Source: Web3 Practitioner

Original title: With the interest rate cut in place, is it time for the market to celebrate?

In the early morning hours of September 18, 2025 (Beijing time), the Federal Reserve announced a 25 basis point interest rate cut as expected. The initial market reaction was in line with classic expectations: a decline in US Treasury yields, a weakening US dollar, and a broad rally in risk assets. However, an hour later, Fed Chairman Jerome Powell held a press conference, and the market trend completely reversed. The US dollar index staged a V-shaped rebound, gold prices fell sharply from their all-time highs, and US stocks diverged, creating a significant overall confusion.

The core of this market turmoil wasn't the 25 basis point rate cut itself. According to data from the CME FedWatch tool, the market had previously expected a 96% probability of this rate cut, making it virtually a foregone conclusion. The real trigger was the deliberately crafted, yet clearly flawed, facade of "unity" behind the monetary policy decision. The lone dissenting vote, cast by White House "Special Envoy" Stephen Miran, served as a rift, puncturing the veneer of "independence" touted by the Federal Reserve as a core institution of the traditional financial system and unexpectedly lending new weight to Bitcoin, a decentralized asset.

1. The shift from “data dependence” to “necessary logic” for interest rate cuts

Before analyzing the particularity of this meeting, we must first clarify the core motivation for the Federal Reserve to initiate loose monetary policy at this time - the employment market has released clear risk signals.

Data from the U.S. Department of Labor shows that in the three months ending in August 2025, the average monthly increase in non-farm payroll jobs in the United States was only approximately 29,000, the lowest level since 2010 (before the pandemic). Deeper employment indicators are also under pressure: initial unemployment claims have climbed to a nearly four-year peak, and the number of long-term unemployed (unemployment cycles exceeding 26 weeks) has reached its highest level since November 2021. In fact, Powell had already signaled at the Jackson Hole Global Central Bank Annual Meeting in late August 2025 that "downside risks to the job market are increasing," marking a significant shift in the Federal Reserve's policy focus from "fighting inflation" to "maintaining full employment."

Although the market generally views this rate cut as a clear move by the Fed to "turn to dovishness," the existence of three core uncertainties makes the impact of this meeting far beyond conventional monetary policy adjustments, pushing the market into a complex situation.

2. Three major uncertainties: uncertainty in policy paths and political interference

(I) Suspense 1: Split dot plot and unclear path of interest rate cuts

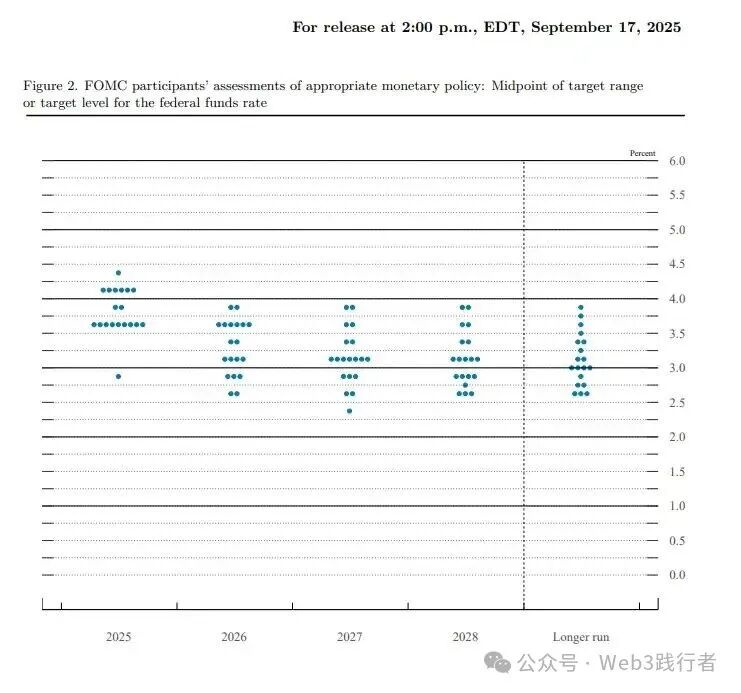

The core market concern is how many more rate cuts the Fed will implement in the remainder of the year. With a 25 basis point rate cut already fully priced in, the dot plot, which reflects the future path of interest rates, has become a key indicator. On the surface, the median of the dot plot indicates that Fed policymakers anticipate two more rate cuts in 2025, totaling 50 basis points, which appears to provide a clear direction.

However, a deeper analysis reveals significant divisions within the decision-making body: of the 19 voting members, nine favor two more rate cuts this year, while another nine believe a maximum of one cut is needed. Some even advocate for a rate hike. Even more extreme, one forecast (generally believed to be from Milan) suggests a 125 basis point rate cut this year. Goldman Sachs economists have previously warned that even if the dot plot points to two rate cuts, market expectations of "little disagreement within the decision-making body" are overly optimistic. This sharply divided forecast distribution significantly undermines the effectiveness of the dot plot as a policy guide.

The ambiguity of official policy signals contrasts sharply with aggressive market pricing. CME interest rate futures data shows that after the meeting, traders quickly raised the probability of further rate cuts in October and December 2025 to over 70%. This suggests two possible market paths: one in which the Fed maintains a cautious stance, conflicting with aggressive market expectations and triggering a new round of market volatility; the other in which the Fed, under the combined influence of political pressure and market expectations, compromises and embarks on an unexpected easing cycle. Regardless of which path is chosen, uncertainty will dominate the market for the coming months.

(II) Suspense 2: Powell’s “Balancing Act” and the Dilemma of Setting the Policy Tone

Facing internal disagreements and external pressure, Powell characterized the rate cut as a "risk management exercise." The core logic of this statement was to strike a balance: internally, by acknowledging the weakness in the job market, it justified the rate cut; externally, by emphasizing the continued risk of inflation and suggesting that further easing would be cautious, he responded to aggressive pressure from the White House.

However, this "all-encompassing" balancing act has instead led to a market split in policy interpretation. As Powell stated at the end of the press conference, "there is no longer a risk-free policy path." Cutting interest rates too much could exacerbate a rebound in inflation, while cutting too little could provoke dissatisfaction in the White House. This core contradiction remains unresolved.

(3) Suspense 3: Unprecedented political interference and the crisis of Federal Reserve independence

The most core potential risk of this meeting is the direct erosion of central bank independence by executive power - this "elephant in the room" (referring to an obvious but deliberately avoided issue) finally surfaced.

Trump's chief economic advisor, Stephen Milan, was officially inaugurated the day before the FOMC meeting and immediately received voting rights. The market generally viewed this as a targeted move by the White House to push for a "significant interest rate cut." Meanwhile, while Trump's attempt to fire Federal Reserve Governor Lisa Cook has been temporarily halted by the courts, the related litigation is ongoing. These events are not accidental, but rather a clear signal of direct executive intervention in central bank decision-making. Milan's lone dissenting vote at the meeting was the ultimate manifestation of this intervention.

While Wall Street is still struggling with the divergence of the dot plot and contradictory economic forecasts (lowering interest rates while raising future inflation expectations), the cryptocurrency market has interpreted a deeper macro narrative from it: on January 3, 2009, Satoshi Nakamoto left the inscription "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks" in the Bitcoin Genesis Block. The core criticism is precisely the fragility and rule flexibility of the centralized financial system in crises.

Sixteen years later, Milan's intervention has pushed this systemic questioning from the economic to the political level. When the monetary policy of the world's most important central bank is no longer based solely on economic data but is directly influenced by short-term political agendas, the long-term credibility of fiat currencies has been weakened. In contrast, Bitcoin's characteristics of "code is law" and "rules before power," its fixed supply cap of 21 million, its predictable issuance cadence, and its decentralized nature, free from the control of a single entity, have created a unique "oasis of certainty" amid the current macroeconomic chaos.

III. Short-term risks: Market competition after the “shoe drops”

While macroeconomic logic supports Bitcoin's long-term value, determining whether to embark on a market frenzy requires a clear distinction between long-term narratives and short-term trading logic. The V-shaped market reversal following the recent rate cut highlights the reality of short-term risks.

First, this rate cut represents an "over-realization of expectations"—when the market prices the probability of an event at 96%, the event itself no longer constitutes a positive catalyst, but instead becomes an opportunity for speculative funds to "take profits," in line with the classic market principle of "buy the rumor, sell the news." Second, the ambiguity of Powell's "risk-management" statement and the significant divergence in the dot plot failed to convey a clear signal to the market that a new easing cycle had begun, dampening the previously preemptive speculative bullish sentiment.

The price trend of Bitcoin more intuitively reflects the market's entanglement: when the resolution was announced at 2 a.m. on September 18, 2025, the market's initial reaction was disappointment, and the price of Bitcoin quickly dropped to around US$114,700, showing a typical "sell on the news" market trend; but unlike the continued decline of gold and mainstream US stocks, as Powell's speech progressed, the market interpreted it as a more dovish signal, and Bitcoin immediately started a V-shaped rebound, breaking through US$117,000, showing a differentiated trend from traditional risky assets.

This phenomenon suggests that in the short term, Bitcoin is still categorized by the market as a "high-beta risk asset," with its price fluctuations highly correlated with macro liquidity expectations. Therefore, market volatility is likely to intensify in the short term. Any employment or inflation data that contradicts mainstream expectations could trigger a sharp pullback in risky assets, including cryptocurrencies.

IV. Conclusion: Beyond the Core Points of the Dot Chart

Overall, the question of whether the implementation of the interest rate cut means the beginning of a market frenzy needs to be answered from two perspectives: short-term trading and long-term value.

From a short-term trading perspective, the answer is no. The Fed's current policy path is fraught with uncertainty, and the benefits of the first rate cut have already been fully realized. Maintaining caution and being wary of volatility is a more rational approach .

From the perspective of long-term value investing and macroeconomic narratives, this incident is merely the beginning. Every instance of executive power interfering with central bank independence, every conflict and struggle in monetary policy decisions, serves as a concrete endorsement of the decentralized financial system and builds support for the long-term value proposition of crypto assets. More worthy of attention than the dot plot's divergent and confusing forecasts is the ongoing power struggle within the Federal Reserve— the ultimate outcome of which will not only determine the direction of the dollar's creditworthiness but will also, to a significant degree, define the central role of crypto assets in the next macroeconomic cycle.

Twitter: https://twitter.com/BitpushNewsCN

BitPush TG discussion group: https://t.me/BitPushCommunity

Bitpush TG subscription: https://t.me/bitpush