Author: 0xStoic; Source: Bitpush

On September 19th, Ethereum core developers officially announced that the Fusaka upgrade would be launched on the mainnet on December 3rd. This marks another important milestone following the introduction of EIP-4844 ("blob data") in the Dencun upgrade, and is considered a key step in Ethereum's scaling roadmap.

Upgrade focus: PeerDAS and Blob expansion

The highlight of this upgrade is PeerDAS (Data Availability Sampling). Previously, nodes were required to download and store the entire block blob. PeerDAS allows nodes to verify only a sample of this data, significantly reducing operational costs and improving network scalability. This not only reduces the pressure on node hardware but also allows ordinary users to run nodes, further strengthening Ethereum's decentralization.

At the same time, the Fusaka upgrade will also reduce transaction costs by expanding blob capacity in phases:

December 17, 2025 : Capacity increased from ~6/9 to ~10/15;

January 7, 2026 : Further increased to ~14/21.

For the second-layer network, this means that more data can be stored at a lower cost, and users' transaction fees on the Rollup network will be significantly reduced.

To ensure the smooth progress of the upgrade, the Ethereum Foundation has launched a $2 million bug bounty program to encourage security teams and community developers to find potential problems and ensure the stability and security of the system.

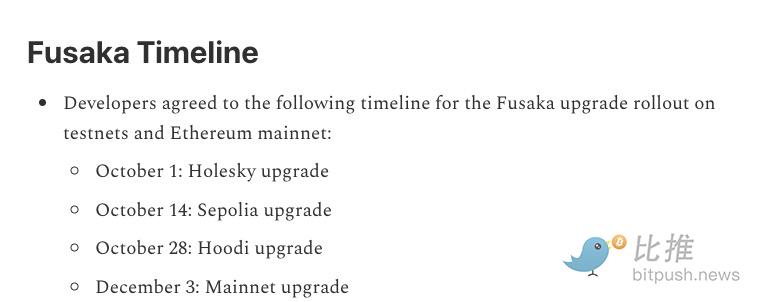

Timeline

Before the mainnet upgrade, Fusaka will conduct drills on three major testnets:

October 1 : Holesky testnet

October 14 : Sepolia Testnet

October 28 : Hoodi testnet

December 3 : Mainnet upgrade

December 17 & January 7, 2026 : BPO hard fork, expansion takes effect

Ecological impact

The Fusaka upgrade will have a significant impact on the Ethereum ecosystem beyond just technical aspects. It will also bring about changes in many areas:

Transaction costs will further decrease: The Rollup ecosystem will benefit the most, and the user experience of second-layer networks such as Arbitrum, Optimism, and Base will be improved.

Lowering the threshold for node operation: PeerDAS reduces the hardware burden, allowing more users to run nodes and enhancing the security and decentralization of the network.

Application and developer opportunities: Lower data costs and higher network efficiency provide space for the complex design of applications such as DeFi, NFT, and GameFi, while driving data service providers and block explorers to upgrade their infrastructure.

Potential impact on prices

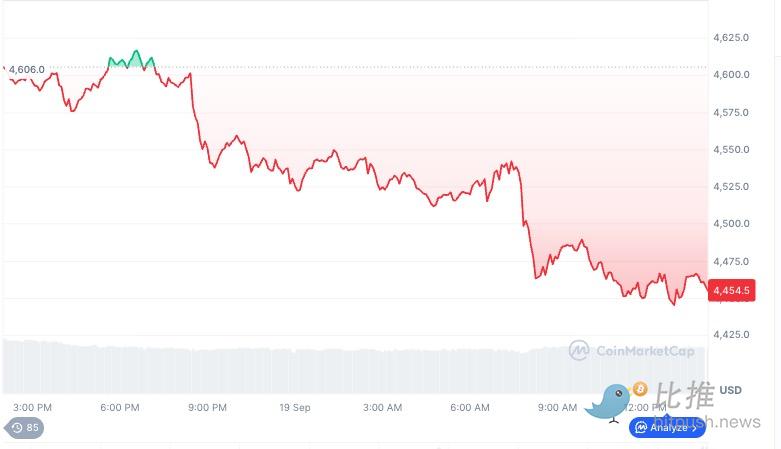

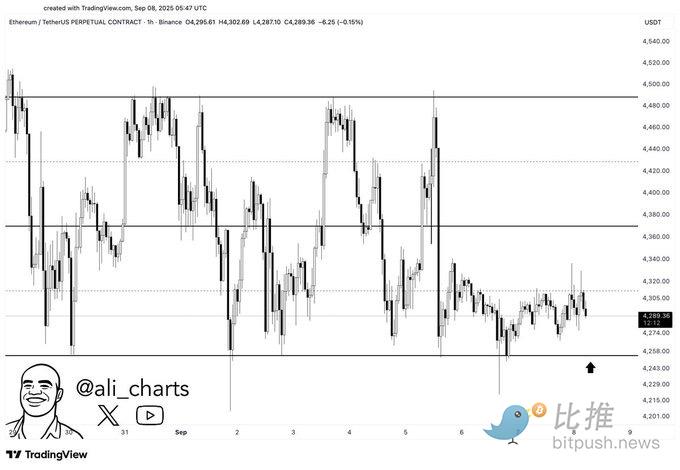

Beyond the positives of technology and ecosystem, the market is more concerned about ETH's price trend. As of press time, ETH is fluctuating between $4,300 and $4,500, entering a critical observation period.

From a technical perspective, analyst Ali stated that $4,250 (the intersection of the 20-day and 50-day moving averages) is a key support level. If it holds, it could potentially reach $4,700–$4,800. A break below this level could lead to a drop to $4,000–$3,700. The RSI remains in neutral territory, while the MACD indicates insufficient momentum. A short-term breakout would require either renewed expectations or external funding.

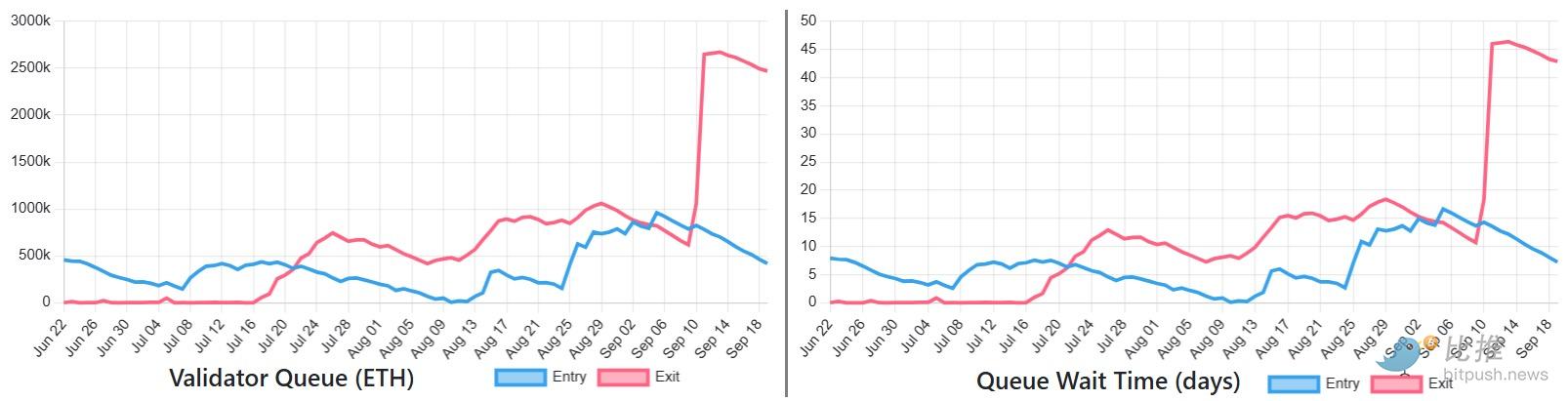

Furthermore, approximately 36.15 million ETH is currently staked, representing 30% of the total supply, providing a buffer against downside risks. However, with the exit queue exceeding $12 billion at one point, coupled with large-scale whale sell-offs, short-term selling pressure is likely. Meanwhile, Ethereum's NVT indicator is at a historical low, with active addresses increasing by 80% year-over-year, indicating long-term undervaluation.

On the bright side, institutional demand for ETH continues to grow. In September 2025 alone, Ethereum-related ETFs attracted over $1.4 billion in inflows, far exceeding Bitcoin ETFs during the same period. Corporate treasuries are also increasing their holdings, adding approximately 878,000 ETH to their reserves over the past month, reducing the market's circulating supply.

Overall, the Fusaka upgrade is a long-term positive, but short-term prices may still fluctuate due to whale selling, exits from staking, and test results. The gains and losses of $4,250 will become a key observation point.