Written by: TechFlow

introduction

Coinglass’s 2024 Exchange Derivatives Market Report states:

In 2024, the global crypto derivatives market set a new record, with an average daily trading volume exceeding US$100 billion, far exceeding the trading volume of the spot market.

Contract trading has become the core battlefield for competition among major exchanges. Whoever can build barriers in the contract track will be more likely to take the initiative in the next stage.

However, building a strong defense in the futures market is not easy. One phenomenon that cannot be ignored is that the futures products on mainstream exchanges are becoming increasingly functionally homogenized, with highly similar product pages and features, narrowing differences in matching performance, and a high degree of overlap in the categories of mainstream cryptocurrency contracts. As the entire futures market enters a competitive phase of "micro-innovation + refined operations," we have noticed some promising platforms among hundreds of exchanges worldwide that are accelerating their breakthroughs:

CoinW ranks 24th in Coingecko's global crypto exchage rankings and is among the top 5 in the global derivatives exchange rankings. The discrepancy between overall volume rankings and contract-specific rankings reveals CoinW's breakthrough in the contract market, and we are increasingly interested in exploring its unique advantages in this area.

As an established exchange with 8 years of stable operation, CoinW has always adhered to the core strategy of "long-termism, security protection, and experience first", and is committed to providing global traders with a safer, more stable, and more user-friendly contract trading environment. It has more than 15 million registered users in more than 200 countries and regions around the world, and has maintained a record of 0 major security incidents in 8 years, laying a solid foundation of trust for the platform's user retention and capital accumulation.

In terms of contract business, the number of contract users has increased by more than 20% year-on-year, and the monthly retention rate has exceeded 80%, with both "growth speed" and "growth quality".

On the occasion of CoinW’s eighth anniversary, we will also delve into CoinW’s underlying breakthrough logic as a “contract exchange” through dimensions such as CoinW’s market data performance, product design philosophy, risk control system, and user experience optimization path.

User experience is the key to attracting users to come in and stay.

However, the quality of user experience does not only depend on whether the product interface is beautiful and easy to use, but also reflects the platform's comprehensive understanding of the user's real demands. It tests the R&D team's insight into the habits and preferences of traders at different levels, and also requires comprehensive control of product details from a global perspective.

As a core business segment, CoinW Contract Trading takes "continuous innovation and user experience first" as its product design concept. Starting from multiple angles such as rates, functions, and support responses that users care about, it aims to create a high-efficiency, low-friction, smooth and coherent one-stop contract trading experience.

In terms of optimizing the fee structure, CoinW has an extremely low transaction fee rate: while the contract Maker fee on most platforms is 0.02%, the CoinW contract Maker fee is as low as 0.01%, further reducing user transaction costs and achieving more efficient capital efficiency.

In terms of contract functions, on the basis of ensuring safe and efficient transaction matching, CoinW has established a differentiated competitive advantage through continuous "micro-innovation" in user experience.

On the one hand, CoinW provides one-stop functional services covering all scenarios of contract trading, and is committed to making users feel convenient and intelligent in every operation link: whether it is free splitting and merging positions to help users manage positions in a refined manner, or one-click reverse opening of positions when the market turns, in any situation required by users, the CoinW contract platform aims to help traders seize market opportunities more promptly and control risks more flexibly through comprehensive and detailed functional design, thereby increasing the possibility of profitability in the ever-changing market.

On the other hand, the copy trading function has always been one of the highlights of contract trading. Based on the openness and transparency of the blockchain, contract copy trading supports one-click copying of professional traders' strategies, thereby effectively connecting novices and experienced players and promoting a two-way value cycle:

CoinW's contract copy trading function attracts active participation from both new and existing players by lowering the threshold: followers only need 1 USDT to follow the trading strategies of star traders and professional KOLs with one click; and there is no threshold for lead traders to join, and the commission for leading orders is settled daily.

At the same time, the principle of "micro-innovation" is further extended in contract copy trading. A number of differentiated designs have built CoinW's comprehensive and flexible copy trading ecosystem: as the industry's first mini-program to support copy trading, the lightweight Telegram copy trading function makes contract trading more convenient, and the deep integration with Telegram also makes contract trading more social scenario-oriented; and signal copy trading supports traders to efficiently publish strategies, and traders can synchronize with traders on their mobile devices with one click, further improving efficiency.

In terms of responding to user demands and solving problems, CoinW provides 24/7 customer service support and has established multi-language support covering Chinese, English, Japanese, French, Spanish, etc. By establishing an efficient user feedback mechanism in the global user community, we ensure that any problems can be responded to and handled in a closed-loop manner in the first time.

Trading opportunities in the contract market change rapidly. If we view contract trading as a running race, then:

Low fees allow users to start light, a comprehensive contract functionality matrix serves as a universal toolkit, one-click copy trading accelerators strategy replication, and 24/7 multi-language support is a thoughtful refueling station... All of these user-centric product designs are designed to help traders avoid detours and achieve faster and more stable performance.

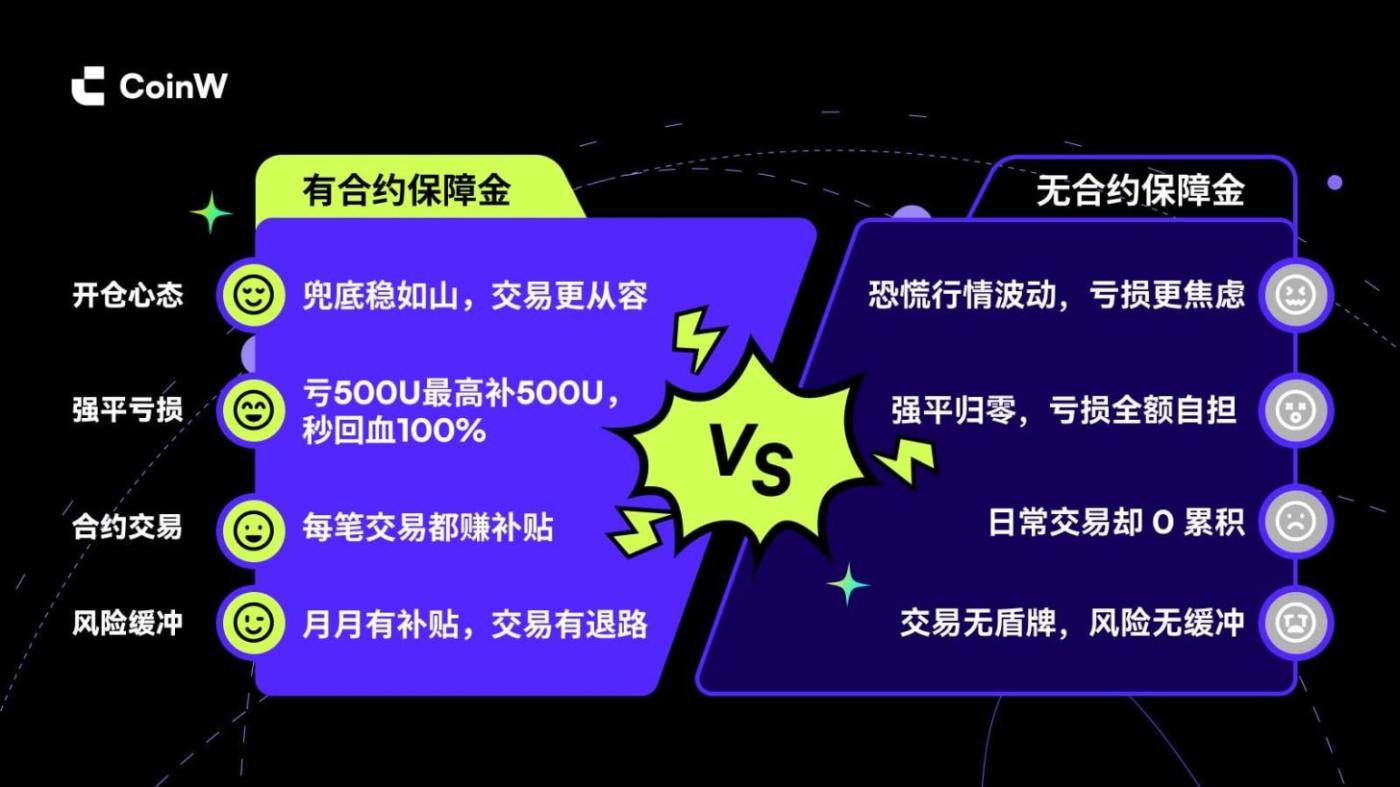

The "Contract Margin Plan", the industry's first systematic instant compensation mechanism for traders launched by CoinW in May 2025, aims to provide additional risk mitigation and subsidy guarantees, laying a layer of protective "cushion" for the contract market runway, so that traders can be less afraid of falling (explosion), and thus run more boldly and with more confidence.

The contract market has always followed the "user bears their own risks" operating model. For many users, they are either afraid of losses and dare not try rashly, or they leave the market sadly due to losses and develop PTSD from contracts.

Amidst the anxiety over losses, a key point of differentiated competition in the contract market has emerged: the risk hedging or buffer mechanism for contract trading.

The launch of CoinW's "Contract Margin Plan" not only caters to this user demand, but also fills this market gap.

So, how does the contract margin protect users?

As a special subsidy program for contract users, CoinW invests 500,000 USDT every month to establish a total guarantee fund pool. When a user's position is liquidated, he or she can receive a USDT subsidy of up to 500 USDT based on his or her personal accumulated amount to offset losses, handling fees or margin, thereby reducing trading losses.

The logic is simple and participation is even easier. It can even be said that every user who has experienced it can easily feel the "user-oriented" product philosophy reflected everywhere in CoinW.

CoinW does not set any threshold for participation. Contract users will be automatically considered to have participated in the event once they click the [Click to Enter] button to enter the contract margin page.

CoinW has established clear calculation rules for subsidy amounts: The subsidy amount is determined by three key factors: trading volume, daily check-in, and new user referrals. The higher the contract trading volume, the higher the subsidy amount. Users who trade at least 100 units per day in contract trading can complete the check-in and receive a fixed daily subsidy. Inviting new users to participate in the contract margin program can increase the margin amount.

Starting from the third phase of the Contract Margin Program, CoinW has adopted a more sophisticated system algorithm to build a dynamic shield throughout the entire transaction cycle to ensure that subsidies are truly distributed to users who participate in contract transactions: the system will automatically adjust the accumulation speed based on the user's current subsidy amount. The lower the amount, the faster the growth. At the same time, the efficiency of converting transaction fees into subsidies has been comprehensively upgraded, and combined with transaction volume to achieve "double acceleration", so that more subsidies can be obtained with the same transaction expenditure.

CoinW prioritizes efficiency, transparency, and fairness when it comes to subsidy redemption: a fixed quota of 500,000 USDT is allocated each period, on a first-come, first-served basis. If a margin call occurs after participating in the margin program, users can immediately claim the corresponding subsidy, with instant deposit and no customer service intervention required. During each margin period, users can increase their subsidy quota by increasing their trading volume and inviting friends. They can also view their individual quota and the total prize pool balance in real time on the official website.

It can be said that the safer, more stable, and more user-friendly contract trading environment under the contract margin mechanism is like CoinW laying a soft cushion in the contract market full of unknowns: before trading, it greatly eliminates users' panic about being liquidated. With the bottom-line guarantee mechanism, users can more boldly explore market profit opportunities; if unfortunately a margin call occurs, it provides users with real cash subsidies to help users achieve a safe landing, and also brings CoinW stronger new user attraction and capital accumulation capabilities.

This also symbolizes a shift in the concept of crypto trading: placing users' transaction security and psychological protection at the core of the business model, from "platform exemption thinking" to "user protection thinking", from "users bearing their own risks" to the platform's active "risk sharing", and CoinW is the pioneer and leader of this transformation.

Since its launch, CoinW has invested a total of 2 million USDT in contract margin, and a number of impressive data have shown that the product value of contract margin has withstood the test of the market and users: According to data released by CoinW, as of now, contract margin has provided protection for more than 40,000 users, with a cumulative amount of more than 970,000 USDT, a 100% success rate for extreme market protection, and a 100% user asset security protection rate.

At the same time, since the launch of this function, the number of new contract users and contract trading activity have increased significantly.

The eighth anniversary celebration concluded, and a new round of evolution began. Through a clear business plan, CoinW also demonstrated to the community the strong growth momentum of its contract business.

According to the official roadmap, the next steps for CoinW contract product iteration and improvement include:

Continuously upgrade the contract margin plan: provide a safety cushion for more users in extreme market conditions, and encourage bolder attempts at diversified trading strategies.

Smart Money feature launched: intelligent algorithms track on-chain profit addresses and KOL operations in real time, support one-click follow-up transactions, and are equipped with algorithm recommendations, rankings, real-time warnings and other functions to create a "zero cognitive gap profit" experience.

Launch of Strategy Square: In collaboration with globally renowned financial institutions, professional quantitative teams, and top strategy developers, we have launched stable quantitative strategies with high returns and low risks. This allows users to follow high-win-rate strategies with one click, and individual developers can also share in the profits, building an open quantitative ecosystem and providing a wealth of asset appreciation options.

Turning our attention from the contract ecosystem to the entire ecosystem, CoinW announced on its eighth anniversary the completion of its full-stack ecosystem integration upgrade, transforming from a single trading entry point to a one-stop crypto-financial ecosystem worthy of user trust. The resulting powerful ecological synergy will further empower the development of the contract business.

After the full-stack integration upgrade, CoinW’s four key products under its four core directions are clearly demonstrated:

Trading platform CoinW: As a comprehensive trading platform, CoinW supports spot and contracts, combines AI strategies with multi-layer risk control, realizes intelligent order routing and matching optimization, allowing users to obtain an efficient and secure trading experience in a centralized environment.

On-chain asset aggregation platform GemW: One-click access to on-chain assets, no separate wallet or gas token required. Transactions can be completed through contract addresses. Based on the LENS model, it integrates on-chain data, social media popularity, and project analysis to help users discover potential assets.

Public chain infrastructure DeriW: Public chain infrastructure, based on Rollup architecture, supports 80,000 TPS, provides zero-gas perpetual contracts and transparent on-chain matching, and builds a high-yield LP liquidity pool to bring users an efficient and low-cost on-chain trading experience.

PropW: The first proprietary trading platform designed specifically for crypto traders. Traders can use platform funds to trade and demonstrate their trading skills through systematic trading assessments, thereby receiving substantial funding support. PropW offers up to 90% profit sharing to top traders.

Through full-stack ecosystem integration and upgrades, CoinW combines centralized efficiency with on-chain transparency, providing users with a collaborative system for the entire transaction life cycle, from narrowing cognitive gaps, reducing trial and error costs, managing risk boundaries to improving profit sustainability.

As CoinW further develops its "one-stop crypto-financial ecosystem," the capital and traffic brought in by its four major products, through lowering user barriers, optimizing underlying performance, and strengthening strategic capabilities, will also provide solid support for CoinW's contract market and broader derivatives business , strengthening CoinW's position as a "contract exchange" and continuously evolving towards a more innovative and prosperous contract trading ecosystem.

There is no end to the competition among crypto market trading platforms. In the eternal pursuit of greater security, lower barriers to entry, higher efficiency, and better user experience, the best milestone is always the next one.

Over the past eight years, CoinW has journeyed from 0 to 1 to +∞, from a single breakthrough to a vibrant ecosystem. With its impressive performance, CoinW has proven to the market that competition in the contract trading market isn't just about technology, speed, and scale; it's also a continuous race focused on user experience, product innovation, and building trust. The choice of over 15 million users, an eight-year zero-accident record, and $5 billion+ in daily contract trading volume are both a triumph of data and a positive reflection of CoinW's commitment to long-term values.

After pioneering the contract margin mechanism and becoming a leader in contract risk sharing platforms, what more innovative paradigm shifts will CoinW lead in the contract track and even the broader crypto-financial market?

With the launch of new engines such as contract margin, smart money copy trading, and strategy square, CoinW's contract trading experience has been taken to a new level. Combined with the four major product strategies of CoinW, GemW, DeriW, and PropW, a one-stop crypto-financial ecosystem covering centralization and decentralization, connecting on-chain and off-chain, is rapidly taking shape. CoinW is also embarking on the pursuit of the next milestone.

TechFlow is a community-driven in- TechFlow content platform dedicated to providing valuable information and thoughtful thinking.

Community:

Official Account: TechFlow

Subscribe to the channel: https://t.me/TechFlowDaily

Telegram: https://t.me/TechFlowPost

Twitter: @TechFlowPost

Join the WeChat group and add the assistant WeChat: blocktheworld

Donate to TechFlow to receive blessings and permanent records

ETH: 0x0E58bB9795a9D0F065e3a8Cc2aed2A63D6977d8A

BSC: 0x0E58bB9795a9D0F065e3a8Cc2aed2A63D6977d8A