Billionaire Pham Nhat Vuong's assets skyrocketed mainly thanks to the strong breakout of VIC stock. Since the beginning of 2025, this stock has increased by nearly 280%, thereby setting a new peak at 153,200 VND/share.

According to an update from Forbes, as of September 19, billionaire Pham Nhat Vuong currently has assets of 15 billion USD, ranking 175th in the list of the richest people in the world. This is the first time in history that a Vietnamese person has reached this level of assets.

The figure of 15 billion USD puts Mr. Vuong above many famous names in the rich list such as Samsung Chairman Lee Jae-yong, US President Donald Trump or legendary speculator George Soros...

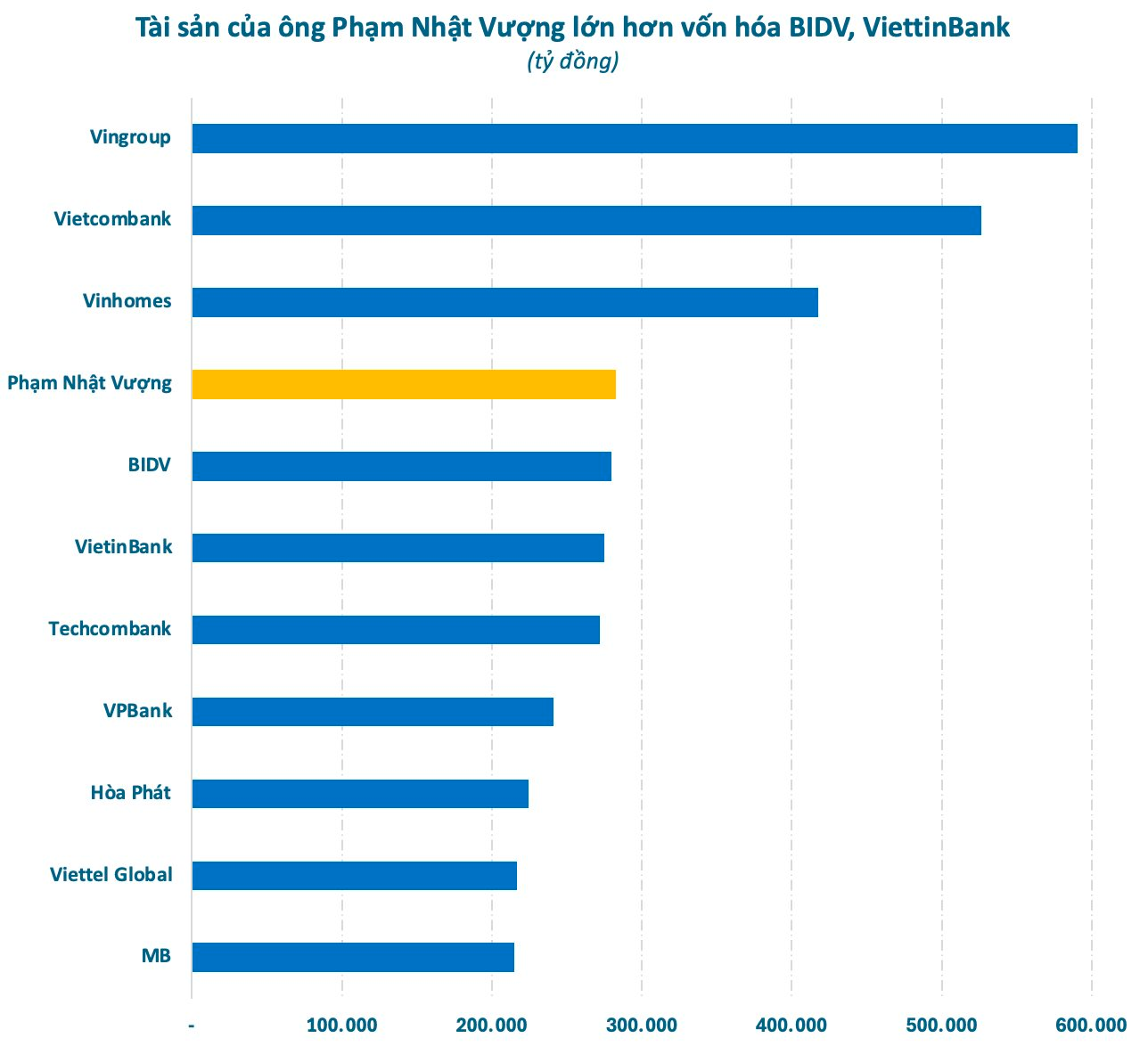

On the Vietnamese stock market alone, billionaire Pham Nhat Vuong's assets (including direct and indirect ownership of VIC shares) are estimated to be nearly VND283,000 billion. This figure is even larger than the Capital of many large banks such as BIDV, VietinBank, Techcombank, VPBank, etc.

Billionaire Pham Nhat Vuong's assets skyrocketed mainly thanks to the strong breakout of Vingroup shares (code VIC). Since the beginning of 2025, this stock has increased by nearly 280%, thereby setting a new peak at 153,200 VND/share. Vingroup's market Capital also set a record of more than 590,000 billion VND (~22 billion USD), an increase of more than 435,000 billion compared to the beginning of the year.

VIC shares surged strongly in the context of Vingroup being honored as one of the best companies in the world - World's Best Companies - voted by TIME Magazine. This is the first and only Vietnamese enterprise to be named in this prestigious global ranking up to now.

Regarding business results in the first 6 months of 2025, Vingroup achieved 130,476 billion VND in revenue, double that of the same period last year. After deducting expenses, pre-tax profit reached 11,159 billion VND, up 69% over the same period in 2024.

In the Technology - Industry segment, VinFast delivered 72,167 electric cars to the global market, 3.2 times higher than the same period in 2024. In the domestic market, VinFast maintained its leading position in the automobile market with 67,569 cars delivered in the first 6 months of the year. In the electric motorbike segment alone, VinFast set a new record with 114,484 cars delivered, 5.5 times higher than the same period.

In the Trade and Services sector, in the first half of 2025, Vingroup recorded total revenue from real estate sales of VND70,500 billion, nearly tripled compared to the same period last year. In particular, Vinhomes continued to lead the recovery of the real estate market, with sales reaching VND67,500 billion and unrecorded sales reaching VND138,200 billion at the end of the second quarter of 2025.

In a recent analysis report, Vietcap forecasts that electric car sales will grow 55%/24% year-on-year in 2025/26, reaching 151,000 and 187,000 units, respectively. At the same time, it expects Vietnam to remain VinFast’s core market, driven by the growing popularity of electric cars among both individual customers and B2B businesses (ride-hailing and delivery services).

According to Vietcap, the Government’s strong green transition orientation could pave the way for potential additional incentives for electric vehicles. VinFast, as the leading electric vehicle brand in Vietnam, is well-positioned to benefit from this policy orientation, reinforced by its extensive charging station network, diversified product portfolio and attractive after-sales services.

Vietcap forecasts Vingroup's pre-tax profit in 2025 to reach VND20,100 billion. Of which, the second half of 2025 profit will be boosted by stronger real estate sales compared to the first half, thanks to the value of unrecorded sales contracts, mainly from the Royal Island project and new large-lot sales transactions. The hotel segment's operating profit is expected to remain positive from the second quarter of 2025, thereby offsetting losses from the industrial segment.