Aster (ASTER) has quickly attracted attention as the latest project to be supported by Binance, with some XEM it as a potential competitor to HyperLiquid. The Token debuted on AsterDEX, where Airdrop recipients have been a major driver of trading. ASTER is currently trading at around $0.62, down more than 5% over the past 24 hours.

However, until withdrawals are unlocked on a specific date, price action remains stuck in DEX-only streams. That date and the recapture of a key level, which will be discussed later, will determine whether ASTER price goes up or down.

Money flows and momentum suggest selling pressure is waning

Since ASTER began trading on September 17, 2023, Chaikin Money Flow (CMF) has been decreasing, indicating that large money flows are leaving the ASTER market. This is consistent with the first wave of Airdrop recipients potentially swapping or selling their initial allocations.

But in the last hour, CMF has started to increase, indicating that the rate of outflow is slowing down. ASTER price could see some more strength if the hourly CMF index can move into positive territory.

ASTER Price and Cash Flow: AsterDEX

ASTER Price and Cash Flow: AsterDEXWant more information about Token like this? Sign up for Editor Harsh Notariya's daily Crypto Newsletter here .

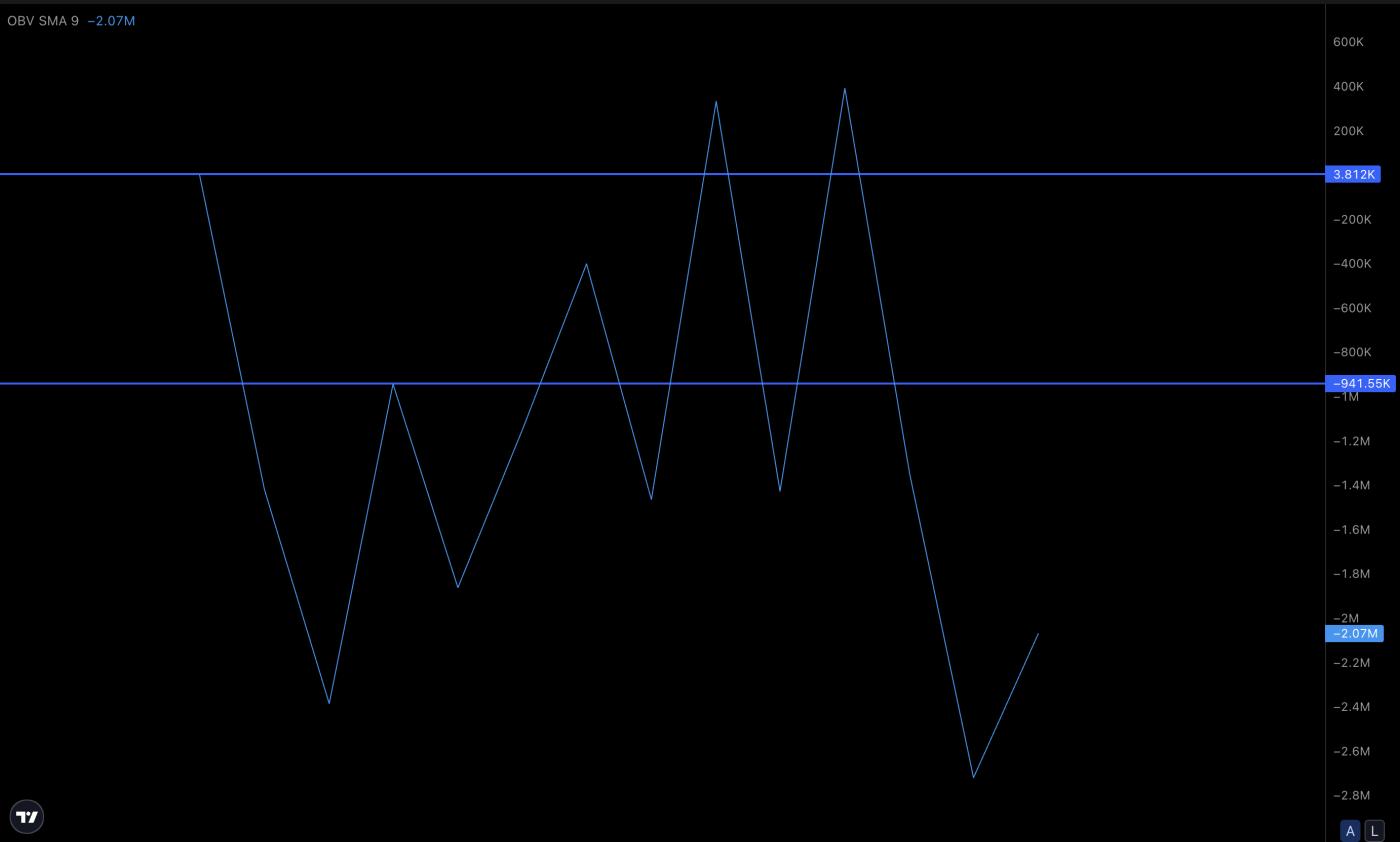

The On-Balance Volume (OBV) line, which tracks aggregate buying and selling, shows a similar zigzag pattern. It fell sharply after the launch but is now trying to return to the upside. If OBV can return to neutral levels, it will confirm that buyers are gradually absorbing the selling pressure on AsterDEX.

ASTER Buyers Try to Change Their Mindset: AsterDEX

ASTER Buyers Try to Change Their Mindset: AsterDEXOn the shorter 15-minute chart, the RSI also shows decreasing pressure. Between a few key ASTER sessions, the price made higher Dip while the RSI made lower Dip — a hidden bullish divergence. This is often an early sign that momentum is shifting toward buyers.

ASTER RSI Suggests Price Recovery: AsterDEX

ASTER RSI Suggests Price Recovery: AsterDEXAll of these indicators tell the same story: selling pressure is easing, even as the market awaits the October 1, 2023 unlock date. Withdrawals open, many holders will be free to sell, but that also means ASTER will become more accessible on major exchanges. That liquidation expansion could either trigger broader selling or allow buyers to step in more aggressively.

RSI (Relative Strength Index) is a momentum indicator that tracks XEM buying or selling pressure is stronger.

Users can receive ASTER in their Spot/DEX accounts from the listing, but withdrawals will be locked until October 1, 2023, which means the Token must stay on the platform (although trading is allowed). After October 1, 2023, many holders will be able to Token Migration off the platform, which could increase both selling pressure and liquidation.

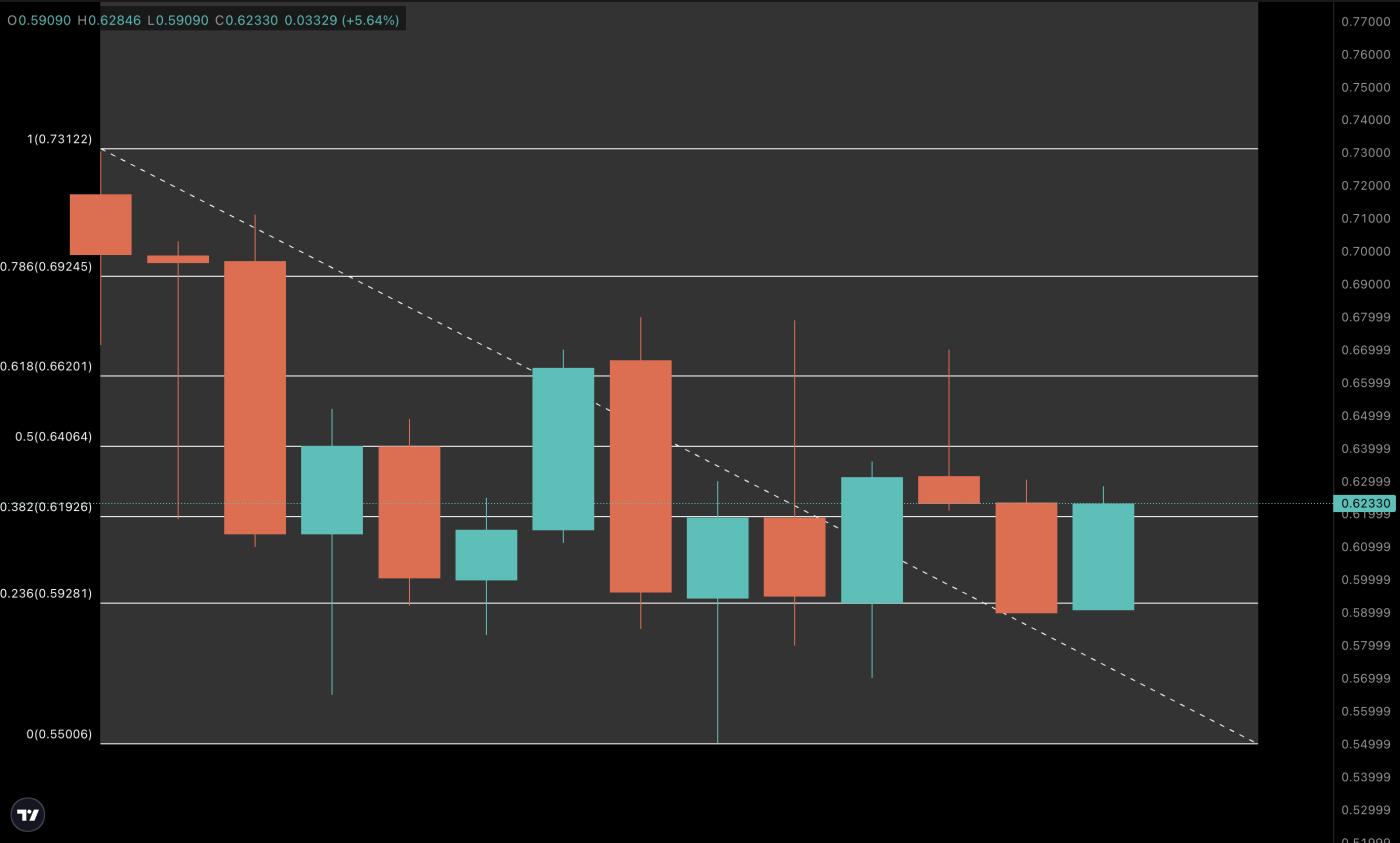

$0.73 is the important ASTER price level to watch

On the price chart, one level stands out. ASTER must reclaim $0.73, its AsterDEX listing high, to confirm further upside. Resistance is currently at $0.64 and $0.66, while $0.55 Vai as important support. If that support is broken, the risk of a deeper decline increases.

ASTER Price Analysis: AsterDEX

ASTER Price Analysis: AsterDEXThis puts the Token at a crossroads. Until October 1, 2023, trading will be limited to AsterDEX spot markets, leaving price discovery in the hands of early participants. After that date, liquidation will expand, a CEX listing is expected, and ASTER will face its first real stress test.

If buyers can absorb the selling pressure and push the price above $0.73, the “ Hyperliquid-flipping ” narrative will be stronger. But if October 1, 2023 brings a wave of selling from Airdrop recipients, ASTER could fall into deeper losses. The market is now waiting to XEM which way it goes.