Author: Bootly; Source: Bitpush

After Base suddenly "changed its tune" and said it would explore issuing coins, MetaMask, a "veteran" non-custodial wallet in the crypto industry, is also about to launch its own token.

Joseph Lubin, founder of MetaMask's parent company Consensys, revealed in an interview: "MetaMask tokens are coming, maybe even sooner than you think." This statement almost confirmed the market's speculation about MASK, and also made "wallet issuing coins" another topic of discussion.

The battle for wallet traffic

It is not difficult to understand why MetaMask chose to issue currency at this time.

According to Consensys, MetaMask's global user base has exceeded 100 million, which has allowed it to dominate the industry for a long time. However, since 2023, the wallet market landscape has quietly changed.

Phantom has surged thanks to the Solana craze, while Rabby has quickly attracted Ethereum users with its lower gas costs and user-friendly interface. Major exchange-affiliated wallets (such as OKX and Binance Wallet) are also vying for traffic. MetaMask, once a household name, is now facing a loss of popularity and even marginalization among some user groups. Issuing a token has become almost a necessary step for it.

From a motivational perspective, MetaMask has at least three considerations for issuing coins.

First, user engagement. For a long time, MetaMask was more like a "tool"—users opened it, interacted, and then left, lacking stickiness. The introduction of tokens can help keep users within the ecosystem through airdrops, rewards, staking, and other methods.

Secondly, MetaMask is expanding its business model. In the past, MetaMask's profit margins primarily focused on swap fees and fiat currency deposits, but this path is becoming increasingly narrow. The launch of MASK means it can expand its revenue potential through governance and dividends, and create a closed value loop with ConsenSys's scaling project, Linea.

Finally, there’s the need for strategic competition. As the wallet market enters a phase of “tokenized competition,” if MetaMask continues to be absent, it will not only lose its narrative, but also potentially user loyalty.

Airdrop deduction: The benefits will eventually go to a few people

The market's biggest concern is still the airdrop issue.

MetaMask claims to have over 100 million users. If all of them were included in the airdrop, the result would likely be just a few dollars per person, making it virtually meaningless. Therefore, the community generally believes that MetaMask will inevitably adopt a tiered screening approach, allocating more rewards to users who truly interact and contribute. Possible factors to consider include activity over the past two years, swap amounts and gas expenditures, and whether or not they have used Linea or participated in DeFi protocols.

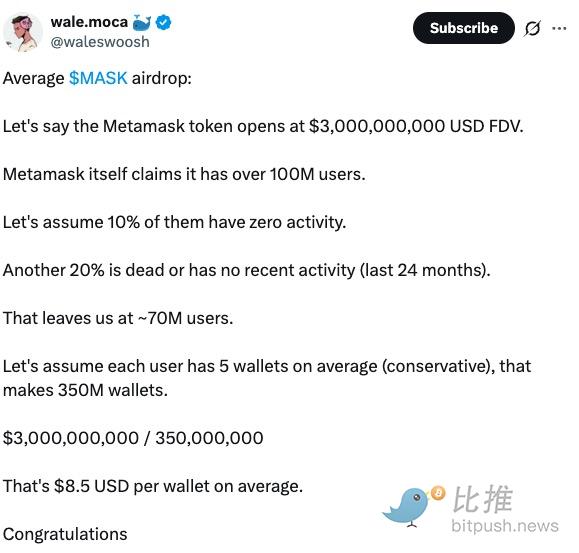

Some analysts have also given estimates on the scale of the airdrop.

Crypto researcher @waleswoosh, in an analysis posted on X (formerly Twitter), suggests that approximately 10% of MetaMask users use zero-interaction wallets, while another 20% have had little to no activity over the past two years. This brings the total number of active users to approximately 70 million. Assuming an average of five wallets per person, the actual total number of wallets could be as high as 350 million.

Based on a fully diluted valuation (FDV) of $3 billion, the average amount each wallet will receive is approximately $8. This conclusion means that most ordinary users will not ultimately receive much MASK, and the real "fat airdrop" will likely be concentrated among core users with high trading volume and long-term activeness.

Other layouts

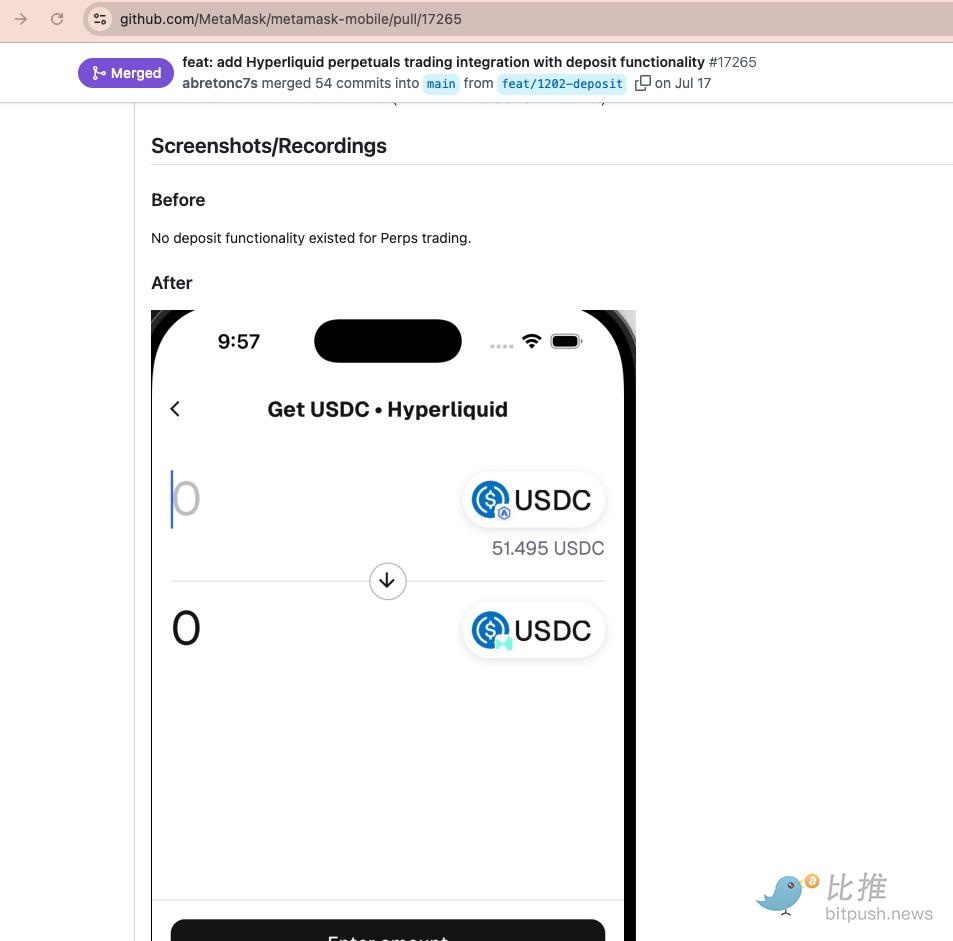

Once the MetaMask airdrop is launched, it will stimulate a large number of users to return to their wallets and re-activate the DeFi ecosystem. To compete for rewards, users will re-swap, try cross-chain transactions, and even actively use the upcoming new feature - Hyperliquid perpetual contract integration .

The feature was first revealed in a GitHub update in July, where code showed that MetaMask would add a deposit process for the USDC stablecoin on mobile devices, allowing users to fund their Hyperliquid trading accounts without leaving their wallets.

According to the pull request on GitHub, the feature design includes a minimum deposit threshold (5 USDC on the mainnet and 10 USDC on the testnet), and provides optimized experiences such as fee preview and transaction tracking.

The integration was originally planned to be released in version 7.53.0, but ultimately did not appear in the latest 7.54.0.

The community generally speculated that the delay was because MetaMask intended to announce the collaboration at the Token2049 conference on October 1-2, especially after the Hyper team had hinted at it in a post on X on September 17.

The dual stimulation of functionality and tokens is expected to drive a wave of on-chain activity. This could become a new growth opportunity for the long-dormant DeFi sector, allowing MetaMask to further evolve beyond its "pure wallet tool" product positioning towards a super-app integrating asset management, trading, and derivatives access. At the same time, competition among wallets will also intensify.

From a broader perspective, MetaMask's token issuance not only impacts its own positioning but also has the potential to have a profound impact on the Ethereum ecosystem. As a core product of ConsenSys, its tokenization is expected to boost ConsenSys' overall valuation and influence, further strengthening the competitiveness of the Ethereum ecosystem. Lubin recently hinted that users holding Linea assets may receive additional rewards in the future, fueling anticipation for potential collaborations between MASK and Linea.

summary

When Base announced its coin offering exploration, MetaMask quickly followed suit, sending a dual message: using MASK to solidify its narrative and user base, while also expanding its product offerings through Hyperliquid integration. While the airdrop presents real opportunities for the average user, most may not be able to secure the desired amount. Regardless of the outcome, these moves signal a new phase for the wallet market. MetaMask is moving away from its role as a "single entry point" and accelerating its evolution towards a comprehensive Web3 super-application.