Author: hejaswini MA

Compiled by: Vernacular Blockchain

In August, September 19, 2025, Bo Hines resigned from the White House Cryptocurrency Council to become CEO of Tether's new US division. His mission was to launch USAT, a stablecoin fully compliant with the GENIUS Act. USAT would be subject to monthly audits, have reserves limited to cash and short-term U.S. Treasury bills, and operate under U.S. federal banking regulations.

Meanwhile, Tether's other stablecoin, USDT, has a monthly trading volume of over $1 trillion. Its reserve assets include Bitcoin, gold, and collateralized loans, are managed by offshore entities, and have never been fully audited.

Same company, two completely different stablecoin strategies.

Tether earned a staggering $13.7 billion in profits last year thanks to its "act first, forgive later" model. In contrast, Circle, through rigorous compliance and proactive communication, successfully went public with a valuation of $7 billion.

This news should have been a moment for celebration.

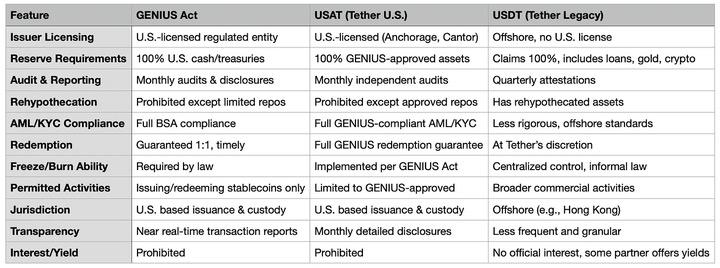

After years of regulatory controversy, including questions about transparency and the nature of its reserve assets, Tether finally offers a product to the US market that meets all regulatory requirements: full compliance, independent audits, a regulated custodian, and reserves comprised solely of cash and short-term US Treasury bills.

Instead, the discussion has shifted to regulatory arbitrage, competitive advantage, and those intriguingly awkward moments when revolutionary technology collides with the established order. People pretend this is all planned, but the truth is that through clever corporate design, Tether seems to have found a way to simultaneously serve two distinct needs.

Tether's Extraordinary Achievements: USDT's Global Dominance

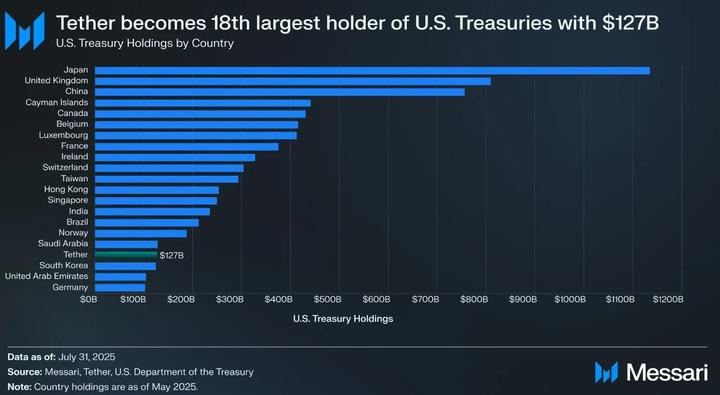

Before delving into USAT, let's first appreciate the staggering scale of USDT. USDT has a total circulation of $172 billion, processes over $1 trillion in transactions monthly, and spans the global cryptocurrency market. If Tether were a country, its $127 billion in US Treasury bonds would rank it as the 18th largest holder of US Treasury bonds globally.

Even more astonishing is that Tether generated $13.7 billion in profits last year—note, this is net profit, not revenue. This makes it one of the most profitable companies in the world, surpassing many Fortune 500 companies.

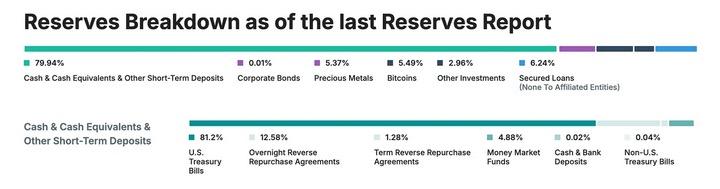

Despite all of this, Tether hasn't undergone a comprehensive audit, nor has it been subject to the rigorous regulations or transparency requirements that traditional financial institutions are accustomed to. Instead, it relies on quarterly "attestations" rather than full audits, and its reserve assets include gold (3.5%), Bitcoin (5.4%), secured loans, and corporate bonds—assets prohibited under strict stablecoin regulations. Furthermore, Tether operates primarily through offshore entities in Hong Kong and the British Virgin Islands.

This is a classic example of Tether building a financial empire by completely deviating from regulatory preferences.

Challenges of the GENIUS Act

In July 2025, the United States introduced the GENIUS Act, the first comprehensive regulation of stablecoins in the United States. Suddenly, the world’s most important and influential US cryptocurrency market had a strict new set of rules:

100% of reserves must be cash and short-term U.S. Treasury bonds (Bitcoin, gold, secured loans, etc. are prohibited).

Independent audits are conducted monthly and certified by the CEO and CFO.

The issuer must be registered in the United States and the custodian institution must be regulated by the United States.

Fully comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements, with asset freezing capabilities.

Payment of interest to holders is prohibited.

The composition of reserve assets is fully transparent.

Considering USDT's existing structure, these requirements clearly pose a significant challenge. The GENIUS Act clearly distinguishes between "foreign" stablecoins and domestically-owned US stablecoins. USDT, issued by Tether entities in the British Virgin Islands and Hong Kong, cannot simply be adjusted to meet these requirements. This would require a complete overhaul of its corporate structure, reserve asset composition, and operating model.

Even more challenging, compliance means Tether must provide the kind of transparency it has historically avoided. As of 2025, Tether still only provides quarterly “certifications” rather than full audits, and approximately 16% of its reserves (gold, Bitcoin, collateralized loans, and corporate bonds) are held in clear violation of the GENIUS Act’s requirements.

Why not reshape USDT instead of launching USAT?

In this case, why doesn’t Tether just make USDT compliant instead of launching a new USAT?

The answer is simple: transforming USDT is like converting a high-speed boat into an aircraft carrier. USDT currently serves 500 million users worldwide, who choose it precisely because it's not subject to strict US regulations. Many of these users are in emerging markets, where USDT provides them with access to US dollars, bypassing unreliable or expensive local banking systems.

If Tether were to suddenly impose US-level KYC requirements, freeze functionality, and audit protocols on USDT, it would completely alter the core value proposition of USDT. Imagine a small business owner in Brazil using USDT to hedge against currency fluctuations and not wanting to face US compliance requirements; or a crypto trader in Southeast Asia who doesn't need to receive monthly certification documents from their CEO.

The deeper reason lies in market segmentation. By launching USAT, Tether can offer a "high-end," compliant product in the US market to meet institutional needs, while retaining USDT as the "popular standard" for global users. It's like owning both a luxury brand and a mass market brand—the same company offering different products to different customers.

USAT's Positioning and Challenges

So, what unique value does USAT provide that differentiates it from Circle’s USDC? The answer is a bit murky.

Technically, both USAT and USDT are based on Tether's Hadron platform, allowing for seamless integration with existing infrastructure while maintaining regulatory separation. Liquidity can flow between the two systems under legal circumstances, but compliance firewalls ensure that each token operates independently within its jurisdiction.

USAT will be issued by Anchorage Digital Bank, a federally chartered crypto bank, with reserves held in custody by Cantor Fitzgerald. It will fully comply with the requirements of the GENIUS Act, including monthly audits, transparent reserves, and all the regulatory features required by institutional users. Led by former White House cryptocurrency advisor Beau Sinise, USAT also boasts a strong political background and Washington connections.

However, Circle's USDC already meets all of these requirements. With deep liquidity, mature exchange integrations, extensive institutional partnerships, and an impeccable regulatory compliance record, USDC has become the stablecoin of choice for US institutional investors.

Tether's advantages lie in its brand and scale. As the world's largest stablecoin issuer, Tether has a massive market share and $13.7 billion in annual profits to support its expansion. CEO Paolo Ardoino has stated, "Unlike our competitors, we don't need to rent distribution channels; we own our own network."

But USAT faced a challenge: it needed to build liquidity from scratch. This meant convincing exchanges to list USAT, attracting market makers to provide liquidity, and getting institutional clients to actually use it. Even with Tether's deep pockets and extensive distribution network, this was no easy task.

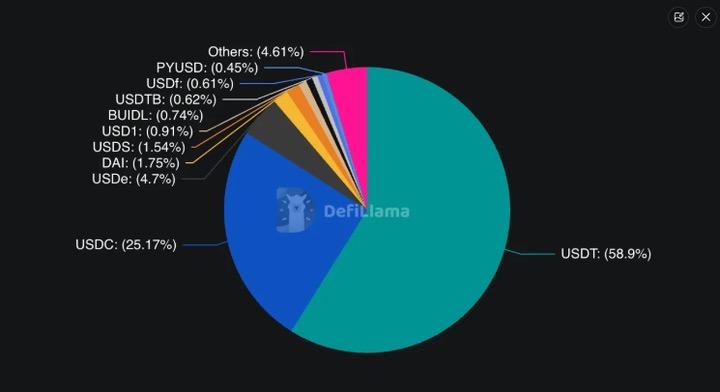

Currently, USDC accounts for about 25% of the global stablecoin market, but dominates the compliant US market; USDT has 58% of the global market share, but is almost excluded from the compliant US market.

Potential advantages of USAT

Despite the challenges, USAT remains uniquely competitive. Tether's global distribution network includes "hundreds of thousands of physical points of sale," as well as digital partnerships like its $775 million investment in Rumble. This infrastructure, built over more than a decade, is difficult to replicate.

In the first half of 2025, Tether generated $5.7 billion in profits, providing ample funding for marketing, liquidity incentives, and partnership expansion. Unlike competitors who need to "rent" distribution channels, Tether owns its own infrastructure.

Another major advantage of USAT could be compatibility. If USAT can seamlessly integrate with existing USDT infrastructure, users won't need to significantly restructure their systems. For developers who have already spent months integrating USDT, switching to another Tether token will be far less labor-intensive than integrating with a completely new provider.

Furthermore, some institutions or risk-conscious users may wish to diversify their exposure by holding multiple compliant stablecoins. If Circle or USDC were to encounter issues, institutions might need a fully compliant alternative. Tether's relationships with partners like Cantor Fitzgerald could also offer better terms or services.

Time constraints and market realities

Time is of the essence. USAT's planned launch date of late 2025 means Tether must quickly build liquidity, secure trading platform listings, and establish relationships with market makers. In financial markets, a head start is crucial, and users often gravitate toward established, liquid options over newcomers.

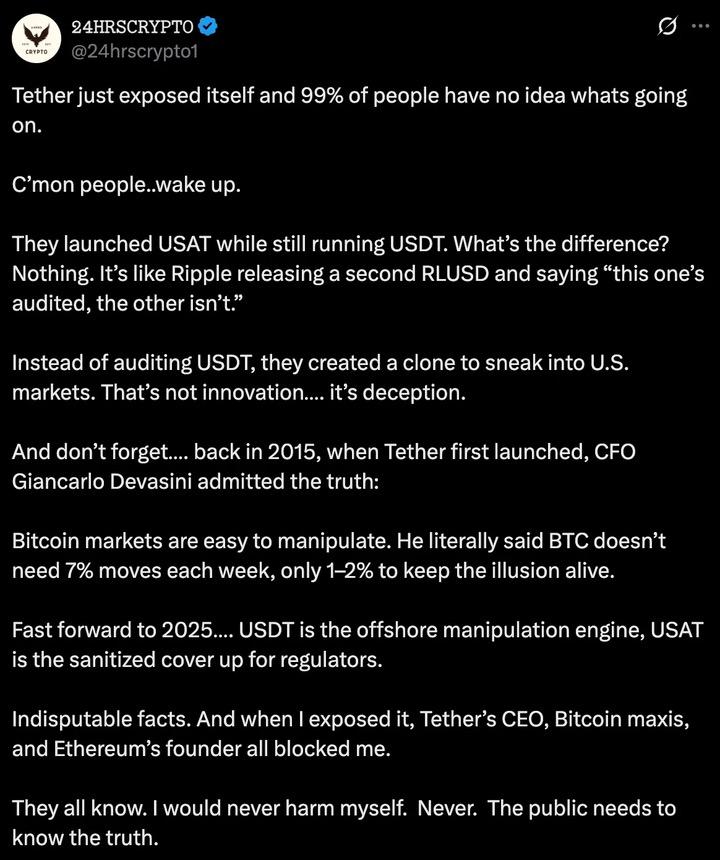

Critics have argued that USAT is merely a compliance exercise—an attempt by Tether to enter the U.S. market without addressing the transparency and operational issues surrounding its core business. This criticism has some merit: choosing to launch USAT rather than fully compliant USDT suggests that Tether prioritizes immediate operational flexibility over comprehensive regulatory legitimacy.

But from another perspective, this is exactly how the market should work. Different customer groups have different needs and risk appetites. US institutions demand compliance and transparency, while users in emerging markets prioritize accessibility and low costs. Why can't one company satisfy both needs with different products?

Conclusion: Tether’s Dual Kingdom

Tether's dual-stablecoin strategy reflects a deep tension in the crypto industry between regulation, decentralization, and institutional adoption. The industry faces a core challenge: how to strike a balance between preserving the original "permissionless" spirit of cryptocurrency and embracing the regulatory framework required for mainstream adoption.

USAT represents a dual bet for Tether: securing regulatory legitimacy for institutional users while retaining flexibility for global retail users. The success or failure of this strategy hinges on execution, market acceptance, and the evolving regulatory landscape.

The regulatory landscape is still evolving. While the GENIUS Act provides some clarity, uncertainty remains regarding its implementation and enforcement. Changes in government or regulatory priorities could profoundly impact the strategies of stablecoin issuers.

More fundamentally, the launch of USAT raises questions about the nature of Tether’s original success: Is USDT’s dominance built on regulatory arbitrage, and therefore unsustainable? Or does it reflect genuine innovation in global financial infrastructure, whose potential can be further enhanced rather than constrained by regulatory compliance?

The answer will determine whether USAT represents Tether’s evolution into a mature financial institution or an acknowledgment of the limitations of its original model. Regardless, the launch of USAT marks a new chapter in stablecoin competition and regulation.

Tether is building a second kingdom. Whether it can rule both remains to be seen.