Crypto investment firm Pantera Capital says the utility token of one layer-1 blockchain possesses massive upside potential amid low adoption by institutional investors relative to Bitcoin (BTC) and Ethereum (ETH).

Pantera Capital says Solana (SOL) is “next in line” for its “institutional moment” ahead of the potential approval of a spot Solana exchange-traded fund (ETF) in the fourth quarter of this year.

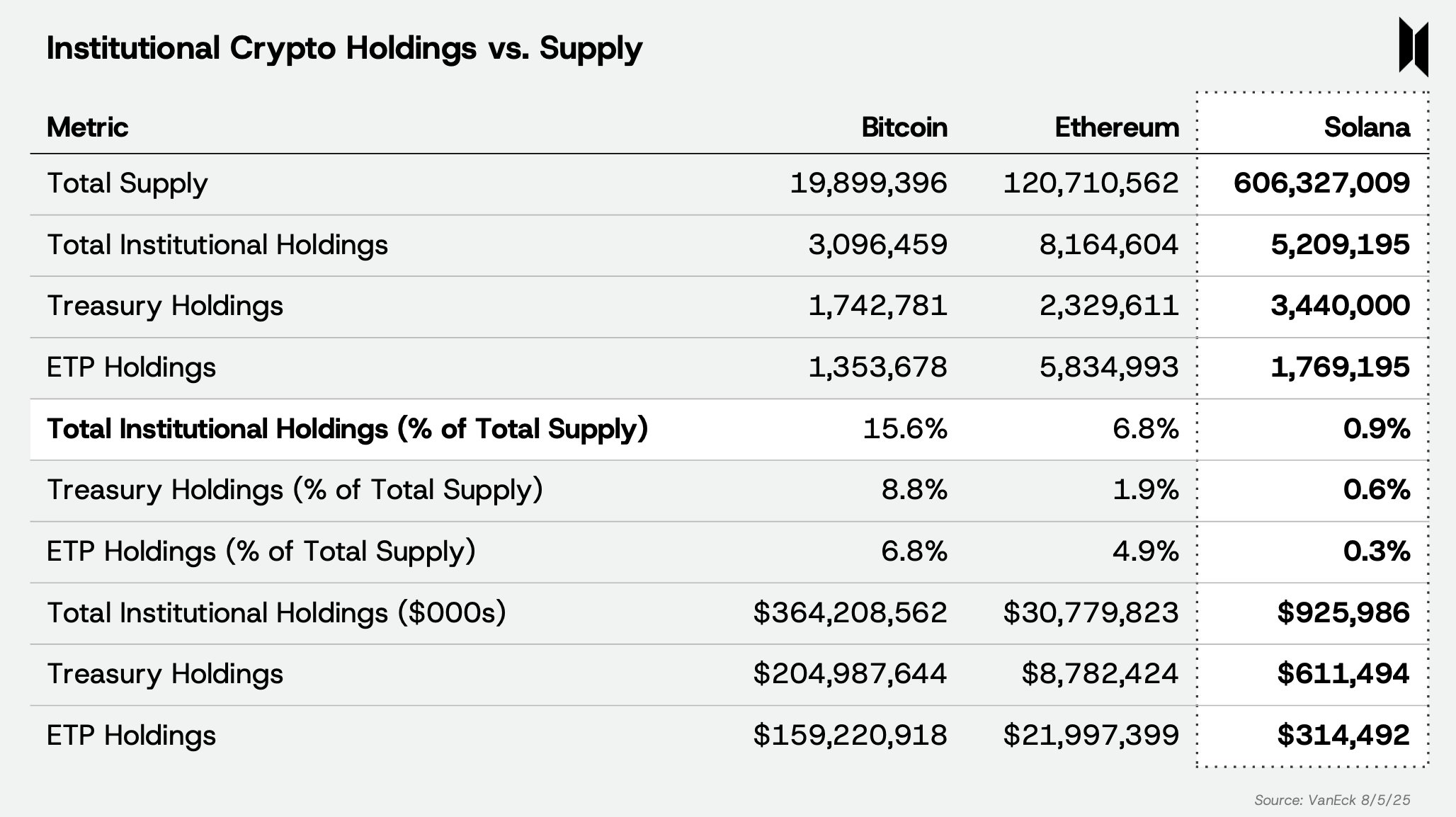

“Institutions are currently under-allocated to SOL relative to BTC and ETH, holding less than 1% of the total supply – compared to 16% of BTC and 7% of ETH.

With a Solana ETF approval expected as early as Q4 2025, we believe Solana is next in line for its ‘institutional moment.’”

Pantera Capital further says,

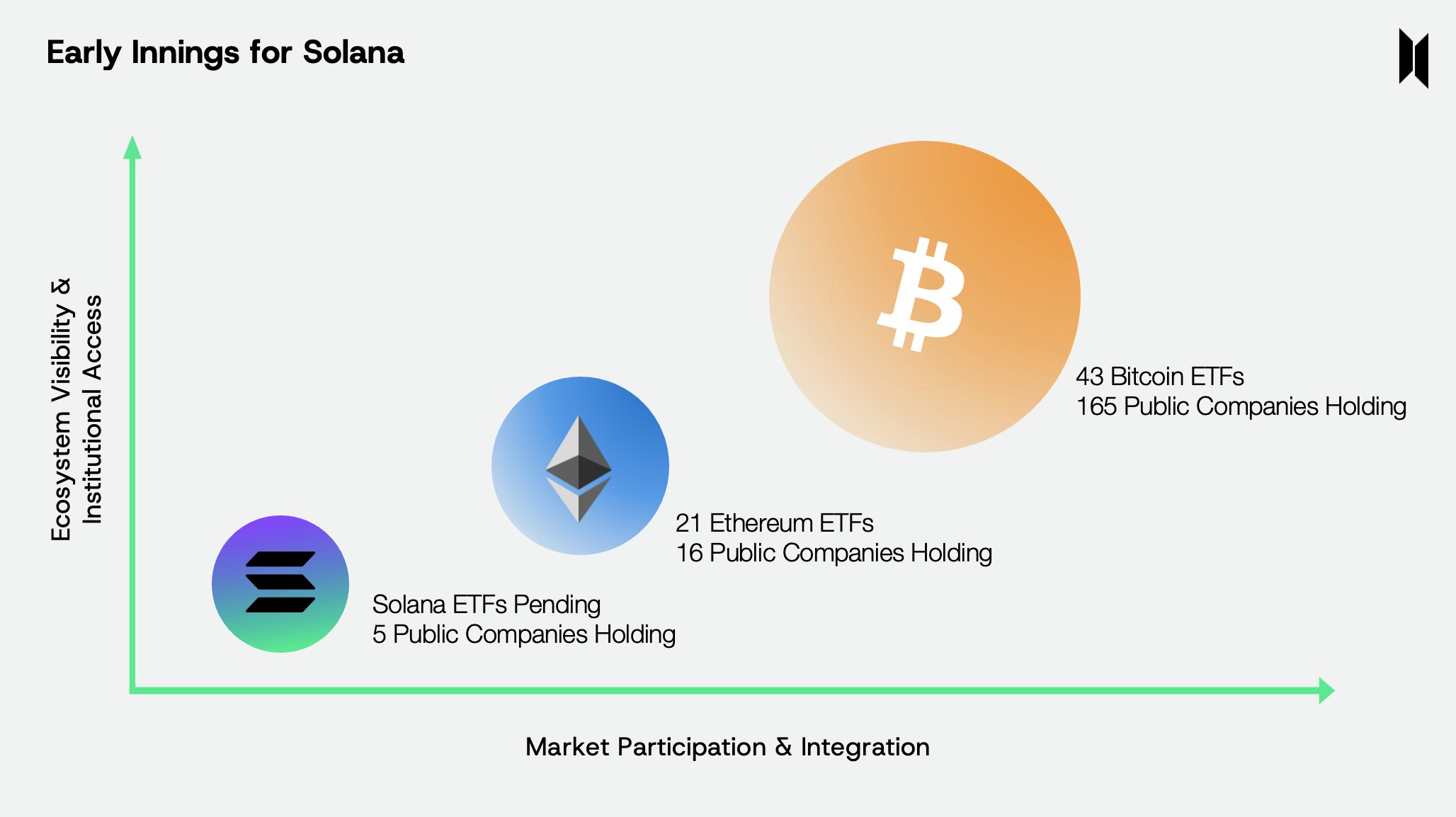

“The ETF launches accelerated institutional adoption of BTC and ETH.

43 Bitcoin ETFs. 165 public companies hold BTC.

21 Ethereum ETFs. 16 public companies hold ETH.

Solana is still in its early days:

0 Solana ETFs. Five public companies hold SOL.”

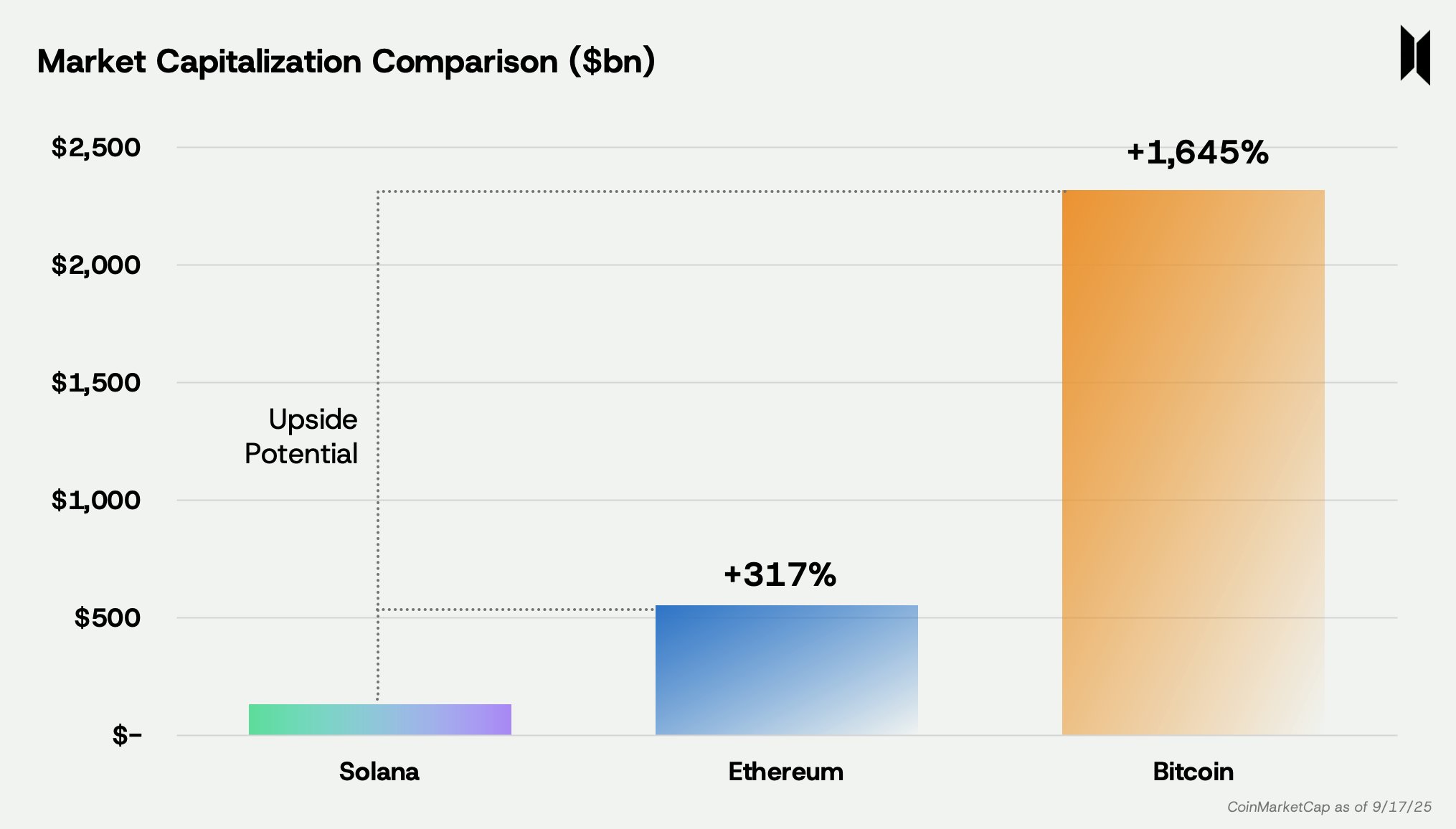

Pantera Capital also says that blue-chip firms such as PayPal and Stripe are beginning to build on Solana. And despite enjoying higher usage metrics compared to the two largest crypto assets by market cap, the market cap of Solana is a quarter of Ethereum’s and 1/20th of Bitcoin’s, according to Pantera Capital.

Earlier this week, Helius Medical Technologies, a Pantera Capital-backed digital asset treasury firm, raised more than $500 million with the intention of using the proceeds to acquire Solana. Helius Medical Technologies intends to have Solana as its primary treasury reserve asset.

At time of writing, Solana is worth $238.

Generated Image: Midjourney