The explosive growth of artificial intelligence is triggering an unprecedented thirst for electricity, while the supply to immediately meet this demand is extremely limited. According to the Wind Trading Desk, a Morgan Stanley research report released on the 21st predicted that the United States alone faces a data center power shortage of up to 45 gigawatts (GW) between 2025 and 2028. Even considering other innovative solutions like natural gas and nuclear power, the gap remains.

Unlike new projects that take years to connect to the grid, Bitcoin mining companies have existing, large-scale sites and power capacity already connected to the grid. The report notes that US Bitcoin mining companies have approximately 6.3 GW of operational large-scale sites and an additional 2.5 GW of capacity under construction, offering AI companies the fastest access to power and the lowest execution risk.

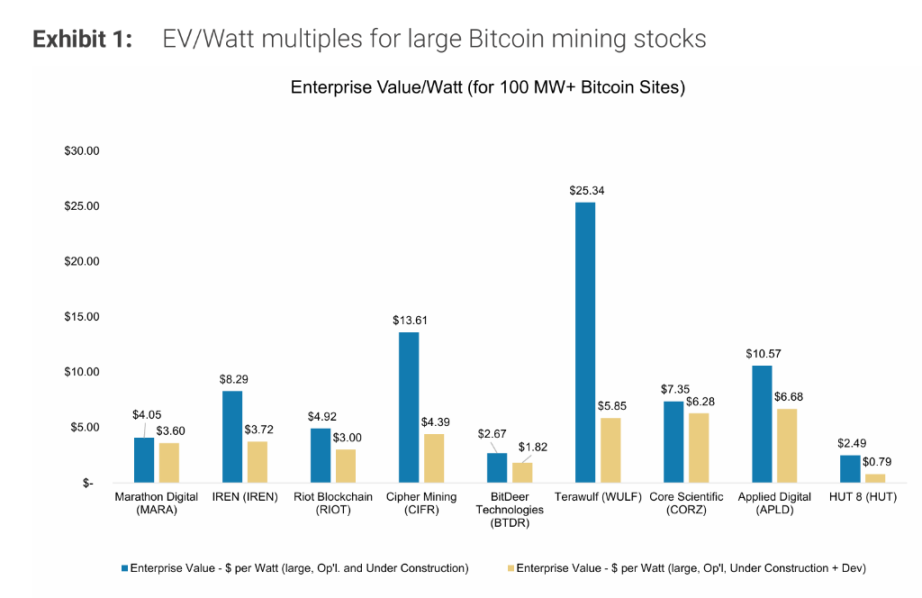

Currently, the stock valuations of many Bitcoin mining companies remain based on mining logic, resulting in extremely low enterprise value per watt (EV/Watt) metrics. The report estimates that converting mining sites into data centers could create equity value of $5 to $8 per watt, significantly higher than these companies' current trading levels. For investors, this may represent a significant value mismatch and potential alpha opportunity.

Impending power bottleneck

The demand for computing power for AI is growing exponentially, but this is driven by the rigid constraints of electricity. Morgan Stanley's modeling projects that US data center electricity demand will reach 65 GW between 2025 and 2028. However, the grid currently offers only 15 GW of near-term access capacity. Adding in the approximately 6 GW of data center capacity under construction, this still leaves a significant power gap of approximately 45 GW.

The report analyzes that even taking into account innovative measures such as natural gas turbine trading (approximately 15-20 GW), Bloom Energy's fuel cells (approximately 5-8 GW), and the utilization of existing nuclear power plants (approximately 5-15 GW), and assuming their successful implementation, US data center developers will still face a power shortage of approximately 5 to 15 GW by 2028. A recent Schneider Electric survey confirms this challenge, noting that "access to power" has become the top reason for data center project delays.

The Undervalued "Spot Electricity": The Unique Value of Bitcoin Mining Farms

Bitcoin mining farms offer a seemingly unexpected yet logical solution to the power bottleneck. Morgan Stanley points out that these farms possess the core assets most valued by AI players: approved grid connections and large-scale power supply capabilities. This allows them to bypass the typically multi-year "heavy-load interconnection" approval process required of new data centers.

Data shows that US Bitcoin mining companies have approximately 6.3 GW of operational large-scale sites (over 100 MW), with an additional 2.5 GW under construction and 8.6 GW of projects under development with grid access permits. The report argues that these readily available power resources are extremely valuable to AI companies, and that the construction cycle (approximately 18-24 months) of converting these sites into AI data centers perfectly aligns with the timeline for developing and improving power infrastructure for Bitcoin sites.

Morgan Stanley highlighted that "Enterprise Value/Watt" (EV/Watt) is a key metric that is often overlooked by the market when assessing the value of such companies. Many Bitcoin mining companies remain significantly undervalued.

The economic value that can be created by converting a Bitcoin mining site into an HPC data center is staggering. Morgan Stanley calculated this using a value creation analysis model: assuming a Bitcoin mining company converts a 100-megawatt site into a "live shell" data center (excluding chips and servers) and then leases it to a customer on a long-term basis.

Analysis shows that if the tenant is a large hyperscaler, the project could create approximately $519 million in equity value, or $5.19 per watt. If the tenant is a neocloud, the equity value could be even higher, reaching approximately $781 million, or $7.81 per watt.

The report notes that this value creation potential of approximately $5 to $8 per watt is significantly higher than the current trading levels of many Bitcoin mining stocks. This transaction structure, which typically utilizes project financing and high leverage, avoids the commercial risks associated with owning the chips, making it attractive to all parties.