Vietnam is laying the foundations for a digital economy that goes beyond cryptocurrency trading, aiming to integrate digital assets into the country's markets and services, according to VinaCapital.

On September 9, 2025, the Vietnamese Government issued Resolution 05, officially launching a 5-year pilot phase for the crypto-asset market in Vietnam. In the latest report, Mr. Michael Kokalari, CFA, Director of Macroeconomic Analysis and Market Research, VinaCapital, said that this move shows the Government's acceptance of crypto-assets.

According to VinaCapital, it is estimated that up to 17 million Vietnamese people have participated in cryptocurrency transactions (with a total annual crypto asset transaction value estimated at over 100 billion USD), of which almost all activities take place on foreign exchanges such as Binance, Bybit and other platforms in Singapore, Korea, Hong Kong, etc.

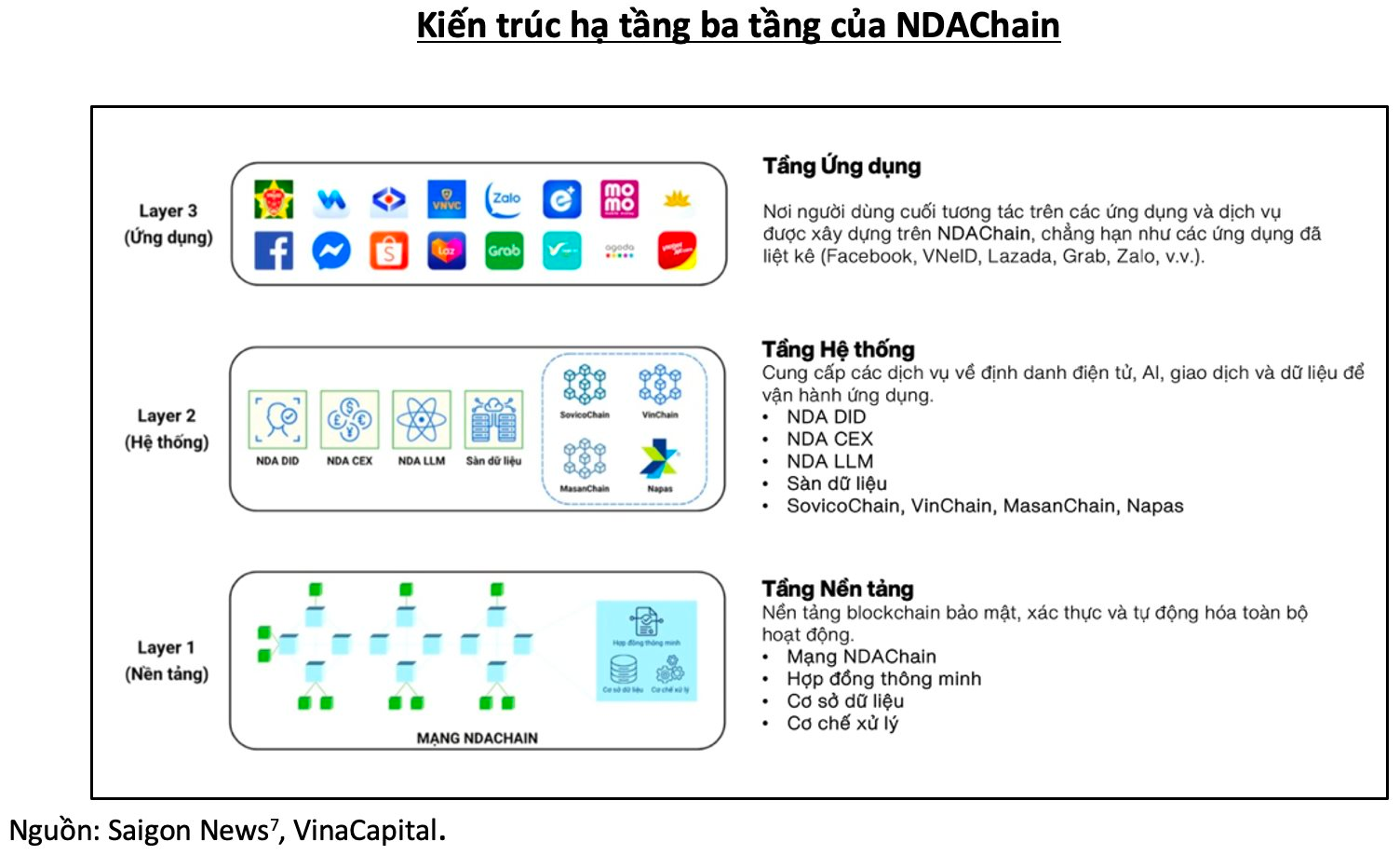

The government aims to move cryptocurrency activity in Vietnam from a large-scale informal market, dependent on foreign channels, to a regulated, tax-free market that can be integrated into the domestic financial system. In July, the National Assembly passed the Law on Digital Technology Industry, officially recognizing digital assets and requiring cryptocurrency platforms to obtain licenses to operate in the country, while also providing a direct transaction gateway in Vietnamese Dong from January 1, 2026. Also in July, the government launched NDAChain – Vietnam’s national blockchain platform, enabling secure financial transactions and secure online shopping.

According to VinaCapital, the Government is focusing on three key objectives. The first is to legalize and tax crypto-asset transactions by shifting billions of dollars of trading activities from overseas exchanges to the domestic system, allowing the Government to generate tax revenue from crypto-asset transactions. The second is to integrate digital assets into the domestic financial system, thereby connecting digital assets more closely with the financial system, opening up new Capital mobilization channels and supporting a digital economy that is less dependent on cash. The third is to strengthen investor protection and market surveillance, set standards for custody and reporting activities, and bring digital assets into the framework of existing regulations on anti-money laundering (AML) and counter-terrorism financing (CFT).

While Vietnam has been moving cautiously in the digital asset space for years, VinaCapital’s observations from the ground up suggest that this time is different. Activity is picking up significantly, with regular discussions between regulators, industry events, and the launch of NDAChain all reflecting a shift towards the recognition of digital assets as a legitimate part of the financial system.

Three key factors supporting the prospects of digital assets in Vietnam

VinaCapital points out three key factors supporting the prospects of digital assets in Vietnam, which are a potential market with active participation of individual investors, one of the fastest growing economies in Asia, and a Government determined to shape cryptocurrency activities into a framework.

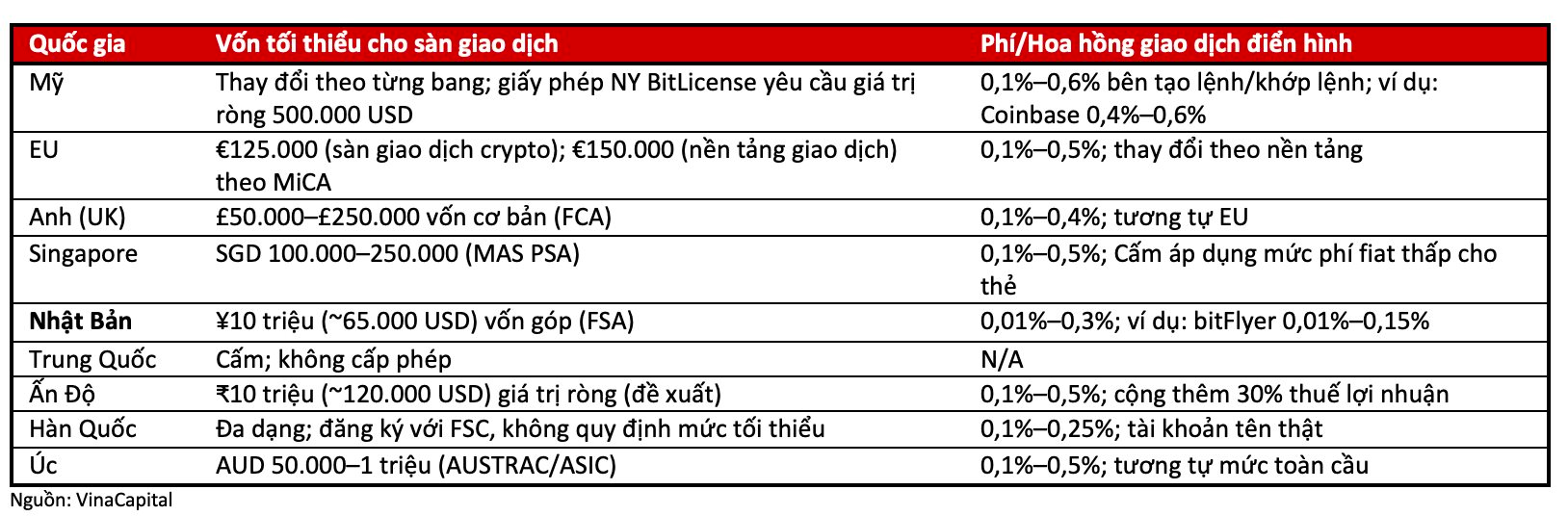

All of the above will create opportunities for participants. Firstly, regarding exchange & brokerage licenses, early licensees can attract volume, fees and valuable market data from offshore platforms to regulated domestic channels. Secondly, the new regulations also pave the way for Bitcoin funds and diversified digital asset funds to meet the needs of insurance organizations, pension funds and other domestic institutions. Thirdly, regarding infrastructure & Tokenize, leveraging the State-sponsored NDAChain and the upcoming pilot exchange will enable the Tokenize of trade invoices, carbon credits and other real assets.

Fourth, licensed exchanges will connect with domestic banks and electronic payment instruments approved by the State Bank for VND deposits and withdrawals, giving pioneers access to payment fees and user data. This could evolve into a “digital asset bank” model, where banks provide custody, payment and lending services for digital assets. The recent surge in the shares of banks that are expected to benefit the most from the new digital asset policy shows that the market is very responsive.

"Vietnam is laying the foundation for a digital economy that goes beyond crypto-asset trading, moving towards integrating digital assets into the country's markets and services," VinaCapital's report stated.

With a large number of retail investors and more institutions ready to participate, the pilot programs and licensing regimes could become the foundation for a more transparent, liquidation and trustworthy market. This move is likely to bring Capital back, creating revenue for banks and securities companies, and opening up opportunities for specialized service providers in custody, compliance and analysis.

Beyond the financial sector, the country’s economy will also benefit from Tokenize and blockchain applications. Industries such as supply chain management, renewable energy, and real estate can access new Capital models through Tokenize assets, while carbon credits, trade invoices, and other instruments will have higher liquidation .