Macro liquidity and Federal Reserve policy

The biggest overall conclusion is that the crypto market will not decouple from the macroeconomy, but will become more closely integrated with it.

The timing and scale of fund rotation, the Fed's interest rate path, and the way institutions adopt it will determine how this cycle evolves.

Unlike 2021, the upcoming copycat season (if there is one) will be slower, more selective, and more institutionally focused.

If the Fed implements easing policy through rate cuts and bond issuance, and this resonates with institutional adoption, 2026 could become the most significant risk cycle since 1999-2000, and the crypto market would benefit, although in a more restrained rather than explosive manner.

1. Fed policy divergence and market liquidity

In 1999, the Fed raised rates by 175 basis points, yet the stock market soared all the way to its peak in 2000. Today, forward markets are pricing in the opposite scenario: a 150 basis point rate cut by the end of 2026. If this materializes, it would create an environment that injects liquidity, not drains it.

The market landscape in 2026 could mirror that of 1999 and 2000 in terms of risk appetite, but with interest rates trending in the opposite direction. If this prediction holds true, 2026 could be a more robust version of the 1999 and 2000 market dynamics.

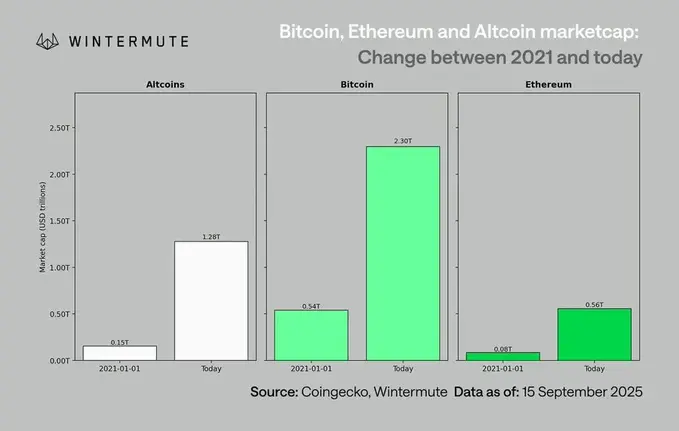

2. Compared with 2021, the new landscape of the crypto market today

Comparing today to the previous bull market cycle:

- Tighter capital discipline: Rising interest rates and persistent inflation are prompting companies to be more selective in their risk-taking.

- There will be no repeat of the COVID-19 liquidity surge: in the absence of an M2 surge, growth must be driven by adoption and distribution.

- 10x market size expansion: A larger market capitalization base means deeper liquidity, but the likelihood of achieving 50-100x outsized returns decreases.

- Institutional capital flows: As mainstream and institutional adoption becomes a foregone conclusion, capital flows are more gradual, tending towards slow rotation and consolidation rather than explosive rotation across assets.

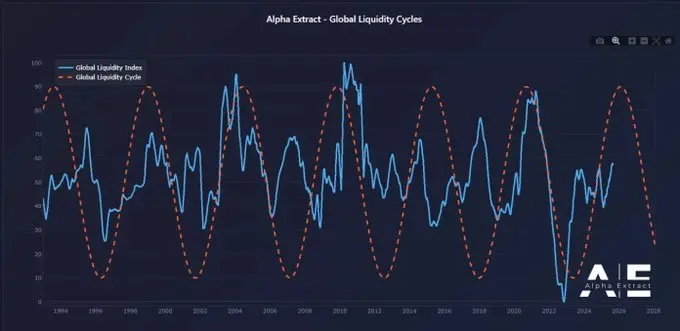

3. Bitcoin’s hysteresis and liquidity chain

Bitcoin lags relative to liquidity conditions because new liquidity is trapped in upstream government bond and money markets. Cryptocurrencies, at the far end of the risk curve, benefit only when liquidity flows downstream.

Catalysts driving the crypto market:

- Bank credit expansion (ISM>50)

- Money market funds see outflows after rate cut

- The Ministry of Finance issues long-term bonds to lower long-term interest rates

- A weaker dollar is easing global financing pressures

When these conditions are met, crypto markets have historically rallied late in the cycle, after stocks and gold.

4. Risks under the Baseline Scenario

Despite this bullish liquidity structure, several risks are looming:

- Long-term yields rise (due to geopolitical pressures).

- The strengthening of the US dollar has led to tightening global liquidity.

- Bank lending is weak or credit conditions are tightening.

- Liquidity in money market funds is stagnating rather than rotating into risky assets.

The characteristics of the next cycle will be defined less by the onslaught of speculative capital and more by the structural integration of crypto markets with global capital markets.

As institutional flows, disciplined venture capital behavior, and policy-driven liquidity shifts intertwine, 2026 could become a critical turning point in the crypto market’s transition from isolated booms and busts to global systemic correlations.