market faces a similar challenge. While existing blockchains support stablecoins, they fail to fully leverage their potential, as IE does. Users accept high fees, complex usage, and frequent network congestion.

This is where Plasma comes in. Plasma is a high-performance Layer 1 blockchain dedicated to stablecoins, aiming to redefine stablecoin infrastructure in the same way Chrome redefined the web browser.

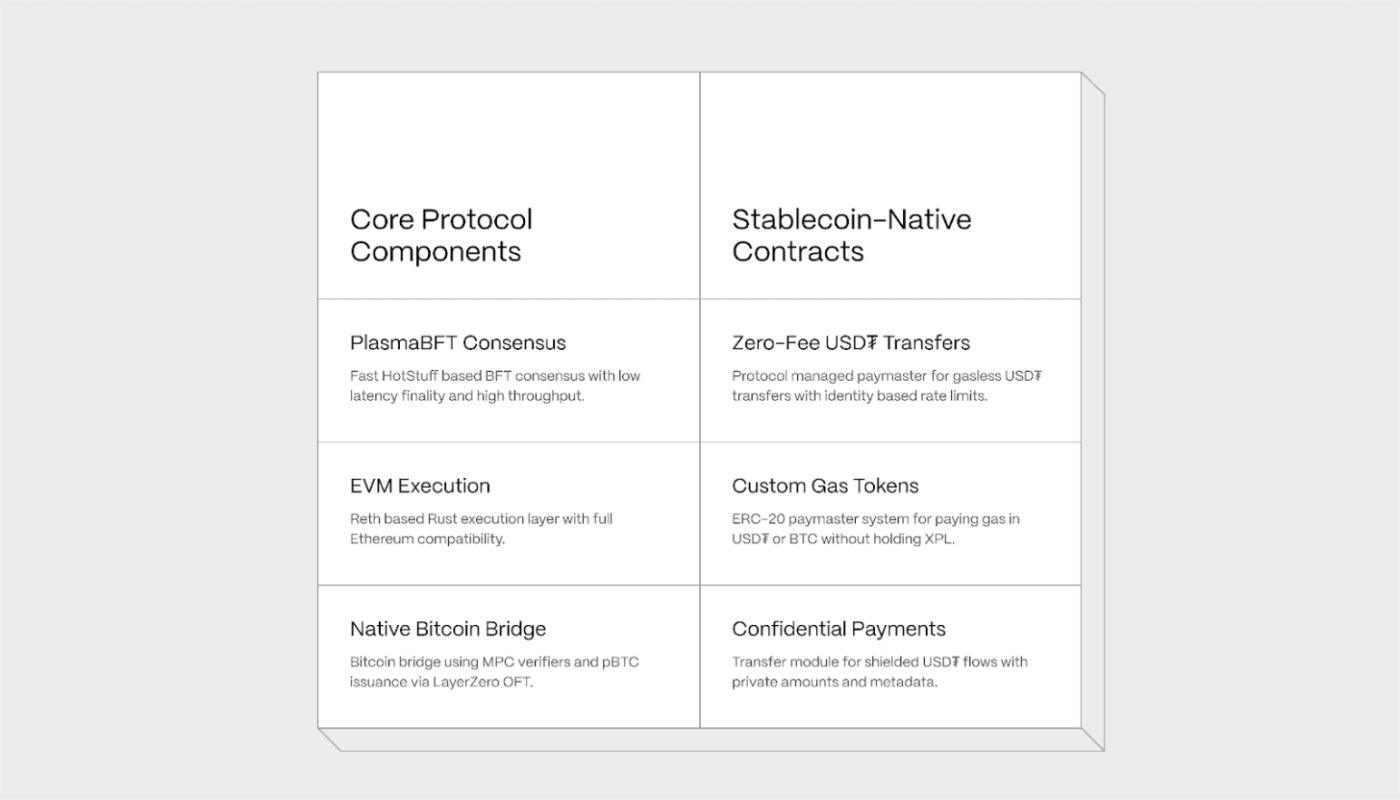

Existing blockchains took minutes or even hours to confirm transactions. Sending USDT on Ethereum often resulted in long wait times when the network was congested. Plasma fundamentally solved this problem. It introduced a new consensus method called PlasmaBFT, allowing transactions to be completed within seconds.

The Fast HotStuff algorithm speeds up the consensus process. Simply put, this algorithm achieves consensus among network participants in fewer steps than before. It streamlines the verification process by combining signatures from multiple nodes. It also reduces the number of messages exchanged at each consensus stage. New block proposals can begin without waiting for the previous block to be completed, increasing overall throughput. Under optimal conditions, transactions are finalized with just two consecutive proofs.

While IE's entire browser crashed when a single tab went down, Chrome secured stability by separating each tab into an independent process. Plasma, similarly, can optimize transaction processing to improve the stability of the entire network.

The most important thing for developers is the ability to use their existing knowledge and tools. Just as Chrome's full support for web standards freed developers from the browser-specific compatibility hell of the Internet Explorer era, Plasma supports all apps and tools used on Ethereum without modification.

You can leverage your familiar development environment. This is because it's based on Reth, a high-performance Ethereum client written in Rust that provides full EVM compatibility. Existing smart contracts can be migrated to Plasma without a single line of code change, significantly lowering the barrier to entry for developers.

Just as websites worked seamlessly when migrating from IE to Chrome, Plasma seamlessly integrates with the existing Ethereum ecosystem.

Plasma is building a Bitcoin bridge alongside stablecoin infrastructure. This project has two core goals: issuing BTC-collateralized stablecoins and building a Bitcoin-centric financial ecosystem.

In a stablecoin system, the stability and reliability of collateral assets are essential. Bitcoin is the most secure digital asset, having proven itself for 15 years. However, it has a critical limitation: it lacks smart contract functionality. This makes it difficult to use Bitcoin directly as collateral.

In the existing market, a centralized institution held Bitcoin and issued wrapped tokens. This structure created two problems: the risk of a single point of failure and high fees.

To address these limitations, Plasma developed a native bridge that brings Bitcoin directly into the EVM environment, enabling it to be used as programmable collateral.

This technology significantly expands the financial utility of Bitcoin while maintaining Bitcoin's security. It also enables participation in the DeFi ecosystem. Ultimately, it will create a financial ecosystem where market participants can save in Bitcoin and spend in USDT.

Fee-free USDT transfers are a key feature that enables Plasma to function as a stablecoin infrastructure. Just as Chrome disrupted the market with its free browser, Plasma aims to conquer the stablecoin market with free transfers.

Users only need to hold USDT. The system will handle the fees on their behalf through a payment function called Paymaster. This only applies to basic transfers of official USDT tokens, and simple identity verification and transfer restrictions prevent abuse.

Simply put, the Plasma Foundation pays gas fees on behalf of users using a pre-arranged fee budget. Users can complete all transactions with a single USDT token, eliminating the need for complex token management.

In existing blockchains, fees could only be paid using the chain's dedicated token. This posed a hassle: Ethereum required ETH, Polygon required MATIC, and Tron required TRX. Users had to manage a separate token for fees in addition to the USDT they intended to use.

Plasma completely eliminates this inconvenience. You can pay fees directly with familiar assets like USDT or Bitcoin. Simply select your desired asset from a list of approved tokens, and a trusted oracle calculates the real-time exchange rate and sets the fee.

One of the most significant features of blockchain is that all transactions are public. Anyone can verify the transaction amount, sender, and recipient, ensuring transparency. However, this compromises personal privacy. Traditional financial systems, on the other hand, protect privacy but require regulatory oversight and control.

Just as Chrome offers both regular browsing and incognito modes, Plasma is researching an optional confidential payment module. While normally open like a typical blockchain, it supports hiding information in areas where privacy is required, such as B2B transactions and settlements.

Technically, it hides recipient information using a one-time address and protects transaction details with encrypted memos. Simultaneously, it operates in the EVM environment and is designed to be compatible with DeFi, seamlessly connecting to existing ecosystems. However, it also satisfies regulatory compliance requirements by allowing for selective disclosure of information to regulatory authorities upon request for legitimate purposes, such as anti-money laundering or tax investigations.

Plasma is currently receiving a strong response from the market. The XPL token public sale completed in minutes, and the Binance Earn campaign, which raised $1 billion and quickly closed with over 30,000 participants, is also underway. However, converting initial interest into sustained growth requires a strategy that goes beyond mere technological superiority.

A look at Chrome's formula for success reveals the answer. Initially, Chrome attracted users with its impressive performance. However, its true growth engine was its extension ecosystem. With everyday tools like MetaMask and DeepL running on Chrome, Chrome went beyond being a simple browser and became a core platform for our digital lives.

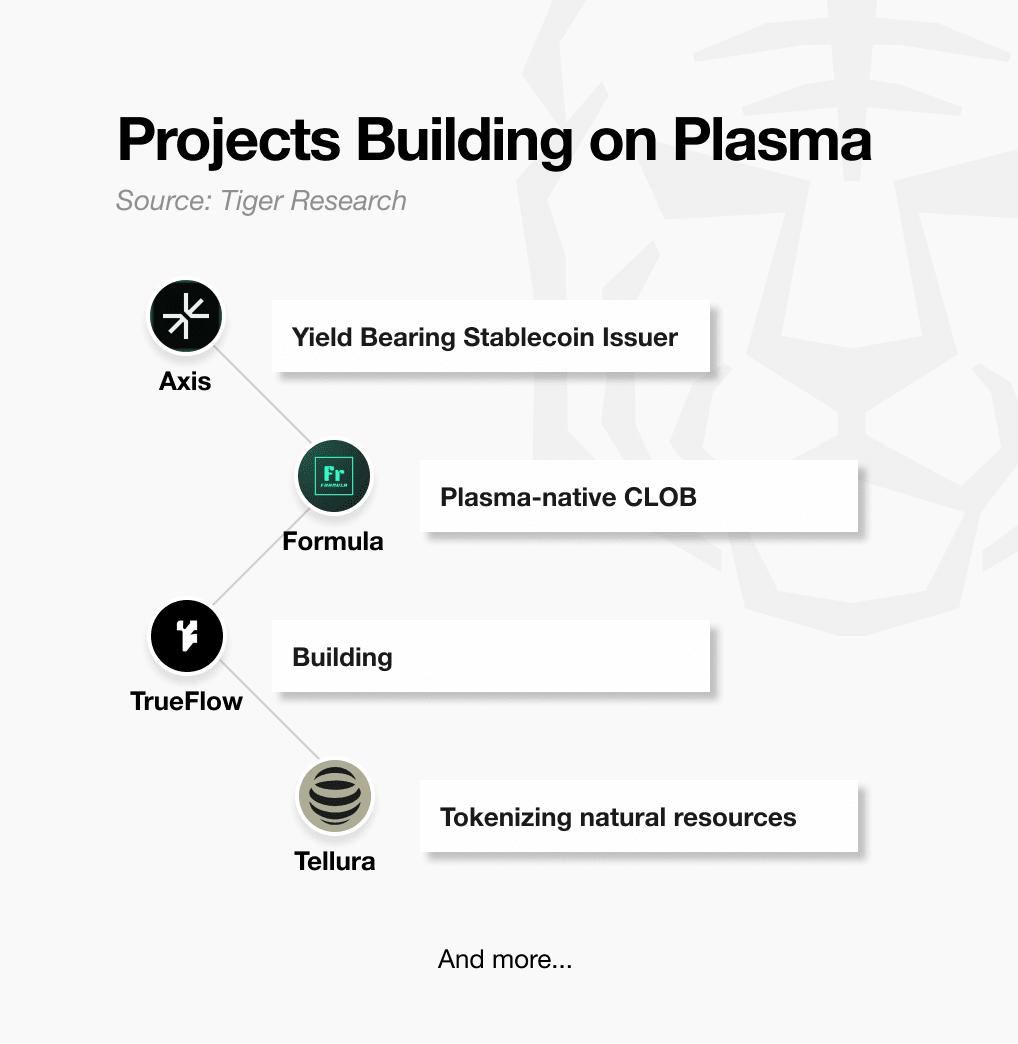

Plasma is following the same path. Currently, it's focusing on building the basic infrastructure ahead of its mainnet launch. Fee-free transactions and EVM compatibility are the first steps, along with Chrome's fast performance. The real competition comes after that.

Fortunately, Plasma understands the importance of the ecosystem . Partnerships with major DeFi protocols like AAVE, Pendle, and Ethena are proof of this. Simultaneously, they are actively recruiting developers through their Community Builder program. These early investments will lay the groundwork for diverse services, like Chrome extensions, to flourish.

Plasma's true potential lies in pioneering new service areas. Microfinance services, real-time payroll, and micropayment-based content payments, previously inaccessible due to high fees, are now economically feasible. As these services emerge, Plasma's value and user base will grow in tandem.

Ultimately, Plasma aims to change the internet in the same way Chrome did: hide complex technologies and provide users with an intuitive and natural experience. For stablecoins to truly establish themselves as digital currencies, ease of use, not technical complexity, will be the key. Plasma aims to become the Chrome of stablecoins precisely at this point.

Be the first to discover insights from the Asian Web3 market, read by over 16,000 Web3 market leaders.

🐯 More from Tiger Research

이번 리서치와 관련된 더 많은 자료를 읽어보세요.

Disclaimer

This report was partially funded by Plasma, but was independently researched and based on reliable sources. However, the conclusions, recommendations, forecasts, estimates, projections, objectives, opinions, and views in this report are based on information current at the time of preparation and are subject to change without notice. Accordingly, we are not responsible for any losses resulting from the use of this report or its contents, and we make no express or implied warranties regarding the accuracy, completeness, or suitability of the information. Furthermore, the opinions of others or organizations may differ from or be inconsistent with those of others. This report is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. Furthermore, any reference to securities or digital assets is for illustrative purposes only and does not constitute investment advice or an offer to provide investment advisory services. This material is not intended for investors or potential investors.

Terms of Usage

Tigersearch supports fair use in its reports. This principle allows for broad use of content for public interest purposes, as long as it doesn't affect commercial value. Under fair use, reports can be used without prior permission. However, when citing Tigersearch reports, 1) "Tigersearch" must be clearly cited as the source, and 2) the Tigersearch logo ( in black and white ) must be included in accordance with Tigersearch's brand guidelines. Republishing materials requires separate consultation. Unauthorized use may result in legal action.