Author: Encrypted Weituo

In the past two days, I have seen many teachers focusing on the DEX track because of Aster.

But to be honest, there is no need to rush to roll it up.

I have been leading the technical team to dismantle most of the Perps on the reverse market since March, and thus caught some unpopular small wins such as AVNT. In May, I was fortunate to receive face-to-face instruction from CZ, and I decisively increased my position in Aster at the second level and made a small win.

The more I study, the more I feel that I shouldn’t overdramatize myself or brainwash myself.

I will talk about my understanding of the track from the perspective of trying not to offend anyone, mainly as a reference for friends who didn’t know much about this track before.

TL;DR

1. Perp is not the only type of Hyperliquid;

2. The Perp track has been around for a long time, it’s time for the spotlight to shine on it now;

3. Exchanges of the same type as Hyperliquid may have fundamental conflicts of interest with Big Data;

4. Avantisfi’s path is the greatest common divisor of the interests of on-chain Perp and exchanges.

5. Infer whether you should participate in points based on the listing process

What exactly is a Perp track?

On-chain Perp (PERP) has existed since 2018, with projects like Synthetix, MUX, and PERP. They're not new. Historically, there have been many ways to implement on-chain contracts, but ultimately, two broad categories have emerged: AMM Perp and CLOB (Order Book Perp).

AMM Perp (Jupiter, Avantisfi, GMX):

Oracles are used to quote trading pairs, and the pool acts as the counterparty for all traders. This is like depositing money in Macau and earning annualized returns, because according to the law of large numbers, if there are enough bets, the house will definitely win.

CLOB Perp (Hyperliquid, edgeX, Lighter, Orderly, Aster, etc.):

Perp exchanges, based on order books and matching transactions, share the same logic as CEXs. The specific differences are that exchanges like Hyperliquid boast about making their entire order book publicly available on-chain, while others like Lighter use ZK circuits for verifiability.

But basically, they are all disguised CEXs, and the more nodes there are, the more it will affect transaction performance and speed.

There are indeed obvious differences between the two in terms of usage costs and transaction methods, but in my opinion, there is no "who replaces whom" logic. Perp DEX has an Blockchain Trilemma: new asset coverage - liquidity depth - price fairness.

Hyperliquid can only choose 2 out of 3. It chose new asset coverage and liquidity depth, sacrificing risk control because it is a MM-oriented product. MM is all about jungle fighting. Events like XPL and JellyJelly are not bugs but features for it.

Jupiter chooses liquidity depth and price fairness, but there are only 3 trading pairs so far.

The vast majority of CLOBs select new assets and price fairness, so there will be strong opening restrictions and poor liquidity of long-tail assets.

Either option is feasible in specific scenarios.

Why was the Perp track not popular before but is popular now?

The previous Perp DEX wasn't ineffective; it was a matter of timing. It should have been the most important DeFi infrastructure in any ecosystem (due to the need for leverage), but the spotlight simply wasn't on them.

The order book was there in the previous round. $snx became a blue chip in 20 years, DYDX's airdrop amazed the entire network, and GMX/GNS saved the bear market in 2023. In the end, you only remember Hyperliquid. The reason is simple:

1. After 23 years, many new users have entered the market, but most of them don’t know the story of DeFi summer.

2. Before Luna’s collapse, many CEXs secretly accepted European and American users to use perp for them.

3. After Luna's collapse, especially after Kucoin was hit by the Iron Fist, European and American users have no Perp left. However, the SEC is extremely unfriendly to DeFi. Buybacks and dividends will be hit by the Iron Fist. They even tried to force DeFi to implement KYC. Therefore, Tier 1 investors should not invest in DeFi (thanks again to @cz_binance for saving DeFi).

Perp, or DeFi, has experienced a resurgence, specifically in the year since Trump took office. For Perp DEX, KYC-free DeFi perp has become a necessity for users in Europe and the United States who can't use Binance. DeFi coins are also free from the numerous compliance issues and historical constraints of exchange-based coins, allowing for more flexible trading. This creates an asymmetric advantage over CEXs.

Stepping out of the box and looking at PERP DEX from the perspective of CEX development history

First think about why a CEX has been able to grow from 2018 to 2019 until now, and you will know why Perp DEX can emerge.

Regardless of whether it is decentralized or not, the core mission of any exchange is to serve its limited partners (LPs), large investors, and capital providers. With them, trading volume and liquidity are generated, which in turn attracts users.

We have now talked about the so-called first-, second- and third-tier exchanges. The saying that which exchange you are listed on can support your valuation is actually a valuation of the liquidity of the exchange and has nothing to do with the project.

This is what is called the pricing power of listing coins.

Conversely, pricing power for listings is also the first step to attracting major investors, as the entire crypto industry is about printing money, with no established funds. By listing tokens, you can turn empty pockets into real money, creating a group of major investors focused on specific assets. By continuously offering new tokens and structured products, you can earn APY (see the three functions of each exchange: VIP, Earn, and Institutional Sales).

Today they are project owners, tomorrow they are speculators. The relationship between exchanges, project owners, and speculators is mutually binding.

Therefore, the core competitiveness of CEXs lies in their pricing power for listing tokens, which is closely tied to the exchange's most important KPI: capital sinking. This is why Bybit, Bitget, and BingX, which initially moved from pure contract trading, were determined to focus on spot trading.

The Challenge of Hyperliquid - Fighting against Big

First, CLOB has no asset sinking. Due to its mechanics, it can only function as a strategy vault, but it's difficult to sink assets, let alone leverage them. This results in CLOB's depth being entirely dependent on market makers. To retain these market makers, the project must offer both tokens and makers a profit margin, sometimes even negative.

After the TGE, the price of the token is realized, and market makers often withdraw their trading volume. If CLOB doesn't engage in a bet like JLP, its vault returns will be very low, with no TVL, and it will be impossible to convert TVL into trading depth. In other words, a pure CLOB will find it difficult to attract large customers. Its role model is 58 Coin or Bingbong in 2019. As we all know, the lifecycle of a perp user is 1-3 months. Therefore, CLOB will inevitably be caught in a "volume-pulling war" with all perp DEXs and CEXs.

Secondly, as mentioned previously, CLOBs are direct competitors to CEX contract trading, boasting the asymmetric advantage of no KYC. This hinges on how Binance or OKX understand CLOBs: do they simply view them as a DeFi platform, or as competitors to CEXs? If the latter, does this mean that nearly all CLOBs currently listed on major exchanges may be unable to be listed (as major exchanges won't list other exchanges' platform coins).

There are only two ways to break the above two games:

1. Without a major exchange listing, they aggressively pump their own assets to break into the top 100 or even 50 by market capitalization, artificially creating capital sinking. They convert all the early large investors and other major chip holders into their own asset management clients (dividend sharing - limiting liquidity and driving up total sunk costs).

2. Build an entire ecosystem and have the ability to issue assets, allowing the local currency and exchange to have pricing power over new assets. This will continue to attract market makers and project groups, and form their own large customer base (split the market).

Doesn’t it look familiar?

Yes, this is how Bitget-BGB and Hyperliquid-Hype play.

On the other hand, you can understand why BGB needs to be expanded rapidly, why Hype and Aster need to expand rapidly (the more capital they expand, the larger the number of users), and why they both need to operate on a single machine, and why Hype chooses Native Markets for USDH.

This is just like the competition in Launchpad is not in Launchpad itself, and the war of CLOB in Perp DEX is not in the product itself. It doesn't matter how difficult Aster is to use. The key is whether it has the resources to get an L1 on the first page of CMC.

With so many CLOB perps, how many of them have this capability?

AVNT's "Another Way" - Doing Good with Greatness

AVNT: The narrative many people see is that it's Base's Hyperliquid... This is completely wrong, it's Base's Jupiter, and order books like Hibachi or Synfutures are Hyperliquid.

The reason why many people are not optimistic about AMM Perp is that its transactions have large slippage, high costs, and slow speeds, unlike CLOB Perp which can be used by institutions such as market makers.

This isn't entirely true. AMM perp uses oracle quotes, and its transactions are virtually slippage-free. However, because it employs global betting, a "price bump" must be added to large transactions to mitigate tail risk. This can also be adjusted based on operational needs. For example, offering free access to leverage above 75x, while "institutional access" is a stereotype stemming from traditional market makers' lack of understanding of AMMs' liquidity-based pricing model, similar to how many MMs initially struggled to develop market-making strategies at Uniswap. In reality, on-chain market makers are increasingly common, and chains other than ETH have largely resolved performance issues.

The real "coolness" of the AMM type lies in two places:

1. AMM spot trading has pricing power. The reason why Meme/on-chain fair launch has become a long-term user growth point in the market is that it enables low-cost, efficient, permissionless issuance, without relying on market makers for pricing. The same is true for AMM contracts, which are the only model that can achieve low-cost, permissionless issuance and market maker-free pricing.

2. It does not conflict with CEXs and will not compete with CEXs for order book depth or large client base. On the contrary, because "JLP" and "GLP" are inherently the highest real yield-earning assets on-chain and possess significant depth and capacity, they are even complementary to CEX asset management departments (much like Binance's BTC and SOLV).

If you don’t believe it, you can check out the coin listings on Binance. There are only 3 Orderbook-type companies: $inj $dydx $aevo

Among them, Aevo is still a coin based on the pre-market logic of the Binance system, and INJ is based on the public chain.

However, there are 5 AMM perps (excluding JUP): $GMX $GNS $AVNT $SNX $PERP

Considering that the number of CLOBs in the Perp project is far greater than that in AMM, it is hard to say that this has no impact.

If you are interested, you can take a look at the logic of Avantisfi and the latest GMX. The previous impression that AMM perp can only support 3 coins is long gone. For example, many people say that lending is "boring" to AAVE and Compound, but they don't see that KMNO and Morpho are completely two different architectures and two different species.

How to choose the angle of integration in Shandong

First, I believe that if you've already invested in a sunk cost, you should stick with your decision. Aster proves that continued investment pays off, and this still happens today.

If you haven't invested at all, then I suggest you think about the following two questions first:

1. Does the project you chose have a direct conflict of interest with the leading exchanges? Will it be considered a "platform coin" and not be listed?

2. Does it have the ability to resolve capital sinking and pricing power issues without the liquidity of a major exchange?

If you choose Orderbook, it is recommended to choose

- Obtain investment from public chain ecosystem (such as Sui, Monad)

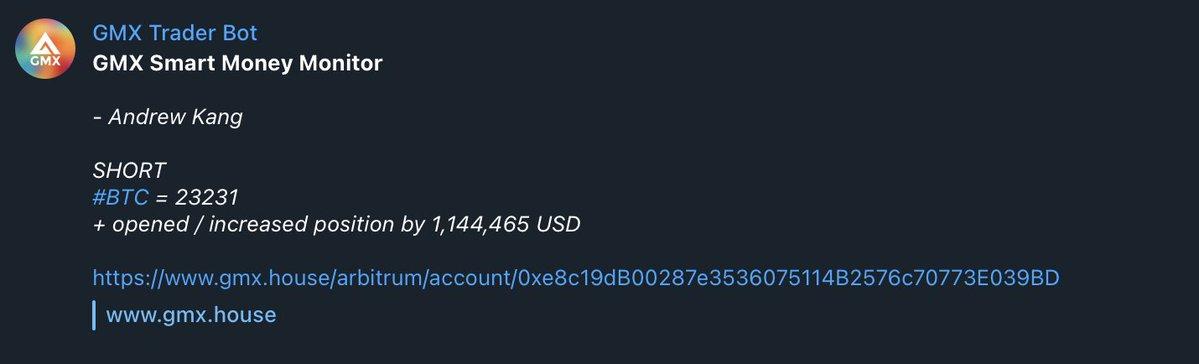

- There are very influential exchange systems, institutions or individuals with third-party verifiable financial resources who continue to milk public domain traffic (CZ for Aster, CL and other big traders and KOLs for Hype).

If it is AMM, then the first choice

- Chains with asset pricing capabilities: There are more than one project with explicit foundation support and high valuations listed on major exchanges, such as Sui, Solana, and Base. The current track on this chain, "Dragon One," has not yet achieved results above Binance Contracts.

- Its "JLP/GLP type" assets have the largest TVL: The most important thing for AMM type Perp is the best capital sinking, and then to do a good job of taker side traffic.

I personally recommend a few that are not very popular but I think may bring you good luck:

- Ethena's Ethereal: Clear background of real money cooperation with major exchanges, the strategic importance of the Binance/Ethena dual system, and the disadvantage of ink

- BasedApp: It is a front-end for Hyperliqui, similar to Axiom to Solana, but with its own HyperEVM launch pad. It is unlikely to be listed on Binance OKX, but it may be a preliminary battle in the strategic battle for pricing power of Hype.

- Phantom: MetaMask's token launch means major wallets are now likely to launch tokens in this cycle. This is also the optimal time to launch. Phantom's revenue primarily comes from swaps and the Hyperliquid frontend. If Phantom has an airdrop, these two are the most likely candidates. Fundamentally, there's no reason not to achieve a grand slam (see WCT for details), even with the Hyperliquid element.