- ASTER’s 2025 TGE and airdrop spark DeFi buzz, with $0.37 price and 3.74B TVL. Privacy-focused, multi-chain DEX rivals Hyperliquid, backed by CZ.

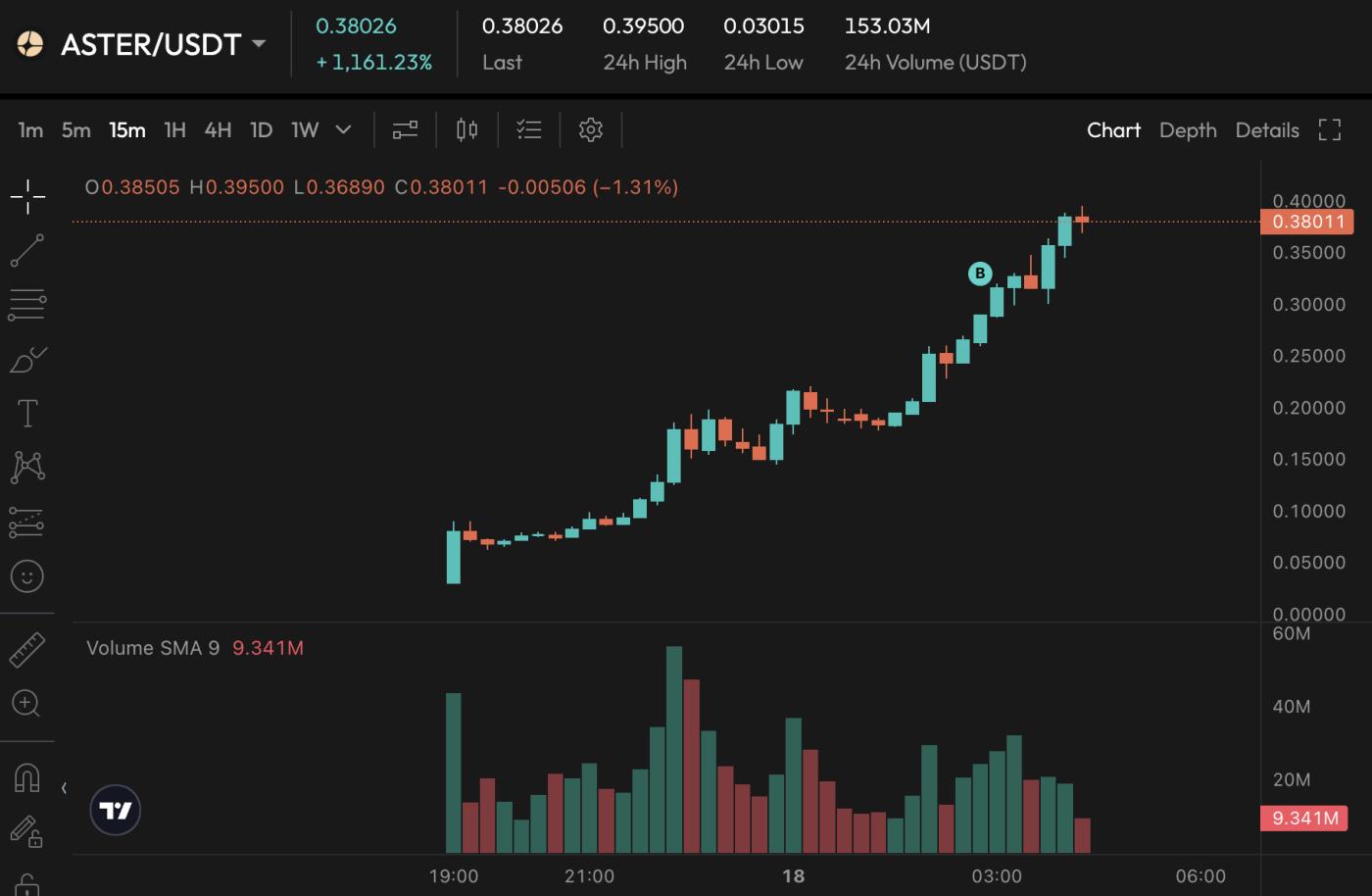

- ASTER’s TGE on September 17, 2025, unlocks 70.4M tokens, driving 150% volume surge. Privacy features and Binance ties fuel its perp DEX rise.

- ASTER, a privacy-driven perp DEX, hits $374M TVL post-TGE. With CZ’s endorsement, $ASTER at $0.37 eyes 2026 growth in DeFi’s $500B market.

In the September 2025 DeFi surge, ASTER (formerly Astherus) captured attention with its Token Generation Event (TGE), marking its rise as a key player in the perpetual futures decentralized exchange (perp DEX) space. On September 17, ASTER launched its TGE, releasing 70.4 million $ASTER tokens for a community airdrop (8.8% of total supply), drawing over 137,000 wallets to claim. This milestone shifted ASTER from a testing phase to a mature ecosystem, sparking widespread discussion in the crypto community.

Former Binance CEO Changpeng Zhao (CZ) posted on X, praising, “Well done! 👏 Good start. Keep building!” His post gained over 6,900 likes and nearly a million views, boosting ASTER’s visibility. Meanwhile, the Stage 2 points program launched on September 8, building on Stage 1’s 527,000 unique wallets and $37.7 billion trading volume, with updated rules to ensure fairness, pushing TVL past $374 million.

As of this writing, $ASTER trades at about $0.37, reflecting strong market interest. As a DeFi-focused analyst, I will analyze ASTER’s value and risks using official documents, DefiLlama data, and reports from CoinTelegraph and BeInCrypto, adhering to EEAT principles (Experience, Expertise, Authoritativeness, Trustworthiness). Investors should do their own research (DYOR), as this is not financial advice.

ASTER Project Overview: From Astherus to Multi-Chain Privacy DEX

ASTER began as Astherus in 2023, incubated by YZi Labs (formerly Binance Labs), aiming to tackle DeFi trading issues like front-running, Miner Extractable Value (MEV) attacks, and high gas fees. As a multi-chain perp DEX, ASTER supports Ethereum, BNB Chain, Arbitrum, and Solana, offering seamless cross-chain trading without bridging.

Its key innovation is a privacy-first infrastructure: the “Hidden Orders” mechanism keeps order size and direction invisible until execution, preventing sniping and MEV attacks. CZ praised this “dark pool” feature on X, noting its appeal to institutional users. ASTER offers a dual-mode interface: Simple Mode for beginners with one-click trading (up to 1001x leverage) and Pro Mode with professional order book tools for pairs like BTCUSDT and tokenized stocks like AAPL/TSLA (100x leverage on-chain). Users can also use USDF (a yield-bearing stablecoin) and asBNB (liquid staked BNB) as margin, earning passive income while holding positions, boosting capital efficiency.

The project has shown strong growth: in 2025, TVL reached $374 million, with annual fee revenue over $30 million, capturing about 20% of the perp DEX market. Total trading volume hit $514 billion, with over 2 million users. ASTER’s Genesis program drives engagement through Rh Points (for trading) and Au Points (for holding assets), with snapshots every 6 hours and weekly Epoch resets, rewarding genuine participation over speculation. This community-focused design supports the Stage 2 farming post-TGE.

Recent News Breakdown: TGE, Airdrop, and Stage 2 Momentum

September 2025 was a defining moment for ASTER, with the TGE sparking market excitement. The airdrop portal opened on TGE day, allowing users to claim tokens via the Aster wallet without gas fees, with a claim window until October 17. Unclaimed tokens will return to the community pool. Eligibility is based on Stage 0/1 Rh/Au Points, Aster Gems, or Aster Pro trading loyalty points, covering over 137,000 wallets.

On average, users receive tokens worth hundreds to thousands of dollars (e.g., a $300 USDT deposit earned 2,360 $ASTER, about $470). Stage 2, launched on September 8, enhanced incentives with an updated formula: Rh = (trading volume × position duration × PnL factor) + 20% referral bonus, encouraging real trading and invites. Trading volume surged 150% in the 24 hours post-TGE.

ASTER also deepened partnerships with PancakeSwap, Trust Wallet, and SafePal, aiming to be a “liquidity layer” for platforms like Four.meme. $ASTER began trading on Aster Spot on TGE day, with Binance support planned for October 1 via a 1:1 APX-to-ASTER swap, boosting liquidity. These developments drove TVL from $350 million to $374 million, highlighting ASTER’s unique positioning in privacy and multi-asset trading, filling gaps left by competitors like Hyperliquid.

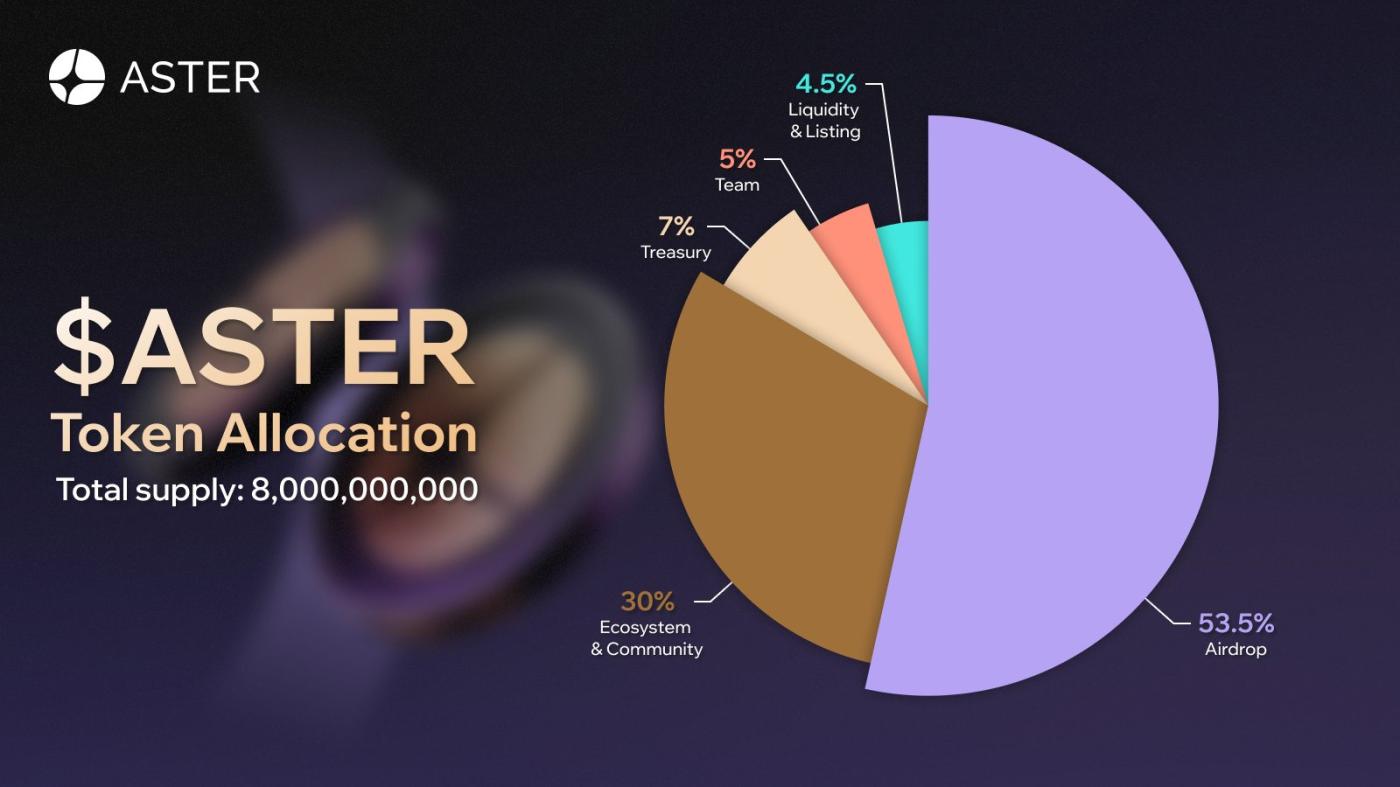

Token Economics: Community-Driven Sustainable Incentives

$ASTER has a total supply of 8 billion tokens, with 53.5% allocated to the community (including 8.8% for the immediate airdrop), 20% for ecosystem incentives, 15% for the team (12-month cliff + 24-month vesting), and 11.7% for liquidity reserves. The token supports governance, fee discounts, and protocol buybacks, prioritizing long-term value over short-term hype.

Compared to Hyperliquid’s 30% community allocation, ASTER’s higher share fosters long-term holding. Post-TGE, $ASTER’s FDV is around $1.58 billion, with community predictions of a $2-$5 price by 2026 based on a 30x P/S multiple. The airdrop’s inclusive design—requiring only Stage 1 points—drew massive retail participation, with X users noting low entry barriers fueling TGE-day FOMO.

Core Mechanisms and Technical Highlights: Privacy and Efficiency

ASTER’s tech stack centers on MEV resistance, using private relayers and zero-knowledge proof variants to hide trading intent, supporting 101 trading pairs, including crypto perpetuals and tokenized stocks. Cross-chain bridging cuts gas fees to 10% of traditional DEXes, and mobile apps for Android/iOS lower the entry barrier.

Stage 2 farming rewards positions held over 7 days and trading volume above $10,000, with a 20% referral bonus creating a closed-loop incentive system. On-chain data shows $254 million in open interest post-TGE, reflecting strong community activity. These features position ASTER as a leader in the $500 billion perp DEX market of 2025, holding a 20% share behind Hyperliquid’s 35%, with tokenized stocks bridging DeFi and TradFi.

ASTER’s Long-Term Potential and Action Steps

ASTER’s TGE and airdrop mark a turning point for DeFi, blending privacy and efficiency. Backed by YZi Labs, CZ’s endorsement, and a community-focused design, ASTER is poised to double its TVL by 2026, potentially leading the perp DEX space. New users can join Stage 2 by connecting an EVM wallet (use invite code Fcd374) and aim for trading volume above $10,000. Check airdrop eligibility at https://www.asterdex.com/en/airdrop. Follow @Aster_DEX on X and join Discord to explore ASTER’s privacy-driven trading revolution. DYOR, NFA.

(Written based on September 18, 2025 data by a DeFi analyst, sourced from CoinTelegraph, BeInCrypto, DefiLlama, and X discussions. )

〈ASTER Project Analysis: Investment Potential of a Privacy-Focused Perpetual DEX〉這篇文章最早發佈於《CoinRank》。