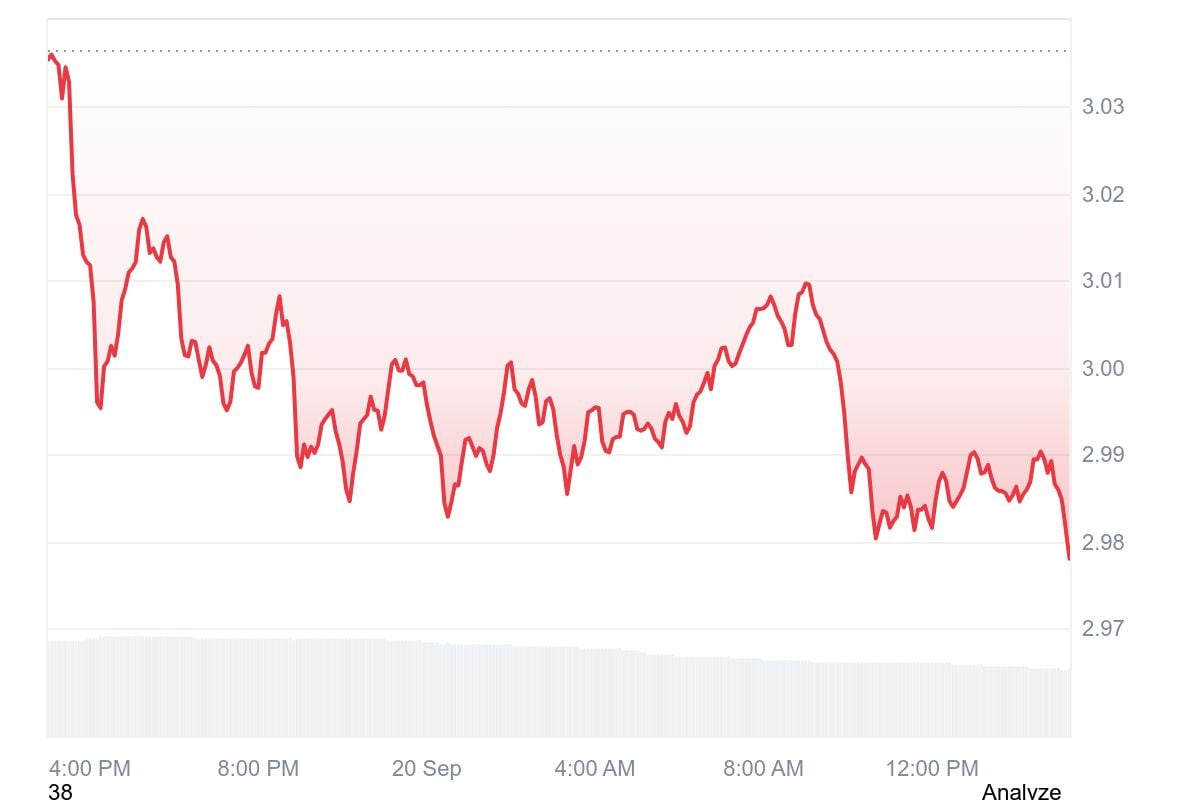

XRP’s price fluctuation has pulled it below the $3 mark in the last 24 hours. This has triggered a massive liquidation imbalance for those betting long on the coin. CoinGlass data shows XRP bulls have been caught unawares as the price took a plunge, contrary to expectations that it would rally.

Long traders' huge loss as XRP falls below $3

Notably, in the last 24 hours, approximately $7.93 million was wiped out as a result of the price volatility. Long traders lost a staggering $7,210,000 to set up a 903% liquidation imbalance within this time frame. It indicates that a lot of XRP holders were betting on a further increase in the value of the asset before it nosedived.

Worth mentioning is that XRP is not the only asset with a liquidation imbalance set against bulls. Ethereum, which posted the highest liquidation figures, saw long position traders losing $61.5 million, as against short position traders’ loss of $4.14 million.

The leading cryptocurrency, Bitcoin, registered a total of $35.10 million within this period. Out of this, bulls betting on a price surge also saw $33.10 million wiped out, while shorts recorded $2 million in losses. This signals a market-wide pattern of liquidation imbalance as the crypto sector fails to rally.

XRP’s price crashed from $3.04, breaching the critical $3 level, and has been prevented from a free fall by the $2.90 support. As of this writing, the coin continues to change hands at a price of $2.98, representing a 1.68% decline in the last 24 hours.

The price dip did not spare short position traders as they also suffered a mild loss of $718,830 within the same period.

XRP investors awaiting October rally?

Interestingly, analysts have attributed the stagnation in XRP’s price to a deliberate suppression move by institutional interests. Versan Aljarrah, the founder of Black Swan Capitalist, and Jim Willie both claimed that powerful financial institutions are manipulating the asset’s growth to accumulate the asset at a cheaper rate.

According to Willie, were it not for this price manipulation, XRP could have soared to between $7 and $8 in the latest run. The analysts consider XRP as an alternative liquidity to U.S. fiat, hence the huge bet by institutional interests.

Regardless of the current price outlook, most market participants appear to be waiting for October, when the price of most crypto assets historically records a rally. The current low trading volume, which is down by 28.6% at $3.83 billion, suggests a cautious pullback by investors.